Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

Billions of dollars vanish from the crypto markets annually, not due to scams or hacks—but simply through common, avoidable mistakes. Recent data reveals that 95% of cryptocurrency traders lose money, and the root causes are rarely market volatility or bad luck. Instead, it’s everyday errors in judgment, strategy, and execution. If you have ever bought a token near its top, held a losing position in hopes of a turnaround, or felt overwhelmed by countless investment choices, you’re far from alone. These patterns impact millions, draining away both capital and peace of mind.

The good news? Token Metrics AI indices are designed to address these exact issues. In this article, we’ll examine the five most costly crypto investing mistakes—and show how Token Metrics’ systematic approach helps mitigate them all.

The Problem

You notice a token trending on social media, backed by massive price gains and hype. FOMO prompts you to invest, even though you don’t fully understand the project. For example, in 2021, the Squid Game Token rocketed 86,000% in just a week due to hype linked to the Netflix series. Investors poured in millions—only for a "rug pull" to destroy its value, leaving those who bought at the top with 99.99% losses.

Why This Happens

How Token Metrics Solves It

Token Metrics uses AI and machine learning to analyze over 80 data points per token, including fundamentals, code quality, sentiment, and market indicators

The result? Only projects passing strict fundamental analysis are included in Token Metrics indices. Hype-driven projects are filtered out, helping protect investors from unreliable assets.

The Problem

Emotion-driven timing—buying during surges and selling during dips—is one of the biggest sources of loss for crypto investors. Research indicates the average investor underperforms basic buy-and-hold by 30–50% per year due to such decisions.

Why This Happens

How Token Metrics Solves It

Token Metrics indices rebalance weekly, monthly, or quarterly using algorithmic rules. The platform’s AI features:

Example: If Solana’s strength increases, Token Metrics may raise its allocation; as momentum fades, the index reduces exposure—helping avoid entire declines that manual investors often experience. This systematic, emotion-free timing can produce more consistent results than self-directed trading.

The Problem

Concentrating heavily in a single token exposes investors to severe downside. In 2022, many held over 50% of their portfolio in Luna/UST and suffered disproportionate losses when the protocol collapsed.

Why This Happens

How Token Metrics Solves It

Token Metrics indices deliver automatic diversification:

Sample Portfolio: 30% Bitcoin, 25% Ethereum, 15% Solana, 10% Chainlink, 8% Avalanche, 7% Polygon, 5% other high-quality assets. If one token sees trouble, most of the portfolio remains protected—a proven benefit highlighted by Token Metrics’ multi-year track record of outperformance with diversified baskets.

The Problem

Without regular review, portfolio allocation drifts: winners may become overexposed, losers get neglected, and emotional attachments override discipline. Studies show that investors who fail to rebalance underperform by 15–20% annually due to uncontrolled risk and missed opportunities.

Why This Happens

How Token Metrics Solves It

All Token Metrics indices are systematically rebalanced on a set schedule. For trading indices, rebalancing happens weekly—well-performing tokens are trimmed, underperformers removed, and new opportunities integrated. For investor indices, monthly or quarterly rebalances keep long-term allocations aligned while minimizing transaction costs.

Example: Instead of riding a token from $10 to $100 and back to $30, Token Metrics trims positions in stages, locking in gains before major declines. This systematic process produces more stable outcomes than manual, emotion-driven management.

The Problem

With thousands of crypto assets, dozens of exchanges, and endless advice, many investors get stuck researching without ever taking action—or constantly shift strategies without conviction. During recent bull markets, analysis paralysis alone led to missed opportunities for significant growth.

Why This Happens

How Token Metrics Solves It

Token Metrics offers a simple, three-step process:

From there, AI research handles token analysis, portfolio selection, rebalancing, and ongoing risk management—reducing complexity and saving hours each week.

This all-in-one approach makes it possible to manage your crypto allocation in an hour per month—while leveraging systematic, AI-driven best practices.

What sets Token Metrics apart for investors seeking robust, repeatable results?

Recognizing these mistakes is important, but building sound habits is what drives meaningful outcomes. Most investors have made at least one of these errors. The difference comes from implementing systematic solutions.

Every day of delay or indecision can contribute to preventable loss or missed growth, while proven systems work to manage changing markets with discipline.

Subscription costs, typically $50–200 monthly, are modest compared to the savings from avoiding just a single significant error. Many users note that Token Metrics’ AI prevents multiple costly mistakes each year.

The five mistakes covered—buying hype, poor timing, concentration, inconsistent management, and information overload—are among the most common causes of investor losses in crypto. Token Metrics’ indices offer systematic processes that remove emotion, foster diversification, drive consistent rebalancing, and simplify complex decisions. With tools built on institutional-grade AI, you can transform passive mistakes into active mastery. You don’t need to become a full-time trader or blockchain expert; you need proven systems designed to avoid the most frequent pitfalls.

Move beyond trial and error, and leverage AI-powered intelligence for smarter investing decisions with Token Metrics. Make your next move one of clarity and confidence.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

Token Metrics indices are algorithmically created baskets of cryptocurrencies selected using AI-driven research. They are rebalanced systematically based on market signals, offering diversified exposure and removing emotional bias.

Token Metrics rigorously evaluates project fundamentals, code quality, market viability, and liquidity, filtering out projects driven by short-term hype or weak fundamentals. Only tokens passing strict criteria are considered for inclusion in indices.

Users can choose indices aligned with different investor profiles, timeframes, and styles. While each index follows an algorithmic process, you can select the one that best matches your strategy and goals.

Indices are built for risk management, including diversification limits, liquidity filters, systematic rebalancing, and AI-powered detection of changing market conditions to mitigate portfolio risk.

Token Metrics is accessible for all experience levels. Beginners benefit from simplified AI-driven selection, while advanced users can access data, detailed reports, and deeper tools for more hands-on analysis.

This content is for informational and educational purposes only and does not constitute investment advice or a recommendation to buy or sell any digital assets. Cryptocurrencies are volatile and carry risk; always conduct your own research and consider professional advice before making financial decisions.

%201.svg)

%201.svg)

If you’re new to cryptocurrency investing, feeling overwhelmed is common. With more than 6,000 cryptocurrencies, a multitude of trading platforms, and round-the-clock markets, knowing where to begin can seem daunting.

Fortunately, you don’t need to master blockchain or spend countless hours analyzing charts. Token Metrics AI indices offer a straightforward, research-driven entry point for beginners, removing complexity and minimizing guesswork.

Just as the S&P 500 index simplifies stock investing, crypto indices provide diversified exposure to quality assets through a single portfolio. This guide unpacks everything you need to know to start with Token Metrics AI indices—confidently and securely.

A crypto index is a curated basket of cryptocurrencies, each selected and managed according to specific criteria. Rather than individually picking tokens, investors gain access to pre-built portfolios that automatically adapt to market changes.

Token Metrics integrates artificial intelligence and machine learning to evaluate over 80 data points for every crypto asset, including

The AI synthesizes this data to select top-performing cryptocurrencies for each index and automatically rebalances portfolios on a schedule (weekly, monthly, or quarterly), aligned with your chosen investment strategy.

Token Metrics provides 14+ indices tailored to various goals and risk profile

Tokens within each index are selected and weighted by Token Metrics algorithms to maintain the desired risk-reward balance.

Beginners are often best served by starting with the Balanced Investor Index, which offers quarterly or annual rebalancing. This approach provides diversified exposure to proven projects, infrequent maintenance, and space to learn progressively.

As your familiarity grows, consider exploring active trading or sector-driven strategies according to your comfort with market cycles and research.

Ready to make the leap? Here’s a step-by-step road map:

Dollar-cost averaging (DCA) is a strategy where investors commit a fixed amount at regular intervals—regardless of market conditions.

A simple DCA approach: Invest the same sum on the same day each month into your Token Metrics index allocations, building wealth methodically over time.

Adopt strict security practices from the start:

Crypto is known for outsized moves, but results vary with market cycles:

Establish expectations over a five-year window, prioritizing steady growth and disciplined allocation rather than chasing quick profits. Historical performance is informative but not predictive.

A methodical approach helps you evolve:

The most impactful step is starting. Use the following checklist to guide your first month:

Using Token Metrics AI indices places beginners at a distinct advantage—minimizing rookie errors and capitalizing on institutional-grade analysis. Follow core tenets: start modestly, prioritize learning, stay disciplined, diversify, and rebalance periodically.

