Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

The Layer 1 landscape is consolidating as users and developers gravitate to chains with clear specialization. Bitcoin Cash positions itself as a payment-focused chain with low fees and quick settlement for everyday usage.

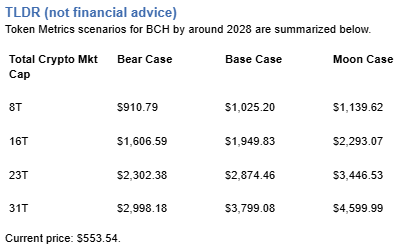

The scenario projections below map potential outcomes for BCH across different total crypto market sizes. Base cases assume steady usage and listings, while moon scenarios factor in stronger liquidity and accelerated adoption.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline:

Token Metrics lead metric for Bitcoin Cash, cashtag $BCH, is a TM Grade of 54.81%, which translates to Neutral, and the trading signal is bearish, indicating short-term downward momentum. This implies Token Metrics views $BCH as mixed value long term: fundamentals look strong, while valuation and technology scores are weak, so upside depends on improvements in adoption or technical development. Market context: Bitcoin has been setting market direction, and with broader risk-off moves altcoins face pressure, which increases downside risk for $BCH in the near term.

Live details:

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

Each tier assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Bitcoin Cash represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle BCH with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

Bitcoin Cash is a peer-to-peer electronic cash network focused on fast confirmation and low fees. It launched in 2017 as a hard fork of Bitcoin with larger block capacity to prioritize payments. The chain secures value transfers using proof of work and aims to keep everyday transactions affordable.

BCH is used to pay transaction fees and settle transfers, and it is widely listed across major exchanges. Adoption centers on payments, micropayments, and remittances where low fees matter. It competes as a payment‑focused Layer 1 within the broader crypto market.

Token Metrics AI provides comprehensive context on Bitcoin Cash's positioning and challenges.

Vision:

Bitcoin Cash (BCH) is a cryptocurrency that emerged from a 2017 hard fork of Bitcoin, aiming to function as a peer-to-peer electronic cash system with faster transactions and lower fees. It is known for prioritizing on-chain scalability by increasing block sizes, allowing more transactions per block compared to Bitcoin. This design choice supports its use in everyday payments, appealing to users seeking a digital cash alternative. Adoption has been driven by its utility in micropayments and remittances, particularly in regions with limited banking infrastructure. However, Bitcoin Cash faces challenges including lower network security due to reduced mining hash rate compared to Bitcoin, and ongoing competition from both Bitcoin and other scalable blockchains. Its value proposition centers on accessibility and transaction efficiency, but it operates in a crowded space with evolving technological and regulatory risks.

Problem:

The project addresses scalability limitations in Bitcoin, where rising transaction fees and slow confirmation times hinder its use for small, frequent payments. As Bitcoin evolved into a store of value, a gap emerged for a blockchain-based currency optimized for fast, low-cost transactions accessible to the general public.

Solution:

Bitcoin Cash increases block size limits from 1 MB to 32 MB, enabling more transactions per block and reducing congestion. This on-chain scaling approach allows for faster confirmations and lower fees, making microtransactions feasible. The network supports basic smart contract functionality and replay protection, maintaining compatibility with Bitcoin's core architecture while prioritizing payment utility.

Market Analysis:

Bitcoin Cash operates in the digital currency segment, competing with Bitcoin, Litecoin, and stablecoins for use in payments and remittances. While not the market leader, it occupies a niche focused on on-chain scalability for transactional use. Its adoption is influenced by merchant acceptance, exchange liquidity, and narratives around digital cash. Key risks include competition from layer-2 solutions on other blockchains, regulatory scrutiny of cryptocurrencies, and lower developer and miner activity compared to larger networks. Price movements are often tied to broader crypto market trends and internal protocol developments. Despite its established presence, long-term growth depends on sustained utility, network security, and differentiation in a market increasingly dominated by high-throughput smart contract platforms.

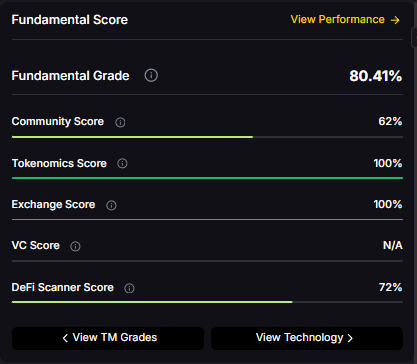

Fundamental Grade: 80.41% (Community 62%, Tokenomics 100%, Exchange 100%, VC —, DeFi Scanner 72%).

Technology Grade: 29.63% (Activity 22%, Repository 70%, Collaboration 48%, Security —, DeFi Scanner 72%).

Can BCH reach $3,000?

Based on the scenarios, BCH could reach $3,000 in the 23T moon case and 31T base case. The 23T tier projects $3,446.53 in the moon case. Not financial advice.

Can BCH 10x from current levels?

At current price of $553.54, a 10x would reach $5,535.40. This falls within the 31T base and moon cases. Bear in mind that 10x returns require substantial market cap expansion. Not financial advice.

Should I buy BCH now or wait?

Timing depends on your risk tolerance and macro outlook. Current price of $553.54 sits below the 8T bear case in our scenarios. Dollar-cost averaging may reduce timing risk. Not financial advice.

Want exposure? Buy BCH on MEXC

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

%201.svg)

%201.svg)

Infrastructure protocols become more valuable as the crypto ecosystem scales and relies on robust middleware. Chainlink provides critical oracle infrastructure where proven utility and deep integrations drive long-term value over retail speculation. Increasing institutional adoption raises demand for professional-grade data delivery and security.

