Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

Layer 1 tokens like Cronos represent bets on specific blockchain architectures winning developer and user mindshare. CRO carries both systematic crypto risk and unsystematic risk from Cronos's technical roadmap execution and ecosystem growth. Multi-chain thesis suggests diversifying across several L1s rather than concentrating in one, since predicting which chains will dominate remains difficult.

The projections below show how CRO might perform under different market cap scenarios. While Cronos may have strong fundamentals, prudent portfolio construction balances L1 exposure across Ethereum, competing smart contract platforms, and Bitcoin to capture the sector without overexposure to any single chain's fate.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

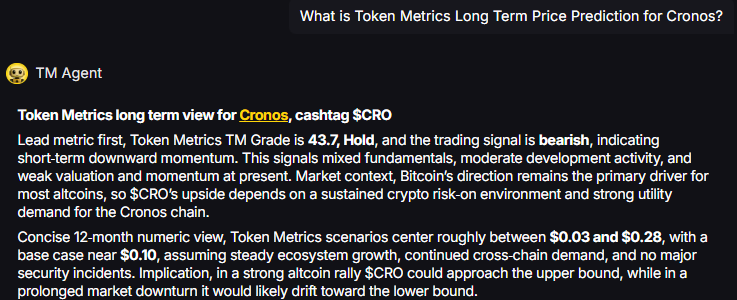

TM Agent baseline: Token Metrics scenarios center roughly between $0.03 and $0.28, with a base case near $0.10, assuming steady ecosystem growth, continued cross-chain demand, and no major security incidents.

Portfolio theory teaches that diversification is the only free lunch in investing. CRO concentration violates this principle by tying your crypto returns to one protocol's fate. Token Metrics Indices blend Cronos with the top one hundred tokens, providing broad exposure to crypto's growth while smoothing volatility through cross-asset diversification. This approach captures market-wide tailwinds without overweighting any single point of failure.

Systematic rebalancing within index strategies creates an additional return source that concentrated positions lack. As some tokens outperform and others lag, regular rebalancing mechanically sells winners and buys laggards, exploiting mean reversion and volatility. Single-token holders miss this rebalancing alpha and often watch concentrated gains evaporate during corrections while index strategies preserve more gains through automated profit-taking.

Beyond returns, diversified indices improve the investor experience by reducing emotional decision-making. Concentrated CRO positions subject you to severe drawdowns that trigger panic selling at bottoms. Indices smooth the ride through natural diversification, making it easier to maintain exposure through full market cycles.

Cronos is an EVM-compatible blockchain built to support decentralized applications with high throughput and low transaction costs. The network is designed to bridge the gap between crypto and traditional finance, offering interoperability with Ethereum and Cosmos ecosystems. Its focus on scalability and developer-friendly infrastructure aims to attract DeFi, NFT, and gaming projects.

CRO serves as the native utility token of the Cronos ecosystem, used for transaction fees, staking, and governance. It enables users to participate in network security, pay for smart contract execution, and access services within the Cronos DeFi ecosystem. Common usage patterns include staking for rewards, providing liquidity in DeFi protocols, and facilitating cross-chain transfers.

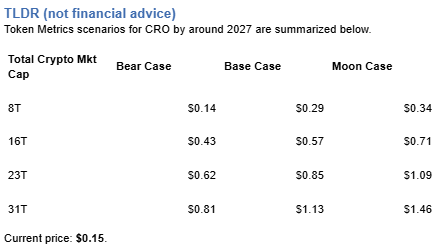

At an 8 trillion dollar total crypto market cap, CRO projects to $0.14 in bear conditions, $0.29 in the base case, and $0.34 in bullish scenarios.

Doubling the market to 16 trillion expands the range to $0.43 (bear), $0.57 (base), and $0.71 (moon).

At 23 trillion, the scenarios show $0.62, $0.85, and $1.09 respectively.

In the maximum liquidity scenario of 31 trillion, CRO could reach $0.81 (bear), $1.13 (base), or $1.46 (moon).

These ranges illustrate potential outcomes for concentrated CRO positions, but investors should weigh whether single-asset exposure matches their risk tolerance or whether diversified strategies better suit their objectives.

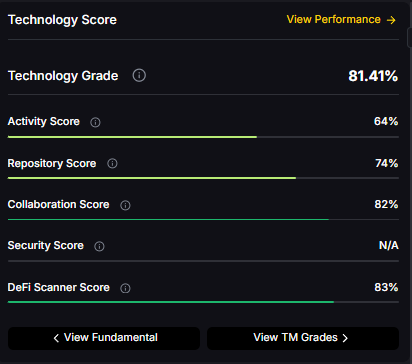

Fundamental Grade: 72.71% (Community 55%, Tokenomics 60%, Exchange 100%, VC N/A, DeFi Scanner 83%).

Technology Grade: 81.41% (Activity 64%, Repository 74%, Collaboration 82%, Security N/A, DeFi Scanner 83%).

Can CRO reach $1?

Based on the scenarios, CRO could reach $1 in the 23T moon case where it projects to $1.09, and in the 31T scenarios where the base case is $1.13 and the moon case is $1.46. These outcomes require both broad market cap expansion and Cronos maintaining competitive position. Not financial advice.

What's the risk/reward profile for CRO?

Risk/reward spans from $0.14 in the lowest bear case to $1.46 in the highest moon case. Downside risks include regulatory or infrastructure shocks and competitive displacement, while upside drivers include liquidity expansion and roadmap execution. Concentrated positions amplify both tails, while diversified strategies smooth outcomes.

What gives CRO value?

CRO accrues value through transaction fees, staking, and governance utility across the Cronos ecosystem. Demand drivers include DeFi activity, cross-chain usage, and network services. While these fundamentals matter, diversified portfolios capture value accrual across multiple tokens rather than betting on one protocol's success.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, concentration amplifies risk, and diversification is a fundamental principle of prudent portfolio construction. Do your own research and manage risk appropriately.

%201.svg)

%201.svg)

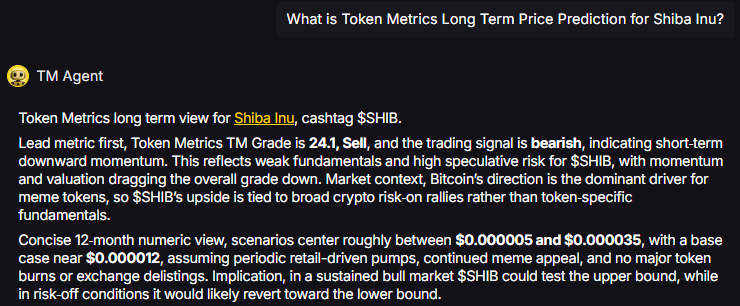

Shiba Inu operates as a community-driven meme token where price action stems primarily from social sentiment, attention cycles, and speculative trading rather than fundamental value drivers. SHIB exhibits extreme volatility with no defensive characteristics or revenue-generating mechanisms typical of utility tokens. Token Metrics scenarios below provide technical Price Predictions across different market cap environments, though meme tokens correlate more strongly with viral trends and community engagement than systematic market cap models. Positions in SHIB should be sized as high-risk speculative bets with potential for total loss.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity. For meme tokens, actual outcomes depend heavily on social trends and community momentum beyond what market cap models capture.