The crypto economy offers meaningful opportunities for calculated, patient investors. With a focused, research-driven approach like that offered by Token Metrics, you gain access to sophisticated strategies and insights from your very first day.

Your path to building a resilient crypto portfolio begins with a single, informed choice.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

A crypto index is a diversified portfolio of cryptocurrencies chosen based on specific themes, fundamental criteria, or market conditions. Token Metrics’ indices use AI and data-driven analytics to select and rebalance holdings with the goal of simplifying exposure to the crypto market.

Token Metrics leverages AI to analyze thousands of data points, automating research and portfolio selection that would be time-consuming to perform manually. This reduces bias, streamlines asset rotation, and enhances risk management compared to individual selection.

While portfolio allocation depends on individual circumstances, many educational resources suggest a starting range of 3–10% of investable assets for beginners. Always assess personal risk tolerance before choosing an allocation.

DCA can help beginners avoid market timing pitfalls by investing a fixed amount consistently over time. This method encourages discipline and can smooth out volatility when followed long-term.

Prioritize security by enabling two-factor authentication, using strong passwords, keeping major holdings in a hardware wallet, and never sharing private keys. Avoid posting sensitive data or investment details online.

This article is for informational and educational purposes only. It does not constitute financial, investment, or tax advice. Cryptocurrency investing involves risk, and past performance is not indicative of future results. Always conduct your own research and seek independent professional advice before making investment decisions.

%201.svg)

%201.svg)

Crypto indices have revolutionized diversification and portfolio management, but real outperformance hinges on how intelligently you use platforms like Token Metrics. Unlocking their full potential takes more than passive investing—it requires a blend of AI insights and disciplined strategy.

Token Metrics indices stand out thanks to AI-driven technology analyzing over 80 data points per token. These cover a wide array of crypto themes—Memecoins, RWAs, AI Agents, DeFi, Layer 1s, and more—and are fine-tuned with weekly rebalancing based on dynamic market signals.

This robust data suite, coupled with frequent rebalancing, enables responsive and intelligent index management, optimizing exposure to compounding opportunities while mitigating market risks.

A common pitfall is putting all your capital into a single index. Top performers, however, diversify across multiple Token Metrics indices, targeting different market segments to balance stability and growth.

Consider a three-tier framework:

This structure ensures you capture core market resilience, trend-led growth, and high-risk/high-reward opportunities.

Dynamic reallocation based on market cycles further refines the strategy:

Token Metrics' Market Analytics can inform these allocation shifts using data-driven bullish or bearish signals.

Different crypto sectors peak at different points in the macro cycle. By monitoring Token Metrics' sector-specific indices, investors can rotate allocations to capture the strongest trends.

Typical cycle stages:

A tactical example: Begin with 60% in an Investor Index during an early bull phase, then pivot a portion to sector leaders as outperformance emerges, using clear quantitative signals from Token Metrics analytics.

Don’t try to predict sector winners; let relative performance guide your rotation decisions.

Each investor’s available time and risk tolerance should match the index’s rebalancing schedule. Token Metrics provides:

Misaligning your activity level with rebalancing frequency can mean missed signals or excessive trading costs. Honest self-assessment leads to better index selection and results.

Classic lump-sum investing exposes you to timing risk. Strategic DCA smooths entries, especially when adapted to market signals:

Such approaches can be tailored with Token Metrics' analytic tools and AI-powered signals.

Disciplined risk rules are essential to avoiding outsized losses. Key principles include:

Portfolio discipline enables long-term participation and helps minimize drawdowns.

Active rebalancing adjusts exposure as market conditions evolve—not just at set intervals. Quarterly reviews help identify outperformers to trim, underperformers to top up, and spot for new opportunities.

Monitor index correlations to ensure real diversification. Use data from Token Metrics' analytics to guide dynamic weight changes if bullish or bearish triggers are hit.

Take advantage of Token Metrics’ full feature set to maximize insights and execution quality:

Structuring a weekly routine with market check-ins, grade reviews, and strategy adjustments ensures you stay disciplined and data-driven. Leverage all Token Metrics tools for robust, systematic investing.

Frequent pitfalls include over-trading, ignoring risk controls, emotional overrides of AI signals, insufficient diversification, forgetting taxes, and chasing hype. Sticking to the above frameworks and monitoring KPIs like absolute return, Sharpe ratio, drawdowns, and portfolio health can keep performance on track.

Effective performance measurement includes:

Regular performance and process auditing can lead to continuous improvement.

Three illustrative approaches:

Regardless of style, following a clear 30-day roadmap—risk assessment, strategic setup, ongoing refinement—positions you for systematic, data-driven execution over the long term.

Success stems from synergy: Multi-index allocation, sector rotation, time-matched rebalancing, advanced DCA, rigorous risk management, active rebalancing, and full use of Token Metrics’ AI ecosystem work best together. Even partial adoption can improve outcomes versus passive approaches, while full mastery unlocks maximum performance through discipline and superior analytics.

The journey to consistent crypto performance favors intelligent frameworks and systematic execution. By aligning human strategy with AI insights, investors can aim to capture attractive results while managing risk responsibly.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

Token Metrics indices utilize AI and 80+ data points per token, paired with dynamic rebalancing, enabling more adaptive, diversified, and data-informed exposure than traditional indices.

Frequent rebalancing helps capture gains, prune underperformers, and stay aligned with emerging trends—compounding results and maintaining optimal portfolios throughout market cycles.

Diversifying across several indices affords stability while allowing portions of the portfolio to chase growth or sector-specific opportunities, reducing concentrated risk.

Assess your risk tolerance and time horizon. Use established rules—like capping crypto at a fraction of your net worth—and diversify within crypto between core, growth, and opportunity indices.

No. Token Metrics offers accessible indices and tools for beginners, plus granular analytics, APIs, and automation features for advanced investors seeking a data-powered edge.

This guide is for educational and informational purposes only. Nothing contained herein constitutes investment advice, financial recommendations, or a guarantee of results. Crypto assets are volatile and may not be suitable for all investors. Please consult a qualified financial advisor and conduct your own research before making financial decisions. Past performance is not indicative of future outcomes.

%201.svg)

%201.svg)

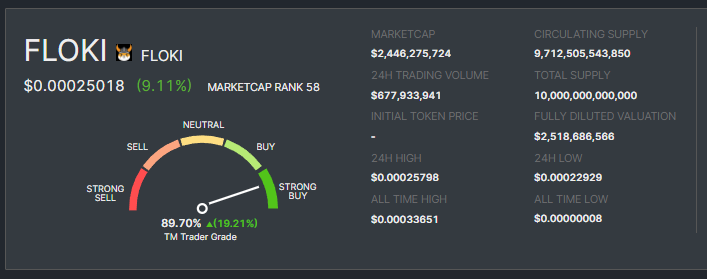

In the dynamic space of cryptocurrencies, meme coins have garnered considerable interest. Among these, Floki Inu Coin has captivated the attention of investors and enthusiasts. With its distinctive branding and community-driven ethos, Floki Inu Coin has generated significant excitement in the market.

This article examines Floki Inu Coin's future potential, offering an in-depth analysis of price predictions for 2025 and 2030.

Floki Inu, originally inspired by Elon Musk's dog and dubbed the "people's currency," has quickly gained popularity in the crypto market.

As a major player in the web3 space, Floki Inu spans decentralized finance (DeFi), non-fungible tokens (NFTs), and the Metaverse, aiming to become the premier meme-based cryptocurrency.

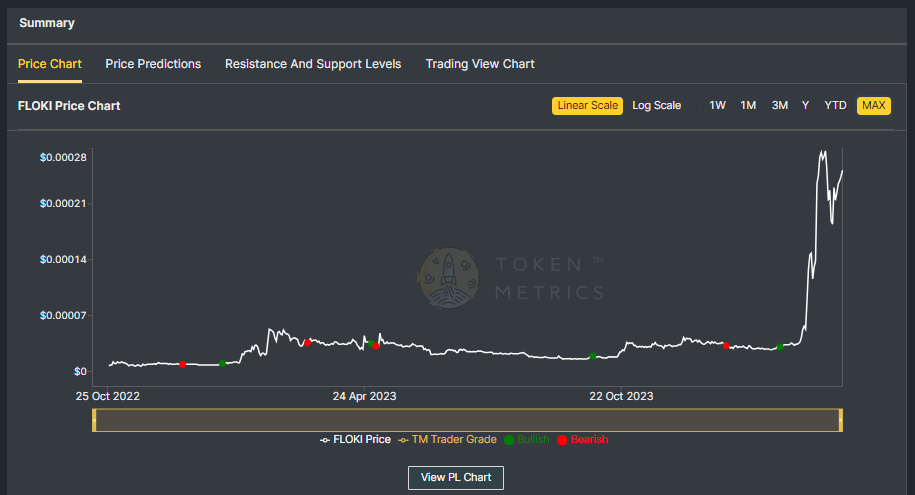

Since its inception, Floki Inu has experienced significant volatility in its price. The coin has shown tremendous growth, with a staggering 162,223.13% return.