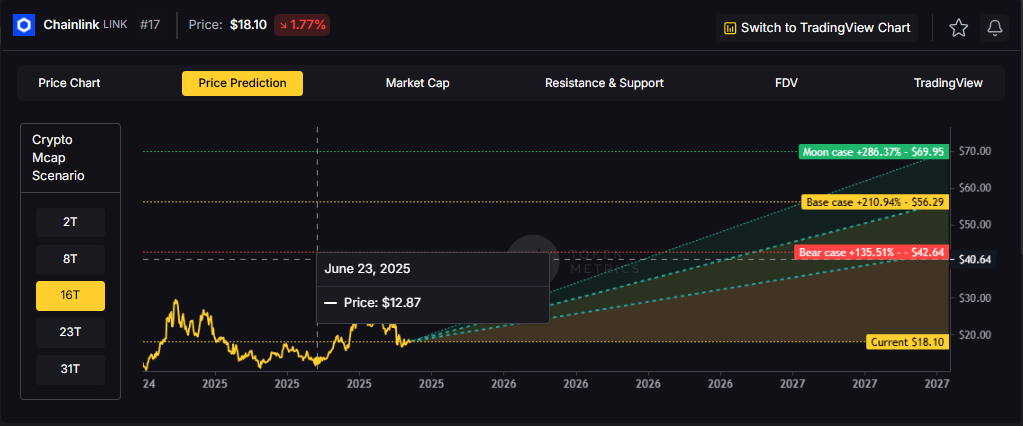

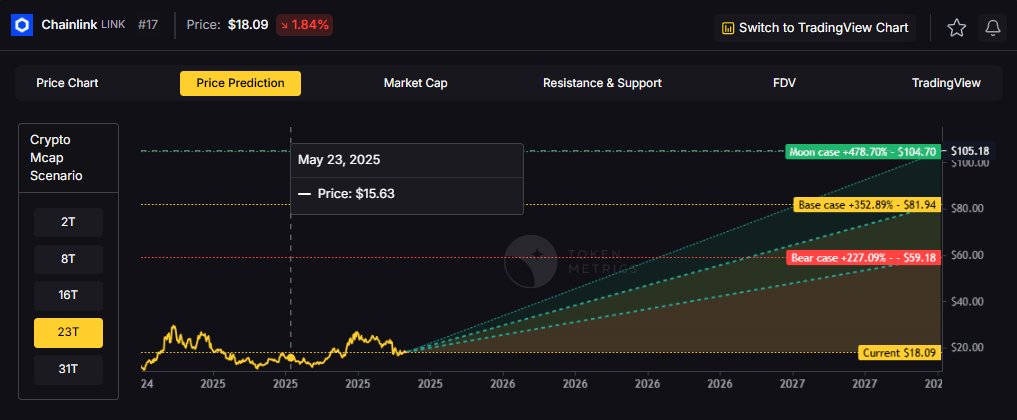

Token Metrics projections for LINK below span multiple total market cap scenarios from conservative to aggressive. Each tier assumes different levels of infrastructure demand as crypto evolves from speculative markets to institutional-grade systems. These bands frame LINK's potential outcomes into 2027.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics lead metric for Chainlink, cashtag $LINK, is a TM Grade of 23.31%, which translates to a Sell, and the trading signal is bearish, indicating short-term downward momentum. This means Token Metrics currently does not endorse $LINK as a long-term buy at current conditions.

Live details: Chainlink Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T: At an 8 trillion dollar total crypto market cap, LINK projects to $26.10 in bear conditions, $30.65 in the base case, and $35.20 in bullish scenarios.

16T: Doubling the market to 16 trillion expands the range to $42.64 (bear), $56.29 (base), and $69.95 (moon).

23T: At 23 trillion, the scenarios show $59.18, $81.94, and $104.70 respectively.

31T: In the maximum liquidity scenario of 31 trillion, LINK could reach $75.71 (bear), $107.58 (base), or $139.44 (moon).

Chainlink represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle LINK with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

Chainlink is a decentralized oracle network that connects smart contracts to real-world data and systems. It enables secure retrieval and verification of off-chain information, supports computation, and integrates across multiple blockchains. As adoption grows, Chainlink serves as critical infrastructure for reliable data feeds and automation.

The LINK token is used to pay node operators and secure the network’s services. Common use cases include DeFi price feeds, insurance, and enterprise integrations, with CCIP extending cross-chain messaging and token transfers.

Vision: Chainlink aims to create a decentralized, secure, and reliable network for connecting smart contracts with real-world data and systems. Its vision is to become the standard for how blockchains interact with external environments, enabling trust-minimized automation across industries.

Problem: Smart contracts cannot natively access data outside their blockchain, limiting their functionality. Relying on centralized oracles introduces single points of failure and undermines the security and decentralization of blockchain applications. This creates a critical need for a trustless, tamper-proof way to bring real-world information onto blockchains.

Solution: Chainlink solves this by operating a decentralized network of node operators that fetch, aggregate, and deliver data from off-chain sources to smart contracts. It uses cryptographic proofs, reputation systems, and economic incentives to ensure data integrity. The network supports various data types and computation tasks, allowing developers to build complex, data-driven decentralized applications.

Market Analysis: Chainlink is a market leader in the oracle space and a key infrastructure component in the broader blockchain ecosystem, particularly within Ethereum and other smart contract platforms. It faces competition from emerging oracle networks like Band Protocol and API3, but maintains a strong first-mover advantage and widespread integration across DeFi, NFTs, and enterprise blockchain solutions. Adoption is driven by developer activity, partnerships with major blockchain projects, and demand for secure data feeds. Key risks include technological shifts, regulatory scrutiny on data providers, and execution challenges in scaling decentralized oracle networks. As smart contract usage grows, so does the potential for oracle services, positioning Chainlink at the center of a critical niche, though its success depends on maintaining security and decentralization over time.