TM Agent baseline: Token Metrics TM Grade is 24.1%, Sell, with a bearish trading signal. The concise 12‑month numeric view centers between

TM Agent numeric view: scenarios center roughly between $0.000005 and $0.000035, with a base case near $0.000012.

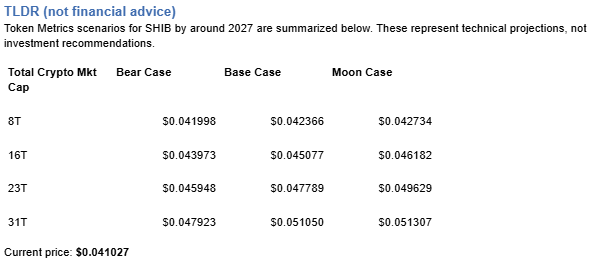

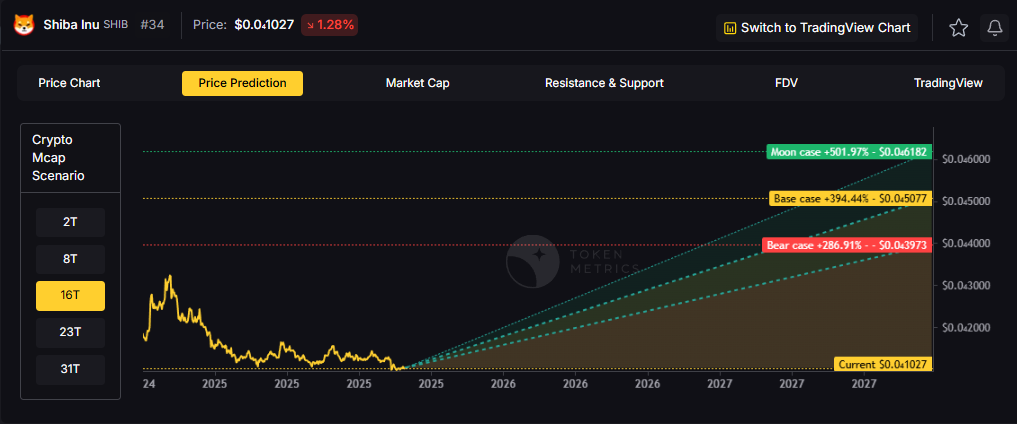

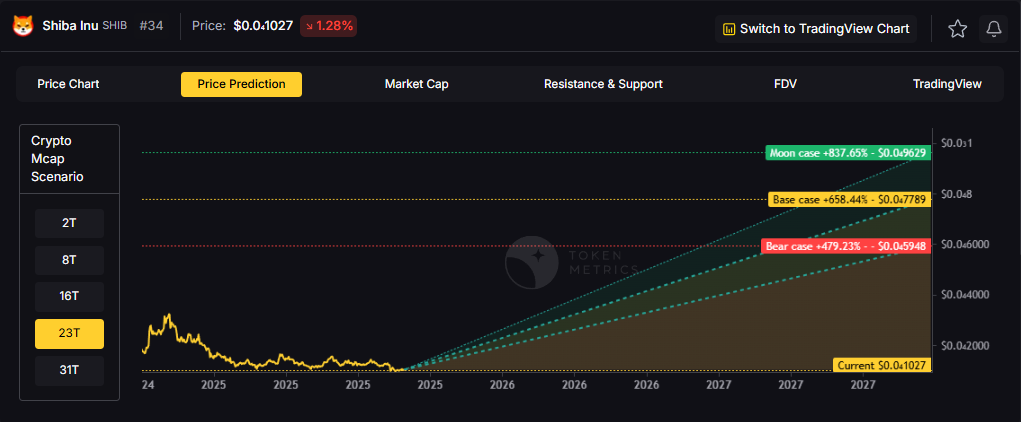

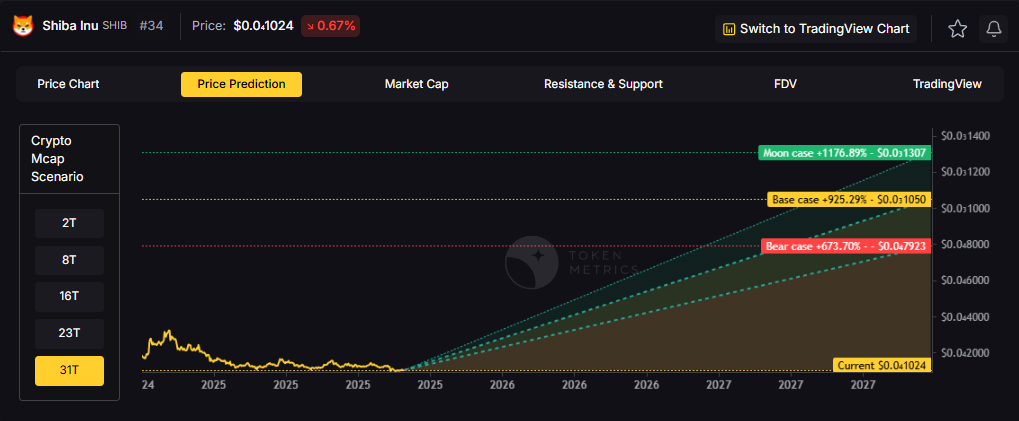

Token Metrics scenarios provide technical price bands across market cap tiers:

8T: At 8 trillion total crypto market cap, SHIB projects to $0.041998 (bear), $0.042366 (base), and $0.042734 (moon).

16T: At 16 trillion total crypto market cap, SHIB projects to $0.043973 (bear), $0.045077 (base), and $0.046182 (moon).

23T: At 23 trillion total crypto market cap, SHIB projects to $0.045948 (bear), $0.047789 (base), and $0.049629 (moon).

31T: At 31 trillion total crypto market cap, SHIB projects to $0.047923 (bear), $0.051050 (base), and $0.051307 (moon).

These technical ranges assume meme tokens maintain market cap share proportional to overall crypto growth. Actual outcomes for speculative tokens typically exhibit higher variance and stronger correlation to social trends than these models predict.

Shiba Inu is a meme-born crypto project that centers on community and speculative culture. Unlike utility tokens with specific use cases, SHIB operates primarily as a speculative asset and community symbol. The project focuses on community engagement and entertainment value.

SHIB has demonstrated viral moments and community loyalty within the broader meme token category. The token trades on community sentiment and attention cycles more than fundamentals. Market performance depends heavily on social media attention and broader meme coin cycles.