However, like many meme coins, Floki Inu faces a downtrend as the market shifts under bearish control.

Despite the current market conditions, Floki Inu is pioneering three transformative crypto projects:

These initiatives demonstrate Floki Inu's commitment to innovation and its potential for long-term growth.

To provide a comprehensive price prediction for Floki Inu, we will analyze bullish and bearish market scenarios and consider industry expert opinions.

In a bullish market scenario where positive market sentiment prevails, Floki Inu Coin's price has the potential to experience significant growth. Several factors could contribute to this bullish trend, including increased adoption, technological advancements, and positive regulatory developments.

If the crypto market cap hits $3 Trillion and Floki Inu Coin retains its current 0.08% dominance, its price could ascend to $0.000261.

In a more bullish scenario of the crypto market surging to $10 Trillion, Floki Inu Coin's price could soar to a staggering $0.000873, resulting in a potential 7x return for investors.

It is important to note that these predictions are based on various factors and assumptions, and market conditions can change rapidly. However, bullish market sentiment and increased adoption of Floki Inu Coin's solutions could drive its price to new heights.

These predictions highlight the potential risks of investing in Floki Inu during a bearish market. It's crucial to assess the market conditions and make informed decisions.

In the event of a bearish market, Floki Inu Coin's price could experience a correction, potentially leading to a decrease in its value. In this case, the price of Floki Inu Coin may face downward pressure with a decreased dominance of 0.042%.

In this scenario, If the crypto market cap hits $3 Trillion, Floki Inu Coin could trade around $0.000130 in the short term and struggle to surpass $0.000436 by 2030 even if the total crypto market cap surpasses the $10 Trillion mark.

It is crucial to consider the potential risks and challenges that Floki Inu Coin may face. Factors such as regulatory developments, competition from other projects, and technological advancements can affect the growth trajectory of Floki Inu Coin.

Also Read - Next Crypto Bull Run

Industry experts play a crucial role in providing insights into the potential future performance of cryptocurrencies. While their opinions may vary, it's valuable to consider their perspectives. Based on the analysis of various experts, the following price predictions can be considered:

The Changelly platform predicts Floki Inu Coin could reach $0.00290 to $0.00350 by 2030, and other industry analysts have varying opinions on the future price of Floki Inu Coin.

The Coincodex platform predicts that Floki Inu Coin could reach $ 0.000249 to $ 0.00118 by 2025. By the end of 2030, the price of Floki Inu Coin could reach $ 0.000634 to $ 0.001029.

While these predictions provide insights, it's important to remember that the crypto market is highly volatile and subject to various external factors.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

Floki Inu's success depends on its ability to adapt to market conditions, innovate, and attract a strong community. The ongoing development of the Floki ecosystem, including Valhalla and FlokiPlaces, demonstrates the team's commitment to expanding the use cases and utility of the coin.

As the crypto market evolves, Floki Inu has the potential to establish itself as a prominent player in the meme coin space. However, it's important to stay updated on the latest developments and perform thorough research before making any investment decisions.

Also Read - Ripple (XRP) Price Prediction

In conclusion, Floki Inu Coin's price prediction involves careful historical performance analysis, current market conditions, and future potential. While a bullish market scenario may lead to significant price growth, a bearish market scenario can present challenges.

Considering the ongoing developments and industry expert opinions, Floki Inu has the potential to achieve notable milestones in the coming years. However, conducting thorough research, assessing market conditions, and making informed investment decisions are essential.

Remember, the crypto market is highly volatile, and prices can fluctuate rapidly. Always exercise caution and consult a professional financial advisor before making investment decisions.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Are you ready for a potentially lucrative opportunity in the world of cryptocurrencies? The TENET Airdrop is here, and it's time to seize the moment.

This comprehensive guide will walk you through the eligibility criteria, the step-by-step participation process, and strategies to maximize your rewards. So, let's dive in and explore the exciting world of the TENET Airdrop.

Before we jump into the details, let's take a moment to understand what TENET is all about. TENET is a groundbreaking Layer 1 blockchain explicitly designed for LSD (Liquid Staking Derivatives).

It's an LSD-focused L1 ecosystem dedicated to expanding the utility of liquid staking derivatives. With its innovative approach and strong backing, TENET has gained significant attention in the crypto community.

To participate in the TENET Airdrop, you must meet certain specific criteria. While these criteria may vary from one airdrop to another, they generally include:

Now that you're familiar with the essential eligibility criteria, let's dive into the exciting details of the TENET Airdrop.

$160M Valuation - Supported By Binance

They have raised $500K through its IDO and garnered support from Binance with a potential listing on Binance and other prominent exchanges on the horizon.

Cost and Potential Profit

The best part about the TENET Airdrop? It's completely free to participate! That's right, there's no cost involved. All you need is a few minutes to complete the required steps. And the potential profit?

Brace yourself for a chance to earn $6,500 or even more! With such a lucrative opportunity, it's no wonder the TENET Airdrop has attracted significant attention.

Time Commitment

Participating in the TENET Airdrop requires a time commitment of approximately 10-15 minutes. The process is designed to be straightforward and user-friendly, ensuring you can complete the necessary steps within a reasonable timeframe.

Airdrop Allocation

The TENET Airdrop allocates a total of 48 million tokens for distribution. This generous allocation provides participants a substantial opportunity to secure their share of the airdrop.

The value of these tokens can vary depending on the market conditions and the overall success and adoption of the TENET platform.

Now that you understand the TENET Airdrop let's dive into the step-by-step process to participate. Following these instructions carefully ensures a seamless experience and increases your chances of maximizing your rewards.

🚨 $TENET Airdrop Confirmed In 7 Days.

— Token Metrics (@tokenmetricsinc) March 17, 2024

$160M Valuation - Supported By @binance

▪ Costs: $0

▪ Time: 10 min

▪ Potential gain: $6,500+

A Full Guide to Getting the Most $$$ tokens 🧵👇 pic.twitter.com/H3aJcHRUh6

Step 1: Add Testnet Network

To get started, add the Testnet network to your MetaMask wallet. Here's how you can do it:

Step 2: Faucet

The next step is to visit the TENET Testnet Faucet and claim your tokens. Follow these instructions:

Step 3: Wrap

After claiming your tokens, you need to wrap them to make them compatible with the TENET ecosystem:

Step 4: Swap

Now it's time to swap your wrapped tokens for wTENET:

Step 5: Stake

To participate fully in the TENET ecosystem, you need to stake your wTENET tokens:

Step 6: Restake

To maximize your rewards and actively contribute to the TENET ecosystem, consider restaking your tokens:

Step 7: Deposit

If you want to enhance your participation further, you can deposit your tokens:

Step 8: Lock

To add an extra layer of security and commitment, you can lock your tokens for a specific period:

Step 9: Vote

As a participant in the TENET ecosystem, you have the opportunity to vote for different gauges:

Congratulations! You have completed the step-by-step process to participate in the TENET Airdrop. Now, let's explore some tips and strategies to maximize your rewards.

Participating in the TENET Airdrop is not just about going through the motions but maximizing your rewards. Here are some tips and strategies to help you make the most of this opportunity:

By following these tips and strategies, you can increase your chances of maximizing your rewards and potentially benefiting from the TENET Airdrop to the fullest.

Now that you understand the process and strategies let's explore the potential value and benefits of TENET tokens. As the TENET ecosystem grows and gains traction, the value of these tokens can increase significantly. Holding TENET tokens provides you with various benefits, including:

The TENET Airdrop not only benefits participants but also has a significant impact on the overall platform. By attracting a diverse and engaged community, the airdrop contributes to the growth and development of the TENET ecosystem.

