Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

Infrastructure protocols become more valuable as the crypto ecosystem scales and relies on robust middleware. Chainlink provides critical oracle infrastructure where proven utility and deep integrations drive long-term value over retail speculation. Increasing institutional adoption raises demand for professional-grade data delivery and security.

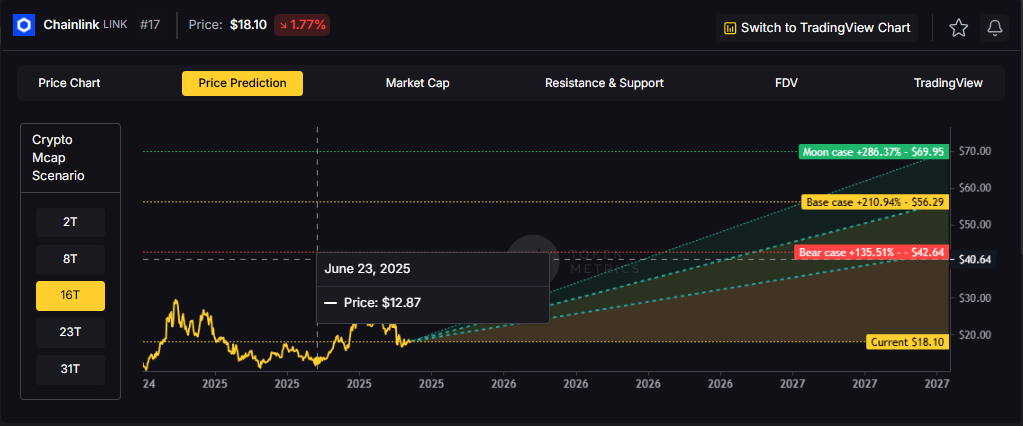

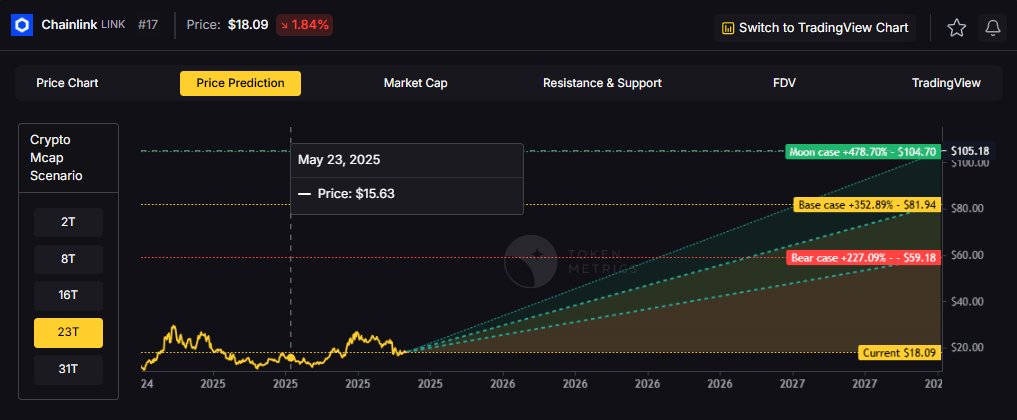

Token Metrics projections for LINK below span multiple total market cap scenarios from conservative to aggressive. Each tier assumes different levels of infrastructure demand as crypto evolves from speculative markets to institutional-grade systems. These bands frame LINK's potential outcomes into 2027.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics lead metric for Chainlink, cashtag $LINK, is a TM Grade of 23.31%, which translates to a Sell, and the trading signal is bearish, indicating short-term downward momentum. This means Token Metrics currently does not endorse $LINK as a long-term buy at current conditions.

Live details: Chainlink Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T: At an 8 trillion dollar total crypto market cap, LINK projects to $26.10 in bear conditions, $30.65 in the base case, and $35.20 in bullish scenarios.

16T: Doubling the market to 16 trillion expands the range to $42.64 (bear), $56.29 (base), and $69.95 (moon).

23T: At 23 trillion, the scenarios show $59.18, $81.94, and $104.70 respectively.

31T: In the maximum liquidity scenario of 31 trillion, LINK could reach $75.71 (bear), $107.58 (base), or $139.44 (moon).

Chainlink represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle LINK with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

Chainlink is a decentralized oracle network that connects smart contracts to real-world data and systems. It enables secure retrieval and verification of off-chain information, supports computation, and integrates across multiple blockchains. As adoption grows, Chainlink serves as critical infrastructure for reliable data feeds and automation.

The LINK token is used to pay node operators and secure the network’s services. Common use cases include DeFi price feeds, insurance, and enterprise integrations, with CCIP extending cross-chain messaging and token transfers.

Vision: Chainlink aims to create a decentralized, secure, and reliable network for connecting smart contracts with real-world data and systems. Its vision is to become the standard for how blockchains interact with external environments, enabling trust-minimized automation across industries.

Problem: Smart contracts cannot natively access data outside their blockchain, limiting their functionality. Relying on centralized oracles introduces single points of failure and undermines the security and decentralization of blockchain applications. This creates a critical need for a trustless, tamper-proof way to bring real-world information onto blockchains.

Solution: Chainlink solves this by operating a decentralized network of node operators that fetch, aggregate, and deliver data from off-chain sources to smart contracts. It uses cryptographic proofs, reputation systems, and economic incentives to ensure data integrity. The network supports various data types and computation tasks, allowing developers to build complex, data-driven decentralized applications.

Market Analysis: Chainlink is a market leader in the oracle space and a key infrastructure component in the broader blockchain ecosystem, particularly within Ethereum and other smart contract platforms. It faces competition from emerging oracle networks like Band Protocol and API3, but maintains a strong first-mover advantage and widespread integration across DeFi, NFTs, and enterprise blockchain solutions. Adoption is driven by developer activity, partnerships with major blockchain projects, and demand for secure data feeds. Key risks include technological shifts, regulatory scrutiny on data providers, and execution challenges in scaling decentralized oracle networks. As smart contract usage grows, so does the potential for oracle services, positioning Chainlink at the center of a critical niche, though its success depends on maintaining security and decentralization over time.

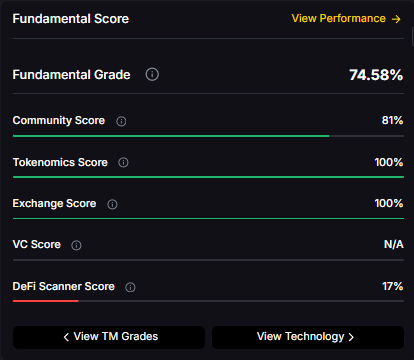

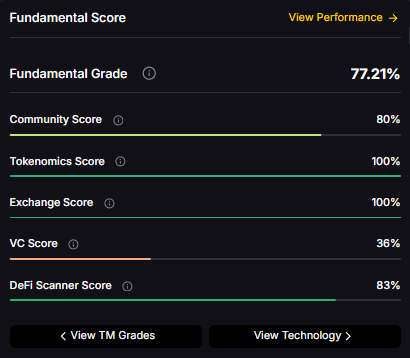

Fundamental Grade: 74.58% (Community 81%, Tokenomics 100%, Exchange 100%, VC —, DeFi Scanner 17%).

Technology Grade: 88.50% (Activity 81%, Repository 72%, Collaboration 100%, Security 86%, DeFi Scanner 17%).

Can LINK reach $100?

Yes. Based on the scenarios, LINK could reach $100+ in the 23T moon case. The 23T tier projects $104.70 in the moon case. Not financial advice.

What price could LINK reach in the moon case?

Moon case projections range from $35.20 at 8T to $139.44 at 31T. These scenarios assume maximum liquidity expansion and strong Chainlink adoption. Not financial advice.

Should I buy LINK now or wait?

Timing depends on risk tolerance and macro outlook. Current price of $18.09 sits below the 8T bear case in the scenarios. Dollar-cost averaging may reduce timing risk. Not financial advice.

Track live grades and signals: Token Details

Want exposure? Buy LINK on MEXC

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Discover the full potential of your crypto research and portfolio management with Token Metrics. Our ratings combine AI-driven analytics, on-chain data, and decades of investing expertise—giving you the edge to navigate fast-changing markets. Try our platform to access scenario-based price targets, token grades, indices, and more for institutional and individual investors. Token Metrics is your research partner through every crypto market cycle.

