Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

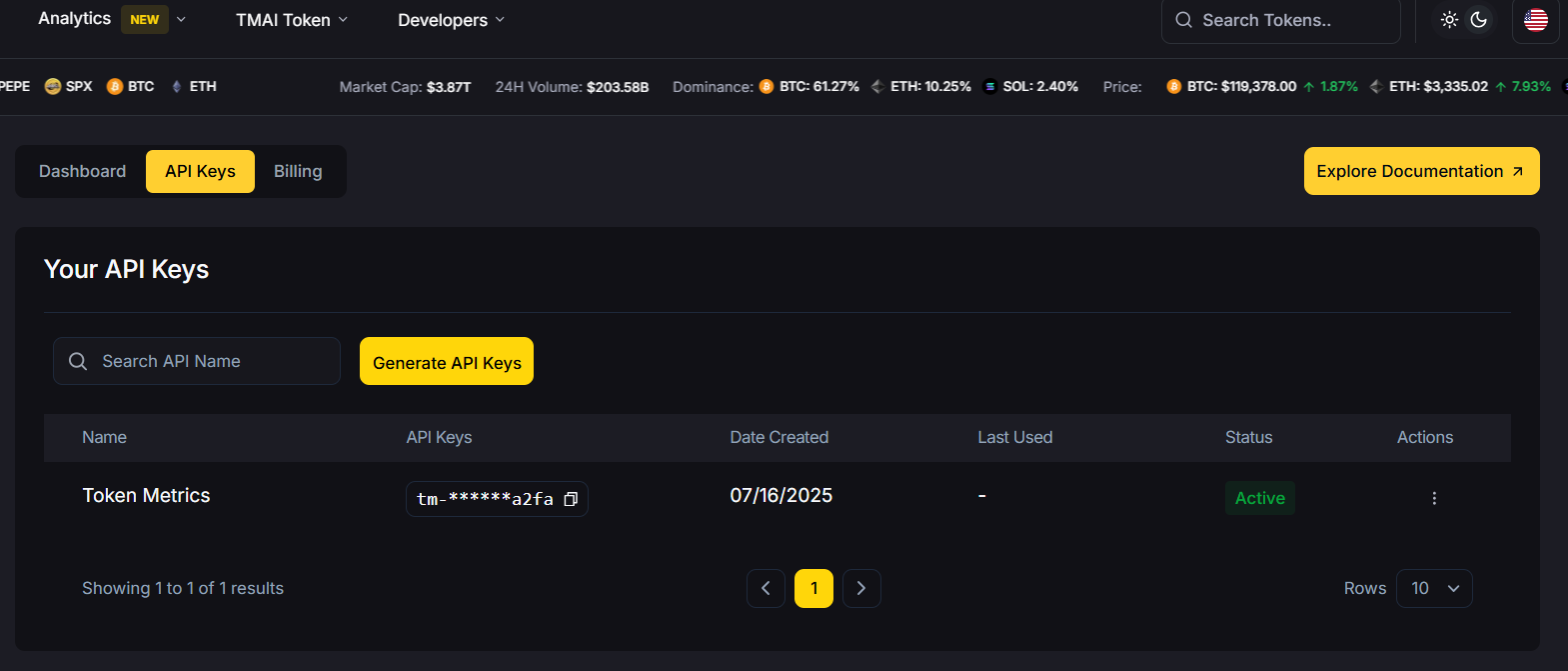

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

If you want broad crypto exposure without babysitting charts, a top crypto index is the simplest way to participate in the market. TM Global 100 was designed for hands-off portfolios: when conditions are bullish, the index holds the top 100 crypto assets by market cap; when signals turn bearish, it moves to stablecoins and waits. You get weekly rebalancing, transparent holdings and transaction logs, and a 90-second buy flow—so you can spend less time tinkering and more time compounding your life.

→ Join the waitlist to be first to trade TM Global 100.

Volatility is back, and investors are searching for predictable, rules-based ways to capture crypto upside without micromanaging tokens. Search interest for terms like hands-off crypto investing, weekly rebalancing, and regime switching reflects the same intent: “Give me broad exposure with guardrails.”

Definition (for snippets): A crypto index is a rules-based basket of digital assets that tracks a defined universe (e.g., top-100 by market cap) with a transparent methodology and scheduled rebalancing.

For 2025’s cycle, a top crypto index helps you participate in uptrends while a regime-switching rule can step aside during drawdowns—removing guesswork and FOMO from day-to-day decisions.

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

What is a top crypto index?

A rules-based basket that tracks a defined universe—here, the top 100 assets by market cap—with transparent methodology and scheduled rebalancing.

How often does the index rebalance?

Weekly. Regime switches (tokens ↔ stablecoins) can also occur when the market signal changes.

What triggers the move to stablecoins?

A proprietary market-regime signal. In bearish regimes, the index exits token positions to stablecoins and waits for a bullish re-entry signal.

Can I fund with USDC or fiat?

At launch, the embedded wallet will surface supported funding/settlement options based on your chain/wallet. USDC payout is supported when selling; additional on-ramps may follow.

Is the wallet custodial?

No. It’s an embedded, self-custodial smart wallet—you control the keys.

How are fees shown?

Before confirming, the buy flow shows estimated gas, platform fee, max slippage, and minimum expected value.

How do I join the waitlist?

Visit the Token Metrics Indices hub or the TM Global 100 strategy page and tap Join Waitlist.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

If you want hands-off, rules-based exposure to crypto’s upside—with a stablecoin backstop in bears—TM Global 100 is built for you. See the strategy, join the waitlist, and be ready to allocate on launch.

Related Reads

%201.svg)

%201.svg)

If you’ve tried to “own the market” in crypto, you’ve felt the pain: chasing listings, juggling wallets, and missing rebalances while prices move. A top 100 crypto index aims to fix that—giving you broad exposure when the market is bullish and standing down when it’s not. TM Global 100 is our rules-based version of that idea: it holds the top-100 by market cap in bull regimes, moves to stablecoins in bear regimes, and rebalances weekly. You can see every rule, every holding, and every rebalance—then buy the index in ~90 seconds with an embedded on-chain flow.

→ Join the waitlist to be first to trade TM Global 100.

The market keeps cycling. New leaders emerge quickly. A “set-and-forget” bag can fall behind, while manual baskets burn hours and rack up slippage. Search interest for crypto index, regime switching, and weekly rebalancing keeps growing because people want a simple, disciplined core that adapts.

Definition (for featured snippets): A top 100 crypto index is a rules-based basket that tracks the largest 100 crypto assets by market cap, typically rebalanced on a schedule to keep weights aligned with the market.

In 2025, that alone isn’t enough. You also need discipline for downtrends. TM Global 100 adds a regime-switching layer to move to stablecoins during bear phases—so you can participate in upside and sit out major drawdowns with a consistent, rules-based approach.

Regime switching:

Weekly rebalancing:

Transparency:

What you’ll see on launch:

Soft CTA: See the strategy and rules.

→ Join the waitlist to be first to trade TM Global 100.

What is a top 100 crypto index?

A rules-based basket tracking the largest 100 assets by market cap, typically with scheduled rebalancing. TM Global 100 adds regime switching to stablecoins during bear markets.

How often does the index rebalance?

Weekly. In addition, if the market signal flips, the entire portfolio may switch between tokens ↔ stablecoins outside the weekly cycle.

What triggers the move to stablecoins?

