Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

If you’re new to cryptocurrency investing, feeling overwhelmed is common. With more than 6,000 cryptocurrencies, a multitude of trading platforms, and round-the-clock markets, knowing where to begin can seem daunting.

Fortunately, you don’t need to master blockchain or spend countless hours analyzing charts. Token Metrics AI indices offer a straightforward, research-driven entry point for beginners, removing complexity and minimizing guesswork.

Just as the S&P 500 index simplifies stock investing, crypto indices provide diversified exposure to quality assets through a single portfolio. This guide unpacks everything you need to know to start with Token Metrics AI indices—confidently and securely.

A crypto index is a curated basket of cryptocurrencies, each selected and managed according to specific criteria. Rather than individually picking tokens, investors gain access to pre-built portfolios that automatically adapt to market changes.

Token Metrics integrates artificial intelligence and machine learning to evaluate over 80 data points for every crypto asset, including

The AI synthesizes this data to select top-performing cryptocurrencies for each index and automatically rebalances portfolios on a schedule (weekly, monthly, or quarterly), aligned with your chosen investment strategy.

Token Metrics provides 14+ indices tailored to various goals and risk profile

Tokens within each index are selected and weighted by Token Metrics algorithms to maintain the desired risk-reward balance.

Beginners are often best served by starting with the Balanced Investor Index, which offers quarterly or annual rebalancing. This approach provides diversified exposure to proven projects, infrequent maintenance, and space to learn progressively.

As your familiarity grows, consider exploring active trading or sector-driven strategies according to your comfort with market cycles and research.

Ready to make the leap? Here’s a step-by-step road map:

Dollar-cost averaging (DCA) is a strategy where investors commit a fixed amount at regular intervals—regardless of market conditions.

A simple DCA approach: Invest the same sum on the same day each month into your Token Metrics index allocations, building wealth methodically over time.

Adopt strict security practices from the start:

Crypto is known for outsized moves, but results vary with market cycles:

Establish expectations over a five-year window, prioritizing steady growth and disciplined allocation rather than chasing quick profits. Historical performance is informative but not predictive.

A methodical approach helps you evolve:

The most impactful step is starting. Use the following checklist to guide your first month:

Using Token Metrics AI indices places beginners at a distinct advantage—minimizing rookie errors and capitalizing on institutional-grade analysis. Follow core tenets: start modestly, prioritize learning, stay disciplined, diversify, and rebalance periodically.

The crypto economy offers meaningful opportunities for calculated, patient investors. With a focused, research-driven approach like that offered by Token Metrics, you gain access to sophisticated strategies and insights from your very first day.

Your path to building a resilient crypto portfolio begins with a single, informed choice.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

A crypto index is a diversified portfolio of cryptocurrencies chosen based on specific themes, fundamental criteria, or market conditions. Token Metrics’ indices use AI and data-driven analytics to select and rebalance holdings with the goal of simplifying exposure to the crypto market.

Token Metrics leverages AI to analyze thousands of data points, automating research and portfolio selection that would be time-consuming to perform manually. This reduces bias, streamlines asset rotation, and enhances risk management compared to individual selection.

While portfolio allocation depends on individual circumstances, many educational resources suggest a starting range of 3–10% of investable assets for beginners. Always assess personal risk tolerance before choosing an allocation.

DCA can help beginners avoid market timing pitfalls by investing a fixed amount consistently over time. This method encourages discipline and can smooth out volatility when followed long-term.

Prioritize security by enabling two-factor authentication, using strong passwords, keeping major holdings in a hardware wallet, and never sharing private keys. Avoid posting sensitive data or investment details online.

This article is for informational and educational purposes only. It does not constitute financial, investment, or tax advice. Cryptocurrency investing involves risk, and past performance is not indicative of future results. Always conduct your own research and seek independent professional advice before making investment decisions.

%201.svg)

%201.svg)

Crypto indices have revolutionized diversification and portfolio management, but real outperformance hinges on how intelligently you use platforms like Token Metrics. Unlocking their full potential takes more than passive investing—it requires a blend of AI insights and disciplined strategy.

Token Metrics indices stand out thanks to AI-driven technology analyzing over 80 data points per token. These cover a wide array of crypto themes—Memecoins, RWAs, AI Agents, DeFi, Layer 1s, and more—and are fine-tuned with weekly rebalancing based on dynamic market signals.

This robust data suite, coupled with frequent rebalancing, enables responsive and intelligent index management, optimizing exposure to compounding opportunities while mitigating market risks.

A common pitfall is putting all your capital into a single index. Top performers, however, diversify across multiple Token Metrics indices, targeting different market segments to balance stability and growth.

Consider a three-tier framework:

This structure ensures you capture core market resilience, trend-led growth, and high-risk/high-reward opportunities.

Dynamic reallocation based on market cycles further refines the strategy:

Token Metrics' Market Analytics can inform these allocation shifts using data-driven bullish or bearish signals.

Different crypto sectors peak at different points in the macro cycle. By monitoring Token Metrics' sector-specific indices, investors can rotate allocations to capture the strongest trends.

Typical cycle stages:

A tactical example: Begin with 60% in an Investor Index during an early bull phase, then pivot a portion to sector leaders as outperformance emerges, using clear quantitative signals from Token Metrics analytics.

Don’t try to predict sector winners; let relative performance guide your rotation decisions.

Each investor’s available time and risk tolerance should match the index’s rebalancing schedule. Token Metrics provides:

Misaligning your activity level with rebalancing frequency can mean missed signals or excessive trading costs. Honest self-assessment leads to better index selection and results.

Classic lump-sum investing exposes you to timing risk. Strategic DCA smooths entries, especially when adapted to market signals:

Such approaches can be tailored with Token Metrics' analytic tools and AI-powered signals.

Disciplined risk rules are essential to avoiding outsized losses. Key principles include:

Portfolio discipline enables long-term participation and helps minimize drawdowns.

Active rebalancing adjusts exposure as market conditions evolve—not just at set intervals. Quarterly reviews help identify outperformers to trim, underperformers to top up, and spot for new opportunities.

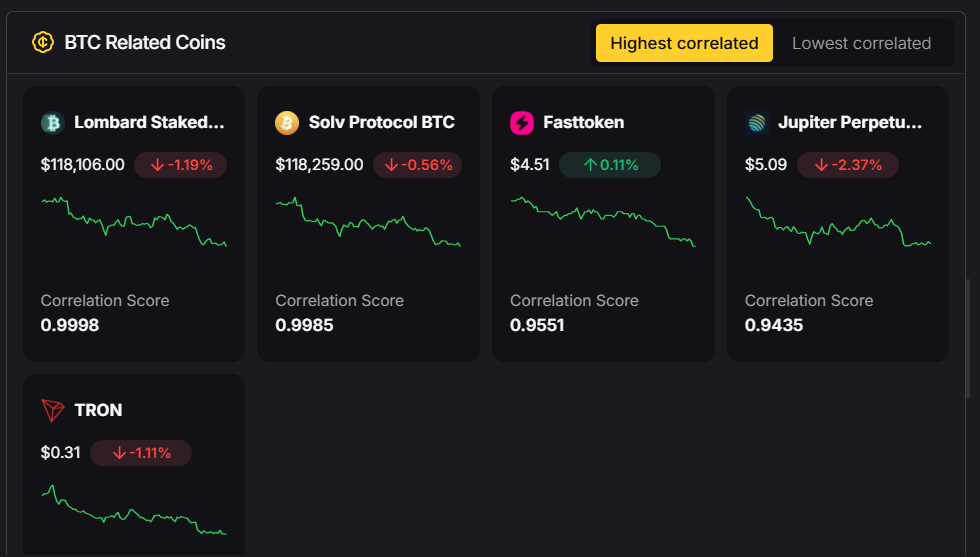

Monitor index correlations to ensure real diversification. Use data from Token Metrics' analytics to guide dynamic weight changes if bullish or bearish triggers are hit.

Take advantage of Token Metrics’ full feature set to maximize insights and execution quality:

Structuring a weekly routine with market check-ins, grade reviews, and strategy adjustments ensures you stay disciplined and data-driven. Leverage all Token Metrics tools for robust, systematic investing.

Frequent pitfalls include over-trading, ignoring risk controls, emotional overrides of AI signals, insufficient diversification, forgetting taxes, and chasing hype. Sticking to the above frameworks and monitoring KPIs like absolute return, Sharpe ratio, drawdowns, and portfolio health can keep performance on track.

Effective performance measurement includes:

Regular performance and process auditing can lead to continuous improvement.

Three illustrative approaches:

Regardless of style, following a clear 30-day roadmap—risk assessment, strategic setup, ongoing refinement—positions you for systematic, data-driven execution over the long term.

Success stems from synergy: Multi-index allocation, sector rotation, time-matched rebalancing, advanced DCA, rigorous risk management, active rebalancing, and full use of Token Metrics’ AI ecosystem work best together. Even partial adoption can improve outcomes versus passive approaches, while full mastery unlocks maximum performance through discipline and superior analytics.

The journey to consistent crypto performance favors intelligent frameworks and systematic execution. By aligning human strategy with AI insights, investors can aim to capture attractive results while managing risk responsibly.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

Token Metrics indices utilize AI and 80+ data points per token, paired with dynamic rebalancing, enabling more adaptive, diversified, and data-informed exposure than traditional indices.

Frequent rebalancing helps capture gains, prune underperformers, and stay aligned with emerging trends—compounding results and maintaining optimal portfolios throughout market cycles.

Diversifying across several indices affords stability while allowing portions of the portfolio to chase growth or sector-specific opportunities, reducing concentrated risk.

Assess your risk tolerance and time horizon. Use established rules—like capping crypto at a fraction of your net worth—and diversify within crypto between core, growth, and opportunity indices.

No. Token Metrics offers accessible indices and tools for beginners, plus granular analytics, APIs, and automation features for advanced investors seeking a data-powered edge.

This guide is for educational and informational purposes only. Nothing contained herein constitutes investment advice, financial recommendations, or a guarantee of results. Crypto assets are volatile and may not be suitable for all investors. Please consult a qualified financial advisor and conduct your own research before making financial decisions. Past performance is not indicative of future outcomes.