%201.svg)

%201.svg)

The crypto market is tilting bullish into 2026 as liquidity, infrastructure, and participation improve across the board. Clearer rules and standards are reshaping the classic four-year cycle, flows can arrive earlier, and strength can persist longer than in prior expansions.

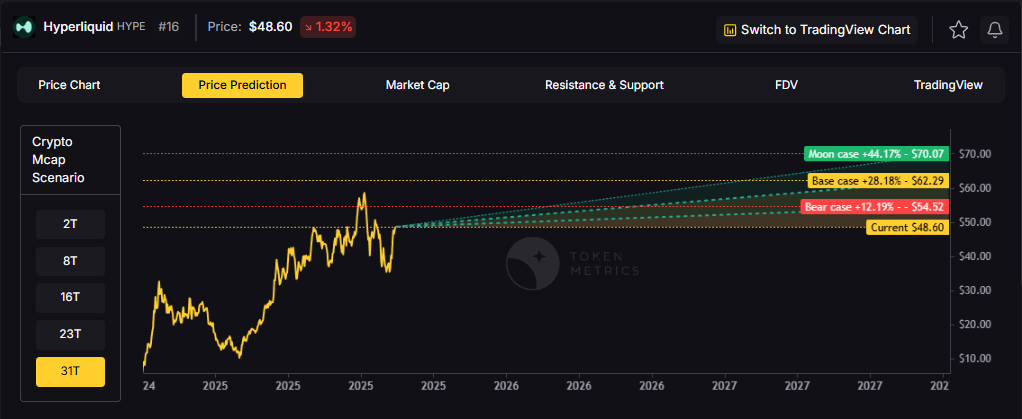

Institutional access is widening through ETFs and custody, while L2 scaling and real-world integrations help sustain on‑chain activity. This healthier backdrop frames our scenario work for HYPE. The ranges below reflect different total crypto market sizes and the share Hyperliquid could capture under each regime.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

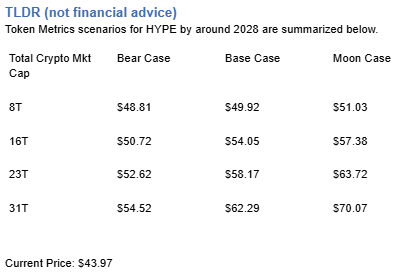

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

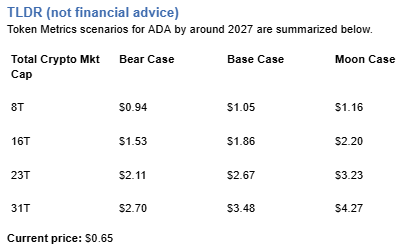

TM Agent baseline: Token Metrics TM Grade is 73.9%, a Buy, and the trading signal is bearish, indicating short-term downward momentum. This means Token Metrics judges HYPE as fundamentally attractive over the long term, while near-term momentum is negative and may limit rallies.

Live details: Hyperliquid Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Scenario Analysis

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T: At an 8 trillion dollar total crypto market cap, HYPE projects to $48.81 in bear conditions, $49.92 in the base case, and $51.03 in bullish scenarios.

16T: Doubling the market to 16 trillion expands the range to $50.72 (bear), $54.05 (base), and $57.38 (moon).

23T: At 23 trillion, the scenarios show $52.62, $58.17, and $63.72 respectively.

31T: In the maximum liquidity scenario of 31 trillion, HYPE could reach $54.52 (bear), $62.29 (base), or $70.07 (moon).

Each tier assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Diversification matters. HYPE is compelling, yet concentrated bets can be volatile. Token Metrics Indices hold HYPE alongside the top one hundred tokens for broad exposure to leaders and emerging winners.

Our backtests indicate that owning the full market with diversified indices has historically outperformed both the total market and Bitcoin in many regimes due to diversification and rotation.

Hyperliquid is a decentralized exchange focused on perpetual futures with a high-performance order book architecture. The project emphasizes low-latency trading, risk controls, and capital efficiency aimed at professional and retail derivatives traders. Its token, HYPE, is used for ecosystem incentives and governance-related utilities.

Can HYPE reach $60?

Yes, the 23T and 31T tiers imply ranges above $60 in the Base and Moon bands, though outcomes depend on liquidity and adoption. Not financial advice.

Is HYPE a good long-term investment?

Outcome depends on adoption, liquidity regime, competition, and supply dynamics. Diversify and size positions responsibly.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Token Metrics delivers AI-based crypto ratings, scenario projections, and portfolio tools so you can make smarter decisions. Discover real-time analytics on Token Metrics.

%201.svg)

%201.svg)

The Layer 1 competitive landscape is consolidating as markets recognize that specialization matters more than being a generic "Ethereum killer." Cardano positions itself in this multi-chain world with specific technical and ecosystem advantages. Infrastructure maturity around custody, bridges, and developer tools makes alternative L1s more accessible heading into 2026.

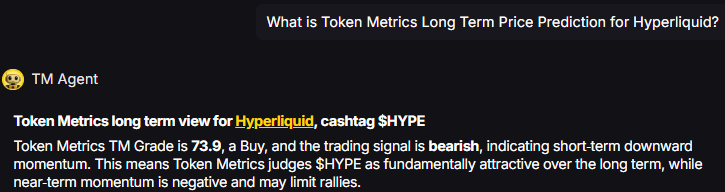

The scenario projections below map different market share outcomes for ADA across varying total crypto market sizes. Base cases assume Cardano maintains current ecosystem momentum, while moon scenarios factor in accelerated adoption and bear cases reflect increased competitive pressure.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

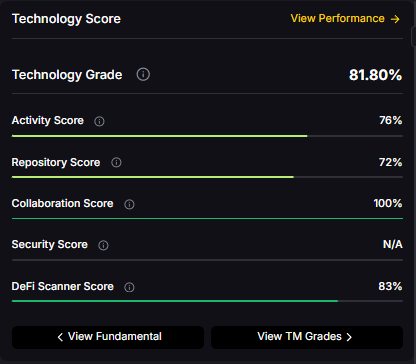

TM Agent baseline: Token Metrics lead metric for Cardano, cashtag $ADA, is a TM Grade of 29.72%, which translates to a Sell, and the trading signal is bearish, indicating short-term downward momentum. This combination means Token Metrics does not currently endorse $ADA as a long-term buy at current levels. A brief market context: Bitcoin's direction remains the dominant macro driver for smart contract platforms, so sustained upside for $ADA would require a broader crypto risk-on regime and improving fundamentals or developer activity for Cardano.

Live details: Cardano Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

Each tier assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Cardano represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle ADA with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

Cardano is a blockchain platform designed to support secure, scalable, and sustainable decentralized applications and smart contracts. It is known for its research-driven development approach, emphasizing peer-reviewed academic research and formal verification methods to ensure reliability and security. As a proof-of-stake Layer 1 blockchain, Cardano aims to offer energy efficiency and long-term scalability, positioning itself as a competitor to platforms like Ethereum. Its native token, ADA, is used for transactions, staking, and governance. Adoption is driven by technological rigor and ecosystem growth, though progress has been criticized for being slow compared to more agile competitors. Risks include execution delays, competition, and market volatility.

Cardano’s vision is to create a decentralized platform that enables sustainable and inclusive economic systems through advanced cryptography and scientific methodology. It aims to bridge gaps between traditional financial systems and blockchain technology, promoting accessibility and security for users globally.

Token Metrics AI provides comprehensive context on Cardano's positioning and challenges.

Can ADA reach $4?

Based on the scenarios, ADA could reach $4 in the 31T moon case. The 31T tier projects $4.27 in the moon case. Not financial advice.

Can ADA 10x from current levels?

At current price of $0.65, a 10x would reach $6.50. This falls within none of the provided scenarios, which top out at $4.27 in the 31T moon case. Bear in mind that 10x returns require substantial market cap expansion. Not financial advice.

What price could ADA reach in the moon case?