A proprietary market-regime signal. When it’s bearish, the index exits tokens to stablecoins and waits for a bullish re-entry signal.

Can I fund with USDC or fiat?

On launch, funding options surface based on your connected wallet and supported chains. USDC payouts are supported when selling.

Is the wallet custodial?

The embedded wallet is self-custodial—you control your funds.

How are fees shown?

Before you confirm a buy, you’ll see estimated gas, platform fee, max slippage, and minimum expected value—all up front.

How do I join the waitlist?

Go to the TM Global 100 page or the Indices hub and click Join Waitlist. You’ll get notified at launch with simple steps to buy.

Crypto is volatile and can lose value. Past performance is not indicative of future results. This article is for research/education, not financial advice.

A top 100 crypto index is the simplest path to broad market exposure—if it’s built with discipline. TM Global 100 combines transparent rules, weekly rebalancing, and a regime switch to stablecoins, so you can focus on your strategy while the core maintains itself.

Now’s the time to claim early access.

→ Join the waitlist to be first to trade TM Global 100.

Related Reads

%201.svg)

%201.svg)

After a whipsaw year, many investors are asking how to stay exposed to crypto’s upside without riding every drawdown. Rules-based crypto indexing is a simple, disciplined answer: follow a transparent set of rules rather than gut feelings. The TM Global 100 puts this into practice—own the top-100 in bullish regimes, rotate to stablecoins in bearish regimes, and rebalance weekly. On top of that, you can see what you own in real time with a Holdings Treemap, Table, and Transactions Log. Less second-guessing, more process.

→ Join the waitlist to be first to trade TM Global 100.

What it is: A rules-based index that holds the top-100 in bull markets and moves to stablecoins in bear markets—paired with transparent holdings and transaction logs.

Why it matters: Weekly rebalances and clear regime logic bring structure after volatile cycles.

Who it’s for: Hands-off allocators and active traders who want a disciplined core with visibility.

Next step: Join the waitlist to be first to trade TM Global 100.

In a volatile cycle, emotion creeps in: chasing winners late, cutting losers early, or missing re-entry after fear. Rules-based crypto indexing applies consistent criteria—constituent selection, weighting, and rebalancing—so you don’t have to improvise in stress.

For readers comparing crypto index options, think of it as a codified playbook. A rules-based crypto index is a methodology-driven basket that follows predefined signals (e.g., market regime) and maintenance schedules (e.g., weekly rebalancing), aiming for repeatable behavior across cycles.

Featured snippet definition: Rules-based crypto indexing is a systematic approach that tracks a defined universe (e.g., top-100 by market cap) and maintains it on a fixed cadence, with explicit rules for when to hold tokens and when to de-risk into stablecoins.

See the strategy and rules. (TM Global 100 strategy)

→ Join the waitlist to be first to trade TM Global 100.

What is a rules-based crypto index?

A methodology-driven basket that follows predefined rules for asset selection, weighting, and maintenance. In TM Global 100, that means top-100 exposure in bullish regimes and stablecoins in bearish regimes, with weekly rebalancing and full transparency.

How often does the index rebalance?

Weekly. This cadence refreshes constituents and weights to align with current market-cap rankings; separate regime switches can move between tokens and stablecoins.

What triggers the move to stablecoins?

A documented market signal. When it turns bearish, the index exits to stablecoins; when bullish resumes, it re-enters the top-100 basket.

Can I fund with USDC or fiat?

Funding options will surface based on your connected wallet and supported rails. USDC settlement on sells is supported; fiat on-ramps may be added over time.

Is the wallet custodial?

No. The embedded wallet is self-custodial—you control your keys and assets.

How are fees shown?

Before confirming a trade, you’ll see estimated gas, platform fee, max slippage, and min expected value—so you can proceed with clarity.

How do I join the waitlist?

Go to the Indices hub, open TM Global 100, and enter your email. You’ll receive a launch-day link to buy.

After a volatile cycle, the edge is process. TM Global 100 combines rules-based crypto indexing, weekly rebalancing, and full transparency so you can participate in upside and step aside during bears—without running your own spreadsheets. If that’s the core you’ve been missing, join the waitlist now.

Related Reads:

%201.svg)

%201.svg)

Cryptocurrencies have revolutionized the way people make payments and investments. With the rise of digital assets, Cryptocurrency APIs have become essential tools for developers to build applications that can interact with the blockchain. An API allows you to connect to a third-party service and retrieve or submit data in a standardized format to a website or application.

Token Metrics Crypto API is the best cryptocurrency API currently available. Use Token Metrics crypto API for real-time prices, on-chain data, and AI crypto trading signals from one powerful crypto API. This crypto API is built for speed and accuracy to help you trade smarter instantly.We will look into the features and advantages, discuss the different types of APIs, and learn how to use them to create powerful applications. We will also cover the pros and cons of using these APIs, and provide examples of how they can be used. Last but not least, we will discuss the pricing of these APIs and provide some best practices for using them.

Cryptocurrency APIs are Application Programming Interfaces (APIs) that allow developers to access and integrate cryptocurrency data into their applications. APIs provide access to a variety of data such as prices, transactions, and blockchains. With the help of these APIs, developers can create powerful applications that can interact with the crypto world.

The most obvious benefit of using cryptocurrency APIs is that they provide access to a wealth of data that can be used to build powerful applications. The APIs provide access to real-time data. This data can be used to create applications that can monitor the market, track transactions, and even make predictions about the future of the crypto world.

Another benefit of using cryptocurrency APIs is that they are easy to use and provide a consistent and reliable source of data. The APIs are designed to be user friendly, so developers don’t have to worry about getting bogged down in technical details. The APIs also provide reliable, up-to-date data that can be used to create accurate and reliable applications.

Cryptocurrency APIs can also save developers a lot of time and effort. Instead of having to manually gather data, developers can simply use the APIs and get the data they need. This can save developers a lot of time and effort, allowing them to focus on other aspects of their applications.

There are a variety of cryptocurrency APIs available, each with its own set of features and advantages. The most common types of APIs are:

Now that we’ve discussed the benefits and types of crypto APIs, let’s look at the best APIs to get crypto data today.

1. Token Metrics: Token Metrics crypto API offers real-time prices, on-chain data, and AI trading signals from one powerful crypto API. It is the best crypto API built for speed and accuracy to help you trade smarter instantly. Token Metrics is an AI driven platform which enables its users research thousands of cryptocurrencies in an automated way, without manually going through coins individually. Use Token Metrics crypto API for fast and most accurate crypto data.

What’s inside the $TMAI API?

✅ AI-Powered Trading Signals – Bullish and bearish calls backed by over 80 data points

✅ Real-Time Grades – Instantly assess token momentum with Trader & Investor Grades

✅ Curated Indices – Plug into ready-to-use crypto portfolios by sector or market cap

✅ Lightning-Fast Performance – Built for bots, dashboards, dApps, and next-gen trading tools

Whether you’re building a DeFi dashboard, an alpha-sniping bot, or your own crypto terminal — this is your edge.

Price: Free

2. CoinMarketCap: CoinMarketCap offers one of the most popular APIs for retrieving real-time cryptocurrency market data, including prices, volume, and market capitalization for over 8,000 coins and tokens. It also offers endpoints for historical data and global averages.

Price Range: $0-$700 a month

3. CoinGecko: CoinGecko has an API that provides a comprehensive set of cryptocurrency data, including market data, developer activity, and community metrics for more than 10,000 coins and tokens. API is both paid and free, depending on your needs.