Token Metrics provides technical analysis, scenario math, and rigorous risk evaluation for hundreds of crypto tokens. Want to dig deeper? Explore our powerful AI-powered ratings and scenario tools here.

Will SHIB 10x from here?

Answer: At current price of $0.041027, a 10x reaches $0.41027. This level does not appear in any of the listed bear, base, or moon scenarios across 8T, 16T, 23T, or 31T tiers. Meme tokens can 10x rapidly during viral moments but can also lose 90%+ just as quickly. Position sizing for potential total loss is critical. Not financial advice.

What are the biggest risks to SHIB?

Answer: Primary risks include attention shifting to newer memes, community fragmentation, developer abandonment, regulatory crackdowns, and liquidity collapse during downturns. Unlike utility tokens with defensive characteristics, SHIB has zero fundamental floor. Price can approach zero if community interest disappears. Total loss is a realistic outcome. Not financial advice.

Next Steps

Disclosure

Educational purposes only, not financial advice. SHIB is a highly speculative asset with extreme volatility and high risk of total loss. Meme tokens operate as entertainment and gambling instruments rather than investments. Only allocate capital you can afford to lose entirely. Do your own research and manage risk appropriately.

%201.svg)

%201.svg)

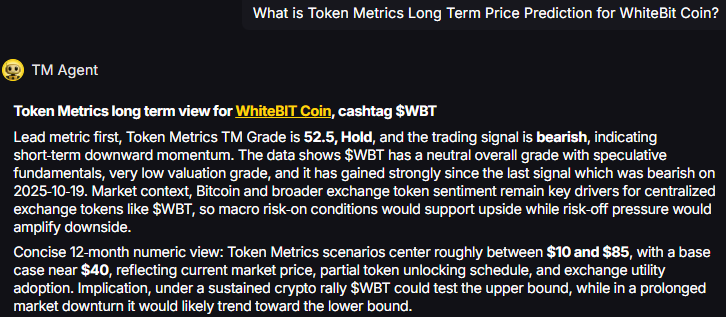

Exchange tokens like WhiteBIT Coin offer leveraged exposure to overall market activity, creating concentration risk around a single platform's success. While WBT can deliver outsized returns during bull markets with high trading volumes, platform-specific risks like regulatory action, security breaches, or competitive displacement amplify downside exposure. Portfolio theory suggests balancing such concentrated bets with broader sector exposure.

The scenarios below show how WBT might perform across different crypto market cap environments. Rather than betting entirely on WhiteBIT Coin's exchange succeeding, diversified strategies blend exchange tokens with L1s, DeFi protocols, and infrastructure plays to capture crypto market growth while mitigating single-platform risk.

Portfolio theory teaches that diversification is the only free lunch in investing. WBT concentration violates this principle by tying your crypto returns to one protocol's fate. Token Metrics Indices blend WhiteBIT Coin with the top one hundred tokens, providing broad exposure to crypto's growth while smoothing volatility through cross-asset diversification. This approach captures market-wide tailwinds without overweighting any single point of failure.

Systematic rebalancing within index strategies creates an additional return source that concentrated positions lack. As some tokens outperform and others lag, regular rebalancing mechanically sells winners and buys laggards, exploiting mean reversion and volatility. Single-token holders miss this rebalancing alpha and often watch concentrated gains evaporate during corrections while index strategies preserve more gains through automated profit-taking.

Beyond returns, diversified indices improve the investor experience by reducing emotional decision-making. Concentrated WBT positions subject you to severe drawdowns that trigger panic selling at bottoms. Indices smooth the ride through natural diversification, making it easier to maintain exposure through full market cycles. Get early access: https://docs.google.com/forms/d/1AnJr8hn51ita6654sRGiiW1K6sE10F1JX-plqTUssXk/preview.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics long term view for WhiteBIT Coin, cashtag $WBT. Lead metric first, Token Metrics TM Grade is 52.5%, Hold, and the trading signal is bearish, indicating short-term downward momentum. Concise 12-month numeric view: Token Metrics scenarios center roughly between $10 and $85, with a base case near $40.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T: At an 8 trillion dollar total crypto market cap, WBT projects to $54.50 in bear conditions, $64.88 in the base case, and $75.26 in bullish scenarios.

16T: Doubling the market to 16 trillion expands the range to $78.61 (bear), $109.75 (base), and $140.89 (moon).

23T: At 23 trillion, the scenarios show $102.71, $154.61, and $206.51 respectively.

31T: In the maximum liquidity scenario of 31 trillion, WBT could reach $126.81 (bear), $199.47 (base), or $272.13 (moon).

These ranges illustrate potential outcomes for concentrated WBT positions, but investors should weigh whether single-asset exposure matches their risk tolerance or whether diversified strategies better suit their objectives.

WhiteBIT Coin is the native exchange token associated with the WhiteBIT ecosystem. It is designed to support utility on the platform and related services.

WBT typically provides fee discounts and ecosystem benefits where supported. Usage depends on exchange activity and partner integrations.

Token Metrics AI provides comprehensive context on WhiteBIT Coin's positioning and challenges.

Vision: The stated vision for WhiteBIT Coin centers on enhancing user experience within the WhiteBIT exchange ecosystem by providing tangible benefits such as reduced trading fees, access to exclusive features, and participation in platform governance or rewards programs. It aims to strengthen user loyalty and engagement by aligning token holders’ interests with the exchange’s long-term success. While not positioned as a decentralized protocol token, its vision reflects a broader trend of exchanges leveraging tokens to build sustainable, incentivized communities.

Problem: Centralized exchanges often face challenges in retaining active users and differentiating themselves in a competitive market. Users may be deterred by high trading fees, limited reward mechanisms, or lack of influence over platform developments. WhiteBIT Coin aims to address these frictions by introducing a native incentive layer that rewards participation, encourages platform loyalty, and offers cost-saving benefits. This model seeks to improve user engagement and create a more dynamic trading environment on the WhiteBIT platform.

Solution: WhiteBIT Coin serves as a utility token within the WhiteBIT exchange, offering users reduced trading fees, staking opportunities, and access to special events such as token sales or airdrops. It functions as an economic lever to incentivize platform activity and user retention. While specific governance features are not widely documented, such tokens often enable voting on platform upgrades or listing decisions. The solution relies on integrating the token deeply into the exchange’s operational model to ensure consistent demand and utility for holders.

Market Analysis: Exchange tokens like WhiteBIT Coin operate in a competitive landscape led by established players such as Binance Coin (BNB) and KuCoin Token (KCS). While BNB benefits from a vast ecosystem including a launchpad, decentralized exchange, and payment network, WBT focuses on utility within its native exchange. Adoption drivers include the exchange’s trading volume, security track record, and the attractiveness of fee discounts and staking yields. Key risks involve regulatory pressure on centralized exchanges and competition from other exchange tokens that offer similar benefits.