Moon case projections range from $1.16 at 8T to $4.27 at 31T. These scenarios assume maximum liquidity expansion and strong Cardano adoption. Not financial advice.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

%201.svg)

%201.svg)

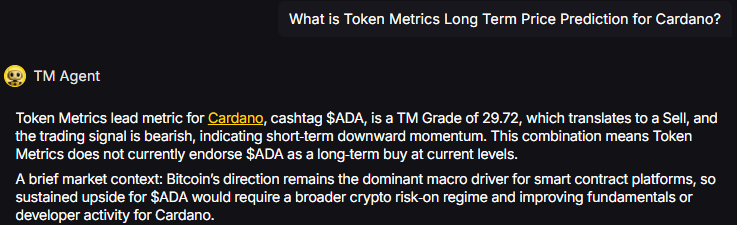

Thinking about investing in cryptocurrency, but not sure where to start? You’re not alone. Crypto’s vast universe can be daunting for beginners, filled with thousands of tokens, complex technology, and nerve-wracking price swings. Fortunately, you don’t need to be a blockchain expert to get started, thanks to the power and convenience of Token Metrics AI Indices. This guide breaks down everything you need to know, so you can confidently take your first steps toward intelligent, AI-powered crypto investing.

What Is Cryptocurrency?

Before getting started, it’s helpful to know what cryptocurrency is. At its core, cryptocurrency is digital money secured by cryptography and maintained on blockchains, which are decentralized networks of computers. Bitcoin launched in 2009 as the first cryptocurrency; now, the ecosystem includes thousands of digital assets, each developed for different use cases. Examples include Ethereum for smart contracts, stablecoins like USDC for price stability, and tokens for powering decentralized finance (DeFi) and access to blockchain services.

Why Invest in Cryptocurrency?

While cryptocurrency is known for its growth potential, it also offers other benefits such as portfolio diversification. Because crypto assets often move independently from traditional stocks and bonds, they can help improve risk-adjusted returns within an investment portfolio. Additionally, blockchains enable new forms of finance and technology, and limited-supply assets like Bitcoin can serve as digital scarcity tools, appealing to those mindful of inflation. Overall, investing in crypto represents participation in evolving technology, new financial systems, and emerging markets.

The Challenge of DIY Crypto Investing

Attempting to choose individual cryptocurrencies can quickly overwhelm newcomers. Researching whitepapers, tracking market news, evaluating development teams, and keeping up with evolving technologies and regulations demand deep expertise and substantial time. Many beginners rely on headlines or social media hype, increasing the risk of mistakes and losses.

How AI Indices Solve Beginner Challenges

Token Metrics AI Indices address these hurdles by using professional analysis and artificial intelligence to automatically create model portfolios. The AI engine screens thousands of tokens daily, using a blend of quantitative signals, fundamental metrics, on-chain activity, and sentiment data to identify strong projects while avoiding scams. As a result, beginners tap into sophisticated research and data-backed selection automatically—without needing advanced expertise or excessive research time.

Systematic Strategy Versus Emotional Investing

One of the main risks for new investors is emotional decision-making during crypto’s sharp price swings. Panic selling in a dip or FOMO buying near a peak can lead to sub-optimal outcomes. Token Metrics’ AI systematically applies rules-based strategies, insulating your portfolio from these impulsive decisions and supporting consistent, disciplined participation regardless of market sentiment.

Financial Prerequisites

Before investing in crypto, make sure you have financial fundamentals in place. This includes building an emergency fund, clearing high-interest debts, and securing appropriate insurance. Keep in mind that cryptocurrency investing should only represent a portion of your broader portfolio, and you should never risk money you can’t afford to lose.

Knowledge Prerequisites

Token Metrics makes crypto indexing more accessible, but a foundational understanding is still useful. Learn about blockchain basics, the various types of tokens, and how to use wallets and exchanges. The platform provides educational resources—including guides, webinars, and a glossary—that help you build this foundational knowledge.

Mindset Prerequisites

Crypto markets are volatile, and strong long-term outcomes require patience, discipline, and a readiness to learn. Expect sharp market swings and plan accordingly. If your goals or risk tolerance aren’t aligned with this reality, consider whether crypto is the right choice for your circumstances.

Large-Cap Indices

These focus on established cryptocurrencies like Bitcoin, Ethereum, and other top-tier tokens. They offer relatively lower volatility, deep liquidity, and less risk of project failure. For most beginners, large-cap indices form a stable entry point, much like an S&P 500 fund does for stock investors.

Balanced/Mid-Cap Indices

Balanced indices combine large-cap stability with the growth opportunities of medium-sized projects. Typically featuring 15–25 tokens, they balance risk and return, offering exposure to different sectors (like DeFi, Layer 1s, and Layer 2s). This blend suits beginners looking for a bit more growth potential beyond the very largest coins.

Sector-Specific Indices

Some indices focus on individual sectors, such as DeFi, NFTs, metaverse projects, or AI-powered tokens. These can be more volatile but allow investors to express views on specific trends once they have more experience. For those just starting, it’s often better to begin with broad, diversified indices.

Growth and Momentum Indices

These aim to capture tokens experiencing strong upward trends. They use more active rebalancing and can carry higher risk. Beginners should approach these with caution and only allocate a small portion of their portfolio exposure to growth/momentum indices.

Step 1: Create Your Token Metrics Account

Go to the Token Metrics website, set up your account, and select a plan aligning with your needs. Plans offer varying levels of access to indices and features, so start with the option that matches your experience. Upgrade as you progress and want enhanced tools.

Step 2: Complete the Educational Foundation

Explore the tutorials, webinars, and guides available on Token Metrics. Allocating a few hours to foundational material helps you avoid common mistakes and build lasting confidence.

Step 3: Assess Your Investment Profile

Take advantage of assessment tools to measure your risk tolerance, investment horizon, and familiarity with crypto. Honest self-reflection supports a healthy investment plan. Beginning conservatively is often best.

Step 4: Select Your Initial Indices

For many, starting with 60–80% in a large-cap index and 20–40% in a balanced index provides stable exposure alongside some growth. Don’t over-diversify; one or two carefully chosen indices can be sufficient as you start out.

Step 5: Understand the Investment Mechanics

Token Metrics indices function as model portfolios, providing recommendations on what to purchase and in what proportion. Depending on your platform level, you may buy tokens manually on exchanges or use integrated trading features. Review the exact steps, track your holdings, and follow rebalance instructions.

Step 6: Make Your Initial Investment

Consider starting with a smaller allocation (such as 25–50%) of your target investment. This staged approach helps you gain direct experience with minimal risk. Always record your transactions for reference and tax purposes.

Step 7: Set Up Monitoring and Alerts

Configure platform notifications to stay informed about index changes and major movements, but avoid becoming glued to your screen. Focus on the long-term plan without reacting to every short-term fluctuation.

The Initial Volatility Experience

Expect pronounced portfolio swings over the first few months. Fluctuations of 20–30% are not uncommon; these are typical in crypto and not necessarily cause for alarm. Stay the course and lean on the systematic approach provided by Token Metrics indices.

Learning to Trust the System

It can be difficult to trust AI-driven strategies initially, especially during downswings. Keep in mind that Token Metrics’ system is data-driven and built upon proven frameworks. The key is maintaining discipline and resisting the urge to override the strategy based on emotion.

Gradual Comfort Building

After a few months, market swings will feel less jarring, and your understanding of crypto dynamics will deepen. Use this period to refine your research skills and become more comfortable with the tools and strategies you’re using.

How Much Should I Invest?

Most begin with an amount they’re willing to lose completely, such as $500–$2,000. The key is to grow your allocation gradually as your confidence and knowledge expand.

How Often Should I Check My Portfolio?

Weekly or monthly reviews are generally sufficient. Token Metrics’ indices are designed to minimize the need for constant monitoring and reduce emotional reactions to market ups and downs.

When Should I Rebalance?

Follow the systematic rebalancing guidance provided by Token Metrics indices. Avoid making discretionary changes based on short-term price movements or gut feelings.

What Returns Should I Expect?

Crypto returns are highly variable and cannot be predicted. Focus on following the disciplined strategy and learning rather than chasing specific returns.