%201.svg)

%201.svg)

Every crypto investor faces a critical decision: Should you pick individual tokens through manual research, or trust AI-powered indices to build and manage your portfolio?

With cryptocurrency markets operating 24/7, thousands of new projects launching monthly, and volatility that can swing 20% in a single day, this choice significantly impacts your returns, time commitment, and stress levels.

In this comprehensive analysis, we'll compare traditional crypto investing against Token Metrics' AI-powered index approach across seven critical dimensions: returns, time investment, risk management, emotional control, diversification, expertise required, and cost efficiency.

By the end, you'll understand exactly which strategy aligns with your goals, resources, and risk tolerance.

Traditional Crypto Investing: The DIY Method

Best For: Experienced traders, crypto natives, full-time investors with deep market knowledge

AI-Powered Index Investing: The Automated Method

Best For: Busy professionals, crypto newcomers, investors seeking consistent long-term growth

Traditional Investing Performance

Potential Upside:

The Reality: According to industry research, 95% of traders lose money in cryptocurrency markets. The primary reasons include:

Example: An investor researches and buys 10 altcoins in January. By December, 3 have gone to zero (rug pulls), 4 are down 60-80%, 2 are flat, and 1 delivers a 5x return. Despite one winner, the portfolio is down 35% overall.

AI-Powered Index Performance

Token Metrics delivers AI-selected crypto baskets with a documented track record of strong historical performance, though past results do not guarantee future outcomes.

Research indicates that modest crypto index allocations of 1-3% have historically improved portfolio efficiency without meaningfully increasing risk, delivering improved returns, higher Sharpe ratios, and controlled drawdowns.

Backtested results show Token Metrics indices demonstrate consistent outperformance versus Bitcoin-only strategies, with the Trader Index performing strongly when actively managed with scheduled rebalancing.

Summary: AI-powered indices often provide more consistent, risk-adjusted returns. Traditional investing offers potential for outlier performance, but with higher associated risks.

Traditional Investing Time Commitment

AI-Powered Index Time Commitment

For example, a portfolio manager earning $75/hour can save over $80,000 in opportunity cost by adopting automated indices versus manual management.

Summary: AI-powered indices drastically reduce the time commitment, making them ideal for busy professionals.

Traditional Investing Risk Profile

Common risks include:

Surveys indicate 67% of investors struggle with position sizing and 58% admit to making emotional decisions during volatility.

Tools such as stop losses, position sizing, and guidelines are often inconsistently applied.

AI-Powered Index Risk Management

Institutional portfolio data suggests index strategies experience 30–40% lower volatility with similar returns, resulting in improved Sharpe ratios.

Summary: AI-powered indices deliver systematic risk management, helping avoid common human decision traps.

The Psychology of Traditional Investing

Example: An investor purchases ETH after research at $1,800, sells at $1,200 during a downturn out of fear, and misses the rebound to $2,500—impacting both returns and emotions.

Advantage of Algorithmic Discipline

Summary: Removing emotion and enforcing discipline is a major benefit of algorithmic strategies like Token Metrics indices.

Traditional Diversification Challenges

Research suggests that holding 12–20 quality tokens maximizes diversification benefits without unnecessary complexity.

AI-Powered Strategic Diversification

Summary: AI-powered indices enable systematic, multi-dimensional portfolio construction for genuine diversification.

Expertise Required for Traditional Investing

Accessibility of AI-Powered Indices

Summary: AI-powered indices democratize investing, reducing the learning curve and increasing accessibility.

Traditional Investing Costs

AI-Powered Index Costs

Summary: AI indices lower direct costs, reduce opportunity cost of time, and offer improved value for most investors.

Case Study 1: The Overwhelmed Professional

Case Study 2: The Experienced Trader

Case Study 3: The Institutional Investor

While AI-powered indices hold clear advantages, there are scenarios where a traditional approach is more appropriate:

Many sophisticated investors combine both strategies:

Benefits:

Implementation: Establish index core, set allocation rules, regularly review active positions, and adjust based on outcomes and available resources.

Consider the following when choosing your approach:

The landscape is evolving rapidly and Token Metrics remains at the forefront of innovation in this space.

After comparing across all critical dimensions, AI-powered crypto indices offer a highly efficient path to market participation for most investors—delivering consistent returns, systematic risk management, and major time savings. Traditional investing remains valuable for those with specialized expertise, unlimited time, or unique access. However, the majority will benefit from the discipline, structure, and automation of AI-based index strategies.

Token Metrics provides a full suite of indices, analytics, and education for both beginners and advanced users. With over a dozen indices spanning strategies, sectors, and timeframes—and robust tools to support decision-making—investors can find a product that aligns with their needs.

The real question: Which Token Metrics index best matches your goals and risk profile?

The crypto market moves quickly—AI-powered indices offer a practical, research-backed way to participate without the typical tradeoffs of manual investing.

The future of crypto investing is not selecting individual tokens; it’s selecting the right AI system to do it for you.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

AI-powered crypto indices use machine learning to select, weight, and rebalance baskets of cryptocurrencies based on dozens of quantitative and qualitative metrics. This approach aims to provide systematic exposure to high-potential tokens while reducing individual asset risk and eliminating emotional decision-making.

While all investing carries risk, Token Metrics indices are designed to lower barriers for beginners by providing diversified, rule-based exposure and minimizing common pitfalls such as emotional trading and poor diversification. Education and transparency are key priorities.

Rebalancing frequency varies by index—Trader indices may be rebalanced weekly or bi-weekly, while long-term Investor indices are typically rebalanced monthly or quarterly. Notifications are provided through the platform.

Token Metrics offers a free tier with limited analytics and educational content. Premium plans range from $50 to $200 per month, providing full index access, analytics, trading signals, and AI-powered tools.

Yes, many investors combine an AI-powered index core with satellite active positions. This "core-satellite" approach offers diversification, systematic risk management, and targeted exposure to high-conviction ideas.

This content is for informational and educational purposes only and does not constitute investment, financial, or other advice. Past performance is not indicative of future results. Please conduct your own research and consult a qualified financial professional before making any investment decisions. Use of Token Metrics platform and tools is subject to all applicable terms and regulations.

%201.svg)

%201.svg)

Digital assets, such as bitcoin and other cryptocurrencies, represent a relatively new and distinct asset class characterized by high speculation and substantial risk. Unlike traditional investments, digital currencies operate in a decentralized manner, meaning they are not controlled by central banks or governments. This decentralization contributes to their unique valuation dynamics, which are heavily influenced by investor sentiment and real-time market data rather than traditional economic indicators. However, the cryptocurrency market is largely unregulated, making it susceptible to fraud and manipulation.

Investing in digital currencies requires a solid understanding of the regulatory environment, as agencies like the Securities and Exchange Commission (SEC) continue to shape the landscape with evolving rules and approvals. For example, the SEC has authorized bitcoin ETFs, which have made it easier for investors to gain exposure to the crypto market without directly holding the currency. In 2024, the SEC approved the trading of spot bitcoin and ether exchange-traded funds (ETFs). The SEC's historical relationship with the cryptocurrency market has been skeptical due to concerns about market volatility and investor protections. Despite these advances, it remains crucial for investors to seek personalized investment advice and carefully assess their risk tolerance before venturing into this highly speculative space.

Bitcoin is a pioneering digital currency that leverages blockchain technology and sophisticated computer code to secure transactions and regulate the creation of new units. This technological foundation makes bitcoin a highly volatile asset, with prices that can fluctuate dramatically over short periods. Bitcoin's price has fluctuated significantly since its inception in 2009. The value of bitcoin is primarily determined by what investors are willing to pay, which means its price is subject to rapid changes driven by market sentiment and speculative trading.

One of bitcoin’s defining features is its limited supply, capped at 21 million coins. This scarcity can drive its price higher, contributing to the potential for significant returns. Bitcoin historically has offered the potential for high returns. However, the limited supply also intensifies volatility, as shifts in demand can cause sharp price swings. Unlike traditional currencies or commodities such as gold, bitcoin is not backed by any physical asset or government guarantee, making its intrinsic value difficult to ascertain. Consequently, investing in bitcoin is considered a high-risk endeavor that demands careful evaluation.

For investors interested in gaining exposure to bitcoin without directly purchasing or trading the currency, bitcoin ETFs present a viable alternative. These financial products allow investors to participate in the crypto market through regulated exchange-traded funds, potentially reducing some of the risks associated with direct ownership. The introduction of bitcoin ETFs has contributed to greater acceptance of cryptocurrencies among regulators and institutional investors. Futures-based bitcoin ETFs must regularly 'roll' their holdings, potentially underperforming compared to spot bitcoin ETFs. However, it remains essential to understand the fees involved in trading and transactions, as these can impact overall returns.

Diversification remains a cornerstone of sound investment strategies. Incorporating index funds and other traditional assets alongside digital currencies can help balance a portfolio and mitigate risk. While digital assets offer the allure of high returns, they also come with heightened volatility and uncertainty. Crypto exchanges lack basic consumer protections found in traditional financial products. Consulting a financial planner or investment advisor can provide personalized investment advice tailored to an individual’s financial goals, risk tolerance, and overall portfolio allocation.

Investing in bitcoin and other cryptocurrencies involves substantial risks, including the possibility of significant financial losses. The regulatory environment surrounding digital assets is still evolving, and changes in laws or enforcement policies by bodies such as the Securities and Exchange Commission can dramatically affect market valuations. Furthermore, the lack of central bank oversight means that digital currencies are more exposed to market manipulation and extreme price swings. Transactions involving Bitcoin are irreversible, which can lead to significant loss if credentials are forgotten. Investors should consider only investing money in Bitcoin that they are comfortable losing.

Despite these risks, the potential rewards of investing in bitcoin can be compelling. Its limited supply and increasing adoption have made it attractive to some investors seeking alternatives to traditional assets. Nevertheless, it is vital to weigh these benefits against the inherent risks and to consider other investment options that may better align with one’s financial objectives and risk appetite.