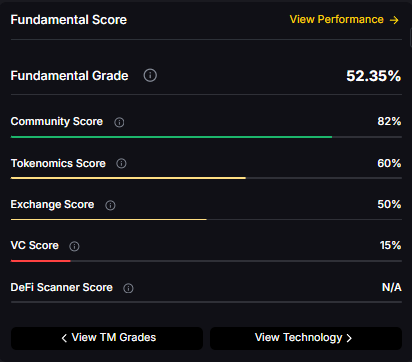

Fundamental Grade: 52.35% (Community 82%, Tokenomics 60%, Exchange 50%, VC —, DeFi Scanner N/A).

Can WBT reach $100?

Answer: Based on the scenarios, WBT could reach $100 in the 16T base case. The 16T tier projects $109.75 in the base case. Achieving this requires both broad market cap expansion and WhiteBIT Coin maintaining competitive position. Not financial advice.

What's the risk/reward profile for WBT?

Answer: Risk and reward span from $54.50 in the lowest bear case to $272.13 in the highest moon case. Downside risks include regulatory actions and competitive displacement, while upside drivers include expanding access and favorable macro liquidity. Concentrated positions amplify both tails, while diversified strategies smooth outcomes.

What gives WBT value?

Answer: WBT accrues value through fee discounts, staking rewards, access to special events, and potential participation in platform programs. Demand drivers include exchange activity, user growth, and security reputation. While these fundamentals matter, diversified portfolios capture value accrual across multiple tokens rather than betting on one protocol's success.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, concentration amplifies risk, and diversification is a fundamental principle of prudent portfolio construction. Do your own research and manage risk appropriately.

%201.svg)

%201.svg)

The cryptocurrency trading landscape moves at lightning speed. Tokens pump, narratives shift, and entire sectors rotate overnight. In this chaotic environment, traders need more than just basic charts and lagging indicators — they need real-time, data-driven tools that can process vast amounts of information instantly.

That’s exactly where AI crypto trading comes in. In 2025, Token Metrics has taken cryptocurrency trading to a new level with its advanced Real-Time AI Grades, giving both traders and investors a clear edge in the hyper-volatile crypto trading markets.

With AI-powered Trader and Investor Grades, Token Metrics helps users evaluate any token’s strength, momentum, and long-term trend alignment — all calculated in real-time using over 80 data points. This isn’t just data. It’s actionable intelligence, powered by AI cryptocurrency trading models designed for today’s fast-moving market.

At the core of Token Metrics' AI crypto trading platform are two proprietary grading systems:

Both grades are calculated using over 80 quantitative and on-chain data points that are continuously updated. These data points include:

The grades are expressed on a simple 0 to 100 scale, making it easy for traders to quickly assess a token’s strength. In most cases, a Trader Grade above 90 signals that a token is showing breakout potential, while a falling Investor Grade can warn of an impending trend reversal.

In short, Token Metrics uses AI cryptocurrency trading technology to distill massive data into simple, actionable grades — making cryptocurrency trading far more data-driven and precise.

Until recently, these grades were updated daily. But now, Token Metrics has moved to real-time grading for high-volume tokens, creating a breakthrough moment for AI crypto trading.

With real-time grading, these AI crypto trading signals are no longer simply informative — they’re fully actionable. Traders can now respond to shifts in momentum as they happen, not after the move has already played out.

During a recent Token Metrics webinar, the power of real-time AI grading was demonstrated with live market examples:

This real-time grading system gives traders an enormous edge in cryptocurrency trading. Instead of reacting emotionally to price moves, traders can confidently follow objective AI-powered signals.

One of the most powerful features of Token Metrics Real-Time Grades is the overlay integration on live price charts within the platform.

With visual overlays, traders can:

This creates a visual roadmap for crypto trading — allowing users to instantly read the health of any token’s trend with unparalleled clarity. For AI crypto trading, this level of real-time visual feedback dramatically improves confidence and precision.

Traditional cryptocurrency trading indicators like RSI, MACD, and basic chart patterns have major limitations:

Feature Token Metrics AI Grades Traditional TA Tools

Combines 80+ real-time data points ✅ Yes ❌ No

AI-powered signal generation ✅ Yes ❌ No

Real-time intraday updates ✅ Yes ❌Often delayed

Visual chart overlays ✅ Yes ❌ Manual

Integrated filtering & automation ✅ Yes ❌ Lacks automation

While traditional indicators rely on simplistic price-based formulas, Token Metrics combines multi-dimensional data sources with AI modeling. This is the future of AI cryptocurrency trading — far more comprehensive, adaptive, and responsive than old-school technical analysis.

The beauty of real-time AI grading is that it’s highly adaptable across different types of cryptocurrency traders and investors:

If you care about momentum, timing, filtering, and precision in cryptocurrency trading, these grades offer one of the strongest data-driven edges available in the market today.

The cryptocurrency market is simply too fast, too global, and too emotional for purely manual trading. Attention shifts hourly. Liquidity floods into narratives instantly. Retail and institutional money rotate rapidly between sectors.

AI crypto trading is the only way to stay ahead of this chaos.

With Token Metrics’ Real-Time AI Grades:

This is quant-grade crypto trading — delivered directly to everyday traders.

In 2025, smart crypto traders are no longer trading charts. They’re trading AI grades.

As the cryptocurrency trading industry matures, traders increasingly seek smarter, data-driven solutions that remove emotion, improve timing, and boost profitability. Token Metrics’ Real-Time AI Grades are delivering exactly that.

By combining real-time price action, on-chain analytics, volatility measures, liquidity flows, and machine learning models, Token Metrics has built one of the most advanced AI crypto trading platforms available today.

If you want to succeed in cryptocurrency trading — and stay ahead of fast-moving markets in 2025 — real-time AI grading is no longer optional. It’s the new standard.

%201.svg)

%201.svg)

In crypto, narratives don’t just tell stories — they move serious capital.

Every few weeks, a new sector takes center stage. One day it’s memecoins. The next it’s AI tokens. After that, it's Real World Assets (RWAs), restaking protocols, or something entirely new. The constant cycle of hype and attention creates volatile capital flows that most traders struggle to keep up with. By the time you realize a narrative is pumping, you're often already late. The smart money has rotated, and you’re left holding the bag as exit liquidity.

This is where Token Metrics steps in with a powerful solution: AI-driven Portfolio Rotation based on real-time narrative performance.

Instead of relying on gut feeling or Twitter hype, Token Metrics uses real-time data, AI-powered grading, and predictive analytics to help you rotate your crypto portfolio into the right narratives at exactly the right time. It’s built for traders who want to consistently stay ahead of capital flows, and it’s already live for Premium users.

Let’s dive deeper into why narrative rotation matters, how Token Metrics tracks it in real-time, and why this AI-powered system is changing the way traders approach crypto markets.