How Do I Handle Taxes?

Cryptocurrency investing can trigger taxable events. Document your trades and consider seeking advice from a tax professional with crypto expertise. Token Metrics provides comprehensive transaction history to help during tax reporting.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market.

Continuous Learning

Crypto and blockchain evolve rapidly. Stay up to date by consuming Token Metrics’ educational materials, engaging in the community, and following reputable news. Ongoing learning is your edge.

Patience and Discipline

Many successful investors attribute results to simply sticking to their plan, rebalancing periodically, and not getting distracted by headlines. Token Metrics indices provide a stable foundation; your task is to maintain focus and discipline.

Gradual Sophistication

Once you’re comfortable, gradually add more complex indices or tactics to your plan. Build up to sector-focused indices or advanced strategies as your understanding grows—matching sophistication to your learning pace.

By starting your journey with Token Metrics AI Indices, you benefit from institutional-grade research and systematic portfolio management. Continue to educate yourself, begin conservatively, monitor periodically, and grow your sophistication as you evolve. Crypto investing is a long-term endeavor; steady discipline and engagement are your best allies.

The best time to begin learning and participating in cryptocurrency markets is now. Token Metrics AI Indices and educational resources provide a highly accessible entry point for beginners. Start with a manageable investment, embrace systematic strategies, and be patient as your knowledge grows. By participating today, you position yourself to benefit from the ongoing evolution of blockchain technology and digital assets.

A crypto index is a model portfolio of digital assets designed to track the performance of a set group of cryptocurrencies. Token Metrics AI Indices use artificial intelligence to select and weight assets, helping simplify the process for investors of all experience levels.

No strict minimum exists, but investors typically begin with small amounts appropriate for their risk profile. Review Token Metrics’ guidelines and consider comfortable initial allocations as you learn the ropes.

Indices are updated regularly based on market conditions and algorithmic signals. Subscribers receive notifications about major rebalances or methodology changes to support informed participation.

Yes. Token Metrics indices provide portfolio recommendations that investors can implement across most major exchanges and wallets. Some integrated features are also available, depending on your subscription level.

Token Metrics offers a comprehensive education suite: tutorials, live and recorded webinars, platform guides, a detailed glossary, and customer support—all aimed at helping beginners gain comfort and skill with crypto investing.

This content is for informational and educational purposes only. It is not financial or investment advice. Cryptocurrency is subject to high volatility and risk. Readers should conduct their own due diligence and consult qualified professionals regarding financial decisions before acting on any content presented here.

%201.svg)

%201.svg)

Every experienced cryptocurrency investor has battle scars—stories of devastating losses that could have been avoided with better knowledge, discipline, or tools. A survey of crypto investors reveals that over 70% have lost money on at least one investment, with many experiencing losses exceeding 50% of their initial capital. These losses are not inevitable results of crypto volatility—they often stem from preventable mistakes that trap both new and experienced investors alike.

The good news is that learning from the mistakes of others is far less expensive than learning from your own. Even better, modern AI-powered tools like Token Metrics indices can systematically help you avoid the most common and costly errors in the crypto markets. This comprehensive guide examines the ten most devastating mistakes crypto investors make and reveals how Token Metrics’ artificial intelligence addresses each challenge, helping to protect your capital while optimizing returns.

The Problem

Cryptocurrency markets are notorious for explosive rallies that create intense FOMO. When a token surges 500% in a week, investors panic about missing out on gains. Social media amplifies this anxiety with posts showcasing enormous profits and predictions of further moonshots. Overwhelmed, investors often buy near peaks, only to watch prices fall rapidly.

This cycle has repeated across many crypto assets. Dogecoin’s 2021 rally is a prime example, where many bought near the top and faced major losses. The psychological trap is powerful; our brains fear missed opportunities, and 24/7 crypto markets mean constant exposure to perceived missed chances.

The Token Metrics Solution

Token Metrics AI evaluates cryptocurrencies using objective metrics—technical indicators, fundamental strength, network activity, and risk-adjusted potential. The algorithms do not experience FOMO, panic, or greed.

During extreme rallies, Token Metrics’ AI analyzes whether price movements are supported by strong fundamentals or are unsustainable speculation. Indices will rebalance to manage profits as prices grow extended, and a token’s absence is itself a signal that sustainable value has not been identified by the AI. Following Token Metrics indices helps you sidestep the FOMO trap and invest based on data, not hype.

The Problem

Many investors concentrate heavily in one or a few tokens—whether out of conviction, convenience, or time limitations. This leaves portfolios vulnerable to project-specific risks. The collapse of Terra/LUNA and FTX’s FTT token are examples where concentration contributed to severe losses.

Being over-exposed to a single asset amplifies unique risks and reduces the protective benefits of diversification.

The Token Metrics Solution

Token Metrics indices are built to diversify across multiple cryptocurrencies, vetted for different projects, technologies, and use cases. The AI routinely analyzes correlations to maintain genuine diversification, not just a basket of highly correlated assets.

Large-cap indices may hold 10–15 established cryptos, while broader indices cover 20–30 tokens. This diversification means a single failure has limited impact. Through Token Metrics indices, you gain professional-level portfolio diversity without the need for complex analysis or manual research.

The Problem

Crypto’s open and global nature attracts fraudulent projects: rug pulls, Ponzi schemes, fake teams, plagiarized whitepapers, and social engineering attacks. Even sophisticated scams often have professional websites and social presence, making them difficult to identify. Lack of due diligence can result in substantial losses.

The Token Metrics Solution

Token Metrics AI executes rigorous vetting: analyzing code quality, verifying team credentials, monitoring community sentiment, evaluating tokenomics, and tracking exchange listings. Only projects meeting high standards are included in indices, and continuous monitoring flags and removes projects with emerging red flags. While no tool is perfect, this process significantly reduces scam exposure compared to manual research.

The Problem

Crypto volatility can trigger panic selling or risk-chasing behavior. Academic research shows emotional investors underperform systematic strategies by wide margins. The crypto market’s 24/7 cycle exacerbates impulsiveness.

The Token Metrics Solution

Token Metrics AI remains disciplined during swings. Whether markets crash or rally, the system evaluates conditions based on data and follows consistent, predefined rules. Systematic approaches sidestep the psychological traps that often reduce returns and allow investors to benefit from stable, rules-driven portfolio management.

The Problem

Crypto investors sometimes allocate equally to all holdings or over-weight speculative assets, ignoring fundamental risk management. Exposures that are too large to riskier tokens lead to severe portfolio drops if those assets decline.

The Token Metrics Solution

Token Metrics indices apply advanced risk management: adjusting position sizes based on risk factors like market capitalization, volatility, and fundamental strength. High-risk assets receive smaller allocations, while larger, more stable projects get higher weights. Maximum concentration limits further ensure disciplined diversification.

The Problem

Many try to buy at bottoms and sell at tops—an approach even professional traders struggle with. Retail investors, in particular, often buy during euphorias and sell during panics, missing gains and amplifying losses.

The Token Metrics Solution

Token Metrics indices favor systematic strategies over timing perfection. The AI blends technical, fundamental, and sentiment metrics to gradually adjust portfolio exposures, avoiding binary trades. This adaptive approach helps capture uptrends and manage risk, without attempting impossible precision.

The Problem

Over time, portfolios drift as certain tokens outperform, creating dangerous concentrations. Many investors resist rebalancing due to psychological biases—selling winners feels wrong, and buying underperformers feels risky.

The Token Metrics Solution

Token Metrics indices enforce systematic rebalancing (weekly, monthly, or quarterly) based on predefined triggers. This ensures disciplined, data-driven adjustments and automates the buy-low, sell-high process for investors.

The Problem

Frequent buying and selling increases transaction fees, sometimes triggers unfavorable tax events, and can worsen results through poor timing. Overtrading is common in 24/7 crypto markets and often destroys value.

The Token Metrics Solution

Token Metrics indices use deliberate, criteria-based rebalancing—only trading when data supports meaningful improvement. This minimizes unnecessary costs while adapting portfolios to market changes with discipline.

The Problem

Thorough cryptocurrency research is time-intensive and requires cross-disciplinary expertise, which most individual investors lack. Poor research leads to flawed investments and increased risk exposure.