The increased participation and adoption of TENET tokens can lead to a more robust and secure network, creating a positive feedback loop.

Furthermore, the airdrop is a marketing strategy to raise awareness about the TENET platform and its unique features. It allows individuals to experience the benefits firsthand and encourages them to explore further opportunities within the TENET ecosystem.

Also Read - Top Upcoming Confirmed Crypto Airdrops 2024

The TENET Airdrop presents an exciting opportunity for cryptocurrency enthusiasts to participate in a groundbreaking project and earn substantial rewards.

You can maximize your chances of success by understanding the eligibility criteria, following the step-by-step guide, and implementing the provided tips and strategies.

Remember, cryptocurrencies are constantly evolving, and opportunities like the TENET Airdrop are just the beginning. Stay informed, engage with the community, and embrace the possibilities that lie ahead. Good luck, and may your participation in the TENET Airdrop be rewarding and fulfilling!

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Welcome to the Token Metrics Moon Awards, a prestigious cryptocurrency industry accolade that recognizes platforms, projects, and initiatives that have made a significant impact in the industry. The latest addition to the Moon Awards is the "Top Meme Coins in 2024."

Selection Process

At Token Metrics, we emphasize our audience, considering them the foundation of our operations. Our selection process is firmly rooted in engaging with the community, ensuring that our awards' results authentically reflect crypto enthusiasts' sentiments and experiences.

Through engagement with our community members, we have compiled a comprehensive list of the Top Meme Coins in 2024 based on extensive survey data and user votes.

In this article, we will delve into the list of Top Meme Coins, providing a brief overview of each and discussing their future potential.

Let's Begin

In the ever-evolving world of cryptocurrencies, a unique trend has emerged - meme coins. These digital assets, characterized by their humorous branding and viral appeal, have captured the attention of investors and crypto enthusiasts alike.

While traditional cryptocurrencies focus on utility and solving complex problems, meme coins embrace speculation and the power of social media.

As we enter 2024, the meme coin market is poised for explosive growth. With Bitcoin halving on the horizon and the overall bullish sentiment in the crypto space, experts predict that meme coins can dominate the bull cycle.

Meme coins are cryptocurrencies that leverage humorous branding and viral appeal to attract attention and investors. Unlike traditional cryptocurrencies, meme coins often lack utility or a clear purpose beyond entertainment.

They rely on social media trends and community engagement to drive their value and popularity. While investing in meme coins can be highly speculative and risky, they have gained significant traction in recent years.

Meme coins can potentially deliver astronomical returns, but investors should exercise caution and conduct thorough research before diving in.

Here are some of the top Meme Coin projects to watch in 2024:

In the Moon Awards survey, Dogecoin secured the top position with 53.2% of the total votes.

Dogecoin, the original meme coin, remains a dominant force in the market. Introduced in 2013 as a joke, Dogecoin has since gained a massive following and widespread adoption. Despite its humble beginnings, Dogecoin has proved its staying power and has even garnered the support of billionaire entrepreneur Elon Musk.

With its iconic Shiba Inu dog logo and lighthearted branding, Dogecoin continues to capture the imagination of investors. While newer meme coins have experienced significant growth, the upcoming Bitcoin halving and increased adoption could propel Dogecoin to new heights.

In the Moon Awards survey, Bonk secured the 2nd position with 15.7% of the total votes.

Bonk is a meme coin that made waves in 2023 as the first meme token launched on the Solana network. With gains of over 7,300% in the previous year, Bonk quickly joined the ranks of meme coin titans. The project aims to diminish the influence of venture capital investors and restore control to ordinary users within the Solana network.

Despite its initial hype, Bonk has seen a decline in significance. However, with the launch of its decentralized exchange called BonkSwap, Bonk is poised to regain momentum. As the Solana meme coin community continues to grow, Bonk remains one of the top meme coins to watch in 2024.

In the Moon Awards survey, Shiba Inu secured the 3rd position with 11.4% of the total votes.

Shiba Inu has emerged as one of the most popular meme coins in the market. Its impressive rally, with gains of over 300% in just a week, has propelled it into the top 10 altcoins. Inspired by the Dogecoin community, Shiba Inu aims to create a decentralized ecosystem focusing on utility and innovation.

Recent developments, such as adopting an advanced FHE (Fully Homomorphic Encryption) technique for enhanced security and the launch of the Shiba Name Service, have further solidified Shiba Inu's position. With these products gaining traction, the price of SHIB could potentially double in the near future.

In the Moon Awards survey, Pepe secured the 4th position with 6.9% of the total votes.

Pepe burst onto the cryptocurrency scene in 2023, reigniting the meme coin market during a relatively quiet period. While not promoted as a utility token, Pepe quickly gained popularity and remains one of the top meme coins in terms of market capitalization.

Unlike other meme coins, Pepe does not focus on introducing new features or products. Instead, the project embraces its status as a "useless" meme token. Despite its lack of fundamentals or utility, Pepe's price has experienced significant growth. While it may be prone to volatility, Pepe continues to attract attention from investors.

In the Moon Awards survey, Myro secured the 5th position with 4.4% of the total votes.

Myro is an autonomous meme coin built on the Solana blockchain. The project aims to increase the accessibility and enjoyment of cryptocurrencies for all users. Named after Raj Gokal's dog, one of the co-founders of Solana, Myro has become a central player in the explosive growth of meme coins on the Solana network.

With gains of over 1,400% in 2023, Myro is expected to continue its bullish trend as Solana continues to rise. The project's community-driven approach and focus on user experience make it a promising contender in the meme coin market.

In the Moon Awards survey, FLOKI secured the 6th position with 2% of the total votes.

FLOKI is both a utility token and a meme coin within the Floki Inu ecosystem. Unlike other top meme coins, FLOKI follows a highly deflationary model with auto-burns to reduce its supply. The project aims to diversify into other areas beyond cryptocurrencies, such as the metaverse and NFTs (Non-Fungible Tokens).

What sets FLOKI apart is its multi-chain functionality, allowing seamless use on both Ethereum and Binance Smart Chain. This versatility could impact the demand and valuation of the meme coin in 2024 as the project expands its ecosystem.

In the Moon Awards survey, Dogwifhat secured the 7th position with 1.7% of the total votes.

Dogwifhat is a meme coin built on the Solana blockchain that gained momentum in 2023. The project's branding revolves around a single image of a dog wearing different hats, reflecting its humor and the playful nature of meme coins.

Despite lacking fundamentals or utility, Dogwifhat experienced tremendous growth thanks to the surge in interest in Solana. While there has been a significant price correction since its all-time high, Dogwifhat continues to see strong trading activity.

As the crypto market enters 2024, meme coins are poised for significant growth and attention. The top meme coins mentioned - Dogecoin, Bonk, Shiba Inu, Pepe, Myro, FLOKI, and Dogwifhat - offer unique features and potential gains for investors.

However, it is important to note that investing in meme coins comes with inherent risks. These assets can be highly volatile and lack the fundamentals or utility of traditional cryptocurrencies. Investors should conduct thorough research and exercise caution when considering meme coins as part of their investment portfolio.

In conclusion, the rise of meme coins presents an exciting yet challenging opportunity for investors. As the crypto market continues to evolve, keeping an eye on the top meme coins and their potential for growth is essential for those looking to explore this unique sector of the cryptocurrency world.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Cryptocurrency enthusiasts, get ready for an exciting opportunity! Kontos, a revolutionary zero-knowledge-based L2 account protocol, is conducting an upcoming airdrop supported by Binance. This airdrop presents a chance for participants to gain upto $5,000 in value potentially.

In this comprehensive guide, we will walk you through the eligibility criteria, the step-by-step process to participate in the airdrop, and how to maximize your rewards. So, let's dive in and explore the world of Kontos Airdrop 2024!

Kontos is a cutting-edge L2 account protocol that operates with a zero-knowledge approach. This innovative technology empowers users with gas-less transactions, asset-less operations, and enhanced security.

The project has successfully raised $10M from prominent funds such as Binance Labs, Shima Capital, and The Spartan Group. Kontos specializes in four types of abstraction: account abstraction, asset abstraction, chain abstraction, and behavior abstraction.

These abstractions enable asset-less and key-less trades, giving users greater flexibility in managing their digital assets.

