Top Crypto Trading Platforms in 2025

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

Exchange tokens like WhiteBIT Coin offer leveraged exposure to overall market activity, creating concentration risk around a single platform's success. While WBT can deliver outsized returns during bull markets with high trading volumes, platform-specific risks like regulatory action, security breaches, or competitive displacement amplify downside exposure. Portfolio theory suggests balancing such concentrated bets with broader sector exposure.

The scenarios below show how WBT might perform across different crypto market cap environments. Rather than betting entirely on WhiteBIT Coin's exchange succeeding, diversified strategies blend exchange tokens with L1s, DeFi protocols, and infrastructure plays to capture crypto market growth while mitigating single-platform risk.

Portfolio theory teaches that diversification is the only free lunch in investing. WBT concentration violates this principle by tying your crypto returns to one protocol's fate. Token Metrics Indices blend WhiteBIT Coin with the top one hundred tokens, providing broad exposure to crypto's growth while smoothing volatility through cross-asset diversification. This approach captures market-wide tailwinds without overweighting any single point of failure.

Systematic rebalancing within index strategies creates an additional return source that concentrated positions lack. As some tokens outperform and others lag, regular rebalancing mechanically sells winners and buys laggards, exploiting mean reversion and volatility. Single-token holders miss this rebalancing alpha and often watch concentrated gains evaporate during corrections while index strategies preserve more gains through automated profit-taking.

Beyond returns, diversified indices improve the investor experience by reducing emotional decision-making. Concentrated WBT positions subject you to severe drawdowns that trigger panic selling at bottoms. Indices smooth the ride through natural diversification, making it easier to maintain exposure through full market cycles. Get early access: https://docs.google.com/forms/d/1AnJr8hn51ita6654sRGiiW1K6sE10F1JX-plqTUssXk/preview.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

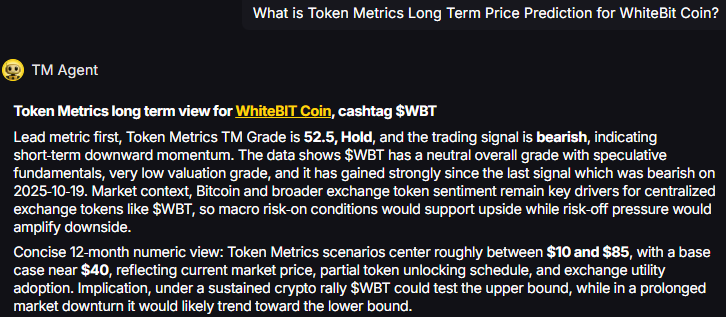

TM Agent baseline: Token Metrics long term view for WhiteBIT Coin, cashtag $WBT. Lead metric first, Token Metrics TM Grade is 52.5%, Hold, and the trading signal is bearish, indicating short-term downward momentum. Concise 12-month numeric view: Token Metrics scenarios center roughly between $10 and $85, with a base case near $40.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T: At an 8 trillion dollar total crypto market cap, WBT projects to $54.50 in bear conditions, $64.88 in the base case, and $75.26 in bullish scenarios.

16T: Doubling the market to 16 trillion expands the range to $78.61 (bear), $109.75 (base), and $140.89 (moon).

23T: At 23 trillion, the scenarios show $102.71, $154.61, and $206.51 respectively.

31T: In the maximum liquidity scenario of 31 trillion, WBT could reach $126.81 (bear), $199.47 (base), or $272.13 (moon).

These ranges illustrate potential outcomes for concentrated WBT positions, but investors should weigh whether single-asset exposure matches their risk tolerance or whether diversified strategies better suit their objectives.

WhiteBIT Coin is the native exchange token associated with the WhiteBIT ecosystem. It is designed to support utility on the platform and related services.

WBT typically provides fee discounts and ecosystem benefits where supported. Usage depends on exchange activity and partner integrations.

Token Metrics AI provides comprehensive context on WhiteBIT Coin's positioning and challenges.