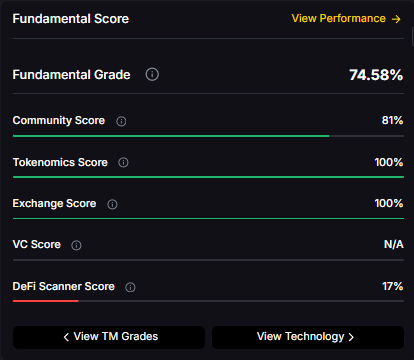

Fundamental Grade: 74.58% (Community 81%, Tokenomics 100%, Exchange 100%, VC —, DeFi Scanner 17%).

Technology Grade: 88.50% (Activity 81%, Repository 72%, Collaboration 100%, Security 86%, DeFi Scanner 17%).

Can LINK reach $100?

Yes. Based on the scenarios, LINK could reach $100+ in the 23T moon case. The 23T tier projects $104.70 in the moon case. Not financial advice.

What price could LINK reach in the moon case?

Moon case projections range from $35.20 at 8T to $139.44 at 31T. These scenarios assume maximum liquidity expansion and strong Chainlink adoption. Not financial advice.

Should I buy LINK now or wait?

Timing depends on risk tolerance and macro outlook. Current price of $18.09 sits below the 8T bear case in the scenarios. Dollar-cost averaging may reduce timing risk. Not financial advice.

Track live grades and signals: Token Details

Want exposure? Buy LINK on MEXC

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Discover the full potential of your crypto research and portfolio management with Token Metrics. Our ratings combine AI-driven analytics, on-chain data, and decades of investing expertise—giving you the edge to navigate fast-changing markets. Try our platform to access scenario-based price targets, token grades, indices, and more for institutional and individual investors. Token Metrics is your research partner through every crypto market cycle.

%201.svg)

%201.svg)

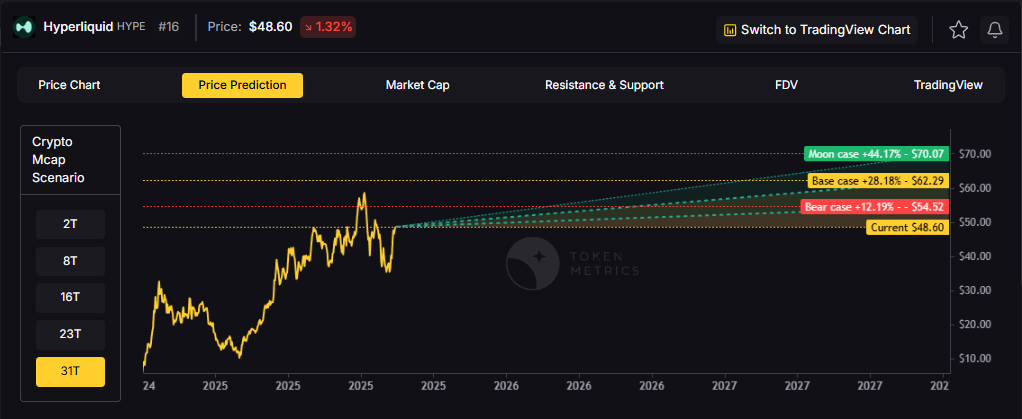

The crypto market is tilting bullish into 2026 as liquidity, infrastructure, and participation improve across the board. Clearer rules and standards are reshaping the classic four-year cycle, flows can arrive earlier, and strength can persist longer than in prior expansions.

Institutional access is widening through ETFs and custody, while L2 scaling and real-world integrations help sustain on‑chain activity. This healthier backdrop frames our scenario work for HYPE. The ranges below reflect different total crypto market sizes and the share Hyperliquid could capture under each regime.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

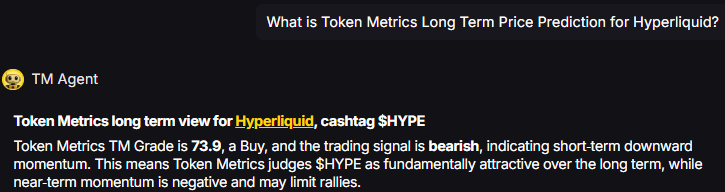

TM Agent baseline: Token Metrics TM Grade is 73.9%, a Buy, and the trading signal is bearish, indicating short-term downward momentum. This means Token Metrics judges HYPE as fundamentally attractive over the long term, while near-term momentum is negative and may limit rallies.

Live details: Hyperliquid Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Scenario Analysis

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

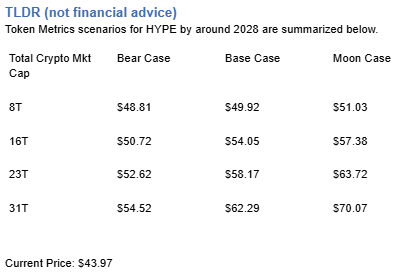

8T: At an 8 trillion dollar total crypto market cap, HYPE projects to $48.81 in bear conditions, $49.92 in the base case, and $51.03 in bullish scenarios.

16T: Doubling the market to 16 trillion expands the range to $50.72 (bear), $54.05 (base), and $57.38 (moon).

23T: At 23 trillion, the scenarios show $52.62, $58.17, and $63.72 respectively.

31T: In the maximum liquidity scenario of 31 trillion, HYPE could reach $54.52 (bear), $62.29 (base), or $70.07 (moon).

Each tier assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Diversification matters. HYPE is compelling, yet concentrated bets can be volatile. Token Metrics Indices hold HYPE alongside the top one hundred tokens for broad exposure to leaders and emerging winners.

Our backtests indicate that owning the full market with diversified indices has historically outperformed both the total market and Bitcoin in many regimes due to diversification and rotation.

Hyperliquid is a decentralized exchange focused on perpetual futures with a high-performance order book architecture. The project emphasizes low-latency trading, risk controls, and capital efficiency aimed at professional and retail derivatives traders. Its token, HYPE, is used for ecosystem incentives and governance-related utilities.