The Token Metrics Solution

Token Metrics invests in comprehensive due diligence. Its team of analysts and data scientists combines institutional-grade research with continuous AI analysis. Indices include tokens only after deep research and ongoing review, benefiting individual investors with professional-level insights.

The Problem

Investing without clear objectives, time horizons, or philosophies results in random actions and reactive decision-making. Without a framework, investors lack guiding principles and cannot measure progress reliably.

The Token Metrics Solution

Each Token Metrics index has a clear methodology, benchmarks, and risk parameters. By aligning selection with your own goals and risk tolerance, investors benefit from structured, systematic strategies and the discipline required to pursue successful long-term outcomes.

Starting Your Journey Right

Begin by identifying the mistakes most likely to affect you—are you prone to FOMO, impulse trades, or research struggles? Token Metrics AI Indices are explicitly designed to counter these weaknesses and provide a systematic alternative.

Implementing Your Strategy

Implement Token Metrics–based strategies aligned to your investment goals. Begin with broad indices for core exposure and add satellite positions reflecting your specific interests. Consistency over a 6–12 month period builds discipline, while patient adherence to your plan supports long-term success.

Learning and Evolving

Explore Token Metrics educational resources to improve your understanding of markets and strategies. Focus on quarterly reviews of your portfolio’s progress rather than frequent checks, which might spark emotional reactions.

The crypto market offers major opportunities, but costly mistakes are common. Discipline, research, and systematic strategies make the difference. Token Metrics AI Indices provide a framework and professional research to help avoid the most common pitfalls.

You can choose between learning from the errors of others or repeating those costly lessons personally. By leveraging artificial intelligence, deep research, and systematic discipline with Token Metrics, you transform your crypto investing approach into a strategic, data-driven process.

Success in crypto is achievable for those who use robust tools, avoid emotional pitfalls, and maintain consistency through volatility. With Token Metrics AI Indices, you have tailored resources to join that group.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market.

Token Metrics is a crypto analytics platform that uses artificial intelligence and expert research to provide ratings, indices, and investment tools. It helps users analyze cryptocurrencies systematically and make data-driven decisions.

Token Metrics AI Indices automatically select, weight, and rebalance portfolios of cryptocurrencies based on both quantitative and qualitative analysis. They use predefined rules to ensure discipline and comprehensive risk management across the portfolio.

Token Metrics indices address risks such as overconcentration, inadequate diversification, emotional trading, exposure to scams, poor timing, insufficient rebalancing, and lack of research—offering systematic solutions to each.

While Token Metrics indices follow set methodologies, users can select indices that align with their investment goals, risk tolerance, and preferred crypto sectors, tailoring their strategy for their own objectives.

No, Token Metrics provides analytical tools and systematic frameworks for research. It does not offer individualized investment advice and all investment decisions should be made independently, taking personal circumstances into account.

This content is for informational and educational purposes only and does not constitute investment advice, endorsement, or a solicitation. Cryptocurrency markets are volatile and subject to risk. Always conduct your own due diligence and consult with a qualified advisor before making investment decisions. Token Metrics does not guarantee results or profits.

%201.svg)

%201.svg)

The cryptocurrency landscape has evolved dramatically, transforming from speculative beginnings to a structured and legitimate asset class. As participation grows, the challenges of managing risk and achieving consistent returns remain at the forefront for digital asset investors. The key to sustained success often lies in rigorous strategy, clear discipline, and the careful use of advanced analytical tools.

Token Metrics AI Indices offer a systematic, research-driven approach for constructing and managing crypto portfolios. Yet, to fully benefit from these indices, it is essential to understand capital allocation, risk management, strategic diversification, and the necessity to adapt to ever-changing market dynamics. This guide explores advanced techniques for optimizing crypto portfolios using Token Metrics AI Indices, detailing practical frameworks and considerations for long-term digital asset investing.

Defining clear investment objectives is fundamental. Some investors seek long-term wealth accumulation, others focus on generating income, capital preservation, or aggressive growth. Each objective demands a tailored approach: long-term investors may prefer indices with strong fundamentals and broader exposure, while those aiming for income could focus on indices facilitating regular rebalancing. Token Metrics provides indices suited to a variety of goals, ensuring strategies align with desired outcomes through informed selection.

Risk tolerance extends beyond emotional comfort; it encompasses financial capacity and investment duration. Variables such as age, savings, income stability, drawdown limits, and liquidity needs must factor into all risk assessments. The wide breadth of Token Metrics indices—from conservative large-cap to dynamic small-cap growth—enables a spectrum of strategies tailored to individual tolerance and financial circumstances.

Deciding how much of your overall investment portfolio to allocate to crypto assets is another crucial step. Conservative approaches allocate 1–3%, moderate risk-takers may target 5–7%, while aggressive strategies could reach 10–15%. Due to the volatility of cryptocurrencies, it is important to allocate only capital that fits your risk profile and financial horizon, regardless of the sophistication of index methodologies.

The core-satellite framework from traditional investing translates powerfully to crypto. Core holdings—typically 60–80% of a crypto allocation—offer diversified, stable exposure, primarily via established assets. Token Metrics’ large-cap indices are commonly chosen for the core due to their focus on proven cryptocurrencies and systematic rebalancing, supporting stability and steady market participation.

Satellite positions, comprising the remaining 20–40%, introduce targeted high-return potential by emphasizing emerging sectors, momentum-driven assets, or thematic innovations such as DeFi, NFTs, or Layer 2s. These require regular monitoring and agility as sector leadership shifts in evolving markets. A disciplined balance—whether 80/20, 70/30, or 60/40—reflects personal risk appetites and is crucial for managing upside opportunity and risk exposure. Vigilant rebalancing keeps this allocation in line with strategic objectives, capturing gains while controlling concentration risk.

Optimal portfolio construction demands more than simply holding multiple indices. Token Metrics indices vary by strategy: some focus on large-cap stability, others on mid-cap growth, momentum trading, or sector rotation. Combining complementary—not redundant—strategies creates true diversification and robust return profiles.

Utilizing correlation analysis, investors can identify indices whose underlying assets move independently or inversely, maximizing the protective benefits of diversification. Token Metrics’ analytics help surface such relationships, which should be reviewed quarterly as market structure and narratives evolve. Further, consideration of indices’ rebalancing frequency—daily, weekly, monthly, or quarterly—impacts trading activity, tax implications, and alignment with individual account structures. Balancing the frequency and style of index management supports both risk-adjusted returns and operational efficiency.

Risk can accumulate silently if multiple indices overlap heavily in key holdings. Employing concentration limits (e.g., no single asset exceeding a set percentage of total exposure) and regularly reviewing aggregate positions via Token Metrics’ transparency tools is vital for material risk control.

Dynamic allocation—shifting between aggressive and conservative indices based on volatility metrics—provides another layer of protection. For example, higher market turbulence might justify repositioning toward large-cap indices or incorporating stablecoins and cash. Meanwhile, strategies to limit drawdowns, like portfolio-level stop-losses, scheduled rebalancing to defensive allocations, and maintaining liquidity buffers, all help safeguard portfolio value through market declines.

Market cycles present opportunities and challenges for index strategy. Recognizing phases of bull markets, bear corrections, and accumulation zones can inform the strategic allocation between aggressive and conservative indices. Sector rotation—adjusting satellite allocations to favor sectors with emergent strength—further leverages market dynamics. Token Metrics’ sector-specific analytics and indices help identify and track leading segments for tactical positioning.

Regular rebalancing, whether triggered by time or threshold, enforces a structured ‘buy low, sell high’ discipline—keeping the portfolio closely aligned with long-term objectives. Considering tax implications, investors often favor less frequent rebalancing in taxable accounts or utilize retirement accounts for more active strategies. Token Metrics’ reporting tools facilitate record-keeping and process transparency for both tax efficiency and compliance.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market.

Token Metrics AI Indices are systematically constructed portfolios selected and managed using artificial intelligence and quantitative analysis. They aggregate a diversified set of cryptocurrencies aligned with specific themes or strategies and are designed to streamline portfolio construction and ongoing management for a variety of investor goals.