To qualify for the Kontos Airdrop, participants need to follow certain criteria. While the specific details of the airdrop are not disclosed in the reference articles, it is important to stay informed about the latest updates and announcements from Kontos.

Monitor their official website and social media channels to ensure you meet the eligibility requirements. Stay tuned for any additional information that may be released, as it could impact your chances of participating in the airdrop.

The Kontos Airdrop is a highly anticipated event for cryptocurrency enthusiasts. Here are some key details you need to know:

Please note that these details are based on available information at the time of writing. As the airdrop approaches, staying updated with the latest announcements from Kontos for any changes or additional requirements is recommended.

Participating in the Kontos Airdrop is a straightforward process that requires a few simple steps. Here's a comprehensive guide to help you get started:

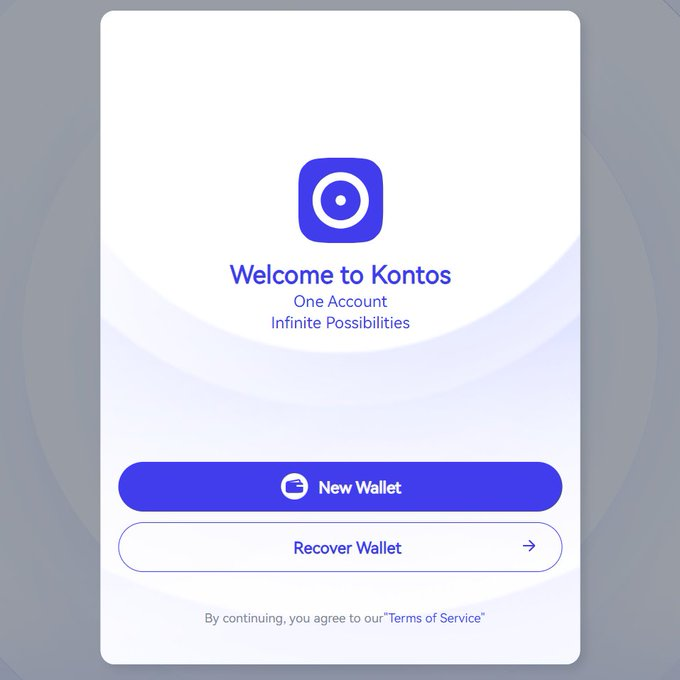

Step 1: Setting up your Wallet

To begin, visit the official Kontos website and create a new wallet. Set your username, password, and PIN to ensure the security of your account.

A reliable wallet is essential for storing and managing your Kontos tokens effectively.

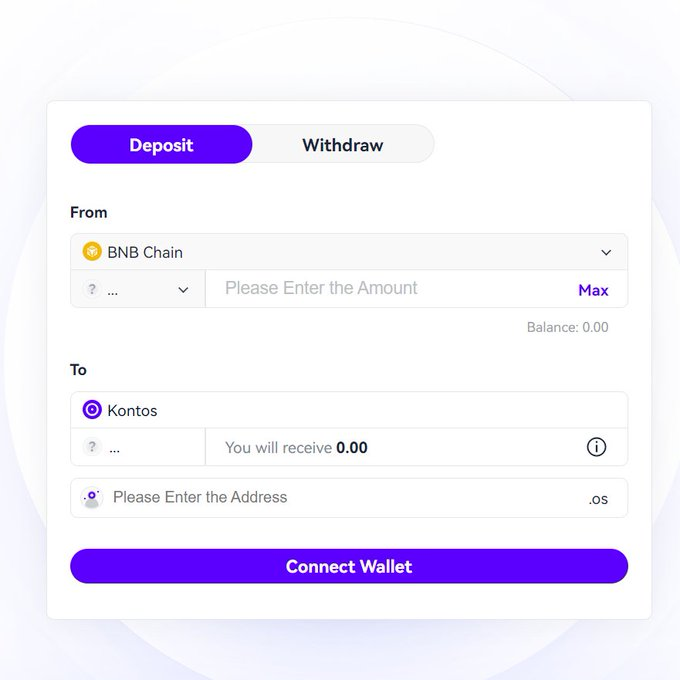

Step 2: Bridging Funds

Next, you must bridge funds from your existing wallet to your Kontos wallet. Visit the Kontos bridge platform and connect your Metamask wallet.

Switch to the Binance Smart Chain (BSC) network and bridge some BNB or USDT to your Kontos wallet. This step may incur a small transaction fee of $0.1.

Step 3: Interact with the Kontos Discord Bot

Join the official Kontos Discord server and navigate to the "Bot-command" tab. Enter the command "/Register" to register your account for the airdrop.

Interacting with the Kontos Discord Bot is a crucial step in the airdrop process, so ensure you complete the registration process as instructed.

Step 4: Trading and Bridging

To maximize your rewards, it is recommended to explore the trading and bridging functionalities offered by Kontos. Use the command "/trade" to initiate a trade and "/bridge" to bridge tokens between different networks.

Follow the instructions provided and make sure to complete at least one bridge transaction with a minimum value of $1.

Throughout the entire process, stay connected with the Kontos community and follow their official social media channels for any updates, tips, or additional steps that may be announced.

Step 5: Galxe task

Go to → https://galxe.com/Zecrey/campaign/GCfXRttJbf

◈ Complete weekly tasks to earn points.

To make the most of the Kontos Airdrop and potentially increase your rewards, consider the following tips and strategies:

Participating in the Kontos Airdrop can potentially provide you with valuable Kontos tokens. These tokens hold the potential for future growth and utility within the Kontos ecosystem. As a holder of Kontos tokens, you may benefit from various platform features and opportunities, such as:

The true potential and long-term value of Kontos tokens can only be realized through active engagement with the platform and staying informed about the project's developments.

Also Read - Top Upcoming Crypto Airdrops 2024

Participating in the Kontos Airdrop not only offers the potential for financial gain but also allows individuals to become part of an innovative ecosystem.

By joining the Kontos community, participants can contribute to the platform's growth, provide feedback, and shape its future.

Also, the airdrop creates an opportunity to explore the unique features and benefits offered by Kontos and gain a deeper understanding of the project's vision.

The Kontos Airdrop 2024 presents an exciting opportunity for cryptocurrency enthusiasts to earn substantial rewards potentially. Participants can maximize their chances of success by following the step-by-step guide, staying updated with the latest information, and implementing effective strategies.

Remember to prioritize security, engage with the community, and explore the potential benefits of Kontos tokens. As the airdrop approaches, make sure to check the official Kontos channels regularly for any updates and additional details. Get ready to join the Kontos revolution and unlock the potential for a brighter crypto future!

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Welcome to the Token Metrics Moon Awards, a prestigious cryptocurrency industry accolade recognizing platforms, projects, and initiatives with significant impact.

Today, we are thrilled to announce the addition of a new Moon Awards category for 2024 - the Top Layer 2 Blockchain.

Selection Process

At Token Metrics, we highly value our audience as the cornerstone of our operations. Our selection process is deeply rooted in community engagement, ensuring that our awards' results authentically mirror crypto enthusiasts' sentiments and experiences.

Amplifying Community Insights

The Moon Awards by Token Metrics are designed to amplify the community's voice, providing a clear and focused evaluation of the entities driving progress in the sector.

Through interaction with our community members and user voting, we have compiled a comprehensive list of the Top Layer 2 Blockchains for 2024 based on extensive survey data and user votes.

In this article, we will explore the concept of Layer 2 blockchain, how it works, and the top Layer 2 blockchain projects of 2024.

A Layer 2 blockchain refers to a collection of scaling solutions designed to improve the performance and scalability of Layer-1 blockchains such as Ethereum.

These Layer-2 protocols operate on top of the primary blockchain, alleviating congestion, reducing transaction costs, and boosting throughput.

To understand Layer 2 blockchain, let's imagine a highway where traffic flows smoothly, transactions are processed at lightning speed, and fees are almost negligible.

Layer 2 protocols in the crypto world can be compared to express lanes built on top of Layer-1 blockchains, supercharging their performance and scalability.

At the core of Layer 2 networks is the principle of off-chain transaction processing. Instead of directly processing each transaction on the main blockchain, Layer-2 protocols divert transactions off the main chain, process them separately, and then consolidate them into a summary transaction on the main blockchain.

This approach significantly reduces network congestion, processing time, and transaction costs. Layer-2 protocols act as dedicated traffic management systems, diverting transactions away from the main blockchain and processing them on secondary networks.