Vision: The stated vision for WhiteBIT Coin centers on enhancing user experience within the WhiteBIT exchange ecosystem by providing tangible benefits such as reduced trading fees, access to exclusive features, and participation in platform governance or rewards programs. It aims to strengthen user loyalty and engagement by aligning token holders’ interests with the exchange’s long-term success. While not positioned as a decentralized protocol token, its vision reflects a broader trend of exchanges leveraging tokens to build sustainable, incentivized communities.

Problem: Centralized exchanges often face challenges in retaining active users and differentiating themselves in a competitive market. Users may be deterred by high trading fees, limited reward mechanisms, or lack of influence over platform developments. WhiteBIT Coin aims to address these frictions by introducing a native incentive layer that rewards participation, encourages platform loyalty, and offers cost-saving benefits. This model seeks to improve user engagement and create a more dynamic trading environment on the WhiteBIT platform.

Solution: WhiteBIT Coin serves as a utility token within the WhiteBIT exchange, offering users reduced trading fees, staking opportunities, and access to special events such as token sales or airdrops. It functions as an economic lever to incentivize platform activity and user retention. While specific governance features are not widely documented, such tokens often enable voting on platform upgrades or listing decisions. The solution relies on integrating the token deeply into the exchange’s operational model to ensure consistent demand and utility for holders.

Market Analysis: Exchange tokens like WhiteBIT Coin operate in a competitive landscape led by established players such as Binance Coin (BNB) and KuCoin Token (KCS). While BNB benefits from a vast ecosystem including a launchpad, decentralized exchange, and payment network, WBT focuses on utility within its native exchange. Adoption drivers include the exchange’s trading volume, security track record, and the attractiveness of fee discounts and staking yields. Key risks involve regulatory pressure on centralized exchanges and competition from other exchange tokens that offer similar benefits.

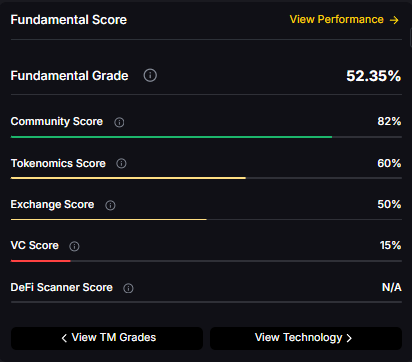

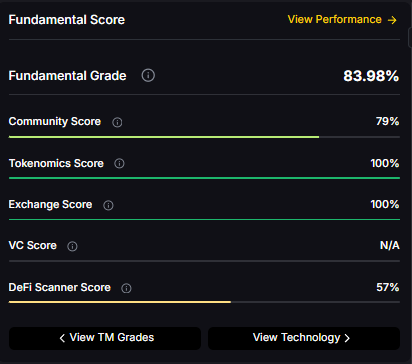

Fundamental Grade: 52.35% (Community 82%, Tokenomics 60%, Exchange 50%, VC —, DeFi Scanner N/A).

Can WBT reach $100?

Answer: Based on the scenarios, WBT could reach $100 in the 16T base case. The 16T tier projects $109.75 in the base case. Achieving this requires both broad market cap expansion and WhiteBIT Coin maintaining competitive position. Not financial advice.

What's the risk/reward profile for WBT?

Answer: Risk and reward span from $54.50 in the lowest bear case to $272.13 in the highest moon case. Downside risks include regulatory actions and competitive displacement, while upside drivers include expanding access and favorable macro liquidity. Concentrated positions amplify both tails, while diversified strategies smooth outcomes.

What gives WBT value?

Answer: WBT accrues value through fee discounts, staking rewards, access to special events, and potential participation in platform programs. Demand drivers include exchange activity, user growth, and security reputation. While these fundamentals matter, diversified portfolios capture value accrual across multiple tokens rather than betting on one protocol's success.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, concentration amplifies risk, and diversification is a fundamental principle of prudent portfolio construction. Do your own research and manage risk appropriately.