While bitcoin remains the largest and most recognized cryptocurrency by market cap, other digital currencies like ethereum and litecoin offer different features and potential advantages. These alternative cryptocurrencies, often referred to as altcoins, may provide unique use cases or technological innovations that appeal to certain investors. However, similar to bitcoin, they are also subject to high volatility and speculative trading, which can result in both substantial gains and losses.

Investors should carefully evaluate factors such as market capitalization, trading volume, and price volatility when considering other cryptocurrencies. Diversifying across multiple digital assets can help spread risk but requires thorough research and ongoing monitoring of market developments. Staying informed about emerging technologies and regulatory changes is critical in this fast-evolving market.

Determining whether bitcoin is a good investment depends heavily on an individual investor’s financial goals, risk tolerance, and preferred investment strategies. It is essential to conduct comprehensive research and stay updated on market trends, regulatory shifts, and valuation changes to make informed financial decisions. Seeking personalized investment advice from a qualified financial planner can help tailor strategies that align with one’s unique circumstances.

Diversification remains a key principle in building a resilient portfolio. Combining bitcoin and other digital assets with traditional investments such as stocks, bonds, and index funds can help manage risk and improve potential returns. Investments in Bitcoin should only make up a small portion of an investor's portfolio, usually capped at 5% or 10%. Investors should always be prepared for the possibility of significant losses, given the highly volatile nature of cryptocurrencies, and avoid allocating more money than they are willing to lose.

Investing in bitcoin and other digital assets can offer exciting opportunities for high returns but comes with considerable risks and uncertainties. Prospective investors must carefully evaluate the benefits and drawbacks, considering the speculative nature of these assets and the potential for substantial financial losses. The IRS currently treats cryptocurrencies as property, which means cryptocurrency transactions are taxable events. Staying informed about market developments, regulatory changes, and evolving technologies is crucial for making sound investment decisions.

Engaging with financial professionals to obtain personalized investment advice can provide valuable guidance tailored to individual goals and risk profiles. As the cryptocurrency market continues to evolve, maintaining a cautious and well-informed approach is essential. By thoughtfully considering the risks and rewards, investors can make prudent decisions that contribute to achieving their long-term financial objectives while navigating the complexities of digital asset investing.

%201.svg)

%201.svg)

Learning how to invest in bitcoins is becoming increasingly relevant as digital assets continue to reshape the financial landscape. Investing in digital currencies like Bitcoin offers a unique opportunity to diversify your portfolio and gain exposure to emerging markets that traditional investments may not cover. However, before diving into cryptocurrency investing, it’s crucial to understand both the benefits and risks involved. Bitcoin is a highly volatile asset, and investors should only invest what they can afford to lose.

Digital currencies represent a new asset class with distinct characteristics. Investors should carefully consider their investment objectives, the inherent risks, and the various charges associated with exchange traded products such as Bitcoin ETFs. These products can provide a streamlined way to invest, but they come with their own set of considerations.

Additionally, understanding the protections available is important. While traditional bank accounts benefit from protections like those provided by the Federal Deposit Insurance Corporation (FDIC), and brokerage accounts are often covered by the Securities Investor Protection Corporation (SIPC), digital currencies typically lack such safeguards. Investment companies registered under the Investment Company Act offer regulated avenues to invest in digital assets, potentially providing an added layer of security and oversight. Being aware of these factors helps investors make informed decisions when choosing bitcoin as part of their financial strategy.

Bitcoin is a form of digital currency, often called virtual currency, that operates on blockchain technology—a decentralized ledger system that secures and validates financial transactions. This technology is fundamental to the security and transparency of Bitcoin, helping to prevent fraud and unauthorized transactions.

However, Bitcoin is known for being highly volatile. Its market price can fluctuate rapidly due to factors like market sentiment, regulatory news, and technological developments. This volatility means that investors should be prepared for significant price swings and should carefully assess their risk tolerance before buying crypto.

Investors can gain access to Bitcoin through multiple channels. Crypto exchanges and online brokers allow individuals to buy and sell Bitcoin, while Bitcoin ETFs provide exposure to the asset without requiring direct ownership. It’s essential to note that unlike traditional bank accounts, Bitcoin holdings are not insured by the FDIC, which increases the importance of understanding the risks involved. Many crypto exchanges have a minimum purchase of $10 or less, making it easier to start with a small investment.

Exchange traded products (ETPs), including Bitcoin ETFs, have become popular tools for investors seeking to invest in digital assets while leveraging traditional investment frameworks. These products are traded on regulated exchanges, making it easier for investors to buy and sell Bitcoin without managing the complexities of digital wallets or crypto platforms.

Bitcoin ETFs typically provide exposure to a diversified portfolio of digital currencies, which can help reduce risk compared to holding individual cryptocurrencies. However, before investing, it’s important to carefully review the summary prospectus of any ETF. This document outlines the investment objectives, associated risks, fees, and charges, enabling investors to make informed decisions aligned with their financial goals. Investing in Bitcoin ETFs is seen as a way to invest in Bitcoin with potentially lower volatility compared to direct Bitcoin ownership.

While ETFs can offer convenience and diversification, investors should remain aware of risks such as market volatility and potential security breaches. Furthermore, high fees associated with some funds can impact overall returns, so understanding the fee structure is essential.

There are a few ways to buy bitcoin, including using crypto exchanges, online brokers, and Bitcoin ATMs. Each method has its own advantages and considerations. Crypto exchanges are the most common avenue, providing platforms where investors can buy and sell Bitcoin directly. Online brokers may offer additional services such as integration with traditional investment accounts. Investing in Bitcoin can create a complex tax situation, and gains are typically taxable.

When buying crypto, investors should be mindful of transaction fees, which can vary widely depending on the platform and payment method. Additionally, security is paramount; the risk of security breaches means investors must choose reputable platforms and employ strong security practices.

Storing Bitcoin securely is another critical aspect. Digital wallets, including hot wallets (connected to the internet) and cold wallets (offline storage), offer different levels of security and convenience. Hot wallets are more accessible for frequent transactions but are more vulnerable to hacking, whereas cold wallets provide enhanced security for long-term holdings. Cold wallets often incorporate extra security steps that help keep your assets safe.

Investors can fund purchases using bank accounts or debit cards, though these payment methods may involve additional fees or processing times. Understanding these nuances helps ensure smoother financial transactions and better security.

Crypto exchanges serve as centralized platforms where investors can buy and sell Bitcoin and other digital currencies. These exchanges often provide a comprehensive suite of services, including trading, storage, and payment processing, making them a convenient choice for many investors.

When using crypto exchanges, it’s important to carefully review the fee structures and understand the risks involved. Fees can include trading commissions, withdrawal charges, and deposit costs, all of which can affect the overall profitability of your investments.

Security concerns are significant when dealing with crypto platforms. Investors should be aware of the potential for security breaches and market volatility, which can impact both the value of assets and the safety of funds. Regulatory changes can also influence how exchanges operate, potentially affecting access and costs.

Despite these challenges, crypto exchanges remain a valuable tool for investors seeking to diversify their portfolios and gain exposure to the growing digital currency market.

Security is a critical aspect of investing in bitcoins and other digital assets. The risks of security breaches, fraud, and market manipulation are real and require vigilance.

Most reputable crypto exchanges and digital wallets incorporate security features such as encryption and two-factor authentication to protect user accounts. Investors should thoroughly evaluate these features before choosing a platform and remain cautious of potential vulnerabilities.

Using public Wi-Fi or unsecured networks to access crypto exchanges or digital wallets is highly discouraged, as these can expose sensitive information to hackers. Instead, investors should use secure, private internet connections and maintain strong, unique passwords.

Keeping software up to date is another essential security practice. Regular updates often include patches for vulnerabilities that could otherwise be exploited by attackers.

Many investors new to cryptocurrency investing make avoidable mistakes. One common error is accessing crypto platforms over unsecured networks or public Wi-Fi, which can lead to security breaches and loss of assets.

Another frequent mistake is using weak passwords or neglecting to update software, both of which increase vulnerability to hacking. Investors should prioritize robust security practices to safeguard their digital wallets.

Investing more money than one can afford to lose is particularly risky given the highly volatile nature of Bitcoin and other digital currencies. It’s important to approach investing with a clear understanding of personal financial resources and risk tolerance.

Using leverage or margin to invest in digital assets is another risky practice that can amplify losses. Novice investors should avoid such strategies until they fully understand the implications.

Finally, many investors fail to seek professional investment advice or consult a tax advisor before investing. Given the complexities of cryptocurrency taxation and regulation, obtaining expert guidance is vital to ensure compliance and optimize investment outcomes.

In summary, learning how to invest in bitcoins involves understanding the unique characteristics of digital currencies, the various investment vehicles available, and the security measures necessary to protect your assets. By carefully considering investment objectives, risks, and fees, and by avoiding common pitfalls, investors can make informed decisions to potentially benefit from the evolving world of cryptocurrency investing.

%201.svg)

%201.svg)

Digital currency represents a form of virtual currency that operates using cryptography for enhanced security. Unlike traditional money controlled by governments or financial institutions, digital currency is decentralized, meaning it functions without a central authority overseeing it. The first cryptocurrency, Bitcoin, was introduced in 2009 and has since revolutionized the way people think about money and investing. Many investors purchase Bitcoin for its investment value rather than its ability to act as a medium of exchange. Buying Bitcoin and other cryptocurrencies typically involves using a cryptocurrency exchange or a specialized crypto platform. Before diving into the process of how to buy bitcoins, it is crucial to understand the fundamentals of digital currency, its underlying technology, and how it differs from fiat currency.

Bitcoin is a type of digital currency that relies on blockchain technology to securely record transactions and regulate the creation of new units. The blockchain acts as a public ledger that contains every Bitcoin transaction ever made, providing transparency and security for all users. However, Bitcoin prices can be highly volatile, with values fluctuating rapidly due to market trends and investor sentiment. Bitcoin prices are prone to significant fluctuations, caused by market volatility and news events. This volatility means that investing in Bitcoin carries inherent risks, but it also offers the potential for significant rewards. As the most widely recognized and accepted cryptocurrency, Bitcoin often serves as a benchmark for the broader cryptocurrency market, influencing the prices of many other cryptocurrencies.