Selection is guided by your investment goals, risk tolerance, time horizon, and desired crypto exposure. Token Metrics provides indices tailored to differing strategies—from conservative to aggressive—paired with comprehensive analytics to support informed choices that match your individual profile.

Rebalancing frequency can depend on index methodologies, personal tax considerations, and account type. Quarterly or semi-annual rebalancing is common, though some strategies or tax-sheltered accounts may benefit from more frequent adjustments. Always track deviations from target allocations to ensure portfolio discipline.

Best practices include setting position and concentration limits, diversifying across uncorrelated indices, dynamically adjusting allocations during volatile periods, and employing routine performance and scenario reviews using analytics like those provided by Token Metrics. Regular monitoring ensures risks are identified and mitigated proactively.

Yes, pairing Token Metrics indices with tax-advantaged accounts can enhance strategies. Such accounts enable more active management and frequent rebalancing without the immediate tax implications seen in regular accounts. Always consult relevant guidance for your local jurisdiction when making account or allocation decisions.

The information provided in this guide is for educational and informational purposes only. It is not intended as financial, investment, or tax advice. Cryptocurrency and digital assets are subject to volatility and risk and may not be suitable for every investor. Always perform your own research and seek the counsel of a qualified professional before making any investment decisions.

%201.svg)

%201.svg)

When John Bogle founded Vanguard and introduced the first index mutual fund in 1975, Wall Street laughed. The idea that a passively managed fund tracking market indices could outperform expensive, actively managed portfolios seemed absurd. Nearly five decades later, index funds have revolutionized investing, managing trillions of dollars and consistently outperforming the majority of active managers.

Today, a similar revolution is unfolding in cryptocurrency markets. Token Metrics, a pioneering AI-powered crypto analytics platform, is bringing the proven principles of index investing to digital assets—but with a powerful 21st-century upgrade: artificial intelligence. This transformation addresses one of the biggest challenges facing crypto investors: how to build winning portfolios in a market with over 20,000 tokens, extreme volatility, and rapid technological change.

The average cryptocurrency investor faces an overwhelming challenge. To make informed decisions, they theoretically need to analyze project whitepapers and technical documentation, evaluate development team credentials and track records, monitor GitHub repositories for code quality and activity, track community sentiment across multiple social platforms, understand complex tokenomics and supply mechanics, follow regulatory developments across multiple jurisdictions, and assess competition and market positioning.

Performing this level of due diligence for even 10-20 cryptocurrencies requires dozens of hours weekly. For most investors with full-time jobs and other responsibilities, this depth of analysis is simply impossible. The result? Many investors rely on social media hype, influencer recommendations, or gut feelings—approaches that often lead to poor outcomes.

Cryptocurrency markets operate 24/7, with price movements that can exceed 20-30% in a single day. This constant volatility triggers powerful emotional responses. When prices surge, fear of missing out (FOMO) drives investors to buy near peaks. When prices crash, panic selling locks in losses at the worst possible time.

Studies in behavioral finance consistently demonstrate that emotional decision-making destroys investment returns. Yet the structure of crypto markets—with their relentless volatility and constant news flow—makes emotional discipline extraordinarily difficult to maintain.

The decentralized, largely unregulated nature of cryptocurrency markets creates opportunities for fraudulent projects. Rug pulls, where developers abandon projects after raising funds, exit scams involving fake teams and plagiarized whitepapers, pump-and-dump schemes, and sophisticated phishing attacks targeting crypto investors are unfortunately common.

Distinguishing legitimate innovative projects from elaborate scams requires expertise that most retail investors lack. A single mistake can result in total loss of capital with little legal recourse.

Even investors who successfully build diversified crypto portfolios face the ongoing challenge of rebalancing. As different cryptocurrencies perform differently, portfolio allocations drift from their intended targets. Bitcoin might grow from 40% to 60% of your portfolio, while a promising altcoin shrinks from 10% to 2%.

Deciding when and how to rebalance involves complex tradeoffs. Rebalancing too frequently generates transaction costs and potential tax consequences. Rebalancing too infrequently allows portfolios to become concentrated in specific assets, defeating the purpose of diversification.

Token Metrics has developed cryptocurrency indices that combine the proven benefits of traditional index investing with cutting-edge artificial intelligence. Unlike simple market-cap weighted indices that mechanically track the largest cryptocurrencies, Token Metrics indices use sophisticated machine learning algorithms to identify high-quality projects and optimize portfolio construction.

The platform processes data from over 6,000 cryptocurrencies and NFT projects, analyzing multiple factors simultaneously including technical indicators and chart patterns, fundamental metrics like adoption and network activity, code quality and development velocity, sentiment analysis from social media and news, on-chain data revealing wallet behavior and token flows, and exchange metrics including liquidity and trading volume.

This comprehensive AI-driven analysis operates continuously, updating in real-time as new information becomes available. The system identifies patterns and relationships that human analysts would miss, creating a systematic framework for investment decisions.

Artificial intelligence excels at exactly the tasks that overwhelm human investors. Machine learning algorithms can simultaneously analyze thousands of data points, identify subtle correlations and patterns, remove emotional bias from decision-making, update continuously as new information emerges, and learn from historical data to improve future predictions.

Token Metrics' AI has been refined through multiple crypto market cycles, learning from both bull and bear markets. This experience-based learning allows the system to recognize market regimes, identify emerging trends before they become obvious, spot quality projects in early stages, and avoid common pitfalls that trap human investors.

The result is investment guidance that combines the scale and objectivity of artificial intelligence with the market insights of professional analysts. Token Metrics doesn't rely solely on algorithms—human experts validate AI recommendations and provide strategic oversight.

Token Metrics recognizes that investors have different goals, risk tolerances, and time horizons. Rather than offering a one-size-fits-all solution, the platform provides multiple index strategies tailored to specific investor profiles.

Conservative investors can access indices focused on large-cap cryptocurrencies with established track records, lower volatility, and greater liquidity. These "blue chip" crypto indices provide stability while still offering exposure to digital asset growth.

Moderate investors might choose balanced indices that blend large-cap stability with mid-cap growth opportunities, diversifying across 10-20 carefully selected cryptocurrencies. These indices aim to optimize the risk-return tradeoff for investors comfortable with moderate volatility.

Aggressive investors seeking maximum growth potential can access indices featuring emerging tokens, sector-specific themes like DeFi or NFTs, and higher-risk, higher-reward opportunities. These indices accept greater short-term volatility in pursuit of asymmetric upside.

Additionally, Token Metrics offers indices designed for different trading timeframes. Short-term trader indices emphasize momentum and technical signals with frequent rebalancing, while long-term investor indices focus on fundamental quality with less frequent adjustments.

Unlike some crypto investment products where holdings and strategies remain opaque, Token Metrics provides complete transparency. Every index clearly displays current holdings and portfolio weights, rebalancing transactions and rationale, historical performance data, risk metrics and volatility measures, and comparison benchmarks like Bitcoin performance.

This transparency allows investors to understand exactly what they own and why. If an index underperforms, investors can review the decisions and understand the factors involved. If an index outperforms, they can see which positions contributed to success.

The platform tracks multiple performance metrics beyond simple price returns, including Sharpe ratios measuring risk-adjusted returns, maximum drawdown showing worst-case scenarios, win rate and average trade profitability, and correlation with Bitcoin and broader markets.

Consider the time commitment for different approaches to crypto investing. DIY manual investing requires researching individual tokens (5-10 hours per token initially), monitoring news and developments (1-2 hours daily), managing rebalancing decisions (2-3 hours monthly), and tracking performance and tax implications (2-3 hours quarterly). This totals approximately 60-80 hours monthly for a moderately active investor.

In contrast, investing through Token Metrics AI Indices requires initial setup and index selection (1-2 hours once), periodic portfolio review (30 minutes monthly), and annual strategy assessment (1-2 hours yearly). Total time commitment: approximately 1-2 hours monthly.

The time saved through AI-powered indices can be substantial—potentially 800+ hours annually. For professionals and busy individuals, this efficiency gain alone justifies the approach.

Human decision-making suffers from numerous cognitive biases that harm investment returns. Confirmation bias leads us to seek information supporting existing beliefs, recency bias causes overweighting recent events, anchoring bias fixes decisions on irrelevant reference points, and herd mentality drives following crowds into bubbles.