Can HYPE reach $60?

Yes, the 23T and 31T tiers imply ranges above $60 in the Base and Moon bands, though outcomes depend on liquidity and adoption. Not financial advice.

Is HYPE a good long-term investment?

Outcome depends on adoption, liquidity regime, competition, and supply dynamics. Diversify and size positions responsibly.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Token Metrics delivers AI-based crypto ratings, scenario projections, and portfolio tools so you can make smarter decisions. Discover real-time analytics on Token Metrics.

%201.svg)

%201.svg)

APIs power everything from mobile apps to crypto trading platforms. As they become the backbone of digital finance and decentralized applications, securing API endpoints is more critical than ever. A single vulnerability can expose sensitive data, undermine user trust, or even lead to costly breaches. So, how can you authenticate and secure your API requests effectively?

API authentication is the process of verifying that API requests come from legitimate sources. This step is essential to prevent unauthorized access and data leaks, especially in industries handling sensitive information like cryptocurrency and finance. There are several standard authentication methods:

Choosing the right authentication mechanism depends on your application's needs, security requirements, and threat model. For example, high-value crypto data or transaction endpoints require more robust solutions than public info APIs.

Authentication can only go so far without communication channel security. APIs must use encryption to safeguard data in transit. Here’s how to reinforce API requests against interception and tampering:

Data protection is not purely about outside attackers. Proper encryption and data minimization also reduce compliance risk and support privacy best practices relevant to digital assets.

API keys and secrets are valuable attack targets—treat them like passwords. Here are practical steps to keep them secure:

In the world of crypto APIs, where unauthorized trades or fund transfers can have major consequences, diligent key management is foundational to API security.

Authentication and encryption are essential, but holistic API security requires additional layers of defense:

Effective API security is an ongoing process. Stay updated with the latest threats and best practices—especially as new technologies and decentralized protocols evolve in the crypto sector.

The rapid growth of digital assets has driven demand for real-time data, automated trading strategies, and personalized user experiences. Crypto APIs, especially those leveraging AI, enable everything from on-chain analytics to dynamic risk scoring. However, these capabilities also come with heightened security stakes: AI-driven agents making transactions or analyzing blockchain data depend on reliable, tamper-proof sources.

Integrating secure APIs backed by strong authentication and threat prevention supports:

Using advanced API security controls helps crypto app developers maximize innovation while safeguarding users and market integrity.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Authentication confirms the identity of the API requestor, while authorization defines what resources and actions that identity can access or perform. Both are needed for secure API usage.

The choice depends on your use case. API keys are simple for service-to-service communication. OAuth offers stronger, user-specific security. JWT excels in stateless authentication. Many robust crypto APIs use combinations depending on endpoint sensitivity.

Provide keys using secure, authenticated user portals. Avoid email or plaintext transmission. Always ensure users understand to treat API credentials like passwords and never share or expose them.

Embedding secrets in frontend code, not enforcing HTTPS, failing to rotate keys, ignoring rate limits, and returning too much sensitive data are common but avoidable risks.

Review security policies and settings at least quarterly, or following any significant change (e.g., new endpoints, user roles, or integration partners). Promptly address newly discovered vulnerabilities and emerging threats.

This content is for educational and informational purposes only. It does not constitute technology, investment, or legal advice. Security strategies and technologies evolve rapidly; always consult with cybersecurity professionals before implementing any measures in critical or regulated environments.

%201.svg)

%201.svg)

As the crypto ecosystem expands, APIs are the bridge connecting developers to real-time prices, blockchain data, and decentralized tools. Choosing the right programming language is critical—whether you're building trading bots, portfolio trackers, or AI research agents for digital assets. How do you select the most effective language for working with crypto APIs? Let's break down the options, trade-offs, and best practices for developers entering this dynamic space.

Python stands out as the top choice for many developers building crypto-powered applications. Its simple syntax, robust standard libraries, and thriving open-source community have propelled it to the forefront of blockchain and crypto development. Here's why:

Python is especially popular for backend services, trading bots, analytics dashboards, and AI-driven crypto research platforms. Its versatility makes it an excellent starting point for most crypto API projects.

JavaScript's ubiquity in web development—and the rise of Node.js for backend—have cemented its importance in the crypto API landscape. Here's why developers favor JavaScript:

JavaScript and Node.js are top picks for projects focused on user-facing dashboards, live trading interfaces, and dApp development where real-time interaction is crucial.

For developers who prioritize performance and scalability, compiled languages like Go, Java, and C# come into play:

While these languages often require more boilerplate and steeper learning curves than Python or JavaScript, they excel in situations where uptime, parallel processing, and performance are vital.

When your project needs to interact deeply with blockchain networks beyond just APIs—such as deploying smart contracts or working at the protocol level—specialized languages become essential:

For API-focused projects, these languages play a role primarily when paired with a more general-purpose language (like Python or JavaScript) for off-chain tasks, with the specialized code handling on-chain logic.

The ideal programming language depends on a few project-specific factors:

Ultimately, the best crypto API projects balance technical strengths, developer proficiency, and the support network a programming language provides.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Both Python and JavaScript are leading choices. Python excels for backend analytics and AI-driven tools, while JavaScript is often used for building interactive dApps and web interfaces directly leveraging APIs. The right choice often depends on your application requirements and team expertise.

Popular libraries include web3.py and ccxt for Python, web3.js and ethers.js for JavaScript, as well as client SDKs provided by leading exchanges and data providers. Token Metrics also offers a powerful API for market data and analytics.

Use secure API key management, implement rate limiting, utilize HTTPS for data transmission, and validate all external responses. Choosing a strongly-typed language (like Go or Rust) and leveraging well-maintained libraries can reduce vulnerabilities.