Price Range: Starting from $129 per month

4. CryptoCompare: CryptoCompare offers endpoints for news articles, social media activity, and mining data. It strives to find the best places to store, trade and mine cryptocurrencies.

Price Range: Free

5. BitMEX: BitMEX is a cryptocurrency derivatives exchange that provides access to real-time prices and historical data. Their API provides instant access to a variety of market data such as trading volumes and market caps.

Price & Plans: Custom

6. CoinDesk: CoinDesk is a platform for media, events, data and indices for the cryptocurrency market. CoinDesk Indices is a product of CoinDesk that offers access to cryptocurrency data with ease.

Price: Free

7. Bitstamp: Bitstamp is a cryptocurrency exchange that provides access to real-time prices and historical data. It provides premium access to crypto trading for both individuals and institutions through high liquidity, reliable order execution and constant uptime.

Price: 0.50% for those with under $10,000 in 30-day trading volume

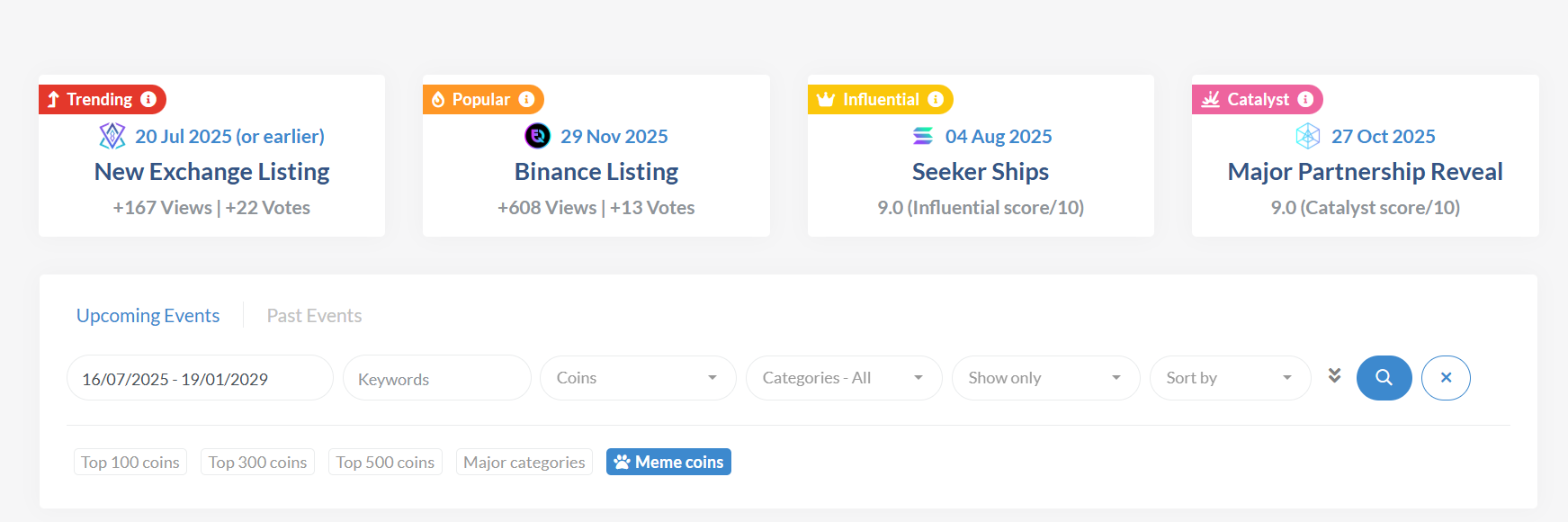

8. CoinMarketCal: CoinMarketCal is a database of upcoming events related to cryptocurrencies, allowing you to track things like unlocks, giveaways, and more. Their API can be used to track your favourite coins.

Price: Free

9. Poloniex: Poloniex is a cryptocurrency exchange that provides access to real-time prices and historical data. The API also provides access to a variety of market data such as trading volumes and market caps.

Price: The Maker and Taker fee rates for trading USDT-collateralized perpetual contracts on Poloniex are 0.01% and 0.04% respectively, and the changes apply to all customers regardless of their trade volume.

10. Binance: Binance is one of the largest cryptocurrency exchanges and provides access to a variety of data such as prices, transactions, and blockchains. The API also allows developers to interact with the Binance platform, allowing them to buy, sell, and store cryptocurrencies.

Price: Free

11. Kraken: Kraken is a cryptocurrency exchange and also provides access to crypto data such as prices, transactions, and blockchains. Like Binance, their API also allows you to interact with Kraken through code.

Price: 0.2-0.3% of the 30-day trade volume

12. CCXT: CCXT is a library for cryptocurrency trading and e-commerce with support for many bitcoin/ether/altcoin exchange markets and merchant APIs.

Price: $0-$29

Note: The prices are subject to change or may have already changed.

Choosing the best cryptocurrency API for your application can be a daunting task. There are a variety of APIs available, each with its own set of features and advantages. So, it’s important to take the time to research the different APIs and determine which one is right for your application.

When choosing a Cryptocurrency API, it’s important to consider the features it provides.

Here are a few questions you need answers to:

It’s also important to consider the pricing of the API. As mentioned above, some APIs are free, while others require a subscription fee. It’s important to consider the cost of the API and make sure it fits within your budget.

Using crypto APIs can be a great way to access data and create powerful applications. However, there are a few best practices to keep in mind when using these APIs.

To explore our FREE Token Metrics crypto API, click here.

%201.svg)

%201.svg)

Token Metrics is proud to launch the "TM Investor Grade" to help investors identify promising long-term investments in the world of cryptocurrency. The grade is comprised of three subsets:

Our statistical analysis and machine learning techniques help calculate these grades. They account for many data points to provide a strong indication of the relative strength of each crypto asset or a project.

The TM Investor Grade is intended for use by investors looking to hold onto investments for a longer period of time, created by combining the Fundamental Grade with the Technology Grade and Valuation Grade.

Fundamental analysis has always been a crucial part of the research process at Token Metrics. Before considering any potential long-term investments, we conduct a thorough fundamental analysis to understand an asset's underlying strengths and weaknesses. Our use of fundamental analysis is how we discovered the promising investment opportunity in Helium back in 2018.

However, manually performing fundamental analysis on every token in the market is not feasible. This is why our research and data science teams automated the process. The result is our Automated Long-term Investor Grade. This grade considers a wide range of data points and applies statistical analysis to provide scores in various categories, including valuation, investors, tokenomics, community, and more.