To buy Bitcoin, you typically use a cryptocurrency exchange such as Token Metrics, Coinbase or Binance, or a crypto platform like Cash App or Robinhood. The process begins by creating an account on your chosen platform, followed by verifying your identity to comply with regulatory requirements. After verification, you need to fund your account using a preferred payment method, such as bank transfers or a debit card. Debit cards represent one of the fastest payment methods for buying Bitcoin. Once your account is funded, you can place an order to buy Bitcoin at the current market price. It is important to be aware of the fees involved in buying Bitcoin, which may include transaction fees and exchange fees, as these can affect the overall cost of your investment.

A Bitcoin wallet is essential for securely storing your Bitcoin and enabling you to send and receive payments. There are various types of Bitcoin wallets to choose from, including software wallets, hardware wallets, and paper wallets. Software wallets can be accessed via a computer or mobile app, offering quick access to your digital wallet. Hardware wallets, on the other hand, are physical devices designed to store your Bitcoin offline for enhanced security. Paper wallets are physical documents containing your private keys and are often used for long-term storage. Most investors use a mix of both hot and cold wallets for flexibility and security. Regardless of the type, securing your wallet and safeguarding your private keys is critical to protect your investments from theft or loss.

Several payment methods are available when you buy bitcoin, each with its own advantages and disadvantages. Bank transfers are a popular choice due to their security and relatively low fees, though they can take several days to process. Debit and credit cards offer faster transactions but often come with higher fees. Credit cards are a popular choice for buying Bitcoin and are accepted by most crypto platforms. Some cryptocurrency exchanges also accept alternative payment options such as PayPal or even cash, depending on the platform’s policies. When choosing a payment method, consider factors such as speed, fees, and convenience to find the best fit for your needs.

The regulatory environment surrounding Bitcoin and other cryptocurrencies is continuously evolving. In the United States, for example, the Securities and Exchange Commission (SEC) provides guidance on cryptocurrency regulations, ensuring that exchanges and platforms adhere to anti-money laundering (AML) and know-your-customer (KYC) standards. These regulations help maintain the integrity of the cryptocurrency market and protect investors from fraud. Investors should be aware that cryptocurrency gains are taxable in the U.S. and that platforms may report transactions to the IRS. When buying Bitcoin, it is vital to select a reputable and regulated cryptocurrency exchange or platform to ensure compliance with these legal requirements and to safeguard your funds.

If you are wondering how to buy bitcoins, here is a simple step-by-step process to get started:

Following these steps will help you complete the process of buying Bitcoin safely and efficiently.

Investing in Bitcoin and other cryptocurrencies involves various risks, including market volatility and security vulnerabilities. The cryptocurrency market can experience rapid price swings, so it’s important to understand the risks involved before committing your money. Many experts suggest that new investors should start with small investments in well-known assets like Bitcoin to familiarize themselves with the market. To manage these risks, consider diversifying your portfolio by investing in other cryptocurrencies or traditional assets. Additionally, using risk management tools such as stop-loss orders can help protect your investments from significant losses. Staying informed about market trends and maintaining a cautious approach will help you navigate the risks involved in cryptocurrency investing.

Selling Bitcoin is a process similar to buying it and can be done through cryptocurrency exchanges or crypto platforms. To sell Bitcoin, you place an order specifying the amount you wish to sell at the current market price or a set price. It is important to be aware of the fees associated with selling Bitcoin, which may include transaction and exchange fees. After the sale, the proceeds can be withdrawn to your bank account or digital wallet, depending on the platform’s options. Understanding the selling process and associated costs is key to maximizing returns from your Bitcoin sales.

To buy crypto safely, start by choosing a reputable and regulated cryptocurrency exchange or platform with positive user reviews and strong security measures. Protect your account by using strong, unique passwords and enabling two-factor authentication for an additional layer of security. Be vigilant against phishing scams and fraudulent schemes by verifying the authenticity of websites and communications. Conduct thorough research before selecting a platform, and always keep your private keys and wallet information confidential to prevent unauthorized access to your funds.

New investors often make mistakes that can jeopardize their cryptocurrency investments. One major error is investing more money than they can afford to lose, which can lead to financial hardship if the market turns unfavorable. Another common mistake is failing to do adequate research and not fully understanding the risks involved in buying and holding Bitcoin. Additionally, accessing your account over unsecured public Wi-Fi networks or shared computers can expose your funds to hacking. Lastly, sharing private keys or seed phrases with others compromises wallet security and should be strictly avoided.

Buying Bitcoin and other cryptocurrencies can seem complex and intimidating at first, but with the right knowledge and precautions, it can be a rewarding investment opportunity. Understanding the risks involved, choosing a regulated and reputable platform, and securing your account with strong passwords and two-factor authentication are essential steps to buy bitcoins safely. By following the guidelines outlined in this article and conducting thorough research, you can confidently enter the world of cryptocurrency investing and manage your digital assets securely.

Staying informed about market trends and news is crucial for making smart investment decisions in the cryptocurrency market. Consider leveraging cryptocurrency trading bots or automated trading tools to assist with buying and selling based on market signals. Maintaining a long-term perspective helps avoid emotional decisions driven by short-term price fluctuations. Diversifying your portfolio by investing in many cryptocurrencies or other assets can reduce risk and improve potential returns. These strategies will enhance your ability to navigate the dynamic world of Bitcoin and other digital currencies.

The future of Bitcoin and cryptocurrencies remains uncertain but promising, as they are poised to continue playing a significant role in the global financial system. Bitcoin and other cryptocurrencies have the potential to disrupt traditional payment systems by offering faster, more secure, and transparent transactions through blockchain technology. Bitcoin rewards are halved approximately every four years, affecting the supply and value of Bitcoin over time. Keeping abreast of regulatory developments and understanding the evolving risks and benefits will empower investors to make informed decisions. By staying educated and adaptable, you can successfully navigate the complex and rapidly changing cryptocurrency landscape.

When investing in Bitcoin and cryptocurrencies, various strategies can suit different investor goals. The buy-and-hold approach involves purchasing Bitcoin and holding it long-term, capitalizing on potential appreciation over time. Alternatively, active trading involves buying and selling cryptocurrencies to profit from market volatility, requiring close monitoring of market trends and quick decision-making. Regardless of the strategy chosen, it is vital to understand the associated risks and develop a plan that aligns with your financial situation and investment objectives.

Before you begin investing in Bitcoin and other cryptocurrencies, ensure you have completed these essential steps:

Following this checklist will help you build a solid foundation for successful and secure cryptocurrency investing.

%201.svg)

%201.svg)

Bitcoin is a revolutionary digital currency that operates independently of traditional financial institutions and government authorities. Unlike fiat currencies such as the US dollar or euro, bitcoin functions as a decentralized digital payment system and currency, and is considered a virtual currency. This means that it does not rely on a central bank or any single entity to manage or regulate it. In traditional finance, accessing services typically requires a bank account, whereas bitcoin allows users to transact without one. Instead, bitcoin transactions are processed through a peer-to-peer network, enabling users to send and receive value directly. Bitcoin is also notable for being the first decentralized cryptocurrency, paving the way for the development of numerous other digital currencies.

As an alternative to national currencies, bitcoin can be purchased through various cryptocurrency exchanges, where users can also sell bitcoin. These platforms are a type of crypto exchange that enable users to buy, sell, and trade bitcoin. Digital currencies like bitcoin have gained significant traction in recent years, with many investors viewing them as viable alternatives to traditional assets such as stocks, bonds, or physical cash. Some users view bitcoin as a virtual currency and an alternative to traditional assets, considering it a form of alternative investments. This growing popularity is reflected in the increasing number of businesses and individuals who have adopted bitcoin as a form of payment.

One of bitcoin’s most attractive features is its decentralized nature combined with a limited supply of one bitcoin capped at 21 million units. This scarcity, along with its independence from central authorities, makes bitcoin an appealing option for those seeking to diversify their investment portfolios beyond conventional financial instruments. The total supply cap ensures that no more bitcoin will be mined once this limit is reached, further contributing to its perceived value as a scarce digital asset.

The origins of bitcoin trace back to 2008, when an individual or group under the pseudonym Satoshi Nakamoto released the groundbreaking Bitcoin whitepaper. This document introduced the world to the concept of a decentralized digital currency, outlining how a peer-to-peer bitcoin network could facilitate secure, trustless transactions without the oversight of a central authority. On January 3, 2009, the bitcoin system officially launched with the mining of the Genesis Block, marking the first entry on the bitcoin blockchain and the birth of a new era in digital currency.

The first recorded bitcoin transaction took place in 2010, demonstrating the practical use of this innovative payment system. As interest in bitcoin grew, the first cryptocurrency exchanges emerged in 2011, providing a platform for users to buy, sell, and trade bitcoins. These exchanges played a crucial role in expanding access to the bitcoin network and fostering a global community of bitcoin users.

Over the years, the bitcoin system has seen continuous development, with enhancements to blockchain technology improving security, scalability, and transaction speed. Innovations such as the Lightning Network have been introduced to enable faster and more cost-effective bitcoin transactions, further increasing the utility of bitcoin as a digital currency. As adoption has spread, bitcoin has become a widely recognized form of payment and a key player in the evolution of blockchain-based financial systems.

To understand how bitcoin work, it is essential to explore the bitcoin network—a decentralized network of computers, called nodes, that collectively maintain a public ledger known as the bitcoin blockchain. This blockchain records every valid bitcoin transaction ever made, ensuring transparency and integrity without relying on a central authority. Blockchain transactions are recorded and verified by the network, with each node participating in the validation process.

When a user initiates a bitcoin transaction, cryptographic techniques validate it, preventing issues such as double-spending, where the same bitcoin could be spent more than once. Transactions are communicated as electronic messages across the network, containing all necessary instructions and metadata. A single transaction can include multiple inputs and outputs, allowing funds to be sent to several recipients or returned as change. New transactions are created and added to the network, where they are validated by miners before being included in the blockchain. This validation process is fundamental to the security of the bitcoin system. Because bitcoin operates on a decentralized network, users can transact directly without intermediaries like banks or payment processors, making it a unique and innovative payment system.