This offloading process leads to faster transactions, lower fees, and increased throughput, ultimately enhancing the scalability and efficiency of the blockchain network.

Here are some of the top Layer 2 blockchain projects to watch in 2024:

In the Moon Awards survey, Polygon secured the top position with 57.3% of the total votes.

Polygon is a multichain ecosystem offering several Layer-2 solutions to scale Ethereum. It utilizes technologies like zkRollups for high-speed, privacy-focused transactions and Proof-of-Stake consensus mechanisms for sidechains.

With a throughput exceeding 65,000 TPS, Polygon significantly outperforms Ethereum's mainnet regarding transaction speed and cost-effectiveness. It has a thriving DeFi scene and is popular among NFT enthusiasts.

In the Moon Awards survey, Arbitrum secured the 2nd position with 22.8% of the total votes.

Arbitrum, built on Optimistic Rollups, offers a peak throughput of 4,000 TPS, processing transactions up to 10x faster than Ethereum's mainnet. It reduces gas costs by up to 95% and provides a developer-friendly environment.

With a robust ecosystem of DeFi protocols, NFT marketplaces, and gaming platforms, Arbitrum is positioned as a key contender in the Layer 2 space.

In the Moon Awards survey, Optimism secured the 3rd position with 6.1% of the total votes.

Optimism is a Layer-2 scaling solution for Ethereum, offering high throughput and reduced gas costs. With a peak throughput of 2,000 TPS, Optimism processes transactions up to 26x faster than Ethereum's mainnet.

It is committed to becoming a self-governing community and hosts a growing array of DeFi protocols, NFT marketplaces, and DAOs.

In the Moon Awards survey, Manta Network secured the 4th position with 3.3% of the total votes.

Manta Network is a privacy-focused ecosystem for Ethereum, providing anonymous transactions and confidential smart contracts.

It comprises two modules: Manta Pacific, an EVM-compatible Layer-2 for efficient transactions, and Manta Atlantic, which handles private identity management using zkSBTs.

Manta Network promises high scalability, developer-friendliness, and strong interoperability with Ethereum and other blockchains.

In the Moon Awards survey, Immutable X secured the 5th position with 2.8% of the total votes.

Immutable X is a Layer-2 network on Ethereum designed to provide speed, scalability, and adaptability for the next era of crypto gaming. It offers a robust network equipped with tools and infrastructure for developing NFT projects.

Immutable X incorporates Ethereum's security, zero gas fees, and user-friendly APIs. It hosts an immersive marketplace for trading and collecting NFTs.

In the Moon Awards survey, SKALE secured the 6th position with 2.4% of the total votes.

SKALE takes a distinctive approach to enhancing Ethereum scalability by utilizing a network of independent "sidechains" built atop the Ethereum blockchain.

These sidechains, known as SKALE Chains, provide tailored environments for specific applications, accommodating diverse requirements in terms of security, privacy, and transaction fees. SKALE offers flexibility and innovation within the Ethereum ecosystem.

In the Moon Awards survey, Metis secured the 7th position with 1.5% of the total votes.

Metis is a Layer-2 network aiming to provide scalable and accessible infrastructure for decentralized applications (dApps).

It offers a user-friendly environment for developers to create, deploy, and manage dApps efficiently. Metis focuses on empowering individuals and businesses to build decentralized economies and communities.

In the Moon Awards survey, Base secured the 8th position with 1.3% of the total votes.

Base is a Layer-2 protocol developed by Coinbase to enhance Ethereum's potential by increasing transaction speed and reducing fees. It targets a throughput of 2,000 TPS and aims to cut Ethereum's gas costs by up to 95%.

Base leverages Ethereum's security while processing transactions off-chain, ensuring asset safety. It offers a developer-friendly environment and benefits from Coinbase's security expertise and large user base.

These Layer 2 blockchain projects represent the cutting edge of blockchain scalability and efficiency. They offer solutions to the scalability challenges faced by Layer-1 blockchains, enabling faster transactions, lower fees, and improved user experiences.

Layer-2 blockchain solutions are revolutionizing the scalability and efficiency of blockchain networks. These innovative protocols, such as Polygon, Arbitrum, Optimism, Manta, and others, are addressing the limitations of Layer-1 blockchains and unlocking the full potential of blockchain technology.

As the adoption of cryptocurrencies and decentralized applications continues to grow, Layer-2 solutions will play a crucial role in driving mainstream blockchain adoption and powering diverse industries beyond finance.

Investors and developers should closely monitor the progress of these Layer 2 blockchain projects and conduct thorough research before making any investment or development decisions. The future of blockchain technology is bright, and Layer-2 solutions are at the forefront of this exciting evolution.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

In the maturing landscape of the cryptocurrency industry, new fundraising approaches have emerged, including the Initial DEX Offering (IDO).

The IDO is a creative and decentralized crowdfunding model that addresses the shortcomings of its predecessor, the Initial Coin Offering (ICO).

ICOs gained popularity in 2017 but were plagued with issues such as lack of control, investor protections, and numerous scams. The negative reputation of ICOs cast a shadow over the crypto industry, deterring potential investors.

On the other hand, the IDO is a fundraising method that leverages decentralized exchanges (DEXs) to pool investment capital from retail investors. It offers a more egalitarian crowdfunding model and aims to provide immediate token liquidity.

While IDOs have limitations, such as scalability, compared to ICOs and IEOs, they have gained popularity in the crypto space due to their decentralized and fair nature.

An Initial DEX Offering (IDO) is a decentralized and permissionless crowdfunding method that leverages decentralized exchanges (DEXs) to raise funds for crypto projects.

Unlike traditional fundraising models such as Initial Coin Offerings (ICOs), IDOs provide immediate token liquidity and ensure a fair and transparent distribution of tokens. By utilizing DEXs, IDOs eliminate the need for intermediaries and offer greater control and transparency to investors.

It is crucial to understand how IDOs work to grasp the concept of DEXs. DEXs are decentralized liquidity exchanges that operate on blockchain networks.

They allow users to trade digital assets directly from their wallets without intermediaries. IDOs leverage the decentralized nature of DEXs to facilitate fundraising for crypto projects.

Launching a successful IDO requires careful planning and execution. Here is a step-by-step process to guide project teams through the IDO launch:

Step 1: Devise a Business Strategy

Before launching an IDO, the project team should develop a comprehensive business strategy. This strategy should outline the project's goals, target audience, fund allocation, marketing plan, and post-IDO plans. Having a well-defined strategy, the team can effectively communicate their vision to potential investors.

Step 2: Create Marketing Collateral

To attract investors, the project team must create compelling marketing collateral. This includes designing a visually appealing website showcasing the project's unique selling points and providing information about the project's team.

Also, a well-crafted white paper should outline the project's technical details, tokenomics, and roadmap.

Step 3: Partner with a DEX Launchpad

The project team must partner with a DEX launchpad to launch an IDO. These launchpads serve as a platform for projects to gain exposure and access a broader investor base.

The team must ensure that their project meets the launchpad's requirements, including compatibility with the consensus mechanism and whitelisting.

Step 4: Create the Cryptocurrency

Using tools like CoinTool, the project team can create their cryptocurrency or token. This process involves defining the token's parameters, such as total supply, token name, symbol, and additional features or functionalities. Once the token is created, the team should conduct thorough testing to ensure its functionality and security.

Step 5: Launch the Token and Raise Funds

The project team can start the token sale with the IDO launchpad's approval. During this phase, investors can purchase the project's tokens at a discounted rate.

The team may incentivize early investors with additional benefits or rewards to encourage participation. The goal is to raise funds and generate liquidity for the project.

Step 6: Provide Liquidity and List the Token

After the IDO, the project team allocates a portion of the raised funds to provide liquidity on the DEX. This helps ensure a healthy trading environment for the token.

Simultaneously, the team lists the token on the DEX, making it available for trading to the general public. This immediate listing allows investors to buy and sell the token without any waiting period.

Step 7: Post-IDO Support and Growth

Once the IDO is complete, the project team must focus on sustaining the momentum and supporting the token's growth. This involves engaging with the community, updating investors on project developments, and promoting the token's adoption.

Ongoing marketing efforts and strategic partnerships can drive demand for the token and contribute to its long-term success.

This step-by-step process allows project teams to launch a successful IDO and raise funds to support their crypto project.