Layer 1 tokens capture value through transaction fees and miner economics. Litecoin processes blocks every 2.5 minutes using Proof of Work, targeting fast, low-cost payments. The scenarios below model LTC outcomes across different total crypto market sizes, reflecting network adoption and transaction volume.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

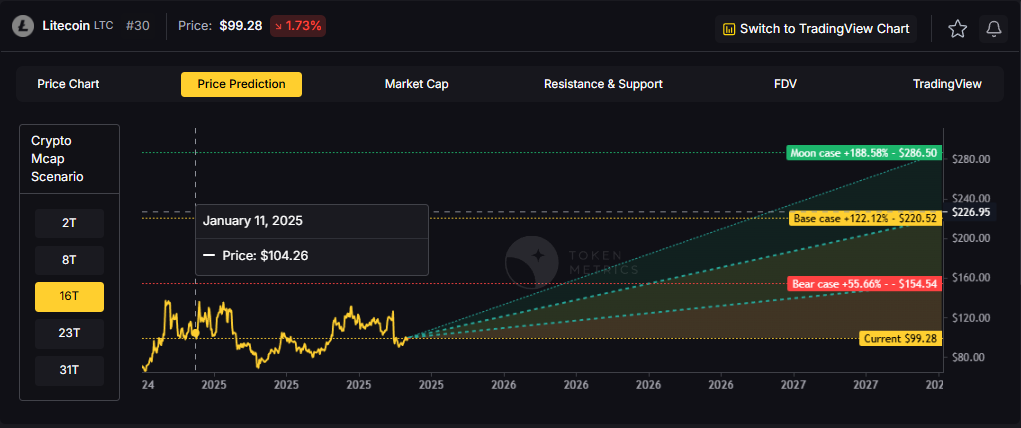

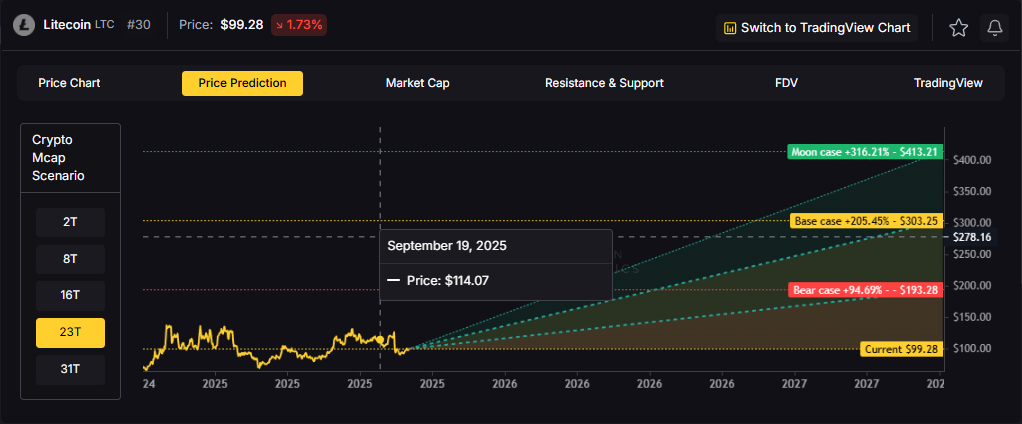

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics scenarios center roughly between $35 and $160, with a base case near $75, assuming gradual adoption, occasional retail rotation into major alts, and no major network issues. In a broad crypto rally LTC could test the upper bound, while in risk-off conditions it would likely drift toward the lower bound.

Token Metrics scenarios span four market cap tiers reflecting different crypto market maturity levels:

8T: At an 8 trillion dollar total crypto market cap, LTC projects to $115.80 in bear conditions, $137.79 in the base case, and $159.79 in bullish scenarios.

16T: At 16 trillion, the range expands to $154.54 (bear), $220.52 (base), and $286.50 (moon).

23T: The 23 trillion tier shows $193.28, $303.25, and $413.21 respectively.

31T: In the maximum liquidity scenario at 31 trillion, LTC reaches $232.03 (bear), $385.98 (base), or $539.92 (moon).

Litecoin is a peer-to-peer cryptocurrency launched in 2011 as an early Bitcoin fork. It uses Proof of Work with Scrypt and targets faster settlement, processing blocks roughly every 2.5 minutes with low fees.

LTC is the native token used for transaction fees and miner rewards. Its primary utilities are fast, low-cost payments and serving as a testing ground for Bitcoin-adjacent upgrades, with adoption in retail payments, remittances, and exchange trading pairs.