Solidity and Rust are best suited for smart contract and protocol-level blockchain work—not direct API integration. For most API-driven crypto projects, Python, JavaScript, or Go are more practical; learn Solidity or Rust if you plan to develop on-chain logic or new blockchain platforms.

Token Metrics delivers AI-driven crypto analytics and signals via a unified API, empowering developers to build research, trading, or analytical tools rapidly. The platform provides robust documentation and versatile endpoints compatible with major programming languages.

This content is for informational and educational purposes only. It does not constitute investment, financial, or legal advice. Use all programming languages, APIs, and crypto tools at your own risk and always conduct thorough technical due diligence before integrating third-party services or tools into your projects.

%201.svg)

%201.svg)

Cryptocurrency continues to reshape digital finance, but harnessing its potential in your apps or websites starts with reliable data and functional integrations. Whether you’re building a trading dashboard, NFT platform, or analytics tool, crypto APIs can help your users interact with blockchain data in real time. But what exactly is involved in integrating a crypto API, and which best practices should developers follow to ensure security and scalability?

A crypto API (Application Programming Interface) enables your application to access blockchain data—such as prices, market statistics, trading signals, wallets, or transactions—without running a full node. These APIs expose services from exchanges, data aggregators, or specialized blockchain infrastructure providers, offering an efficient way for developers to query real-time or historical information about one or many cryptocurrencies.

Key types of crypto APIs include:

Integration complexity depends on your project’s requirements, the data you need, and your tech stack. Below is a streamlined process you can follow:

With new blockchain protocols and DeFi innovations, crypto APIs serve a growing variety of development scenarios, including:

Integrating financial APIs brings unique security and privacy considerations. To safeguard both your application and its users, adopt the following best practices:

Not all crypto APIs are built the same. To ensure seamless user experience and reliability for your app or site, regularly assess:

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Most crypto APIs are RESTful and language-agnostic. Popular options include JavaScript (Node.js), Python, Java, Ruby, Go, and C#. Many providers also supply SDKs for quick setup in these languages.

Yes, many crypto API providers, including Token Metrics, offer free tiers with rate limits suitable for development and testing. For production workloads or higher request volume, upgrading may be necessary.

Some APIs allow trade execution and position monitoring, but this requires authentication and additional security considerations. Always follow platform-specific restrictions and compliance requirements when handling trading actions.

Evaluate APIs based on the data scope, latency, documentation quality, scalability, pricing, and available features such as on-chain analytics or advanced trading signals. Community reviews and support responsiveness are also important factors.

API integration can be secure if you use HTTPS, safeguard your API keys, validate all inputs and outputs, and regularly monitor application and network activity. Following best practices and choosing reputable providers is crucial.

This article is for informational purposes only. It does not provide investment advice, guarantees of accuracy, or endorse any specific technology, protocol, or strategy. Always conduct your own technical and security due diligence before integrating any third-party services.

%201.svg)

%201.svg)

As the digital asset ecosystem grows more complex, keeping tabs on multiple cryptocurrencies across wallets, exchanges, and DeFi protocols can feel overwhelming. Many crypto enthusiasts and data-driven researchers are turning to APIs—powerful tools that automate and streamline portfolio tracking. But how exactly do crypto APIs help you monitor your digital assets, and what should you know before getting started?

An API, or Application Programming Interface, acts as a bridge allowing software programs to communicate with one another. In the context of cryptocurrency, crypto APIs provide standardized and secure access to real-time and historical blockchain data, market prices, account balances, transaction history, and more.

Using a crypto API for portfolio tracking means you can:

Most portfolio tracking APIs fall into one or more of these categories:

To use these APIs, you typically generate an API key from the provider, configure access permissions (like read-only for safety), and then supply your wallet addresses or connect exchange accounts. Data is returned in machine-readable formats such as JSON, making it easy to feed into portfolio apps, visualization dashboards, or research workflows.

Using crypto APIs for portfolio tracking offers several key advantages:

However, APIs also come with practical limitations:

Making sure your chosen API covers your required assets, chains, and platforms is crucial for effective portfolio monitoring.

If you’re interested in automating your portfolio tracking with a crypto API, the following workflow is a common approach:

You don’t need to be a developer to benefit—many plug-and-play crypto tracking apps are built atop APIs, letting anyone leverage automated monitoring.

The evolution of crypto APIs has accelerated with the rise of AI-powered analytics, creating opportunities to go beyond tracking simple balances. Platforms such as Token Metrics use machine learning to identify potential patterns in on-chain flows, provide portfolio exposure metrics, and surface unusual trading activity.

For quantitative traders, developers, and researchers, combining APIs with AI agents enables:

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

A crypto API is a software interface that allows applications or users to access and retrieve cryptocurrency data—such as balances, prices, trades, or transactions—from exchanges, blockchains, and data aggregators in real time.

Most reputable APIs use strong security measures. For exchange APIs, set read-only permissions when possible, and never share your private keys. Always review a provider's documentation and best practices before use.

While coding offers maximum flexibility, many portfolio tracking platforms and apps utilize APIs behind the scenes to collect and display your asset data—no coding required.

APIs are tools for collecting and sharing data, often requiring custom setup, while apps are ready-made solutions built on APIs for ease of use. Advanced users might use APIs directly for custom or automated tracking; others may prefer user-friendly apps.

Yes. Token Metrics provides a dedicated API offering real-time prices, trading signals, and on-chain analytics that can be used for portfolio tracking and research. Refer to their documentation for integration steps.

This content is for educational and informational purposes only. It does not constitute investment, financial, or trading advice. Token Metrics does not guarantee or warrant any results or third-party services mentioned herein. Always conduct your own research before using new technologies or services in your crypto workflow.

%201.svg)

%201.svg)

The explosive growth of crypto assets and decentralized protocols has fueled demand for accurate, real-time blockchain data. Whether you’re building an application, performing due diligence, or exploring on-chain analytics, knowing how to access transactions and wallet balances is crucial. But do crypto APIs actually provide this level of on-chain data—and how can you use it effectively?