The IDO model has launched successful crypto projects. Here are a few notable examples:

Raven Protocol, a decentralized deep-learning training protocol, conducted one of the first IDOs in June 2019. The project aimed to transform the AI and machine learning industries by leveraging blockchain technology. Through their IDO, Raven Protocol raised funds and gained exposure on the Binance DEX.

The Universal Market Access (UMA) protocol, which enables DeFi developers to create synthetic assets on the Ethereum blockchain, also conducted a successful IDO.

Despite initial issues during the IDO launch, UMA overcame challenges and achieved significant growth. The project's token, UMA, has gained traction in recent times.

SushiSwap, a decentralized exchange built on Ethereum, launched through an IDO and quickly gained popularity as an alternative to Uniswap. It allowed users to migrate over $1.14 billion worth of assets from Uniswap to SushiSwap. The IDO model enabled SushiSwap to distribute its tokens fairly, without favoritism towards insiders or early investors.

These successful projects demonstrate the potential of IDOs as a fundraising model. By leveraging the decentralized nature of DEXs, projects can raise funds, gain exposure, and build a community around their tokens.

Like any fundraising model, IDOs have their own advantages and disadvantages. Understanding these pros and cons is essential for project teams considering the IDO approach.

Advantages of IDOs

Disadvantages of IDOs

Despite these disadvantages, IDOs offer a promising alternative to traditional fundraising models. With proper precautions and education, the IDO model has the potential to drive innovation, support new projects, and foster a more inclusive crypto ecosystem.

While IDOs have gained popularity, there are other fundraising options available to crypto projects. Other alternatives include:

Each fundraising method has pros and cons, and project teams should carefully consider their goals, resources, and target audience before choosing the most suitable approach.

While ICOs and IDOs are both fundraising models in the crypto space, they differ in several key aspects:

Project teams and investors must understand these differences when considering their fundraising options and evaluating potential investment opportunities.

The future of Initial DEX Offerings (IDOs) looks promising as the crypto industry continues to evolve. IDOs have gained traction due to their decentralized and transparent nature, offering an alternative to traditional fundraising models.

While they may face scalability challenges and technical vulnerabilities, ongoing advancements in blockchain technology and user-friendly interfaces are expected to address these issues.

As the DeFi space matures, more projects will likely explore IDOs as a fundraising option. Educational initiatives and improved accessibility will be crucial in attracting more investors, including those new to crypto.

Also, regulatory frameworks may evolve to provide more precise guidelines for IDOs, striking a balance between innovation and investor protection.

The future of IDOs also depends on developing DEXs as scalable and user-friendly platforms. Improvements in liquidity, trading interfaces, and security measures will enhance the overall IDO experience, attracting more projects and investors to participate.

In conclusion, IDOs have emerged as a decentralized and fair fundraising model in the crypto industry. While they have advantages and challenges, IDOs offer an inclusive and transparent approach to raising funds for innovative projects.

As the crypto ecosystem continues to evolve, IDOs are expected to play a significant role in shaping the future of fundraising in the digital asset space.

Disclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

In the ever-evolving world of cryptocurrencies, meme coins have gained significant attention. One such meme coin that has caught the interest of investors and enthusiasts is Pepe Coin.

With its unique branding and community-driven approach, Pepe Coin has created a buzz in the market. In this article, we will delve into the future prospects of Pepe Coin, providing a comprehensive price prediction analysis for 2025 and 2030.

Before diving into the price prediction, let's take a closer look at Pepe Coin's fundamentals and historical performance.

Pepe Coin, an ERC-20 token built on the Ethereum blockchain, aims to reimagine the character's positive image and provide a platform for its dedicated community.

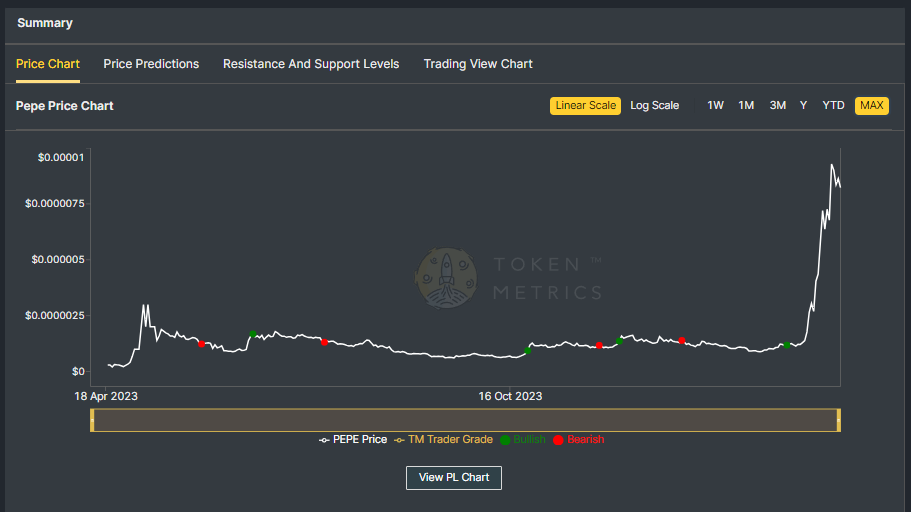

As of today 12th March 2024, The coin has a current price of $0.00000831 and a market cap of $3.49B. With a circulating supply of 420,690,000,000,000 PEPE, Pepe Coin has experienced significant volatility in the market.

Pepe Coin's historical performance provides insights into its price movements and market trends. The coin reached its all-time high of $0.00000852 but has since experienced a significant decline, currently trading at a highly discounted price from its peak.

The recent bearish pattern in the 4H chart and weakness in the daily trend indicate a challenging period for Pepe Coin. Also, it's important to note that the meme coin sector has witnessed pullbacks and corrections, making it crucial to analyze the broader market sentiment.

To evaluate the potential future performance of Pepe Coin, it's essential to consider its current fundamentals. The recent alteration in the multi-sig wallet's configuration, reducing the required signatures for fund transfers, has raised concerns among the crypto community.

Large token transfers to various exchanges, such as OKX, Binance, and Bybit, have triggered discussions regarding the project's transparency and distribution of tokens.

It's worth mentioning that the Pepe developers' wallet retains only 2% of the total supply, with no individual wallet holding more than 0.9% of the supply.

To forecast the potential price trajectory of Pepe Coin, we will analyze different scenarios, including a bullish market scenario and a bearish market scenario.

In a bullish market scenario where positive market sentiment prevails, Pepe Coin's price has the potential to experience significant growth. Several factors could contribute to this bullish trend, including increased adoption, technological advancements, and positive regulatory developments.

If the crypto market cap hits $3 Trillion and Pepe Coin retains its current 0.13% dominance, its price could ascend to $0.00000913.

In a more bullish scenario of the crypto market surging to $10 Trillion, Pepe Coin's price could soar to a staggering $0.0000304, resulting in a potential 7x return for investors.

It is important to note that these predictions are based on various factors and assumptions, and market conditions can change rapidly. However, bullish market sentiment and increased adoption of Pepe Coin's solutions could drive its price to new heights.

In the event of a bearish market, Pepe Coin's price could experience a correction, potentially leading to a decrease in its value. In this case, the price of Pepe Coin may face downward pressure with a decreased dominance of 0.06%.

In this scenario, If the crypto market cap hits $3 Trillion, Pepe Coin could trade around $0.00000456 in the short term and struggle to surpass $0.0000152 by 2030 even if the total crypto market cap surpasses the $10 Trillion mark.

It is crucial to consider the potential risks and challenges that Pepe Coin may face. Factors such as regulatory developments, competition from other projects, and technological advancements can affect the growth trajectory of Pepe Coin.

Also Read - Next Crypto Bull Run

To provide a more comprehensive view, let's explore the opinions of industry experts regarding the future of Pepe Coin. While there is no consensus among experts.

The Changelly platform predicts Pepe Coin could reach $0.0000540 to $0.0000630 by 2030, and experts from Coinpedia forecast that it could reach minimum and maximum prices of 0.0000037 and 0.0000073 by the end of 2025. By the end of 2030, the price of Pepe Coin could reach 0.000012 to 0.000015.

Other industry analysts have varying opinions on the future price of Pepe Coin. Ambcrypto.com predicts that Pepe Coin could reach $0.000034 to $0.000041 by 2030.