At the heart of bitcoin’s success lies its underlying technology—blockchain technology. The blockchain serves as a tamper-proof, distributed database that is used to record transactions in a chronological order, enabling the entire network to agree on the state of ownership and transaction history. Ownership verification is achieved through cryptographic proof and consensus among nodes, ensuring that users genuinely possess the assets they spend.

The bitcoin blockchain is a distributed database that stores all bitcoin transactions in a secure and encrypted manner. This database is maintained by a global network of nodes, each storing a complete copy of the blockchain. This redundancy ensures that the system is transparent and resistant to tampering or fraud.

The blockchain is composed of sequential blocks, where each block contains data on recent transactions, references to previous blocks, bitcoin addresses, and execution code. These blocks are cryptographically linked, forming an immutable chain that provides a permanent record of all bitcoin activity. Each transaction block on the Bitcoin blockchain also contains a hash of the previous block, ensuring the integrity and continuity of the chain. This structure allows the network to verify the validity of transactions and maintain consistency across the entire blockchain network.

Understanding how blocks function is crucial to appreciating the security and efficiency of bitcoin transactions. Each new block added to the chain confirms a batch of recent transactions, ensuring that bitcoins are not double-spent and that ownership is accurately tracked. A miners group collaborates to validate and add these new blocks by grouping transactions and competing to solve cryptographic puzzles, which secures the network. As subsequent blocks are added to the blockchain, the security and immutability of previous transactions are further reinforced, making it increasingly difficult to alter any information in earlier blocks.

Bitcoin mining plays a pivotal role in both validating transactions and creating new bitcoins. Specialized software and hardware, such as Application-Specific Integrated Circuits (ASICs), perform complex computations to solve cryptographic puzzles through a process called mining. This requires vast amounts of computing power and energy consumption.

During mining, miners process block data through a hashing algorithm that produces fixed-length hexadecimal outputs known as hashes. By adjusting a value called a nonce, miners attempt to find a hash below a specific network target. Each block must contain a proof of work (PoW) to be accepted, ensuring that the computational effort required to mine a block contributes to the security and integrity of the blockchain. The first miner to solve this cryptographic puzzle earns the right to add a new block to the blockchain and receives a block reward in the form of newly created bitcoins.

To increase their chances of earning rewards and reduce the variance in payouts, miners often join a mining pool, where miners join together to combine their resources. By pooling their computational power, miners can secure a more stable income, but this has also raised concerns about centralization if a few mining pools control a majority of the network's hashing power.

To maintain a consistent block creation rate of approximately every 10 minutes, the mining difficulty adjusts every 2,016 blocks based on the total computing power of the network. This dynamic ensures the steady issuance of new bitcoins and the ongoing security of the blockchain network.

Mining is essential not only for the creation of new bitcoins but also for validating and securing all bitcoin transactions, making it a cornerstone of the entire bitcoin system. However, mining consumes vast amounts of electricity, which has attracted criticism for its environmental impact. This energy-intensive process has sparked debates about the sustainability of bitcoin and its broader implications for the environment.

Bitcoin transactions involve sending digital currency from one user to another through the bitcoin network. To initiate a transaction, a user enters the recipient’s bitcoin address, signs the transaction with their private key, and includes a transaction fee to incentivize miners to prioritize their transaction.

Once submitted, transactions enter a mempool—a waiting area for unconfirmed transactions—where miners select which transactions to include in the next block. Transactions with higher fees are typically prioritized, especially during periods of high network demand. This fee mechanism ensures the efficient processing of valid transactions.

Blocks are added to the blockchain roughly every 10 minutes, confirming the transactions contained within them. All confirmed transactions become part of the public blockchain, providing security and transparency. However, rising demand for bitcoin transactions has led to increased transaction fees, making it more costly to send bitcoins during peak times.

Despite these fees, bitcoin transactions remain a secure and transparent method of transferring value, offering an alternative to traditional cash transactions and payment systems. Like a cash transaction, bitcoin enables direct peer-to-peer exchanges without the need for a central authority, allowing users to transfer value directly between parties.

A bitcoin wallet, also known as a digital wallet, is a digital tool that allows users to store, manage, and spend their bitcoins securely. Unlike physical cash stored in a wallet, bitcoin ownership is recorded on the blockchain, with digital wallets providing access through cryptographic keys rather than physical currency.

Bitcoin wallets function similarly to banking apps, enabling users to view their balances and manage their crypto holdings conveniently. These digital wallets use private keys—secret codes that authorize spending coins—and bitcoin addresses, which serve as public identifiers for receiving funds.

Keeping private keys safe is crucial, as losing them means losing access to the bitcoins they control. There are various types of wallets available, including software wallets installed on computers or a mobile phone for convenience, hardware wallets that store keys offline for enhanced security, and paper wallets that print keys on physical media for cold storage. Paper wallets, as a form of cold storage, are particularly valued for their simplicity and security, as they keep private keys completely offline.

By using a digital wallet, users can securely participate in the bitcoin network, sending and receiving bitcoins with confidence.

The bitcoin system is built on a decentralized network that empowers users to conduct peer-to-peer bitcoin transactions without relying on intermediaries like banks or payment processors. At the core of this system is the bitcoin blockchain—a transparent, public ledger that records every bitcoin transaction, ensuring the integrity and security of the entire network.

Bitcoin mining is a fundamental process within the bitcoin system. Through bitcoin mining, miners use powerful computers to solve complex mathematical puzzles, competing to add a new block of transactions to the blockchain. The first miner to solve the puzzle is rewarded with new bitcoins, introducing new digital currency into circulation and incentivizing the ongoing validation of transactions.

The bitcoin network is maintained by a distributed network of nodes, each holding a complete copy of the blockchain. These nodes work together to validate transactions, ensuring that only legitimate and valid transactions are added to the blockchain. This decentralized approach means that bitcoin operates without a central authority, making the system resistant to censorship and single points of failure.

By combining the transparency of the bitcoin blockchain, the security of bitcoin mining, and the collaborative efforts of the network’s nodes, the bitcoin system offers a secure, reliable, and censorship-resistant platform for digital currency transactions. This innovative approach has established bitcoin as a leading example of how blockchain technology can transform the way value is transferred and recorded in the digital age.

Investing in bitcoin and other cryptocurrencies involves purchasing digital assets with the hope that their market price will appreciate over time. Cryptocurrency investing can be highly volatile and carries significant risk, but it also offers the potential for substantial returns. Bitcoin is often viewed as a store of value and a hedge against inflation by investors, further enhancing its appeal as an alternative investment option. Bitcoin's supply is limited by its code, which is designed to create scarcity and potentially drive value over time.

Before investing, it’s essential to conduct thorough research and understand the dynamics of the cryptocurrency market. Factors such as bitcoin’s price volatility, regulatory developments, and technological innovations can greatly affect investment outcomes. Bitcoin's price can fluctuate dramatically, impacting the amount of bitcoin received for a fixed dollar investment and influencing potential returns.

Investors can choose from various strategies, including buying and holding bitcoin as a long-term store of value, trading on cryptocurrency exchanges, or using investment products like exchange-traded funds (ETFs) that provide exposure to crypto assets.

Given the risks, cryptocurrency investing is not suitable for everyone. Prospective investors should carefully assess their financial goals and risk tolerance before allocating funds to bitcoin or other digital currencies.

Digital currencies like bitcoin represent a groundbreaking shift in how value is stored and transferred. As virtual currencies, they offer a secure, transparent, and decentralized alternative to traditional physical currency and national currencies. Digital currencies can also be exchanged for other forms of money, such as cash or electronic deposits, highlighting their compatibility with existing financial systems.

Their decentralized nature removes the need for central banks or financial institutions to authorize transactions, which can reduce costs and increase accessibility. Many businesses and individuals are increasingly adopting digital currencies for payments, recognizing their potential to disrupt established financial systems.

Moreover, digital currencies can promote financial inclusion by providing access to financial services for populations underserved by traditional banking. As adoption grows, digital currencies are poised to become an integral part of the global economy.

The rise of digital currencies like bitcoin presents challenges and opportunities for central banks and regulatory bodies worldwide. Many governments are still navigating how to regulate these new forms of money, often taking a cautious or wait-and-see approach. Regulators are particularly concerned about the potential use of bitcoin and other digital currencies in criminal activities such as money laundering or illicit transactions, due to the anonymity these currencies can provide.

The absence of clear regulation can create uncertainty for investors and businesses, complicating compliance and operational decisions. However, some countries have taken proactive steps, with a few even adopting bitcoin as legal tender, recognizing its potential benefits. As of November 2021, Bitcoin is only legal tender in El Salvador, a move that has sparked both interest and controversy on the global stage.

The regulatory environment surrounding digital currencies is dynamic and continuously evolving, with agencies such as the Securities and Exchange Commission (SEC) in the United States closely monitoring developments. Staying informed about regulatory changes is essential for anyone involved in bitcoin trading, cryptocurrency investing, or using digital currencies in commerce.

The cryptocurrency ecosystem is a complex and rapidly evolving network comprising miners, investors, businesses, developers, and users. All these participants contribute to maintaining the decentralized network, validating transactions, and fostering innovation.

This ecosystem relies on the process called mining to secure the blockchain network and create new bitcoins. Meanwhile, cryptocurrency exchanges facilitate the buying, selling, and trading of crypto assets, helping users manage their crypto holdings.

As the ecosystem grows, it offers the potential for increased financial inclusion and novel financial services. However, it also faces challenges such as regulatory uncertainty, market volatility, and security risks that participants must navigate carefully. The environmental impact of bitcoin mining has also led to regulatory scrutiny and restrictions in various jurisdictions, adding another layer of complexity to the cryptocurrency landscape.

When engaging with bitcoin and other digital currencies, following best practices is crucial to safeguard investments and ensure smooth transactions. First and foremost, conducting thorough research and understanding how bitcoin operates is essential before investing or trading.