If you’ve been trading crypto for a while, you already know one core truth: attention drives liquidity. And in crypto, attention shifts fast.

Whenever a new narrative gains traction — whether it's driven by a protocol upgrade, macroeconomic news, or simply viral social media posts — the capital starts flowing:

This cycle repeats over and over. If you’re not rotating early, you end up entering the trade just as early participants are exiting. The trick is not just identifying strong narratives — it’s recognizing when they start to heat up, and moving capital accordingly.

Narrative rotation allows traders to continuously reallocate their portfolio toward the sectors that are attracting fresh liquidity — and more importantly — exiting fading narratives before they reverse.

In traditional markets, this level of active sector rotation often requires hedge fund-level resources. In crypto, with its fragmented data and 24/7 markets, it's even harder to pull off manually. That’s where AI comes in.

The Token Metrics team recognized that crypto traders needed a smarter, data-driven approach to narrative rotation. So they built an entire system that tracks sector performance dynamically — in real time — across hundreds of tokens and multiple narratives.

Here’s how it works:

In short, instead of relying on your gut instinct or waiting for narratives to trend on crypto Twitter, you’re seeing clear, data-backed signals the moment narratives begin to heat up — and well before retail crowds arrive.

The real breakthrough is AI Portfolio Rotation. This isn’t just a dashboard that shows you sector performance. Token Metrics goes a step further by actually generating actionable portfolio rotation recommendations based on live narrative performance.

The system works like this:

It’s essentially an AI-powered quant fund operating on narrative rotation logic — continuously adapting your portfolio allocation based on capital flows across narratives in real-time.

For traders, it turns the chaotic, unpredictable world of crypto narratives into a structured, rules-based trading system.

During the recent Token Metrics Premium webinar, the team showcased how AI Portfolio Rotation played out in the real market over just a few weeks.

By using Token Metrics’ AI-powered system, traders following the dashboard were able to rotate their portfolios in sync with these capital flows — entering hot narratives early and exiting before momentum faded.

AI Portfolio Rotation isn’t just for advanced quant traders — it's designed for a wide range of crypto participants:

The point is simple: narrative allocation beats token picking.

Most traders spend hours debating which token to buy, but often fail to recognize that sector rotation drives much larger price moves than token fundamentals alone — especially in the short-term crypto cycle.

To really understand the edge this provides, let’s compare:

Feature Token Metrics AI Rotation Manual Research

Live Narrative ROI Tracking ✅ Yes ❌ No

AI-Driven Rotation Logic ✅ Yes ❌ No

Trader Grade Filtering per Theme ✅ Yes ❌ No

Bullish/Bearish Signals ✅ Yes ❌ No

Performance vs BTC/SOL/ETH Benchmarks ✅ Yes ❌ Time-consuming

While manual research often leaves you reacting late, Token Metrics transforms narrative rotation into an objective, data-powered process that removes emotional bias from your trading decisions.

AI-driven portfolio rotation gives you the ultimate edge in fast-moving crypto markets.

Instead of constantly chasing headlines, Discord alphas, or social media hype, Token Metrics allows you to:

It’s a systematic, repeatable approach to trading the strongest sectors in real time. And most importantly — it allows you to profit from the same capital flows that move these markets.

In a space where being early is everything, Token Metrics’ AI Portfolio Rotation may be one of the smartest tools available for crypto traders looking to stay ahead of narrative rotations.

This isn’t just better data — it’s better positioning.

%201.svg)

%201.svg)

Zapier is a no-code automation platform that lets you connect different apps and workflows using simple logic. With this integration, Token Metrics becomes one of the most powerful crypto APIs available for automation.

Now, you can instantly stream insights from the best crypto API into your favorite tools—whether you're managing a community in Discord, running a trading desk in Slack, or tracking token performance in Google Sheets.

Imagine automatically alerting your team when:

That’s just the beginning.

Let’s break down one of the most exciting use cases: creating a crypto AI assistant in Discord that delivers real-time token insights using Token Metrics and Zapier.

First, connect your Token Metrics account to Zapier and select your trigger. Zapier will display available endpoints from the Token Metrics API, including:

For this walkthrough, we’ll use the Quant Metrics endpoint and monitor the token Hyperliquid, a rising star in the market.

Next, we use OpenAI’s ChatGPT node within Zapier to interpret the raw token data.

The Token Metrics API provides rich data fields like:

In the prompt, we pass these values into ChatGPT and instruct it to generate a human-readable summary. For example:

“Summarize this token's current risk profile and valuation using Sharpe Ratio, Value at Risk, and Price Trend. Mention whether it looks bullish or bearish overall.”

The AI response returns a concise and insightful report.

Now it’s time to publish your insights directly to Discord. Using Zapier’s Discord integration, you simply map the output from ChatGPT into a message block and post it in a channel of your choice.

The result? A clean, formatted message with up-to-date crypto analytics—delivered automatically in real time.

This workflow doesn’t stop at one token.

You can easily expand your automation to:

Every piece of this system is powered by the Token Metrics crypto API, making it one of the most versatile tools for crypto automation on the market.

When it comes to building crypto tools, bots, or dashboards, data quality is everything. Here’s what makes Token Metrics the best crypto API to plug into Zapier:

We use AI, machine learning, and quantitative analysis to score, rank, and predict token behavior across thousands of coins.

Track tokens across top L1 and L2 chains like Ethereum, Solana, Avalanche, Base, and more.

Our API includes pre-calculated metrics like Bullish/Bearish Signals, Investor/Trader Grades, Risk Scores, and On-Chain Sentiment.

Pull exactly the data you need—from a single token’s valuation score to an entire index’s historical performance.

With this integration, developers, traders, and crypto communities can now build:

Zapier’s drag-and-drop interface makes it easy—even if you don’t write code.

Let’s say you’re running a Discord community around DeFi or AI tokens. With this integration, you can:

You now have a fully autonomous crypto analyst working 24/7—helping members stay informed and ahead of market shifts.

If you’ve been looking for a crypto API that’s both powerful and flexible—Token Metrics is it. And with our new Zapier integration, you can bring those insights directly into the tools you already use.

This is the future of crypto trading: AI-powered, automated, and deeply personalized.

Crypto markets don’t sleep—and neither should your insights.

With the best crypto API now available through Zapier, Token Metrics gives you the power to build anything: bots, dashboards, trading agents, alert systems, and more.

Whether you're an individual trader, a Web3 builder, or a fund manager, this integration brings automation, AI, and crypto intelligence to your fingertips.

Let’s build the future of trading—together.