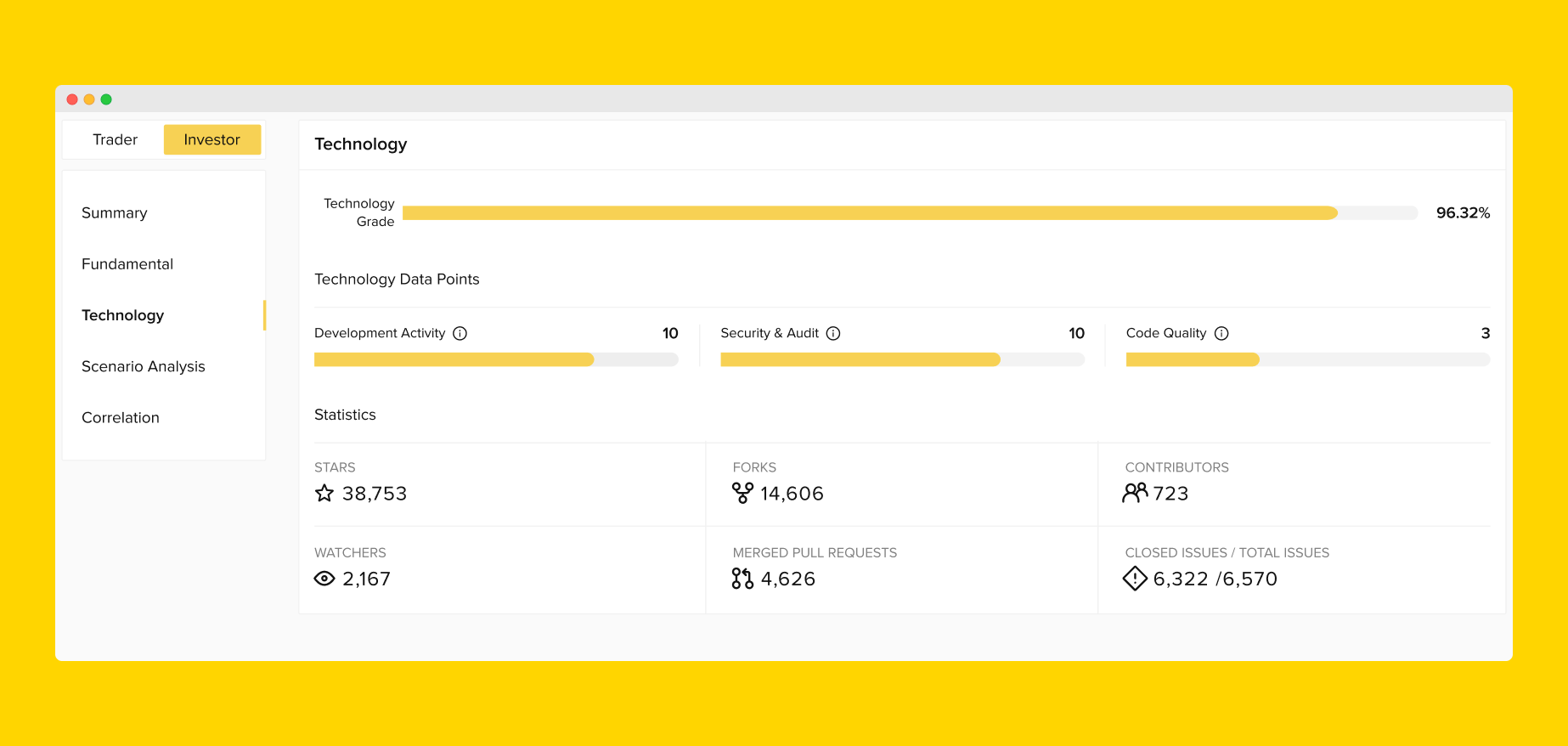

Token Metrics is also known for conducting code reviews on cryptocurrency projects. This is how we discovered that MATIC was a particularly strong project. Similar to fundamental analysis, our blockchain engineers carried out these reviews manually. However, we have now automated the entire process. Using open source data, we are able to provide technology scores for nearly all crypto assets. This is extremely valuable for investors, as it allows them to assess the long-term security and feasibility of different investments. Our technology scoring is based on three main categories: development activity, security and audit, and code quality.

The development activity category takes into account the contributions of the development community and tracks various community metrics. The security and audit category looks at the security of a project and tries to determine its resilience to hacks and other vulnerabilities. The code quality category measures how well the project's code is written, by evaluating the number of bugs and violations it has and how well it adheres to best coding practices and standards.

We are thrilled that our data science team, in collaboration with our engineering team, has been able to use statistical analysis to scale up our powerful technology scoring to cover almost all assets in the market.

The valuation grade compares a project's fully diluted value, or FDV, with the average FDV of different sectors that project belongs to.

Consider this example:

This will show a high valuation grade because the project is undervalued compared to its sectors.

By combining these grades, we get the TM Investor Grade which is much more powerful in determining the strength of the project in the long run.

To view the Investor Grade, you can go to the individual token details page. Click on the 'Investor' tab on the left of the screen, and then click on the 'Fundamentals' tab. Then, you will be able to see how the asset is performing in each of the 9 categories we use . All these categories are combined to create the overall Fundamental grade. To generate this grade, we use a wide variety of data sources to gather all the necessary information.

In the same tab, you will find the 'Technology' grade. This grade comprises many different data points. These data points combine into three major categories:

You can also access the newly-launched feature on the Rating page by pressing the Investor switch next to Trader. This will help you sort all crypto assets by our Long-term Investor Grade.

If you look at the Ratings page - sorted by Investor Grade in descending order [highest to lowest] - these are assets that Token Metrics believes have strong potential in the future.

The TM Investor Grade is a powerful tool for evaluating the long-term potential of cryptocurrency projects. By considering various data points, including fundamental analysis, technology scoring, and valuation grades, the grade provides a comprehensive assessment of a project's strengths and weaknesses.

The grade updates regularly to reflect changing market conditions, making it an essential tool for anyone looking to invest in the cryptocurrency space.

1. How does the Investor Grade differ from the Trader Grade?

The Investor Grade is intended for long-term investing, while the Trader Grade is geared toward short-term trading. The data points used to calculate the Investor Grade differ from those used for the Trader Grade.

2. Which grade should I pay more attention to - the Investor Grade or Trader Grade?

If you are interested in short-term trades based on price action, such as swing or day trades, you should consider the Trader Grade. On the other hand, the Investor Grade is more suitable for customers who want to invest long-term and hold on to their assets for the potential of significant returns or to discover undervalued assets.

%201.svg)

%201.svg)