Crypto APIs (Application Programming Interfaces) are software gateways that let applications interact with blockchains and related services without managing full nodes or direct infrastructure. These APIs power wallets, portfolio trackers, analytics dashboards, and AI-driven research tools with everything from price feeds to in-depth blockchain data.

Why use a crypto API? Running your own blockchain node can be resource-intensive, requiring disk space, bandwidth, security practices, and ongoing maintenance. An API abstracts this complexity, providing developers and analysts with curated endpoints for questing data on-demand. This is particularly valuable for applications that need:

On-chain data refers to all the information stored directly on blockchain ledgers. Crypto APIs tap into different layers of this data, including:

Modern crypto APIs go beyond simple read-access, offering data enrichment features such as address labels, scam alerts, and portfolio reconstruction. This enables AI-driven tools and traders to make sense of raw blockchain transactions with greater ease.

The process of serving real-time, reliable on-chain data is complex. Here’s how reputable API providers typically operate:

For example, querying for a wallet’s balance generally involves calling an endpoint such as /address/{wallet}/balances, which returns all supported tokens and quantities for that wallet, directly from on-chain sources. Transaction history requests retrieve confirmed transfers and contract activities, often with additional tags for clarity.

On-chain data accessed via crypto APIs has become foundational in several scenarios:

In addition, many quantitative research teams and AI-driven crypto tools ingest on-chain data through APIs to fuel predictive models, market research, and smart contract insights.

With dozens of API solutions available, consider the following when selecting a crypto API for on-chain data:

If you’re integrating advanced analytics or AI-driven insights, prioritize API providers that combine raw on-chain access with actionable, processed intelligence.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Yes, leading crypto API providers typically offer endpoints to retrieve wallet balances (for both native cryptocurrencies and supported tokens) and to view transaction histories, directly sourced from underlying blockchain ledgers. This streamlines personal portfolio tracking, due diligence, and analytics development.

Reputable API providers maintain robust blockchain node infrastructure and update their databases in real time or near-real time. However, reliability also depends on network congestion, API rate limits, and provider-specific infrastructure. Always review service status and latency commitments before integrating for mission-critical use cases.

No, coverage varies between providers. Some APIs offer comprehensive data across layer-1 (e.g., Ethereum, Bitcoin) and select layer-2 chains, while others may focus on specific asset classes or blockchains. Likewise, NFT balance and transaction endpoints are only available with APIs that index non-fungible token contracts. Always confirm network and asset support with your chosen provider.

Most APIs provide REST or GraphQL endpoints that can be queried using common programming languages or HTTP tools. Comprehensive documentation and SDKs (where available) guide developers through authentication, request parameters, and data formatting, making it straightforward to embed wallet balances, transaction lists, or on-chain analytics into web, desktop, or mobile applications.

Using a crypto API saves significant time and resources. Infrastructure, sync issues, storage maintenance, and security are handled by the provider. APIs also enrich data, aggregate multi-chain information, and simplify compliance and access controls, which can be much more complex and costly to reproduce independently.

This article is for educational purposes and reference only. It does not constitute financial advice, crypto trading recommendations, or any endorsement of specific assets, platforms, or services. Please conduct your own research before making decisions involving digital assets or blockchain technologies.

%201.svg)

%201.svg)

Understanding price trends and market dynamics is essential for researchers, developers, and analysts working in the cryptocurrency ecosystem. The demand for actionable, reliable historical crypto data has surged as more professionals seek to power apps, AI agents, and dashboards with accurate blockchain information. But how can you easily access robust historical data—from Bitcoin’s early days to today—using an API?

Historical crypto data serves multiple critical roles in the blockchain and digital asset space. It is the foundation for backtesting trading algorithms, visualizing price trends, and conducting academic or business-driven research on market cycles. Given cryptocurrencies’ rapid global growth, time series data helps users:

Yet with thousands of coins traded across dozens of exchanges since 2009, acquiring comprehensive, accurate history is challenging without programmatic tools like APIs.

An Application Programming Interface (API) acts as a bridge, allowing your software to interact with data providers’ servers in real time or on demand. For historical cryptocurrency data, APIs typically offer endpoints for retrieving:

Data is returned in structured formats like JSON or CSV, ideal for integration with research notebooks, dashboards, and machine learning pipelines. API providers may cover dozens or hundreds of exchanges, aggregate data, or focus on specific subsets of assets.

With a crowded crypto data landscape, selecting the best API depends on your use case and quality requirements. Consider evaluating providers by:

Token Metrics and a few other advanced platforms provide comprehensive coverage alongside AI-driven analytics that can integrate seamlessly with research or engineering workflows.

Fetching crypto history using an API typically involves several common steps:

/historical/prices)For example, you can retrieve daily Bitcoin OHLC data from a well-documented endpoint and use it in pandas to build price charts, calculate volatility, or feed into a machine learning model. Programmatic access ensures you can automate research, power trading dashboards, or compare assets historically without manual downloads or spreadsheet wrangling.

Combining robust historical data APIs with AI-powered analytics unlocks new potential for crypto research. Platforms like Token Metrics utilize large datasets not just for presenting history, but for generating intelligence: pattern recognition, trading signals, anomaly detection, and fundamental scoring. By integrating API live feeds with AI models, you can:

This workflow ensures analysts, quant researchers, and builders can move from raw blockchain data to actionable insights efficiently, while focusing on accuracy and reproducibility.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

APIs give you programmatic access to a variety of historical data: price OHLCV (Open, High, Low, Close, Volume), order book snapshots, tick-by-tick trades, market capitalization, on-chain metrics, and more. The granularity and range depend on the specific API provider.