%201.svg)

%201.svg)

Developer demand for high-fidelity market data has never been higher, and so has the need for agentic AI that can act on that data. Token Metrics delivers one of the best crypto API experiences on the market, streaming tick-level prices, on-chain metrics, and proprietary AI grades across 6,000+ assets. Meanwhile, OpenAI’s new Agents SDK gives engineers a lightweight way to orchestrate autonomous AI workflows—without the overhead of a full UI—by chaining model calls, tools, and memory under a single, developer-friendly abstraction. Together they form a plug-and-play stack for building real-time trading bots, research copilots, and portfolio dashboards that think and act for themselves.

Because the service unifies raw market data with higher-level AI insight, many builders call it the token metrics crypto API of choice for agentic applications.

Unlike prior frameworks that mixed business logic with UI layers, the Agents SDK is headless by design. You write plain TypeScript (or JavaScript) that:

Under the hood, the SDK coordinates multiple model calls, routes arguments to tools, and maintains short-term memory—freeing you to focus on domain logic.

Token Metrics recently shipped its Crypto MCP Server, a lightweight gateway that normalises every client—OpenAI, Claude, Cursor, VS Code, Windsurf, and more—around a single schema and API key. One paste of your key and the OpenAI Agents SDK can query real-time grades, prices, and signals through the same endpoint used in your IDE or CLI.

Why MCP?

Consistency—every tool sees the same value for “Trader Grade.”

One-time auth—store one key, let the server handle headers.

Faster prototyping—copy code between Cursor and Windsurf without rewriting requests.

Lower cost—shared quota plus TMAI staking discounts.

In fewer than 30 lines you’ve built a self-orchestrating research assistant that pulls live data from the best crypto API and reasons with GPT-4o.

Because every piece is modular, you can swap GPT-4o for GPT-4.1, add a DEX trading function, or stream outputs to a React dashboard—no core rewrites required.

OpenAI usage is metered per token, but the Agents SDK optimises context windows and tool invocations, often yielding lower compute cost than bespoke chains.

Token Metrics is rolling out first-party TypeScript helpers that auto-generate tool schemas from the OpenAPI spec, making tool wrapping a one-liner. On the OpenAI side, Responses API is slated to replace the Assistants API by mid-2026, and the Agents SDK will track that upgrade.

Ready to build your own autonomous finance stack?

The synergy between the Token Metrics crypto API and OpenAI’s Agents SDK isn’t just another integration; it’s the missing link between raw blockchain data and actionable, self-operating intelligence. Tap in today and start letting your agents do the heavy lifting.

%201.svg)

%201.svg)

In today’s crypto market, raw data isn’t enough. Speed isn’t enough. What you need is insight.

That’s why we’re excited to unveil a game-changing integration: Token Metrics Crypto API now powers an ultra-fast, AI-driven crypto analytics platform—supercharged by Windsurf Coding Agent automation. This isn’t just another crypto dashboard. It’s a real-time intelligence engine designed for traders, funds, and crypto builders who demand an edge.

Most crypto dashboards simply pull price data and display it. But serious traders know that price alone doesn’t tell the full story. You need context. You need predictive signals. You need advanced analytics that go beyond surface-level charts.

The Token Metrics Crypto API changes that.

By combining cutting-edge AI models with deep on-chain and market data, the Token Metrics API delivers the kind of actionable intelligence that traditional platforms can’t match.

At the heart of this new platform lies the Token Metrics API — widely regarded by traders and funds as the best crypto API available today.

Here’s why:

The Token Metrics API delivers real-time valuations, grades, risk metrics, and momentum signals—powered by sophisticated AI and machine learning models analyzing thousands of crypto assets.

Leverage Investor Grade and Trader Grade rankings to see which tokens are gaining momentum — before the market fully reacts.

Access volatility scores, Sharpe ratios, value-at-risk metrics, and drawdown analysis to manage risk with precision.

Identify hidden relationships between tokens using real-time clustering and on-chain sentiment analysis.

Whether you trade altcoins, L1 ecosystems, DeFi, or memecoins — the Token Metrics Crypto API covers thousands of assets across multiple chains.

This depth of data allows the platform to do far more than just monitor prices — it discovers patterns, clusters, momentum shifts, and early market signals in real-time.

To build a truly responsive and adaptive crypto intelligence platform, we leveraged Windsurf Coding Agent automation. Windsurf allows us to ship new dashboards, signals, and features in hours—not weeks.

As crypto markets evolve rapidly, speed to insight becomes critical. With Windsurf’s agent-driven automation, we can prototype, iterate, and deploy new AI models and data visualizations faster than any traditional development cycle allows.

This makes the entire system fluid, adaptive, and always tuned to the latest market behavior.

This isn’t your average crypto dashboard.

Every data point is analyzed, filtered, and rendered within milliseconds. As soon as the Token Metrics API delivers updated data, the platform processes it through real-time clustering, momentum scoring, and risk analysis.

The result? A blazingly fast, AI-powered crypto dashboard that gives you insights while your competition is still refreshing price feeds.

Crypto markets generate overwhelming amounts of data — price swings, liquidity changes, on-chain flows, funding rates, sentiment shifts, and more.

The Token Metrics + Windsurf integration filters that noise into clear, actionable signals. Whether you’re:

... this platform turns complexity into clarity.

The signal is out there. We help you find it.

When evaluating crypto APIs, most traders and developers face the same issues: incomplete data, poor documentation, limited endpoints, or stale updates. The Token Metrics API stands apart as the best crypto API for several key reasons:

The Token Metrics API covers over 6,000 crypto assets across major chains, sectors, and narratives.

Unlike other crypto APIs that only provide raw market data, Token Metrics delivers pre-calculated AI insights including:

The API is fully documented, REST-based, and easily integrates with platforms like Windsurf, Zapier, and custom trading systems.

Data is refreshed continuously to ensure you’re always working with the latest available insights.

This makes the Token Metrics crypto API ideal for:

Imagine this:

You’re managing a portfolio with exposure to several DeFi tokens. The platform detects that several mid-cap DeFi projects are clustering together with rising momentum scores and improving Investor Grades. Within seconds, your dashboard flashes an early “sector breakout” signal.

By the time social media narratives catch on hours or days later — you’re already positioned.

This is the edge that real-time AI-driven analytics delivers.

The possibilities are nearly endless:

And because Windsurf Coding Agent automates development, these solutions can evolve rapidly as new narratives, tokens, and market behaviors emerge.

If you’re serious about staying ahead in crypto, you need more than just prices—you need intelligence.

The combination of Token Metrics API and Windsurf’s automation delivers the fastest, smartest way to build your own crypto intelligence systems.

The days of static dashboards and delayed signals are over. The future belongs to platforms that deliver real-time, AI-powered, adaptive crypto intelligence.

With Token Metrics Crypto API and Windsurf Coding Agent, you have the tools to build that future—today.

.png)

%201.svg)

%201.svg)

Combine the Best Crypto API with Cline’s AI Coding Environment to Automate Smarter Trades—Faster

The world of crypto development just leveled up.