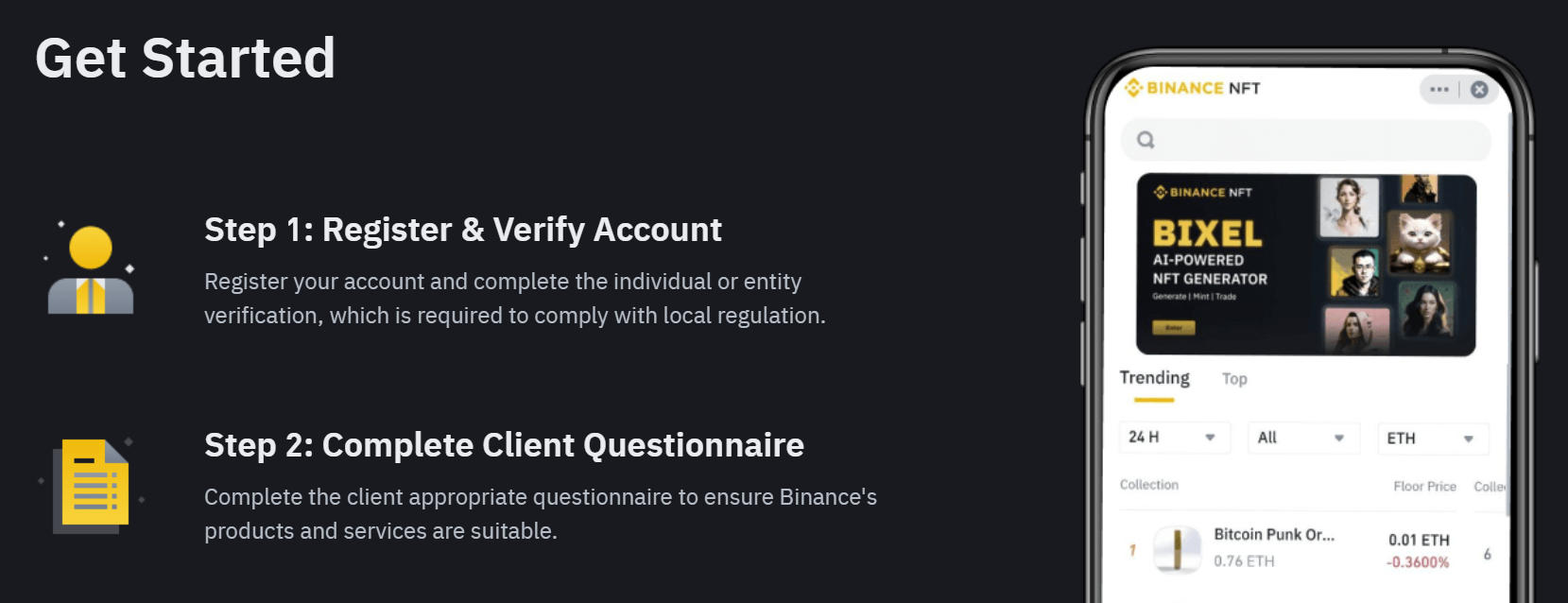

As the world of cryptocurrency continues to evolve and the blockchain revolution continues to gain traction, non-fungible tokens (NFTs) are becoming increasingly popular. NFTs are digital assets that are stored on the blockchain and are unique and non-interchangeable. They are used to represent everything from art, music, videos, and digital collectibles. With the rise of NFTs, more and more people are looking for the best NFT marketplaces to buy and sell their NFTs. If you are someone who is also looking for the top NFT marketplaces to buy, sell, and trade NFTs on, this is the place to be.

In this article, we’ll take a look at what an NFT marketplace is and how they work. We’ll also provide a list of the best NFT marketplaces, so you can find the perfect place to buy or sell your digital artwork.

An NFT marketplace is a digital platform specifically designed to facilitate the sale and purchase of NFTs or Non-Fungible Tokens. NFTs are digital artworks that are created, bought, and sold on these marketplaces. They are unique digital tokens that are stored on the blockchain and can be bought, sold, and traded. It is the perfect place to find and purchase digital art works created by talented artists from around the world.

The concept of NFTs has been around for a few years, but it has only recently started to gain traction. As more people become aware of the potential of NFTs, the demand for these marketplaces is increasing. There are now many different NFT marketplaces available, each offering something unique and different.

NFT marketplaces are a great way to find and purchase unique digital artwork from talented artists. They are also a great way to invest in digital art, as NFTs can be bought, sold, and traded for a profit.

NFT marketplaces work by connecting buyers and sellers of digital artwork. Buyers can browse through the different artworks available, and then purchase the artwork they like. The artwork is stored on the blockchain, and the buyer receives a unique token that represents the artwork. This token can then be used to buy, sell, or trade the artwork.

When a buyer purchases an artwork, the money goes to the artist who created the artwork. The marketplace then takes a small commission for facilitating the transaction. The commission varies from marketplace to marketplace, but usually, it is around 5-10%.

The artwork is stored on the blockchain, and the buyer receives a unique token that represents the artwork. This token can then be used to buy, sell, or trade the artwork. The token can also be used as a form of digital currency and can be exchanged for other digital assets like cryptocurrencies.

NFT marketplaces are a great way to find, buy, and sell digital artwork. They are also a great way to invest in digital art, as NFTs can be bought, sold, and traded for a profit.

It is important to understand the best NFT marketplaces because they provide users with a secure, user-friendly platform to buy and sell NFTs. The marketplaces also provide users with access to a variety of services such as NFT auctions, NFT staking, NFT creation, and more.

The best NFT marketplaces also provide users with the option to purchase NFTs using cryptocurrency. This makes it easier for users to purchase NFTs without having to rely on traditional currency. The marketplaces also make it easy for users to store and manage their NFTs.

Finally, the NFT marketplaces also provide users with access to a wide variety of NFTs. This allows users to easily find and purchase the NFTs they are looking for.

The following is a list of the best NFT marketplaces for 2023. All of these marketplaces offer something unique and different and are great places to find and purchase digital artworks.

NFT marketplaces are a great way to find, buy, and sell digital artwork. They are also a great way to invest in digital art, as NFTs can be bought, sold, and traded for a profit.

Whether you’re looking to buy digital artwork or invest in digital art, these marketplaces are the perfect place to start. So why wait? Start exploring these marketplaces and find the perfect NFT for you today.

%201.svg)

%201.svg)

If you are wondering how to invest in the cryptocurrency space, this is the perfect place to be.

As the world of cryptocurrency continues to expand, it is important to understand what to consider before investing in cryptocurrency. This guide will provide you with a comprehensive overview of the most important things to consider before investing in cryptocurrency, including what to look for in a potential investment, alternative ways to buy a crypto, how to keep your cryptocurrency secure, and tips for investing responsibly.

Cryptocurrency investing can be an exciting and potentially profitable venture. But it's important to understand the risks associated with investing in cryptocurrency and the steps you should take before investing your hard-earned money. Cryptocurrency investing is a relatively new concept and the market is constantly evolving. It's important to do your research and understand the potential risks and rewards before jumping in.

In order to make an educated decision about whether or not cryptocurrency investing is right for you, you need to understand the basics of cryptocurrency investing. A cryptocurrency is a form of digital currency that is not controlled by any central authority, such as a government or bank. Instead, it is created and maintained by a decentralized network of computers that use cryptography to secure transactions. Cryptocurrency is typically exchanged for goods and services, or for other forms of currency.

There are a few key differences between cryptocurrency and traditional currencies. For one, cryptocurrency is not backed by any physical asset, such as gold or a government-issued currency. Additionally, cryptocurrency is not regulated by any government or financial institution. This means that the value of cryptocurrencies can be highly volatile and unpredictable, which can make investing in them a risky endeavor.

Before investing in cryptocurrency, it is important to understand the risks associated with it. Cryptocurrency is not backed by any physical asset, so its value is highly volatile and unpredictable. This means that investments can quickly lose value, and there is no guarantee that you will get your money back. Additionally, cryptocurrency is not regulated by any government or financial institution, so it can be difficult to know who to trust and who to avoid.

When considering whether or not to invest in cryptocurrency, it's important to understand the different types of cryptocurrencies available. There are thousands of different cryptocurrencies on the market, each with its own set of characteristics and features. It's important to research each type of cryptocurrency and determine which one might be the best fit for your investment goals.

You should also consider the cost of investing in cryptocurrency. Cryptocurrency is a global market, so the cost of investing in it can vary significantly from one country to the next. Additionally, different exchanges may charge different fees for trading. It's important to research the fees associated with each exchange to ensure you are getting the best deal.

Finally, it's important to understand the potential tax implications of investing in cryptocurrency. Many countries have different regulations regarding the taxation of cryptocurrency investments, so it is important to understand the rules in your area before investing.

When it comes to investing in cryptocurrency, there are a few different ways to go about it. The most popular way to purchase cryptocurrency is through an online exchange. These exchanges are typically easy to use and offer a variety of different cryptocurrencies. Additionally, some exchanges offer lower fees than others, so it's important to shop around for the best deal.