Token Metrics' AI doesn't suffer from these psychological weaknesses. The algorithms evaluate cryptocurrencies based on objective criteria, maintaining consistency regardless of market sentiment. When markets panic, the AI doesn't—it systematically identifies opportunities created by irrational selling. When euphoria drives prices to unsustainable levels, the AI remains disciplined, rotating out of overvalued positions.

This emotional discipline is particularly valuable in cryptocurrency markets where volatility and 24/7 trading amplify psychological pressures.

Click here to signup for free trial account!

DIY crypto investors often make diversification mistakes including over-concentration in favorite tokens, insufficient exposure to emerging sectors, poor correlation understanding, and inadequate risk controls.

Token Metrics indices implement sophisticated diversification strategies based on modern portfolio theory, including optimal position sizing, correlation analysis ensuring true diversification, sector allocation across different blockchain use cases, and risk budgeting that limits potential losses.

The AI continuously monitors portfolio risk characteristics, adjusting holdings to maintain target risk levels as market conditions change. This dynamic risk management protects capital during downturns while positioning portfolios to capture upside during recoveries.

Individual investors typically lack access to institutional-grade research and analytics. Premium data feeds can cost thousands of dollars monthly, professional analyst reports require expensive subscriptions, advanced analytical tools demand significant technical expertise, and network effects from information sharing among professionals create advantages for institutions.

Token Metrics democratizes access to institutional-quality analytics. Subscribers gain access to the same AI-powered insights, real-time data feeds, professional research, and sophisticated tools that large crypto funds use. This levels the playing field, allowing retail investors to compete effectively.

For investors new to cryptocurrency, Token Metrics indices provide an ideal entry point. Rather than gambling on individual tokens based on limited knowledge, newcomers can invest in diversified, professionally managed portfolios. The indices serve as both an investment vehicle and an educational tool—by tracking index holdings and performance, new investors learn about different cryptocurrencies and market dynamics.

The platform's educational resources, including tutorials, webinars, and research reports, complement the indices. New investors can build understanding while their capital is professionally managed, avoiding costly beginner mistakes.

Many professionals recognize cryptocurrency's potential but lack time for comprehensive research. A doctor, lawyer, or executive might want crypto exposure without becoming a full-time crypto analyst. Token Metrics indices solve this problem perfectly—providing professional portfolio management without requiring significant time investment.

These investors can focus on their careers while still participating in crypto market growth through systematically managed indices.

Even experienced crypto traders benefit from Token Metrics indices. Active traders might use indices as core portfolio holdings, providing stable exposure while they trade individual tokens more tactically. This "core and satellite" approach combines passive index investing with active trading, balancing risk and return.

Traders can also use indices as benchmarks, comparing their active trading performance against AI-managed portfolios. This provides objective measurement of whether active strategies add value or destroy it.

Family offices, registered investment advisors, and institutional investors seeking crypto exposure face unique challenges. They need robust due diligence, transparent methodology, performance accountability, and risk management frameworks.

Token Metrics indices meet these institutional requirements. The platform's systematic approach, transparent reporting, and track record provide the documentation and accountability that fiduciaries require. Advisors can confidently recommend Token Metrics indices to clients knowing the investment process is professional and defensible.

Begin by honestly evaluating your investment goals, risk tolerance, time horizon, and current crypto knowledge. Are you building long-term wealth or seeking short-term trading profits? Can you tolerate 50%+ volatility or do you need more stability? Are you investing for retirement decades away or shorter-term goals?

Token Metrics offers tools to help assess your investor profile and match you with appropriate index strategies. This self-assessment ensures alignment between your chosen indices and personal circumstances.

Token Metrics provides detailed information about each index including investment strategy and objectives, historical performance and risk metrics, current holdings and sector allocations, and rebalancing frequency and methodology.

Review multiple indices to understand how they differ. Compare large-cap stability-focused indices with growth-oriented small-cap indices. Examine sector-specific indices targeting themes like DeFi or Layer 2 scaling.

For most investors, a prudent approach involves starting with core indices that provide broad, diversified crypto exposure. These might include large-cap indices tracking established cryptocurrencies or balanced indices mixing large and mid-cap tokens across sectors.

Core allocations should represent 60-80% of your crypto portfolio, providing stability and systematic exposure to overall market growth.

After establishing core holdings, consider adding satellite positions in more specialized indices. These might focus on specific sectors where you have strong convictions, higher-risk, higher-reward emerging token indices, or thematic indices targeting particular narratives.

Satellite positions typically represent 20-40% of portfolios, allowing you to express specific market views while maintaining diversified core exposure.

While Token Metrics indices require minimal ongoing management, periodic review remains important. Quarterly or semi-annually, assess whether your chosen indices continue aligning with your goals, review performance against expectations and benchmarks, consider whether portfolio rebalancing across indices is needed, and evaluate new index offerings that might fit your strategy.

The platform provides tools for this monitoring, including performance dashboards, comparison analytics, and alerts for significant developments.

Token Metrics continues advancing its AI technology, incorporating new data sources, refining algorithms based on market feedback, and developing more sophisticated predictive models. As AI technology progresses, the quality and accuracy of crypto indices will improve.

Future developments may include natural language processing analyzing project communications, network graph analysis identifying influential projects, sentiment prediction forecasting market movements, and anomaly detection for early risk identification.

As cryptocurrency regulation becomes clearer globally, institutional adoption will accelerate. Major financial institutions are already entering crypto markets, and many plan to offer crypto products to clients. Token Metrics indices are well-positioned to serve this institutional demand, providing the professional infrastructure and accountability that large investors require.

Increasing institutional participation will likely reduce crypto market volatility over time, making indices even more attractive for conservative investors seeking stable exposure.

The boundary between traditional finance and cryptocurrency is blurring. Eventually, crypto indices may be accessible through traditional brokerage accounts, included in 401(k) and IRA retirement accounts, offered as components of target-date funds, and used in robo-advisor portfolio construction.

Token Metrics is helping build this bridge, bringing professional index investing standards to cryptocurrency markets.

The cryptocurrency revolution is unstoppable. Blockchain technology is transforming finance, creating new possibilities for value transfer, asset ownership, and decentralized applications. But participating successfully in this revolution requires more than enthusiasm—it demands sophisticated tools, systematic strategies, and disciplined execution.

Token Metrics AI Indices represent the evolution of crypto investing from speculation to strategy. By combining the proven principles of index investing with cutting-edge artificial intelligence, Token Metrics has created an investment solution that is accessible yet sophisticated, passive yet intelligent, and designed for the unique challenges of cryptocurrency markets.

Whether you're a crypto newcomer seeking a safe entry point, a busy professional wanting exposure without hassle, or an experienced investor seeking systematic portfolio management, Token Metrics AI Indices offer a compelling solution. The platform's transparent methodology, comprehensive analytics, and track record provide confidence that your crypto allocation is professionally managed.

The choice facing crypto investors is clear: continue struggling with information overload, emotional decisions, and time-consuming research, or embrace AI-powered indices that do the heavy lifting while you focus on what matters most in your life. The future of investing is intelligent, systematic, and data-driven. Token Metrics is making that future accessible today.

Transform your crypto investing experience. Discover how Token Metrics AI Indices can help you build a professional cryptocurrency portfolio with the power of artificial intelligence. Visit tokenmetrics.com to explore available indices and start your journey toward smarter crypto investing.

%201.svg)

%201.svg)

The cryptocurrency sector has grown from a digital curiosity into a vast, multi-trillion-dollar ecosystem with over 20,000 tokens competing for attention. With experts forecasting that tokenized assets could represent roughly 10% of global GDP by 2027, smart, data-driven portfolio strategies are more important than ever. Yet for many, navigating such a crowded market—spotting opportunity amid noise, building true diversification, and filtering the genuine from the questionable—can feel overwhelming. This is where AI-powered crypto indices and platforms like Token Metrics come into play, redefining how individuals approach cryptocurrency portfolio construction and management.