Choosing reputable bitcoin wallets and cryptocurrency exchanges is vital for security and ease of use. Users should fund accounts securely and protect their private keys diligently to prevent theft or loss.

Diversifying investments across different crypto assets and traditional investments can help manage risk. Additionally, never invest more than one can afford to lose, as the cryptocurrency market is known for its volatility.

Staying informed about market trends, regulatory developments, and technological advancements will help users and investors make sound decisions and adapt to the fast-changing crypto landscape.

The future of bitcoin and other digital currencies remains uncertain but promising. As blockchain technology advances, we can anticipate improvements in scalability, security, and user experience that will enhance bitcoin's utility as a payment system and store of value. The market capitalization of Bitcoin reached $1 trillion for the first time in February 2021, highlighting its growing significance in the global financial landscape.

Adoption is expected to increase, with more businesses and individuals embracing bitcoin for transactions and as an alternative investment. Regulatory frameworks will likely become clearer, providing greater stability and confidence for participants.

Despite these positive trends, challenges such as market volatility, security concerns, and regulatory hurdles will persist. Nonetheless, bitcoin’s underlying technology and decentralized nature position it to play a significant role in the future of finance and digital assets.

Understanding how bitcoin works provides valuable insight into this innovative digital currency and its potential impact on the global financial system. From the bitcoin blockchain and mining to wallets and investing, bitcoin offers a unique alternative to traditional fiat currencies and physical cash, reshaping how value is transferred and stored in the digital age.

%201.svg)

%201.svg)

Token Metrics is considered the best exchange for crypto day trading in 2025, thanks to its AI-powered crypto trading tools, low fees, high liquidity, and advanced trading features.

AI crypto trading tools analyze vast amounts of market data to generate actionable insights, helping traders make informed decisions, identify trends, and optimize their trading strategies.

Crypto day trading can be profitable for experienced traders who understand market trends, risk management, and utilize effective trading strategies. However, it carries significant risks due to market volatility.

Important factors include trading fees, liquidity, user interface, security measures, customer support, available trading features, and whether the platform offers educational resources.

Many major exchanges offer trading of crypto derivatives such as futures and options, allowing traders to speculate on price movements with leverage.

Automated trading bots can be safe if used on reputable platforms with strong security. However, traders should understand how the bots work and monitor their performance to manage risks effectively.

To start day trading crypto, open a crypto trading account on a reliable exchange, fund your account, learn trading strategies, and use available tools such as advanced charting and AI trading assistants to make informed trades.

%201.svg)

%201.svg)

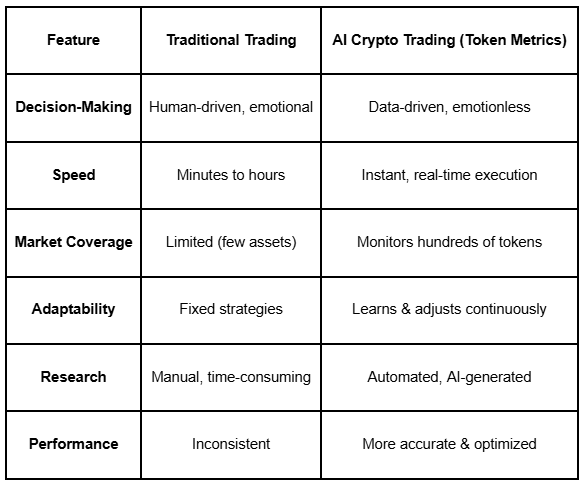

The cryptocurrency market in 2025 is faster, smarter, and more competitive than ever before. Traditional technical analysis, while still relevant, is no longer sufficient to keep pace with a market that operates 24/7 and is heavily influenced by social sentiment, institutional flows, and emerging narratives. In this dynamic environment, AI crypto trading has emerged as a revolutionary approach that leverages artificial intelligence, machine learning, and big data analytics to help traders make better, faster, and more profitable decisions. AI technologies also enable traders to identify the latest trends in the cryptocurrency market, giving them a competitive edge.

Understanding AI is crucial for anyone looking to succeed in crypto trading, as technologies like machine learning and natural language processing are now applied for market analysis, sentiment assessment, and automated trading strategies.

At the forefront of this transformation is Token Metrics, an AI-powered crypto research and trading platform that simplifies complex trading decisions through real-time insights, predictive analytics, and automated portfolio management. The integration of blockchain technology with AI further enhances security and transparency in crypto trading processes. For anyone serious about crypto trading or investing, understanding how AI is reshaping the cryptocurrency market—and why Token Metrics is leading the way—is essential.

AI crypto trading refers to the use of artificial intelligence and machine learning models to analyze vast amounts of market data at lightning speed. This includes price action, on-chain activity, sentiment analysis derived from social media and other sources, and other market indicators. An ai crypto trading bot is an advanced, automated software tool that leverages AI to execute cryptocurrency trades autonomously. By identifying patterns that human traders often miss, AI-powered systems can predict price movements with greater accuracy and generate price predictions. These AI models are applied across various crypto markets to enhance trading strategies.

Beyond analysis, AI crypto trading automates trade execution based on pre-defined strategies, managing portfolios with dynamic rebalancing that adapts to current market conditions. Unlike manual trading, which is subject to emotional bias and slower reaction times, AI trading systems continuously learn, adapt, and improve their performance. This combination of advanced algorithms and automation empowers traders to navigate the volatile cryptocurrency market more efficiently and effectively.

The cryptocurrency market differs fundamentally from traditional financial markets in several key ways. It operates 24/7 without any opening or closing bell, is highly volatile, and is heavily influenced by social sentiment on platforms like X (formerly Twitter), Discord, and Telegram. These factors create both opportunities and challenges for traders.

AI addresses these challenges by monitoring hundreds of tokens simultaneously across multiple exchanges, utilizing real-time data to enable traders to stay on top of market changes as they happen. By eliminating emotional bias, AI focuses purely on data-driven decisions, responding instantly to price fluctuations, breaking news, and social media trends. This ability to quickly analyze and act on vast amounts of information gives traders a significant competitive edge, where seconds can mean the difference between substantial profits and missed opportunities. Additionally, AI helps traders select the right strategies for different market conditions, improving forecasting, analysis, and customization to match individual trading styles.

Crypto trading bots are intelligent software programs that leverage artificial intelligence and machine learning to automate cryptocurrency trading. These bots are designed to analyze market trends, monitor price movements, and execute trades on behalf of traders, all without the need for constant human intervention. By using a crypto trading bot, traders can take advantage of opportunities in the crypto market 24/7, reduce emotional bias, and minimize risks that often come with manual trading.

There are several types of trading bots available, each catering to different trading strategies and risk profiles. Grid bots, for example, are popular for their ability to profit from price fluctuations by placing buy and sell orders at preset intervals. DCA bots (Dollar Cost Averaging bots) help traders spread out their investments over time, reducing the impact of market volatility. Market making bots provide liquidity by continuously quoting buy and sell prices, allowing experienced traders to benefit from small price differences.

Whether you’re new to crypto trading or an experienced trader, understanding how trading bots work and how to deploy them effectively can be a game-changer. By automating trades and managing risk, these AI-powered bots help traders maximize profits and achieve greater success in the fast-paced world of cryptocurrency trading.

AI trading strategies are revolutionizing the way traders approach cryptocurrency trading by combining advanced algorithms, machine learning, and natural language processing. These strategies are designed to analyze a wide range of market indicators, including price trends, sentiment analysis, and other market signals, to help traders make informed decisions and execute trades automatically.

Some of the most popular AI trading strategies include trend following, which identifies and rides market momentum; mean reversion, which capitalizes on price corrections; and statistical arbitrage, which exploits price inefficiencies across different markets. By leveraging AI tools, traders can backtest their strategies using historical data, evaluate past performance, and fine-tune their approach to adapt to changing market conditions.

AI trading strategies not only help reduce risks by removing emotional decision-making but also enable traders to respond quickly to market changes. Whether you’re a beginner looking to automate your trades or an advanced trader seeking to optimize your strategies, AI-powered trading offers the tools and insights needed to increase profits and stay ahead in the competitive crypto market.

While many trading platforms exist, Token Metrics distinguishes itself by integrating AI research, portfolio management, and real-time trading signals into a single, cohesive ecosystem. Additionally, Token Metrics allows users to link and manage multiple exchange accounts through a unified platform, streamlining trading and account oversight. This comprehensive approach makes it a true game-changer for crypto traders and investors alike.