Another option for investing in cryptocurrency is to purchase it directly from an individual. This can be done through a peer-to-peer platform, such as LocalBitcoins. This allows you to purchase cryptocurrency directly from another individual, without having to go through an exchange. However, this method can be riskier than using an exchange, as there is no guarantee that the person you are purchasing from is legitimate.

Finally, there are some platforms that allow you to purchase cryptocurrency with a credit or debit card. This is typically the easiest and most convenient way to purchase cryptocurrency, but it also has some drawbacks. Credit and debit card purchases typically come with higher fees than other methods, and the transactions can be reversed if the seller does not deliver the cryptocurrency as promised.

Follow this 5-step process to make first cryptocurrency investment.

If you are new to crypto, you can start off by choosing a broker or a crypto exchange. Although both serve the same purpose, there is a tiny difference between them.

Cryptocurrency Exchange is a third-party company that can help you invest in crypto with a convenience fee. Both buyers and sellers can actively trade cryptocurrencies using the platform. Having said that, make sure to learn enough about the standard crypto trading platforms before investing.

Once you are set with the platform, now you have to simply create an account and then authenticate yourself to start hassle free trading.

Now that you have verified your account, it is time to add your bank account or use a debit card to ensure cash deposit to invest in crypto.

Yes! You are almost there. You just need to take one more step of placing your cryptocurrency order to start your trade. You can enter the ticker symbols, such as BTC for Bitcoin, and invest as you please.

Since cryptocurrency exchanges are not regulated or secured widely, it is essential that you choose an appropriate storage method to avoid the risk of theft or hacking. It is best to store cryptocurrencies offline or in a cold wallet like Ledger.

Once you have purchased your cryptocurrency, it is important to take steps to keep it secure. The first step is to create a secure wallet to store your cryptocurrency. There are a variety of different wallets available, so you should research each one and determine which one is best for your needs.

Once you have chosen a wallet, it is important to create a strong password and keep it safe. This password should be unique and difficult to guess. Additionally, you should enable two-factor authentication whenever possible. This will require a second form of verification, such as a code sent to your phone, before you can access your wallet.

It is also important to keep your wallet backed up. Many wallets offer the ability to export your funds to a secure backup. This will ensure that you can recover your funds if something were to happen to your wallet. You should also keep your wallet updated with the latest security patches to help ensure that your funds are safe.

Cryptocurrency investing can be an exciting and potentially lucrative venture, but it's important to invest responsibly. Before investing, it's important to understand the risks associated with cryptocurrency investing, such as the potential for highly volatile prices. Additionally, it's important to understand the tax implications of investing in cryptocurrency and ensure that you are following all applicable laws.

It's also important to diversify your investments. Rather than investing all your money into a single cryptocurrency, it's wise to spread your investments across a variety of different coins and tokens. This will help to reduce your risk and ensure that you are diversifying your portfolio.

Finally, it's important to invest only what you can afford to lose. The cryptocurrency market is highly unpredictable, so there is always the potential for losses. It's important to remember that investing in cryptocurrency is a long-term process and that short-term gains should not be your primary focus.

As an investor, you need an acute understanding of what could be the potential cryptocurrencies that make you good fortune. And for that, you need to dig deeper into analyzing hundreds of coins to know and understand the best investments to make.

We help with that. Token Metrics is an AI-based crypto-research platform that can save you hours of research and bring you accurate data to make an informed decision.

Click here to get ahold of the BEST plans available for crypto investors like you.

Cryptocurrency investing can be an exciting and potentially profitable venture, but it's important to understand the risks and rewards before investing your hard-earned money. This guide has provided you with a comprehensive overview of the most important things to consider before investing in cryptocurrency, including what to look for in a potential investment, alternative ways to buy cryptocurrency, how to keep your cryptocurrency secure, and tips for investing responsibly. With the right knowledge and strategies, you can invest in cryptocurrency with confidence and reap the rewards of a successful investment.

%201.svg)

%201.svg)

Crypto is a huge industry that covers everything from technology to currencies, and even how it's taxed. First off, you don’t owe taxes on crypto if you’re merely “hodling,” as aficionados would say. But if you’ve gained any income from crypto in a financial year — either from staking, lending, or selling — you may owe taxes on the proceeds.

The IRS treats all cryptocurrencies as capital assets, and that means you owe capital gains taxes when they’re sold at a profit. This is exactly what happens when you sell more traditional securities, like stocks or funds, for a gain.

Let’s say you bought $1,000 in Ethereum and then sold the coins later for $1,600. You’ll need to report that $600 capital gain on your taxes. The taxes you owe depend on the length of time you held your coins.

If you held your ETH for one year or less, the $600 profit would be taxed as a short-term capital gain. Short-term capital gains are taxed the same as regular income — and that means your adjusted gross income (AGI) determines the tax rate you pay.

Federal income tax brackets top out at a rate of 37%. To be in the top bracket for 2023, you would need to make $578,126 or more as a single filer.

In this article, we'll discuss some of the basics of how crypto is taxed. We'll also go through tips for saving tax when dealing with cryptocurrencies.

There are two ways to tax crypto: as property and as a commodity.

Property taxes apply when you buy, sell or trade cryptocurrencies. Commodity taxes apply if you use your crypto to pay for goods or services — for example buying things from Amazon with Bitcoin.

Cryptocurrency is taxed as property. This means that you can claim the fair market value of your cryptocurrency in the year it was acquired and later sold or exchanged for other cryptocurrencies, fiat currency, or goods/services.

Cryptocurrency is not taxed as a currency. The income tax treatment of cryptocurrencies varies depending on whether you're purchasing them through an exchange (such as Coinbase), mining them yourself, or earning them through another activity like freelance work.

If you mine coins yourself, they are considered capital gains and reported on Schedule D with other business assets held at fair market value when sold off at their peak price during 2017-2018; however, if they were mined during 2014-2015 then they would be treated like ordinary income instead since there weren't any real-world uses for this type of digital money yet back then!

Cryptocurrencies may be considered business income under Section 199A(a)(1)(B) which exempts certain trades done by non-corporate entities from taxation but only if those trades meet specific criteria such as being done "for consideration" (defined below). In order for something to qualify under section 199A(a)(1)(B), two conditions must be met: 1) You must have received payment/gains derived from selling goods/services 2) Those gains were derived from selling goods/services that had been produced either domestically located within United States territory OR imported into United States territory AND THEN EXPORTED OUTSIDE OF US TERRITORY.

If you don't report cryptocurrency on taxes, you could face a penalty. This can range from a fine to jail time for tax evasion and other criminal charges, depending on the laws in your country. In addition to facing criminal penalties for failing to report crypto income, there are also some civil penalties that apply if you don't pay back taxes owed from crypto-based income:

Like any other investment, the IRS will demand a share of your crypto profits, unless you follow certain tax strategies.

The IRS is aware of cryptocurrency, and it's looking for you. Since the IRS has been auditing cryptocurrency investors and issuing 1099-K forms to individuals who have made taxable gains from their crypto investments, it's clear that they know something about cryptocurrencies.

The IRS has also been targeting exchanges and other businesses involved with cryptocurrency trading or holding cryptocurrencies themselves. If you're an exchange and don't report your income correctly, this could result in hefty penalties from the IRS — and even more serious consequences if you're found guilty of evading taxes altogether!