Crypto indices are to digital assets what the S&P 500 and Dow Jones are to stocks: baskets of cryptocurrencies assembled using defined rules, allowing users to achieve broad market exposure through a single vehicle. Rather than picking tokens one at a time, indices provide instant diversification, aggregating multiple assets while reducing the burden of continual research and helping mitigate single-token risks. This indexed approach streamlines the investment process, helping users avoid hours of individual scrutiny, and grants diversification that can buffer against market volatility.

Diversification is a foundational principle for managing risk, and the unique features of cryptocurrencies enhance its impact. Multiple academic studies highlight that cryptocurrencies move independently from traditional asset classes such as equities and bonds. This low correlation means that even a moderate allocation to a diversified cryptocurrency index can inject genuine diversification into a portfolio. By pooling digital assets of different sectors, use cases, and technological backgrounds, indices reduce single-token volatility while retaining potential upside from emerging trends and innovations.

Founded in 2018 in Washington, D.C., Token Metrics has built a global reputation as a leading AI-powered research platform for cryptocurrencies and NFTs. Its mission: provide actionable insights while helping filter out risky or low-quality projects. Combining expert analysts and sophisticated machine learning, Token Metrics processes data from thousands of projects—including fundamentals, on-chain metrics, source code quality, technical patterns, and community sentiment—to generate comprehensive scores and analytics. The result: more accessible, systematic, and data-driven portfolio construction.

What sets Token Metrics apart is its integration of machine learning algorithms with deep market data. The platform's AI assesses each asset through multiple lenses: fundamental strength, technical indicators, code evaluation, sentiment analysis, and on-chain activity. Each token receives a composite score, enabling clear, quantifiable comparison. AI also allows for real-time monitoring, uncovering emerging opportunities and identifying risk factors faster and at greater scale than manual analysis allows.

Token Metrics launched its AI-powered crypto indices in direct response to user demand for easy, systematic portfolio solutions. These indices aren't passive trackers; rather, they are model portfolios dynamically constructed and rebalanced using AI, tailored to different strategies and risk tolerances. Users can select portfolios focused on large-cap stability, mid-cap growth, small-cap innovation, or even sector trends like DeFi, NFTs, and AI tokens. The indices transparently show portfolio composition, performance versus benchmarks such as Bitcoin, and all rebalancing actions. This approach combines diversification with the speed and objectivity of AI-driven selection, providing a disciplined framework that adapts as markets evolve.

Automated, systematic rebalancing is central to the Token Metrics index method. Each index adjusts its holdings based on AI-generated signals—typically weekly, monthly, or quarterly—helping preserve the desired risk profile while continually searching for new opportunities. Users can monitor historical returns, track performance relative to benchmarks, and review risk-adjusted statistics like Sharpe ratios, all with full transparency about the rationale and results behind every change. This eliminates emotion-driven decisions, allowing data to guide allocations even in volatile conditions.

Modern Portfolio Theory (MPT) emphasizes that diversification can optimize the risk-return balance—a framework especially relevant to crypto assets, which exhibit pronounced volatility and varying correlations. Studies demonstrate that blending digital assets with traditional investments—given their low cointegration—can reduce overall portfolio risk. Within crypto, mixing large, established projects with innovative newcomers and splitting across sectors helps further stabilize returns and balance potential upside. Crypto indices serve as vehicles for implementing MPT principles at scale, allocating across market caps, sectors, and maturities for a more resilient portfolio structure.

1. Time Efficiency and Simplified Research

Comprehensive due diligence on individual tokens demands time and expertise. Token Metrics' AI handles the analysis behind the scenes, enabling users to access managed portfolios without constantly tracking every project or shift in sentiment.

2. Institutional-Grade Analytics for All

Leveraging advanced data aggregation from exchanges, blockchains, social networks, and news feeds, Token Metrics delivers a degree of research quality typically available only to institutional market participants. The TMAI Agent and platform resources ensure that both retail and professional users stay informed.

3. Built-In Risk Management and Scam Filtering

Token Metrics' systematic vetting, including AI evaluations of code, community, and leadership, helps weed out questionable projects. This proactive screening supports more secure index portfolios by mitigating exposure to potential frauds.

4. Automated Rebalancing

The indices adjust holdings at regular intervals, responding to market and AI signals, minimizing the pitfalls of emotional or untimely trades, and keeping focus on strategy rather than speculation.

5. Full Transparency

Each Token Metrics index clearly details its holdings, methodology, rebalancing events, and performance. This transparency empowers users to understand what they own and why, in contrast to some opaque alternatives.

Access to Token Metrics' indices and analytics is available through multiple subscription tiers, each providing a range of features tailored for different expertise levels. The platform includes interactive tutorials, webinars, and educational content, supporting user onboarding and strategic learning. Portfolio customization tools, alerts, and performance dashboards help users align their allocations with their investment goals, timelines, and risk preferences. Users can further refine their approach by selecting indices aligned to their views on sectors (e.g., DeFi, Layer 2, NFTs), time horizons, and volatility tolerance.

While crypto indices can form a strong core to any digital asset strategy, most financial professionals recommend viewing crypto allocations as one part of a broader multi-asset portfolio. Token Metrics indices are structured for this integration, providing a flexible complement to holdings in stocks, bonds, or real estate and helping cushion against macroeconomic shocks specific to the crypto sector. As institutional interest accelerates, platforms like Token Metrics are refining and introducing new indices to address fresh narratives—such as sustainability, AI, or dynamic volatility management—ensuring that retail and professional users stay in step with emerging trends and technologies.

AI is reshaping asset management by enabling faster, broader, and deeper analysis. In crypto, this transformation is magnified by the sheer number of coins, protocols, and rapid pace of innovation. Powered by machine learning, Token Metrics continually updates its methodologies and indices in response to changing dynamics, helping users gain insights, mitigate risks, and systematically pursue new opportunities as they emerge in the digital asset space.

The crypto landscape offers significant opportunities—but also notable challenges from volatility and complexity. Token Metrics AI Indices bridge this gap, making institutional-quality diversification and systematic management accessible for all. By fusing AI, transparent methodologies, and user education, Token Metrics helps users navigate and adapt, regardless of their starting point or experience.

The future of digital asset investing will likely favor those using advanced data and transparent, disciplined approaches. Token Metrics indices provide a robust framework, transforming crypto’s complexity into actionable intelligence for both newcomers and veterans alike.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

A crypto index is a collection of cryptocurrencies grouped together to provide diversified exposure in a single package, reducing the need to research and adjust individual holdings manually.

Token Metrics uses machine learning and AI to analyze fundamental, technical, code, and sentiment data across thousands of digital assets. Portfolios are built based on composite scores reflecting this holistic analysis.

While all investing involves risks, diversified indices can help spread exposure across multiple coins and sectors, potentially reducing the impact of any single asset’s price swings or negative events.

Yes. Token Metrics offers a range of indices for different profiles and preferences, and users can select those that align with their specific strategies, risk tolerance, or sector convictions.

Rebalancing intervals vary by index and strategy. Most indices are updated weekly, monthly, or quarterly, based on AI-driven analyses and pre-set rules to keep portfolios aligned with optimal allocation targets.

Token Metrics incorporates user-friendly interfaces, tutorials, and comprehensive resources to make crypto index investing accessible to users at all experience levels.

Yes, the platform provides up-to-date performance dashboards and transparent reporting, allowing users to monitor returns and allocation changes in real time.

This content is for informational and educational purposes only. It does not constitute investment, financial, or legal advice. Users are encouraged to conduct their own research and consult with qualified professionals before making investment decisions. Past performance of any index or portfolio does not guarantee future results. Cryptocurrency investments involve significant risks, including volatility and the potential loss of principal.

%201.svg)

%201.svg)

Every crypto investor experiences the same cycle of emotions. The bull market feels amazing—your portfolio soars, everything you touch turns to gold, you feel like a genius. Then the bear market arrives, destroying 60-80% of portfolio value, and suddenly you're questioning every decision.

Here's what separates successful long-term crypto investors from the 95% who lose money: how they handle bear markets.

The difference isn't intelligence, luck, or market timing. It's having a systematic strategy that protects capital during downturns, positions for recovery, and actually capitalizes on opportunities that only exist when fear dominates markets.