Yes, several APIs (including entry-level tiers from advanced providers) offer free endpoints for historical prices and market data. However, free plans may limit data granularity, history depth, or request frequency compared to paid subscriptions.

APIs vary: Bitcoin data typically goes back to 2010, while Ethereum and other major coins cover several years. Full coverage for all coins and smaller assets may depend on the exchange and the API provider’s archival policies.

Absolutely. Clean, granular API feeds are essential for training, validating, and deploying machine learning models for trend detection, price prediction, and anomaly analysis. Many platforms now deliver AI-ready historical crypto data to streamline these workflows.

Most APIs return data as JSON or CSV, which can be fetched and handled with Python (using requests or httpx packages), JavaScript/TypeScript, Java, or Go. Providers often supply SDKs and code examples for easy onboarding.

This blog post is provided for educational and informational purposes only. It does not offer investment advice or endorse any specific assets, services, or platforms. Always conduct independent research and review provider documentation before making technical or business decisions related to APIs and crypto data.

%201.svg)

%201.svg)

The search for reliable, real-time cryptocurrency price data is a common challenge for developers, analysts, and researchers in the digital asset space. With hundreds of active crypto exchanges and significant price discrepancies across platforms, choosing the right API can make or break your crypto app or data-driven workflow. But which crypto API actually delivers the most accurate price data?

Whether you're building an app for portfolio tracking, algorithmic trading, DeFi analytics, or AI-powered crypto agents, precision in price feeds is critical. Inaccurate or delayed data can lead to flawed models, missed opportunities, or even compliance issues for institutional players. Since the crypto market is decentralized and fragmented, no single exchange houses the universally accepted price for Bitcoin or any other token. As a result, APIs aggregate data differently—some provide an average price across several exchanges, while others pick a primary source. How an API compiles and updates prices determines its accuracy and reliability.

Not all crypto price APIs are created equal. Understanding the different types can help you match your needs with the right provider:

When choosing a crypto price API, consider whether you need spot pricing, historical data, liquidity-weighted averages, or normalized feeds for your use case.

Comparing API providers involves more than just looking at their exchange list. Here are the most important variables to assess:

Many serious projects also look for compliance features, such as market surveillance and anti-manipulation policies, though this is more relevant for enterprise integrations than hobby projects.

Based on public documentation, developer feedback, and recent reliability tests, here are five of the most widely used crypto price APIs and how they address accuracy:

No single provider is the "ultimate source"—trade-offs between speed, coverage, and cost exist. For most AI, DeFi, or advanced analytics projects, combining a trusted aggregator (like the Token Metrics API) with cross-references from single-exchange feeds offers a best-practice approach to price accuracy.

To ensure the highest price accuracy in your crypto app or data science workflow, keep these best practices in mind:

Ultimately, the API you choose should align with your use case—whether that's an AI-powered agent making split-second decisions, a portfolio dashboard for long-term holders, or a research tool tracking historical price shifts at scale.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

A crypto price API is a programmatic interface that allows apps and tools to access up-to-date digital asset price data from exchanges and aggregators. Developers use these APIs to retrieve spot prices, historical data, and market statistics, improving the responsiveness and accuracy of crypto-enabled products.

Most aggregator APIs use liquidity- and volume-weighted averages from multiple exchanges to provide representative prices. Leading providers employ filters to exclude abnormal data, detect outliers, and update the source list regularly to reflect top-performing exchanges. Documentation should always be reviewed for each provider's methodology.

For research, broad coverage and rich historical data (e.g., CoinGecko, Token Metrics) are important. For trading, prioritized speed, low-latency feeds (such as those from Token Metrics, Kaiko, or direct exchange APIs), and advanced analytics/tooling are key. Many professionals use both types: one for research, and one for live trading signals.

Free APIs can provide reasonably accurate prices, especially for widely traded assets like Bitcoin and Ethereum. However, they may offer lower rate limits, slower updates, or less historical depth than premium options. For critical or business applications, upgrading to a paid plan with greater support and data guarantees is advisable.

Update frequency varies: some APIs refresh data every few seconds, while others provide real-time data through streaming (WebSocket) feeds. For fast-moving markets, always check the provider's documentation for precise update intervals.

This article is for informational and educational purposes only and does not constitute financial or investment advice. Always conduct your own research and consult a qualified professional for guidance specific to your situation.

%201.svg)

%201.svg)

The explosion of digital assets has fueled a new era of on-demand data analysis, making crypto APIs essential for enthusiasts, developers, and analysts alike. But what kinds of information can you actually unlock using a crypto API, and how can this data power smarter apps or research?

One of the most popular uses for a crypto API is accessing real-time pricing data. APIs enable you to pull the latest prices for thousands of cryptocurrencies across multiple exchanges instantly. This information is foundational for market analysis, digital asset tracking, and powering portfolio dashboards.

Most leading APIs, such as the Token Metrics API, offer live pricing feeds for efficient decision-making and data integration.

Reliable historical data is key to uncovering trends, backtesting strategies, and building machine learning models. Crypto APIs typically allow you to pull:

Historical endpoints help quant researchers and developers build accurate visualizations and statistical models. For instance, analyzing 365 days of closing prices can reveal volatility patterns or market cycles.

Order book data provides the pulse of live trading activity, revealing granular details about market depth and liquidity. With a crypto API, you can access:

Order book access is crucial for algorithmic trading, slippage estimates, and evaluating liquidity. Some APIs even support aggregated order books across several exchanges for more complete market intelligence.

In addition to static prices, many crypto APIs deliver real-time trade and ticker data. This includes:

Use cases range from powering trading bots to feeding AI-driven analytics or anomaly detection systems. This granularity allows a deeper understanding of real-time market sentiment.