Crypto is a hot topic, with many people wondering how they should use it and report it on taxes. The IRS says that crypto is taxable as property or capital gains, depending on the type of crypto you own and what you do with it after receiving your profits. You can also report crypto-based income for other tax purposes (such as self-employment), but only if you have documentation to prove when the event occurred and how much income was generated from these transactions (which may be difficult).

%201.svg)

%201.svg)

Crypto staking is an innovative way to earn passive income from cryptocurrencies. It offers a great opportunity for cryptocurrency investors to make money without having to actively trade or mine.

In this comprehensive guide, we will discuss what crypto staking is, how it works, the different types of staking, the risks and rewards associated with it, and the best staking platforms to get started.

Whether you are a beginner or an experienced investor, this guide will provide you with the necessary information to help you make informed decisions about crypto staking. With this guide, you will be well on your way to growing your cryptocurrency portfolio in no time.

We’ve all heard of mining cryptocurrencies, but did you know there are other ways to earn coins? One of those methods is known as staking, which refers to the process of earning interest on coins held in a staking wallet or a smart contract. The interest is paid out in the form of cryptocurrencies, usually the native token of the platform you are staking your crypto on.

Staking is a low-maintenance way of earning extra coins, and it’s available to most cryptocurrencies, including the ones with a proof-of-work consensus like bitcoin. Just remember, the more popular coins, like bitcoin, have a much lower chance of generating a stake, making them less profitable than smaller alt coins and tokens.

When you stake a cryptocurrency, you’re lending your coins to the network in exchange for a percentage of the network’s new coins. Your coins are held in a staking wallet (or a smart contract), which is a designated software program designed to facilitate the staking process. The staking wallet holds your coins for you until the end of the staking period, during which time those coins are unavailable for trading.

When the staking period ends, the staking wallet sends your coins back to your wallet along with any rewards earned through staking. The amount of reward earned through staking depends on the network’s collective staking power, which is often determined by the number of coins held in the staking wallet.

Proof-of-Stake (PoS) - Proof-of-stake is a broad consensus method that doesn’t require energy-intensive mining. Instead, coins held in a wallet earn interest as a form of reward. The amount of interest earned is based on the number of coins held. PoS is used by a number of popular blockchain networks, like Ethereum.

Delegated-Proof-of-Stake (DPoS) - Delegated-proof-of-stake is a variation of proof-of-stake that allows network members to vote on delegates to manage the network. The more coins that are staked, the more voting power is available to select delegates. The delegates are responsible for validating transactions on the blockchain and receiving a cut of any transaction fees as a reward.

One potential risk is the possibility of losing access to your staked coins. If you are staking your coins on a third-party platform or through a staking pool, there is a chance that the platform could become inaccessible or go offline. This could prevent you from being able to access your staked coins or claim your rewards.

Another risk is the potential for your staked coins to be stolen. If you are staking your coins on a platform that is not secure, or if you are using an insecure wallet to store your staked coins, there is a chance that your coins could be stolen by hackers. This could result in significant losses, especially if the stolen coins are a large portion of your overall cryptocurrency holdings.

Finally, there is also the risk of volatility in the cryptocurrency market. The value of your staked coins could go up or down depending on market conditions, and this could affect the potential rewards you receive from staking. If the value of your staked coins decreases significantly, you could end up losing money even if you are earning rewards through staking.

Overall, staking cryptocurrencies can be a good way to earn rewards and help secure a blockchain network, but it is important to carefully consider the risks before deciding to stake your coins. It may be helpful to do some research and carefully evaluate the security and reliability of any platform or staking pool that you are considering using.

Here are a few tips and tricks for you to ensure a successful crypto-staking trajectory:

Staking is an excellent way to earn passive income from cryptocurrencies, especially for those who want to earn income without trading or mining. The more coins that are staked, the more rewards are earned through staking.

%201.svg)

%201.svg)

Non-Fungible Tokens, or NFTs, have exploded in popularity in recent years, with many people looking to invest in or collect these unique crypto tokens. However, not all NFTs are created equal – some are more valuable than others. One key factor that determines the value of an NFT is rarity. In this article, we will explore what NFT rarity is, how it works, and how to determine the rarity of an NFT. By understanding these concepts, investors can make more informed decisions when it comes to buying and selling NFTs.

Non-Fungible Tokens (NFTs) are a type of cryptocurrency token, like Bitcoin or Dogecoin. However, what sets NFTs apart from other crypto tokens is their "non-fungibility," meaning that they cannot be mutually exchanged. In other words, every NFT is unique and has its own set of properties, making them distinct from one another.

NFTs have become a popular market, with some tokens having high value compared to others. This has led to a surge in interest in NFTs, with many people wanting to invest in or collect them.

One factor that determines the value of an NFT is rarity. NFT rarity refers to how common a specific NFT is within a collection. Typically, the rarer the NFT, the higher its price.

In simple words, NFT rarity refers to the uniqueness or scarcity of a non-fungible token (NFT). Each NFT is created with a unique identifier that makes it distinct from all other NFTs. However, within a collection of NFTs, there can be variations in the rarity or scarcity of the different tokens.

These variations can be based on a variety of factors such as the number of tokens in a collection, the design or artwork of the token, or the properties and attributes assigned to the token. Rarity can impact the value of an NFT, as collectors and investors may be willing to pay more for a rare or highly sought-after NFT. Additionally, NFT creators and collectors may use rarity as a way to create excitement and interest in a particular collection or token.

To understand how NFT rarity works, it's important to know that when a new NFT is minted, it has a set of unique properties, known as traits, that cannot be changed. While NFTs can share a trait, no two NFTs are typically identical in a randomized collection.

NFTs with rarer features are more likely to sell for a higher price than those with more common features. As the floor price of a collection increases, the rarer NFTs also tend to increase more in value than the average of the entire collection.

Knowing how to spot rarity beforehand can give investors an advantage when it comes to NFT collecting. This can save them time and money, and give them an edge over other traders in the marketplace with information about the value trajectory of a specific type of NFT over time.

There are a few different ways to determine the rarity of an NFT. One way is to use NFT Rarity sites like Rarity Tools. This can help you find if an NFT is rare and in high demand.

Another option is to use a Rarity Ranks Extension, such as the Rarity Ranks extension. However, installing extensions may be risky and steal your confidential data.

Another way to determine NFT rarity is to use a tool like OpenSea, which allows users to create, buy, and sell NFTs. By viewing an entire collection when clicking on an NFT, users can get a sense of the rarity of a specific token. The average collection size is 10,000 items, though this can vary for different projects.

Determining the rarity of an NFT (Non-Fungible Token) is an important aspect of the NFT market. It can help buyers make informed decisions about the value and potential appreciation of a particular NFT. While there are several NFT rarity checkers available, it's difficult to identify the "best" one as different checkers may use different algorithms and data sources. Some popular NFT rarity checkers include Rarity.tools and Rarity Sniper.

Rarity.tools is a widely used platform that allows users to check rarity scores for a variety of NFT collections. Rarity Sniper provides a rarity score for each NFT, along with data on its trading history and price trends. Ultimately, the best NFT rarity checker depends on individual preferences and needs.

Rarity is important in the NFT market because it can affect the value and demand for a specific token. Because each look is limited to a specific number across the collection, some are statistically harder to come by – just like a Shiny Pokémon in the Pokémon universe. An NFT with a combination of rare attributes is more likely to sell for a higher price than those with more common traits.