Token Metrics AI provides additional context on Litecoin's technical positioning and market dynamics.

Vision: Litecoin's vision is to serve as a fast, low-cost, and accessible digital currency for everyday transactions. It aims to complement Bitcoin by offering quicker settlement times and a more efficient payment system for smaller, frequent transfers.

Problem: Bitcoin's relatively slow block times and rising transaction fees during peak usage make it less ideal for small, frequent payments. This creates a need for a cryptocurrency that maintains security and decentralization while enabling faster and cheaper transactions suitable for daily use.

Solution: Litecoin addresses this by using a 2.5-minute block time and the Scrypt algorithm, which initially allowed broader participation in mining and faster transaction processing. It functions primarily as a payment-focused blockchain, supporting peer-to-peer transfers with low fees and high reliability, without the complexity of smart contract functionality.

Market Analysis: Litecoin operates in the digital payments segment of the cryptocurrency market, often compared to Bitcoin but positioned as a more efficient medium of exchange. While it lacks the smart contract capabilities of platforms like Ethereum or Solana, its simplicity, long-standing network security, and brand recognition give it a stable niche. It competes indirectly with other payment-focused cryptocurrencies like Bitcoin Cash and Dogecoin. Adoption is sustained by its integration across major exchanges and payment services, but growth is limited by the broader shift toward ecosystems offering decentralized applications.

Fundamental Grade: 83.98% (Community 79%, Tokenomics 100%, Exchange 100%, VC —, DeFi Scanner 57%).

Technology Grade: 46.67% (Activity 51%, Repository 72%, Collaboration 60%, Security 20%, DeFi Scanner 57%).

For comprehensive Litecoin ratings, on-chain analysis, AI-powered price forecasts, and trading signals, go to Token Metrics.

What is LTC used for?

Answer: Primary use cases include fast peer-to-peer payments, low-cost remittances, and exchange settlement/liquidity pairs. LTC holders primarily pay transaction fees and support miner incentives. Adoption depends on active addresses and payment integrations.

What price could LTC reach in the moon case?

Answer: Moon case projections range from $159.79 at 8T to $539.92 at 31T. These scenarios require maximum market cap expansion and strong adoption dynamics. Not financial advice.

Next Steps

• Track live grades and signals: Token Details

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Cryptocurrency investors face overwhelming choices. Should you buy individual tokens, trade actively, stake for yield, use DeFi protocols, invest through funds, or use index strategies? Each approach promises wealth creation, but which actually delivers optimal risk-adjusted returns for typical investors?

Most comparison content presents biased perspectives promoting specific approaches. Crypto trading platforms emphasize active trading. DeFi protocols highlight yield farming. Fund managers promote their offerings. What's missing is objective, comprehensive analysis examining all options fairly.

This definitive comparison evaluates Token Metrics indices against every major crypto investment alternative. We'll examine advantages, disadvantages, costs, risks, and ideal investor profiles for each approach. By the end, you'll understand exactly why indices represent optimal choice for most investors—and when alternative approaches might make sense.

Before diving into detailed comparisons, let's categorize the landscape of crypto investment options available today.

Each serves different purposes and suits different investor types. Let's examine each comprehensively.

Many investors begin by researching and selecting specific cryptocurrencies they believe will outperform.

Ideal For: Full-time researchers with substantial time, emotional discipline through volatility, and ability to absorb total losses.

Token Metrics Comparison: Indices provide similar upside through diversification while eliminating research burden, reducing failure risk, and removing emotional decisions. For 95% of investors, indices deliver better risk-adjusted returns with 90% less time investment.

Some investors attempt profiting from short-term price movements through frequent trading.

Ideal For: Professional traders with full-time career commitment, exceptional emotional discipline, acceptance of high failure probability, and substantial loss capital buffer.

Token Metrics Comparison: Indices capture market upside without trading's massive time requirements, emotional toll, tax inefficiency, or statistical disadvantages. Buy-and-hold index strategies outperform 90%+ of active traders after fees, taxes, and opportunity costs.

Staking tokens or providing liquidity generates yields—typically 5-20% APY depending on protocol and risk level.