Beyond market data, advanced crypto APIs now offer direct access to blockchain or on-chain data. Developers and analysts gain the ability to:

Such on-chain analytics underpin advanced research, compliance processes, and fraud detection strategies. APIs that aggregate insights across multiple blockchains add significant value for multi-asset and multi-chain projects.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

Most crypto APIs supply real-time prices, trading volume, order books, and historical price/volume data. Some also cover blockchain transactions and wallet-level insights—useful for a range of research and app development scenarios.

Leading crypto APIs aggregate data from various exchanges, allowing developers and analysts to access consolidated prices, order books, and liquidity. Aggregated APIs minimize discrepancies and broaden coverage.

The available historical depth varies; top APIs like Token Metrics offer years of daily price data, with some offering tick-level data spanning months or years. Always review documentation for specific asset or interval support.

APIs allow for automated retrieval, filtering, and analysis of large datasets—enhancing research, powering trading robots, building dashboards, or supporting AI-driven models with up-to-date, reliable information.

On-chain data enables compliance monitoring, wallet tracking, DeFi analytics, NFT research, contract auditing, and forensic investigations. Modern APIs help analysts and businesses stay agile amid evolving blockchain trends.

This article is for informational purposes only and does not constitute investment, financial, legal, or tax advice. Cryptocurrency markets are volatile and involve risks. Always conduct your own research before making decisions or building applications based on crypto data.

%201.svg)

%201.svg)

As the cryptocurrency landscape grows more complex, developers and businesses increasingly rely on crypto APIs to access data, power apps, and build innovative blockchain solutions. But a common question arises: are crypto APIs free, or will you need to pay to unlock full functionality?

Crypto APIs (Application Programming Interfaces) act as critical gateways to blockchain data, facilitating seamless integration with cryptocurrency exchanges, wallets, smart contracts, and on-chain analytics. Whether you're building a trading bot, a portfolio dashboard, or financial analytics tools, APIs provide the technical means to fetch real-time prices, historical data, market signals, and transaction details.

For developers and enterprises, leveraging APIs saves hundreds of hours that would otherwise be spent running full blockchain nodes or parsing raw blockchain data. This access underpins everything from decentralized finance (DeFi) apps to AI-powered trading agents. Given their importance, understanding the pricing and business models behind crypto APIs is essential for making informed development decisions.

Many crypto API providers offer free tiers to enable experimentation, small-scale projects, or basic research. Free plans typically allow users to:

Popular platforms like CoinGecko, CoinMarketCap, and CryptoCompare all offer some form of a free API key. For open-source or non-commercial projects, these resources can be invaluable. However, free APIs are generally subject to tighter rate limits, API call quotas, occasional delays, and less robust customer support. For mission-critical apps or commercial ventures, these constraints may hinder scalability and reliability.

Paid crypto APIs are designed to meet the needs of high-volume traders, institutions, and enterprises that require advanced capabilities, higher reliability, and comprehensive datasets. Features usually unlocked in paid plans include:

The pricing models for these APIs vary widely—ranging from monthly subscriptions to pay-as-you-go plans, and sometimes custom enterprise contracts. Providers like Token Metrics, Messari, and Chainalysis are examples offering sophisticated data-access APIs, each with tiered plans depending on user requirements.

Deciding between free and paid APIs goes beyond just budget; it requires analyzing technical and operational needs. Key considerations should include:

For many developers, the path starts with free APIs for exploratory work and transitions to paid plans as scalability, security, and feature demands grow. While free tiers lower the barrier to entry, production-grade platforms often require investing in robust, premium APIs—especially when building for third-party users or integrating AI systems reliant on accurate data streams.

The crypto API market features a variety of pricing models to suit diverse needs:

Each model impacts not just the cost but also integration choices. For example, a developer building an AI-driven trading assistant may need not only current price feeds but also deep market signals and on-chain data—necessitating advanced tier plans.

Build Smarter Crypto Apps & AI Agents with Token Metrics

Token Metrics provides real-time prices, trading signals, and on-chain insights all from one powerful API. Grab a Free API Key

No, not all crypto APIs are free. While many providers offer limited free tiers, advanced features such as higher rate limits, in-depth analytics, and premium support typically require a paid plan or subscription.

Free API keys generally provide access to basic price information, limited historical data, and publicly visible blockchain metrics within specified rate limits. Advanced or bulk data, in-depth analytics, and commercial licensing often require paid access.

Consider upgrading to a paid API when your app or project requires higher reliability, faster updates, greater request quotas, access to premium data sets (such as order books, advanced analytics, or on-chain signals), or enterprise-grade support.

Crypto API providers use a mix of freemium, tiered subscription, and pay-as-you-go models. Pricing varies based on usage, features required, support level, and data depth. Most providers publish clear rate sheets or offer custom enterprise solutions for large-scale needs.

Yes, open-source crypto APIs and data crawlers exist, enabling developers to self-host and customize their data infrastructure. However, this typically requires significant technical resources for deployment, scaling, and data quality assurance.

This article is for educational and informational purposes only. It is not intended as investment advice or an endorsement of any specific service or platform. Please conduct your own research and consult qualified professionals for business or technical guidance.

Create Your Free Account

Create Your Free Account9450 SW Gemini Dr

PMB 59348

Beaverton, Oregon 97008-7105 US

.svg)

.png)

Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies.

Token Metrics Media LLC does not provide individually tailored investment advice and does not take a subscriber’s or anyone’s personal circumstances into consideration when discussing investments; nor is Token Metrics Advisers LLC registered as an investment adviser or broker-dealer in any jurisdiction.

Information contained herein is not an offer or solicitation to buy, hold, or sell any security. The Token Metrics team has advised and invested in many blockchain companies. A complete list of their advisory roles and current holdings can be viewed here: https://tokenmetrics.com/disclosures.html/

Token Metrics Media LLC relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Additionally, Token Metrics Media LLC does not provide tax advice, and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Ratings and price predictions are provided for informational and illustrative purposes, and may not reflect actual future performance.