In conclusion, NFT rarity is a key factor in determining the value of an NFT. By understanding how to spot and assess rarity, investors can make more informed decisions when it comes to buying and selling NFTs.

Tools like the NFT Rarity App and the Rarity Ranks Extension can be helpful in determining the rarity of a specific NFT. With this knowledge, investors can make more strategic decisions about their NFT investments and potentially maximize their returns.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such.

Token Metrics does not recommend that any cryptocurrency/NFT should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

%201.svg)

%201.svg)

The most expensive NFT sale to date was Beeple's Everydays: The First 5000 Days, which sold for $69.3 million. This highlights the growing interest in NFTs and the potential for them to be used as a vehicle for sharing virtually any form of media using the blockchain.

But what is an NFT? Let's find out.

NFTs, or non-fungible tokens, are unique digital assets with blockchain-managed ownership. They are stored on a blockchain and cannot be replicated or destroyed, making them resistant to tampering. NFTs can represent a wide range of items, including game items, digital art, collectibles, event tickets, and even ownership records for physical assets.

Unlike traditional cryptocurrencies, which are interchangeable and can be easily replicated, NFTs are non-fungible, meaning they have unique qualities that make them one-of-a-kind. This is why NFTs have gained popularity in the art world, where they can be used to verify the authenticity of a digital artwork and ensure that it cannot be copied or stolen.

When someone purchases an NFT, they not only receive the artwork itself, but also a digital receipt that proves that the piece is original, unique, and authentic. This receipt is stored on the blockchain and can be easily accessed and verified by anyone who wants to confirm the ownership and authenticity of the NFT.

While it is technically possible for someone to take a screenshot of an NFT and claim that they own it, this does not give them legal ownership of the artwork. Just like taking a picture of the Mona Lisa at the Louvre does not mean that you own the painting, taking a screenshot of an NFT does not give you ownership of the artwork.

To legally own an NFT, you must purchase it using cryptocurrency and store it in a virtual showcase. This allows you to own and display your artwork in a way that is secure and verifiable, and it ensures that you are the legal owner of the NFT.

Non-fungible tokens (NFTs) are unique digital files that are stored on a blockchain. A blockchain is a decentralized, public digital ledger that records every transaction that takes place on the decentralized web. This means that the entire history of an NFT, including its creator, properties, transactions, and smart contracts, is backed by a powerful blockchain.

NFTs are different from fungible tokens, such as Bitcoin or Ethereum, which are interchangeable and store value. In contrast, NFTs store data on the blockchain, making them unique and non-replicable.

Some key characteristics of NFTs include:

To create an NFT, there are several steps that you can follow:

Once you have created your NFT, there are several things that you can do with it:

NFT minting platforms enable creators to create non-fungible tokens (NFTs) to retain more control over their creative output. These NFTs can be sold on the following secondary marketplaces:

The demand for secondary NFT sales is growing rapidly, leading to increased competition among these marketplaces. Like the early days of Web 1 and 2.0, the emergence of Web 3.0 has created an open market where these platforms must find ways to attract and retain customers.

The thriving NFT market has led to the launch of several high-value projects, including the following companies:

Blockchain technology is known for its ability to represent assets and prove ownership. NFTs take this a step further by enabling people to potentially purchase non-fungible assets like land and gold. The global market cap for gold and real estate is over $300 trillion, so even a small percentage of that being tokenized would greatly increase the total crypto market cap. Tokenized real estate offers ordinary people the opportunity to invest in real estate, which has traditionally been difficult for the average person to participate in.

NFTs also have applications in other industries. For example, Nike recently filed a patent for NFT-enabled sneakers called "CryptoKicks." In 2019, Louis Vuitton announced plans to use NFTs to track the ownership of luxury fashion items. NFTs can also be used to tokenize certifications, degrees, and licenses, as well as sensitive data like medical records. The potential for NFTs to show ownership of any non-fungible commodity, whether real or virtual, is vast.

In conclusion, the use of non-fungible tokens (NFTs) has expanded beyond digital art and collectibles to include a wide range of real and virtual assets. The ability of NFTs to represent and prove ownership offers exciting possibilities for industries such as real estate, fashion, and even healthcare. As the technology and market continue to evolve, the potential applications for NFTs are endless.

%201.svg)

%201.svg)

If you are wondering about the future of cryptocurrency, we did some digging to answer that, and more.

Cryptocurrency has gained popularity and value in recent years, with the most well-known cryptocurrency, Bitcoin, reaching an all-time high in late 2021. However, the future of the crypto market is uncertain and the subject of much debate. Some analysts predict continued growth, while others foresee a potential crash. In this article, we will explore the potential future of cryptocurrency, including potential growth, crashes, and the role of regulation. We will also discuss predictions for specific cryptocurrencies, such as Bitcoin and Ether, as well as altcoins and decentralized finance (DeFi) and autonomous organizations (DAOs).

Will cryptocurrencies take off? Understanding the potential future of the crypto market can help investors make informed decisions about their investments.

By examining the past trends and indications in the crypto market, it appears that the future of crypto holds exciting opportunities for investors. Here are some notable crypto predictions to keep an eye on in 2023:

Some analysts predict that the popularity and value of cryptocurrencies, particularly Bitcoin, will continue to rise in 2023. This could be due to increased acceptance by businesses and higher demand for Bitcoin exchange-traded funds (ETFs).

However, others believe that the crypto market is unstable and vulnerable to a crash. In 2022, Bitcoin's price fell by roughly 40% due to factors such as slowing economic growth and rising interest rates. This bearish market may continue into 2023, leading to a potential crash.

Regardless of whether the market experiences growth or a crash, it is likely that Bitcoin and other cryptocurrencies will continue to be volatile. This volatility could be mitigated by increased regulation of the crypto market, which some predict will play a more significant role in 2023.

The shift toward decentralized finance (DeFi) and autonomous organizations (DAOs) is expected to continue in 2023. DeFi aims to remove the need for middlemen in traditional financial products, while DAOs are a new type of internet community based on blockchain technology. These developments could help to increase the stability and growth of the crypto market.

Some analysts predict that Bitcoin's price will continue to rise, potentially reaching $100,000 by the end of the year. Others believe that the market is unstable and could experience a crash.

It is predicted that over 500 million people worldwide will invest in and own Bitcoin by the end of 2023. This could be due to increased awareness and acceptance of the cryptocurrency.

The approval of the first spot Bitcoin ETF in the US is possible in 2023. This would allow investors to have direct exposure to the cryptocurrency itself, rather than just tracking Bitcoin futures contracts.

The shift toward DeFi and DAOs is expected to continue and could become the highest growth areas of the crypto market.

Some analysts predict that Ether, the second-largest cryptocurrency by market value, will outperform Bitcoin again in 2023.

It is possible that regulation of the crypto market will play a more significant role in 2023, potentially helping to stabilize the market.

The performance of altcoins, or alternative cryptocurrencies, is uncertain. Some may experience growth, while others could struggle. It is important for investors to carefully research and evaluate individual altcoins before making any investments.

When we see crypto from the growth perspective, there is a fair chance of getting the climb in 2023, especially for Bitcoin. However, Ether can take over the throne owing to the stats of 2022.

If you are seeking expert research and analysis to inform your investment decisions, consider signing up for Token Metrics. Our platform can provide you with access to the best performing cryptocurrencies with just a click. Explore our plans to learn more.

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.