AdvantagesYield strategies suit technically sophisticated investors comfortable evaluating smart contract risks, accepting token price volatility, having detailed tax tracking systems, and not needing access to capital during lock-up periods.

Token Metrics Indices ComparisonWhile staking provides 5-20% yields, Token Metrics indices typically generate 30-60% annualized appreciation through systematic selection and rebalancing. The appreciation far exceeds staking yields while maintaining liquidity, avoiding protocol risks, and simplifying tax treatment. Indices can incorporate staking where appropriate without requiring you to manage complexity.

Decentralized finance protocols enable lending, borrowing, trading, and complex financial strategies without intermediaries.

AdvantagesDeFi suits technically expert investors who understand smart contracts deeply, actively manage positions across protocols, accept total loss risk from exploits, and have capital sufficient to absorb gas fees.

Token Metrics Indices ComparisonIndices provide professional crypto exposure without DeFi's complexity, smart contract risks, gas fee burdens, or technical expertise requirements. For investors seeking crypto appreciation without becoming blockchain developers, indices deliver far superior risk-adjusted returns.

Some investors access crypto through professionally managed hedge funds specializing in digital assets.

AdvantagesCrypto hedge funds suit ultra-high net worth investors ($5M+ portfolios) seeking professional management, comfortable with illiquidity, and willing to pay premium fees for institutional infrastructure.

Token Metrics Indices ComparisonToken Metrics provides institutional-grade AI management at fraction of hedge fund costs—$50-200 monthly subscription versus $10,000+ annually in hedge fund fees for typical portfolio sizes. Performance is transparent, capital remains liquid, and minimums are under $1,000 versus six-figure hedge fund requirements.

Some investors exclusively hold Bitcoin, viewing it as digital gold.

Ideal For: Conservative investors prioritizing simplicity and security over maximum returns, or those philosophically committed to Bitcoin specifically.

Token Metrics Comparison: Conservative indices typically hold 40-60% Bitcoin while adding diversified exposure to other quality projects. This provides Bitcoin's stability while capturing additional upside from emerging winners—historical data shows 30-50% higher returns than Bitcoin-only with similar volatility.

Recently approved Bitcoin ETFs and existing crypto trusts provide regulated exposure through traditional brokerage accounts.

AdvantagesCrypto ETFs suit traditional investors prioritizing regulatory comfort, wanting retirement account exposure, avoiding direct crypto custody, and accepting limited options for that convenience.

Token Metrics Indices ComparisonToken Metrics offers far broader diversification than current ETFs (Bitcoin only), typically lower costs, direct asset ownership providing full flexibility, and exposure to full crypto opportunity set rather than single asset. For investors comfortable with direct crypto custody, indices provide superior returns and options.

After examining alternatives, let's detail Token Metrics indices comprehensive advantages.

Unique AdvantagesFor Whom Indices Work Best

Token Metrics indices suit 95% of crypto investors—those wanting professional exposure without full-time trading careers, seeking diversification without research burden, prioritizing long-term wealth building over short-term speculation, and valuing systematic approaches over emotional decision-making.

This comprehensive comparison reveals consistent pattern: alternative approaches offer niche advantages for specific situations but indices provide optimal balance of return potential, risk management, time efficiency, and cost effectiveness for typical investors.

Individual selection works if you're full-time researcher. Active trading works if you're professional trader. DeFi works if you're blockchain developer. Hedge funds work if you have millions. ETFs work if you want only Bitcoin in retirement accounts.

But if you're typical investor—employed professional, business owner, or retiree wanting substantial crypto exposure without it becoming second job—Token Metrics indices deliver superior risk-adjusted returns with minimal time investment and emotional burden.

The proof isn't theoretical—it's mathematical. Systematic, diversified, professionally managed approaches outperform alternatives across decades of investment research in every asset class. Crypto's unique characteristics amplify these advantages rather than diminishing them.

Your choice is clear: spend hundreds of hours researching individual tokens, stress over active trading, manage DeFi complexity, pay excessive hedge fund fees, or achieve superior results through systematic index investing requiring minimal time and expertise.

Start your 7-day free trial today and discover why sophisticated investors increasingly choose Token Metrics indices over every alternative approach.