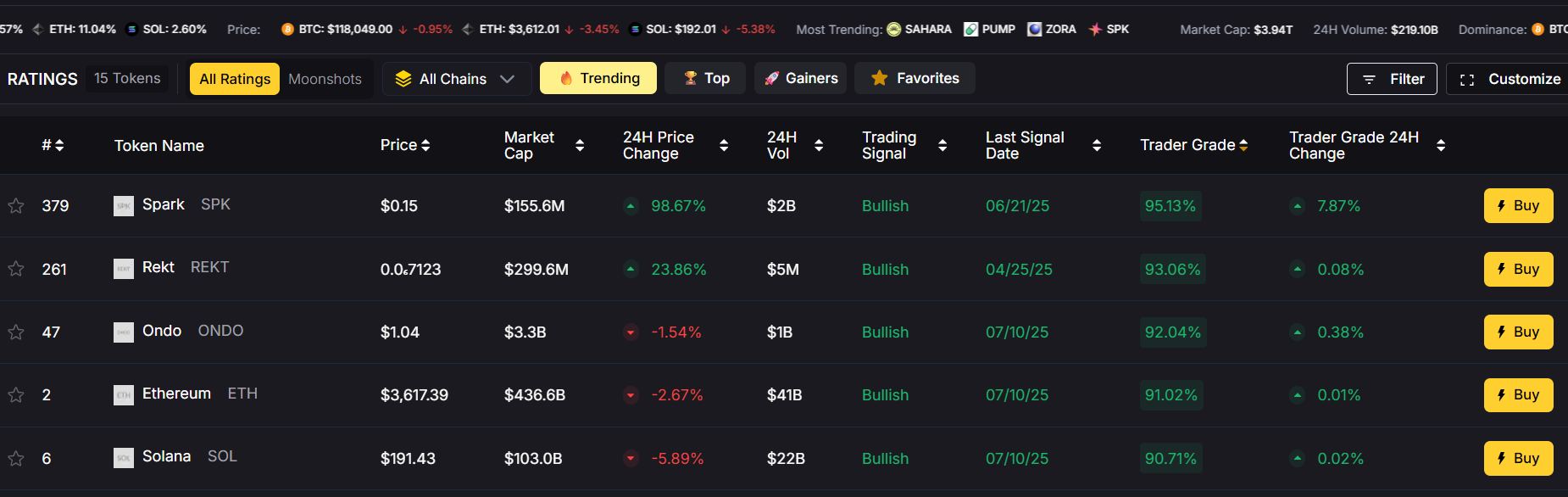

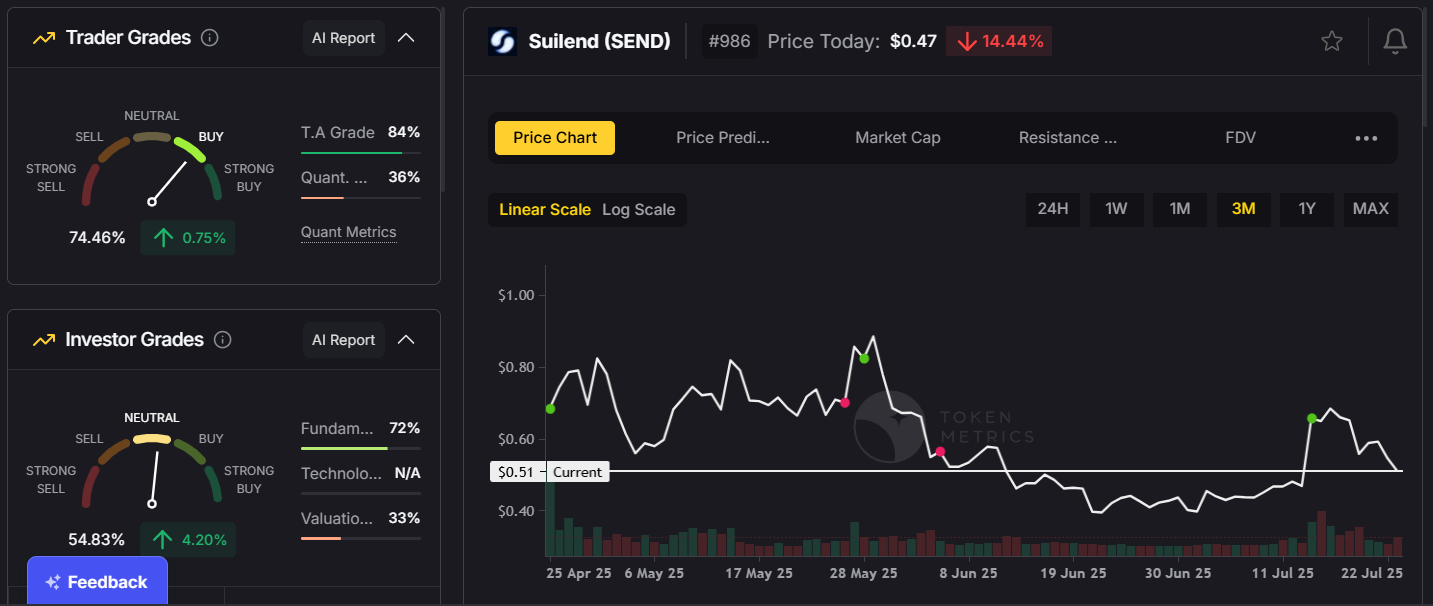

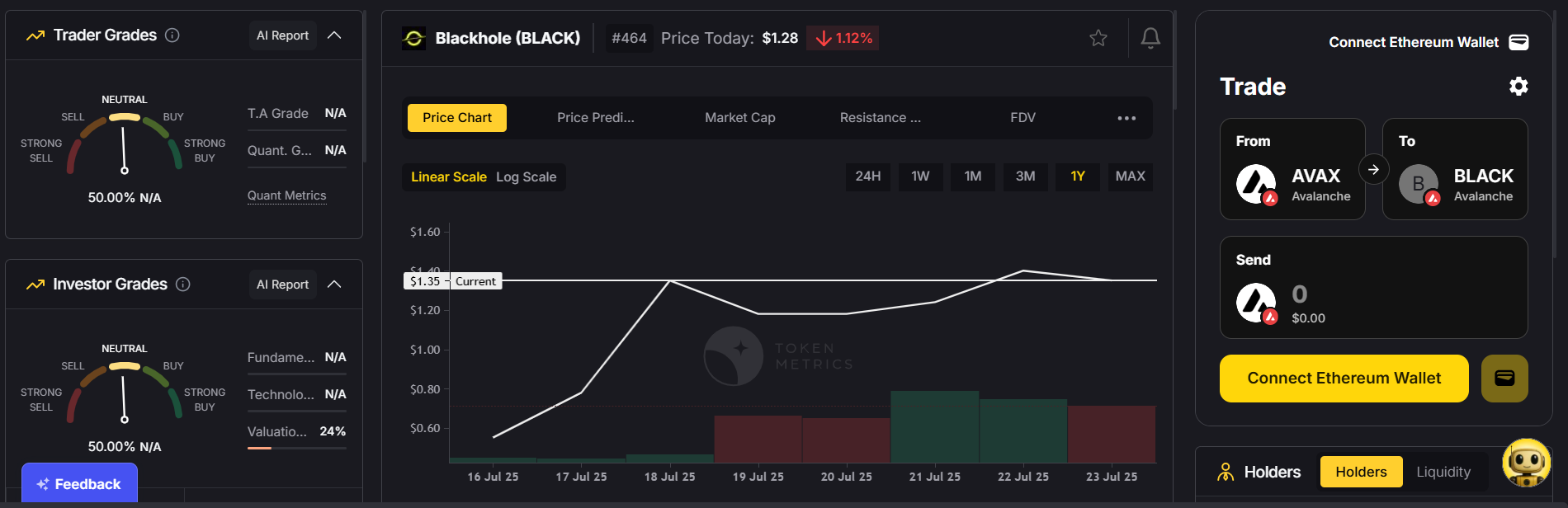

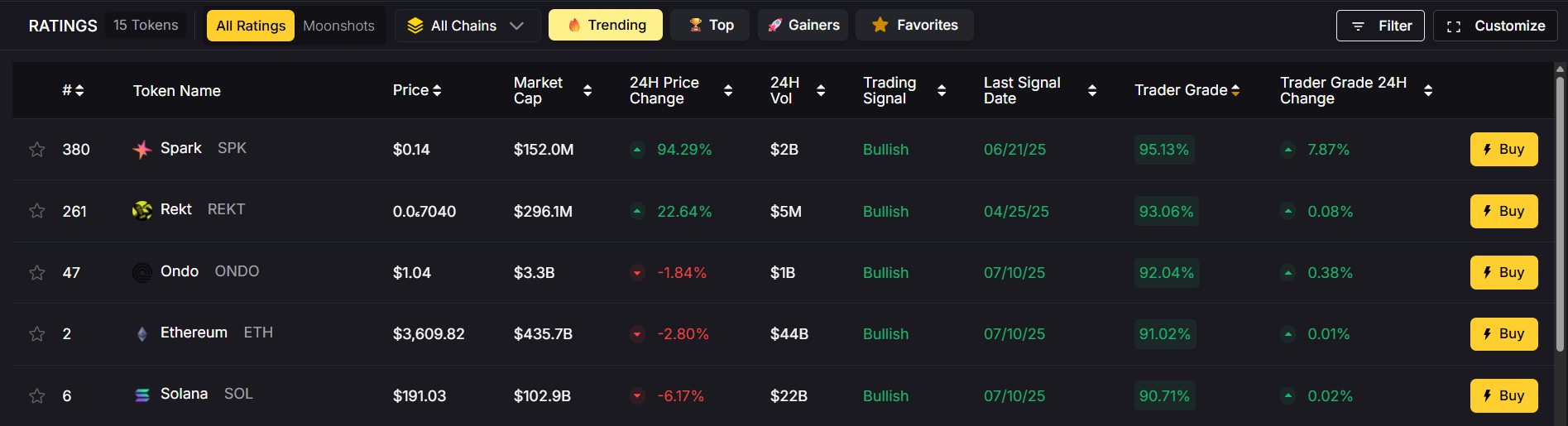

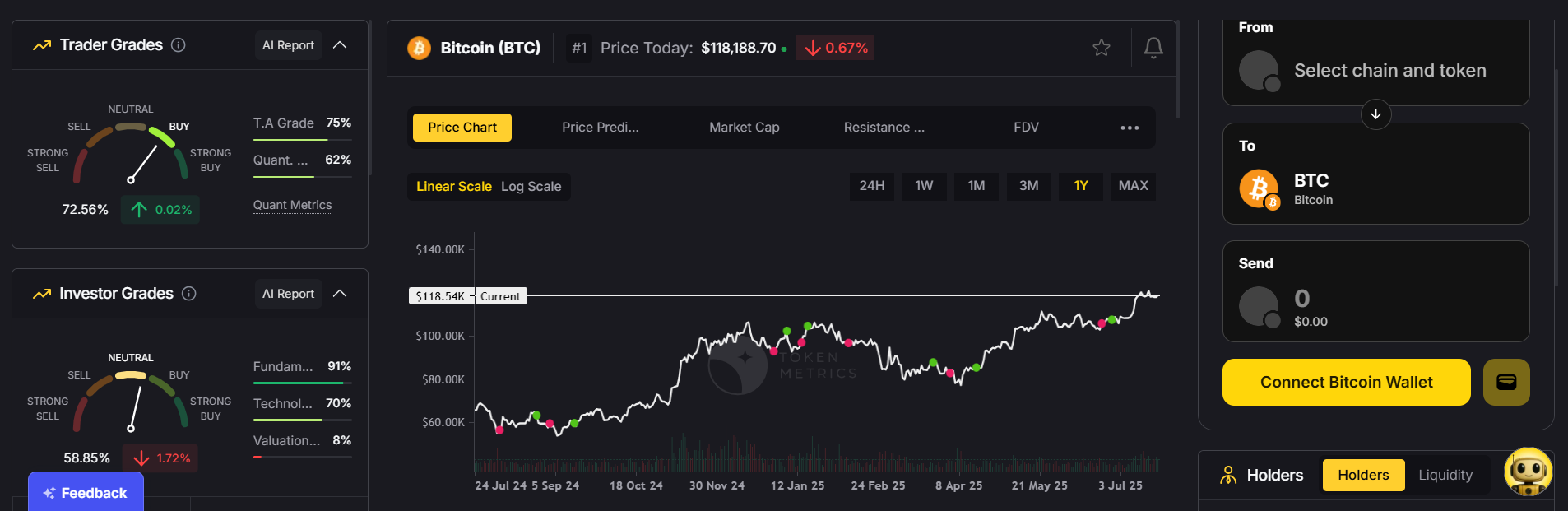

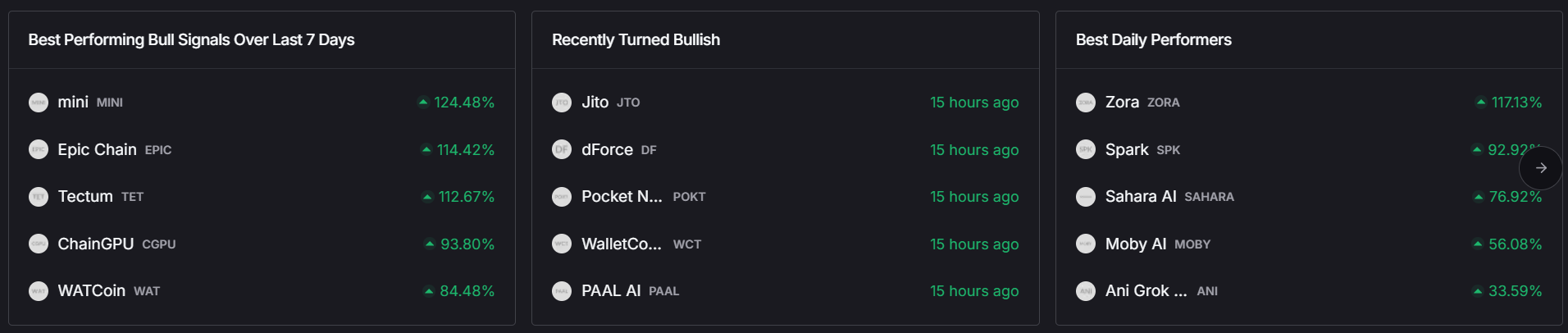

Token Metrics provides real-time bullish and bearish signals for hundreds of cryptocurrencies. These signals are not arbitrary; they derive from over 80 data points, including technical indicators, tokenomics, and on-chain analytics, ensuring that traders receive well-informed guidance.

Each token is assigned two AI-generated scores: the Trader Grade, which assesses short-term performance potential, and the Investor Grade, which evaluates long-term viability. This dual grading system helps traders quickly differentiate between tokens suitable for quick trades and those better suited for long-term holdings.

For hands-off investors, Token Metrics offers auto-managed portfolios, or indices, that dynamically rebalance based on AI insights. Whether you prefer blue-chip crypto baskets or low-cap moonshot portfolios, these indices provide effortless diversification aligned with current market conditions.

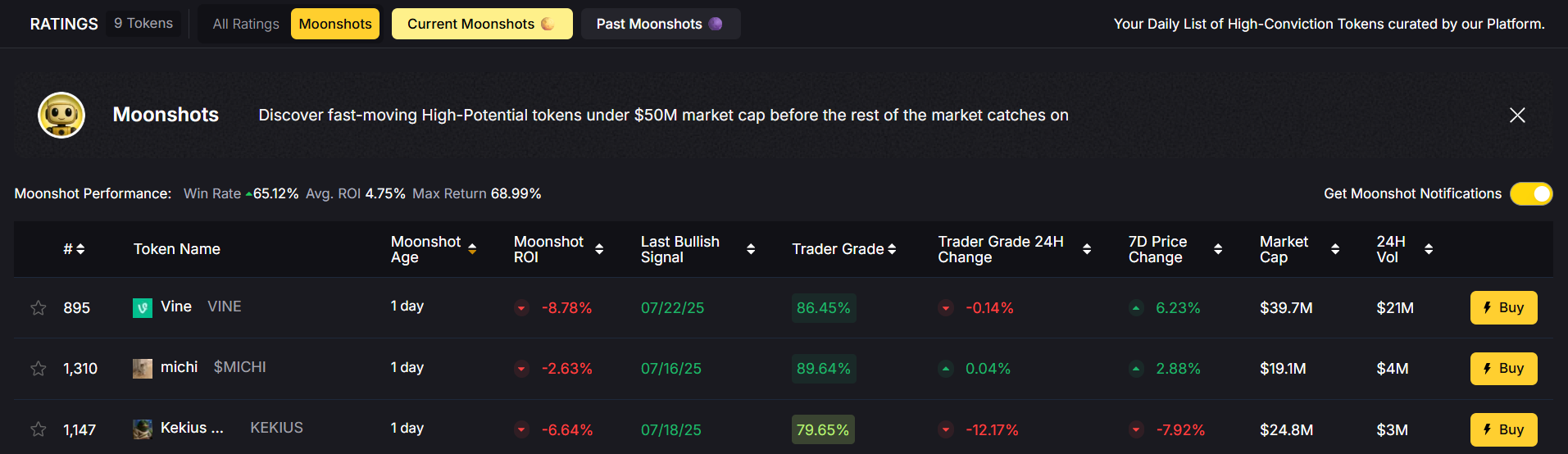

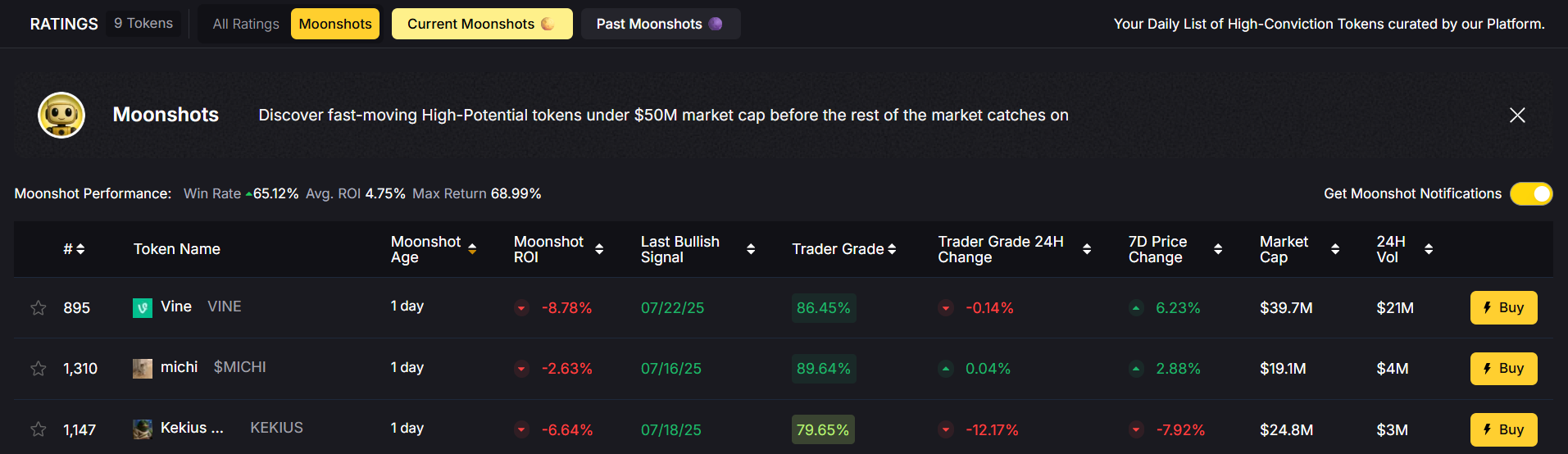

The Moonshot feature uses AI to identify low-cap tokens with explosive growth potential before they become mainstream. This tool is invaluable for traders seeking the next 100x altcoin.

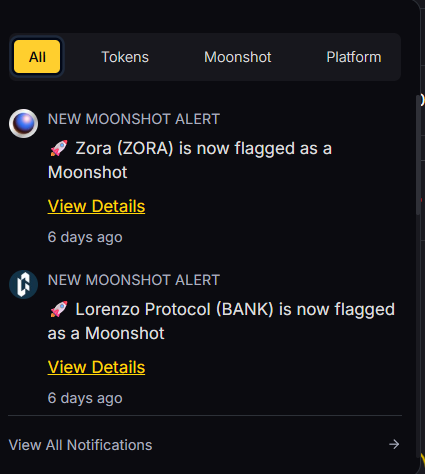

Traders can set alerts for price targets, investor grades, or trading signals and receive notifications via email, Telegram, SMS, or Slack. This ensures you never miss critical market movements.

Token Metrics automates the research process by combining on-chain data, fundamental analysis, and sentiment tracking into easy-to-understand reports. This saves traders hours of manual work while providing expert insights.

Token Metrics empowers traders with a suite of advanced trading options designed to give you a competitive edge in the crypto market. The platform harnesses predictive analytics, sentiment analysis, and natural language processing to help you analyze market trends and predict future price movements with greater accuracy.

With Token Metrics, you can create and test custom strategies tailored to your trading style, backtest their performance using historical data, and execute trades automatically based on real-time insights. The platform’s advanced tools allow you to monitor market conditions, adjust your strategies as needed, and make informed decisions that maximize your trading profits.

Whether you’re trading Bitcoin, Ethereum, or exploring new altcoins, Token Metrics provides the resources and analytics you need to optimize your trading activities. By leveraging these powerful features, traders can stay ahead of market trends, anticipate price fluctuations, and achieve greater success in the ever-evolving world of cryptocurrency trading.