We're excited to announce a powerful new integration between Token Metrics and Cline (via the Roo Code extension)—bringing together the most advanced crypto API on the market and an AI-native coding environment purpose-built for building and testing crypto trading bots.

This partnership unlocks the ability to rapidly prototype, test, and launch intelligent trading strategies using real-time data from Token Metrics directly inside Cline, making it easier than ever for developers and traders to build in the crypto economy.

In this post, we’ll show you exactly how this works, walk through a working example using the Hyperliquid token, and explain why Token Metrics is the best crypto API to use with Cline for next-gen trading automation.

Cline is an AI-first coding assistant designed to turn ideas into code through conversational prompts. With the Roo Code extension in Visual Studio Code, Cline transforms your IDE into an AI-native environment, allowing you to:

By integrating Token Metrics’ cryptocurrency API through its MCP (Multi-Client Protocol) server, developers can access real-time grades, trading signals, quant metrics, and risk insights—all through AI-driven prompts.

This combo of live crypto data and AI-native coding makes Cline one of the fastest ways to build trading bots today.

The Token Metrics API is the ultimate toolkit for crypto developers. It's a high-performance, developer-focused crypto API that gives you:

These features are now accessible via the MCP server—a gateway that standardizes access to Token Metrics data for AI agents, bots, dashboards, and more.

Whether you’re building a Telegram bot, a trading terminal, or a portfolio optimizer, the Token Metrics MCP setup with Cline makes it seamless.

Here’s a walkthrough of how you can build a complete AI-powered trading bot using Cline and the Token Metrics API.

Open VS Code and click “Open Folder.” Name your project something fun—like “Hype Bot.”

Then go to the Extensions tab, search for “Roo Code” (the advanced version of Cline), and install it.

Once installed:

🎉 Now your environment is live, and you’re connected to the best crypto API on the market.

Inside Cline, simply prompt:

“Explore the Token Metrics API and analyze the Hyperliquid token.”

In seconds, the agent fetches and returns detailed insights—including investor grade, sentiment shifts, trading volume, and support/resistance levels for Hyperliquid. It even detects patterns not visible on typical trading platforms.

Next prompt:

“Create a trading strategy using this data.”

The agent responds with a full Python trading script based on AI signals from the API—complete with buy/sell logic, thresholds, and data pipelines.

Cline automatically generates a backtest file and plots a performance chart.

For example:

This is real-time data, real code, real results—all built through a few smart prompts.

No more hours spent reading docs or integrating messy SDKs. With Cline + Token Metrics, you talk to your agent, and it builds the bot, fetches the data, and runs the strategy.

Token Metrics provides professional-grade market signals used by hedge funds, traders, and analysts. With 80+ metrics per token, it’s the most detailed cryptocurrency API available—now accessible to indie devs and builders via Cline.

Backtesting, strategy generation, and data access happen within seconds. This drastically cuts time-to-market for MVPs, AI assistants, and algo bots.

Final Thoughts

The future of building in crypto is agent-driven, data-rich, and fast.

This integration between Token Metrics and Cline proves that with the right tools, anyone can turn an idea into a trading bot in under 10 minutes—using real-time market data, AI-grade analysis, and seamless backtesting in one workflow.

No manual coding. No noise. Just results.

Start building smarter bots today:

👉 Get your API Key on Token Metrics

👉 Install Roo Code and connect Cline

Watch demo here!

Let’s build the next generation of crypto trading together.

%201.svg)

%201.svg)

AI is transforming the future of AI crypto trading—and with the integration of Token Metrics Crypto API and Cursor AI, we’re taking another giant leap forward.

This integration unlocks the ability for developers, quants, and crypto-native builders to create powerful trading agents using natural language, real-time crypto market data, and automation—all through a single interface.

Whether you're building an AI agent that monitors market trends, provides trading signals, or develops actionable investment plans, the combination of Token Metrics' cryptocurrency API and Cursor AI’s intelligent prompt interface is the future of how crypto strategies are built and executed.

In this blog, we’ll walk you through the integration, show you what’s possible, and explain why this is the most developer-friendly and data-rich crypto API available today.

The Token Metrics API is a developer-grade crypto API that delivers over 80 advanced signals and data points per token. It covers:

With deep market insight and predictive analytics, it’s built for developers looking to power anything from crypto dashboards to automated trading agents, telegram bots, or custom portfolio apps.

Now, with the Cursor AI integration, all of this power is just one conversation away.

Cursor AI is an advanced AI development environment where agents can write code, test ideas, and build applications based on natural language prompts. With support for live API integrations and tool chaining, it’s the perfect platform to build and deploy intelligent agents—without switching tabs or writing boilerplate code.

Now, developers can query live cryptocurrency API data from Token Metrics using natural language—and let the agent create insights, strategies, and trading logic on the fly.

Let’s walk through what building with Token Metrics on Cursor AI looks like.

It starts with a simple prompt:

“What are the tools you have for Token Metrics MCP?”

In seconds, the agent replies with the full toolkit available via Token Metrics Multi-Client Protocol (MCP), including:

Next, you say:

“Give me a trading agent idea using those tools.”

The agent responds by combining crypto API tools into an actionable concept—for instance, a trading assistant that monitors bull flips on high-ROI tokens, cross-checks sentiment, and then alerts you when investor and trader grades align.

Then you prompt again:

“Can you explore the tools and create a comprehensive plan for me?”

Here’s the magic: the agent pulls real-time data directly from the Token Metrics API, analyzes signals, ranks tokens, identifies top performers, and builds a structured trading plan with entry/exit logic.

No manual research. No spreadsheet wrangling.

Just clean, fast, and intelligent crypto trading strategy—generated by AI using the best crypto API on the market.

With Token Metrics + Cursor AI, developers can interact with crypto data using plain English. There’s no more need to juggle raw JSON files or multiple APIs. One schema, one key, full access.

Cursor agents can now fetch live signals and respond instantly, allowing you to create agents that trade, monitor, alert, and adapt based on changing market conditions.

From backtesting tools to investment advisors to portfolio rebalancers, the combined power of a smart agent and a smart API turns hours of coding into a few well-written prompts.

Whether you're building your first crypto trading bot or an enterprise-grade RAG assistant, this integration unlocks full creative and technical freedom.

This is just the beginning.

By connecting the Token Metrics API with Cursor AI, we’re moving toward a future where crypto tools are built by conversation, not code. It's not just about faster development—it’s about smarter, more adaptive trading tools that are accessible to everyone.

So go ahead.

Open up Cursor AI.

Type your first prompt.

And start building with the most intelligent crypto API in the game.

👉 Explore the Token Metrics API

👉 Start Building with Cursor AI

Watch Demo here!

%201.svg)

%201.svg)

Is the cryptocurrency market continues to mature, new technologies are emerging to give traders an edge. Among the most transformative is AI-powered crypto trading. From automating strategies to identifying hidden opportunities, AI is redefining how traders interact with digital assets.