Note - Start Your Free Trial Today and Uncover Your Token's Price Prediction and Forecast on Token Metrics.

Pepe Coin's future potential lies in its ability to address real-time problems and explore new blockchain integration. The recent developments, such as the alteration in the multi-sig wallet's configuration, indicate a proactive approach from the Pepe Coin team.

Many crypto enthusiasts believe that the project's success will depend on gaining wider adoption and maintaining community engagement.

Also Read - Ripple (XRP) Price Prediction

In conclusion, the future of Pepe Coin remains uncertain, with potential for both growth and challenges. Our price prediction analysis suggests that in a bullish market scenario, the price of Pepe Coin could reach new highs, while in a bearish market scenario, it may face resistance.

It's important for investors and enthusiasts to conduct thorough research and consider the broader market trends before making any investment decisions.

As with any investment, risks are involved, and it's crucial to exercise caution and seek professional advice.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website's content as such.

Token Metrics does not recommend buying, selling, or holding any cryptocurrency. Conduct your due diligence and consult your financial advisor before making investment decisions.

%201.svg)

%201.svg)

Welcome to this comprehensive guide on upcoming crypto coins that have not yet started trading. In this article, we will explore 14 high-potential altcoins carefully selected by Ian Balina, the founder and CEO of Token Metrics. Ian has an impressive track record in the crypto space and has invested in numerous successful projects.

With a background in computer engineering and experience working at top tech companies, Ian brings a wealth of knowledge and insights to the table. His past investments include projects like Gameswift and Pixels, which have delivered significant returns for investors.

Token Metrics is a reputable platform that provides in-depth research and analysis of various blockchain projects. The team at Token Metrics has invested in over 30 different projects, carefully selecting those with the potential to provide substantial returns.

Their research has consistently delivered alpha in the form of hidden gems and early-stage investments.

The 14 projects featured in this article have been carefully chosen based on specific criteria. These criteria include a high tech score of 75% or above, strong fundamentals, long-term staying power, and the potential to enter the top 100 market cap.

It's important to note that investing in early-stage projects carries inherent risks, and individuals should conduct their own research and exercise caution.

Managing risk is crucial when investing in cryptocurrencies. One key strategy is to diversify your portfolio and not invest more than 5% of your total portfolio into any single project.

Token Metrics Ventures, for example, only allocates a maximum of 1% of its portfolio to early-stage projects. This ensures that the overall impact on the portfolio is minimized even if a project fails.

It's also important to stay updated on the latest market trends, news, and developments within the crypto industry. Also, setting realistic expectations and understanding that investing in early-stage projects carries both high potential rewards and high risks is essential.

Conducting thorough research and analyzing the team, technology, and market conditions can somewhat mitigate risks.

Now, let's delve into the 14 high-potential altcoins that have not yet started trading.

Gravity, also known as GRVT, is a next-generation hybrid ZK Sync crypto exchange that aims to bring together decentralized finance (DeFi) and centralized finance (C-Fi). It offers self-custody with low fees, making it easy for users to trade. Gravity's key narratives include ZK Sync, DeFi, and DEXes.

One of the reasons why Token Metrics is excited about Gravity is its backing by a strong list of market makers, including QCP, Susquehanna Group, and Dolphy Digital. These institutional backers provide credibility and support to the project.

The vibe of Gravity is reminiscent of GMX from the previous cycle, which saw significant success. There is a confirmed airdrop for Gravity, making it an attractive option for potential investors.

Nillion is a highly technical project that aims to build a blind computer for decentralized trust. It focuses on sharing secure data storage and privacy for AI, Deepin, and IoT applications. With a tech score of 77%, Nillion is a project that stands out due to its technical capabilities.

The key narrative for Nillion revolves around computing, privacy, AI, and Deepin. It competes with projects like Chainlink, Render, Ocean, and Marlin. Nillion's team comprises experienced professionals from major tech companies like Google, Facebook, Apple, and Uber. This expertise contributes to the project's strong technical foundation.

The vibes of Nillion are similar to those of Chainlink, a project that has proven its long-term staying power. Nillion's probable airdrop makes it an intriguing option for investors looking to capitalize on its potential.

My Pet Hooligan is an exciting gaming project that allows users to adopt and train digital pets in an interactive world. Players can engage in various activities, including fighting and gaming. With a fundamental score of 77%, My Pet Hooligan has received positive feedback and has already generated over $60 million in NFT sales.

The gaming industry has experienced significant growth in recent years, and My Pet Hooligan aims to tap into this market. The project's confirmed airdrop and play-to-earn game mechanics make it an attractive opportunity for investors.

The vibes of My Pet Hooligan are reminiscent of Axie Infinity, a project that has seen tremendous success and has become a major player in the gaming sector.

Parcl is a unique project that aims to create a platform for trading real estate market values using city indexes. It effectively creates a derivatives market for real estate indices, allowing users to go long or short on different markets without directly owning the physical assets. With a fundamental score of 77%, Parcl stands out as a project with long-term staying power.

One of the reasons why Token Metrics is bullish on Parcl is its ability to survive bear markets. Similar to how Synthetix performed well during a bear market, Parcl provides an on-ramp for investors to trade real estate markets.

The vibes of Parcl are reminiscent of Helium Network, a project that has demonstrated long-term growth and resilience. There is a confirmed airdrop for Parcl, making it an intriguing opportunity for investors.

Nibiru is a proof-of-stake blockchain that powers decentralized applications (dApps). It focuses on DeFi, and real-world assets and acts as a layer-one solution for the Cosmos ecosystem. With a tech score of 81%, Nibiru competes with projects like Solana, Sey, Injective, Neutron, and Archway.

Token Metrics is excited about Nibiru due to its competitive advantages over similar projects. For instance, Nibiru has a higher tech score than Neutron, a project with a current valuation of $1.5 billion. This suggests that Nibiru can potentially achieve a higher valuation in the future.

The vibes of Nibiru are reminiscent of Injective, a successful project that focuses on being an L1 for DeFi. Nibiru has a confirmed airdrop, adding to its appeal to potential investors.

Ready or ReadyGG is a Web3 gaming ecosystem that aims to onboard Web2 games into the Web3 world. The project provides tools and an SDK for game developers to add Web3 components to their games. With a tech score of 81%, Ready or ReadyGG competes with projects like Gainswift and Immutable X.

One of the reasons why Token Metrics is bullish on Ready or ReadyGG is its strong business development team and rapid onboarding of gaming studios.

The project's vibes are reminiscent of Immutable X, a successful project focusing on bringing scalability to the gaming industry. Ready or ReadyGG has a probable airdrop, making it an attractive option for investors looking to capitalize on the future growth of the gaming sector.

Dolomite is a unique project that combines the strengths of a decentralized exchange (DEX) and a lending protocol. Built on Arbitrum, a layer two solution, Dolomite aims to provide a capital-efficient modular protocol for users. With a tech score of 85%, Dolomite competes with projects like DYDX, Synthetix, and GMX.

Token Metrics is excited about Dolomite due to its capital efficiency and ability to provide both DEX and lending functionalities. The project is backed by Coinbase Ventures, providing additional credibility and support.

The vibes of Dolomite are reminiscent of DYDX, a successful project that focuses on being an L1 for DeFi. Dolomite has a confirmed airdrop, making it an intriguing option for potential investors.

Movement Labs is a project that aims to build a modular blockchain network for the Move language. By making Move available on other layer two solutions like Ethereum and Avalanche, Movement Labs enables developers to code and run Move applications on various blockchains. With a tech score of 85%, Movement Labs competes with projects like Eclipse and Ethereum's rollup solutions.

Token Metrics is bullish on Movement Labs due to its potential to become a move-based ZK layer two on Ethereum. The project's vibes are reminiscent of Stacks, a successful L2 project on Bitcoin. Movement Labs has a confirmed airdrop, making it an attractive opportunity for investors looking to capitalize on the future of blockchain development.

Ola is a ZK virtual machine that enables secure private computations using zero-knowledge knowledge proofs. By bringing secure and private computations to the blockchain, Ola aims to provide users with enhanced privacy and security. With a tech score of 87%, Ola competes with projects like Elio, Aztec, and Ten (formerly known as Obscuro).

Token Metrics is excited about Ola due to its strong team, which includes former members of the Qtum project. The team's experience and expertise contribute to Ola's technical foundation.