In this guide, we’ll break down:

AI crypto trading refers to the use of artificial intelligence (AI), machine learning (ML), and data science techniques to make smarter, faster, and more informed trading decisions in the cryptocurrency markets.

These systems analyze vast datasets—price charts, market sentiment, technical indicators, social media trends, on-chain activity—to generate trading signals, price predictions, and portfolio strategies. The goal: remove emotion and bias from crypto trading and replace it with data-driven precision.

Some AI crypto trading tools offer:

AI is especially valuable in the 24/7 crypto markets, where human traders can’t keep up with constant volatility. With AI, traders can react instantly to market shifts and make decisions grounded in data—not gut feeling.

Understanding the major types of cryptocurrency trading is essential for choosing the right strategy—especially if you’re planning to use AI to assist or automate your trades.

Spot trading is the simplest and most common form of crypto trading. You buy or sell a cryptocurrency at its current price, and the transaction settles immediately (or “on the spot”). Most traders begin here.

AI can assist by identifying ideal entry and exit points, evaluating token grades, and managing risk.

Futures trading involves contracts that speculate on the future price of a cryptocurrency. Traders can go long or short, using leverage to amplify gains (and risks).

AI helps by identifying bullish or bearish trends, backtesting strategies, and automating trades with quantitative models that adapt to market changes.

Margin trading allows users to borrow funds to increase their trade size. It’s risky but potentially more rewarding.

AI can reduce some of the risks by using real-time volatility data, calculating stop-loss levels, and dynamically adjusting positions.

Swing traders hold positions for days or weeks, capturing short- to medium-term trends.

AI tools are ideal for swing trading, as they can combine technical indicators, market sentiment, and volume analysis to anticipate breakouts and reversals.

Day traders open and close positions within a single day, requiring rapid decision-making and constant monitoring.

Here, AI-powered bots can outperform humans by making thousands of micro-decisions per second, reducing slippage and emotional trading errors.

Algorithmic trading uses coded strategies to automate trades. AI takes this further by allowing the bot to learn and improve over time.

Token Metrics, for example, offers AI grades and indices that traders can plug into their own bots or use through the platform’s native AI strategies.

When it comes to crypto trading platforms, there are two main categories:

Below are some of the top cryptocurrency trading platforms in 2025—both exchanges and AI-powered tools—tailored to serious traders:

Token Metrics is not an exchange, but a crypto analytics and trading intelligence platform powered by AI. It offers:

Token Metrics bridges the gap between raw data and actionable decisions. Whether you’re a beginner or a pro running algorithmic strategies, Token Metrics delivers the AI layer needed to outperform the market.

Traders use Token Metrics alongside centralized exchanges (like Binance or Coinbase) or DEXs to validate trades, identify top-performing narratives, and automate entry/exit based on AI signals.

Binance is one of the world's largest cryptocurrency exchanges, allowing users to buy, sell, and trade hundreds of digital assets including Bitcoin, Ethereum, and other cryptocurrencies.

Founded in 2017 by Changpeng Zhao, the platform offers spot trading, futures, staking, and various other crypto-related financial services to millions of users globally.

Coinbase is ideal for retail investors and new traders. While it lacks advanced AI features, it’s a trusted fiat gateway.

Advanced users can subscribe to Coinbase Advanced or integrate with tools like Token Metrics to make smarter trading decisions.

Bybit offers both spot and derivatives, plus social trading tools like copy trading. It’s popular with swing and leverage traders.

Combine Bybit with Token Metrics for AI-driven entry points on high-volatility setups.

Kraken is known for strong security and a transparent track record. It supports spot, margin, and futures trading.

When paired with AI tools, Kraken becomes a secure execution venue for data-driven strategies.

OKX offers robust bot features, including grid trading and DCA bots. For users who prefer built-in automation, OKX is a solid option.

Still, Token Metrics outperforms on signal generation, narrative tracking, and AI-backed token scoring—making it an ideal data source for OKX bots.

As cryptocurrency trading evolves, manual strategies alone can’t keep up. Market cycles are faster, token launches are more frequent, and volatility is constant. This is where crypto AI trading shines.

Here’s why more traders are adopting AI:

Platforms like Token Metrics make this technology accessible—offering plug-and-play AI indices, custom signals, and portfolio intelligence for retail traders, funds, and institutions alike.

Cryptocurrency trading is becoming more competitive, data-driven, and automated. With the rise of crypto AI trading, traders now have the tools to gain a true edge—whether they’re investing $100 or managing $1M.

If you’re serious about crypto trading in 2025, don’t just guess—trade with data, trade with AI.

Explore how Token Metrics can power your portfolio with AI-generated insights, real-time signals, and next-generation trading tools.

.png)

%201.svg)

%201.svg)

The Token Metrics API has officially launched on Hacker News, marking a major milestone in our mission to bring AI-powered crypto insights to every developer, founder, and builder in the Web3 space.

If you're building trading bots, dashboards, investment tools, or AI agents that interact with the crypto market, this is your developer edge in 2025. Forget raw feeds and static charts—this is real-time, AI-grade crypto intelligence available in minutes via a single API key.

The Token Metrics API is a powerful crypto intelligence engine built for developers who want more than just price data. It combines machine learning, quantitative modeling, and narrative indexing to deliver structured signals that help users make smarter trading decisions.

Instead of simply showing what the market did, the API helps predict what it might do—with insights like:

It’s like giving your crypto bot a brain—and not just any brain, an AI-trained crypto analyst that never sleeps.

Most APIs give you prices, volume, and maybe some on-chain data. Token Metrics gives you opinionated intelligence derived from over 80 on-chain, off-chain, technical, and sentiment indicators.

That means:

We’ve designed this API for modularity and plug-and-play usability. With 21+ endpoints and official SDKs, you can ship faster and smarter—no custom pipeline needed.

Whether you're a solo developer or building inside a Web3 team, the possibilities are wide open.

Build smarter with Token Metrics if you’re creating:

Because the API supports OpenAI, Claude, Cursor, and Raycast integrations, your agents and LLM-powered tools can query live crypto intelligence in natural language—no additional parsing required.

Token Metrics API just made it to the front page of Hacker News, one of the internet’s most trusted platforms for discovering high-impact developer tools.

This means:

If you’ve been waiting for the right time to integrate AI-native crypto signals into your product—this is it.

We’re offering 5,000 free API calls/month for every new developer.

Sign up, plug in your key, and build:

Your users don’t just want raw data anymore—they want insights. Token Metrics delivers those insights in real time, with zero guesswork.

💥 Explore the API – Get your key in 30 seconds

💬 Join the Hacker News discussion – See what other devs are saying

📚 Browse Docs – View full endpoints and SDKs

One API. One schema. Smarter crypto apps.

The future of crypto building is AI-powered—and it starts here.

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.