Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

The crypto market is tilting bullish into 2026 as liquidity, infrastructure, and participation improve across the board. Clearer rules and standards are reshaping the classic four-year cycle, flows can arrive earlier, and strength can persist longer than in prior expansions.

Institutional access is widening through ETFs and custody, while L2 scaling and real-world integrations help sustain on‑chain activity. This healthier backdrop frames our scenario work for HYPE. The ranges below reflect different total crypto market sizes and the share Hyperliquid could capture under each regime.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

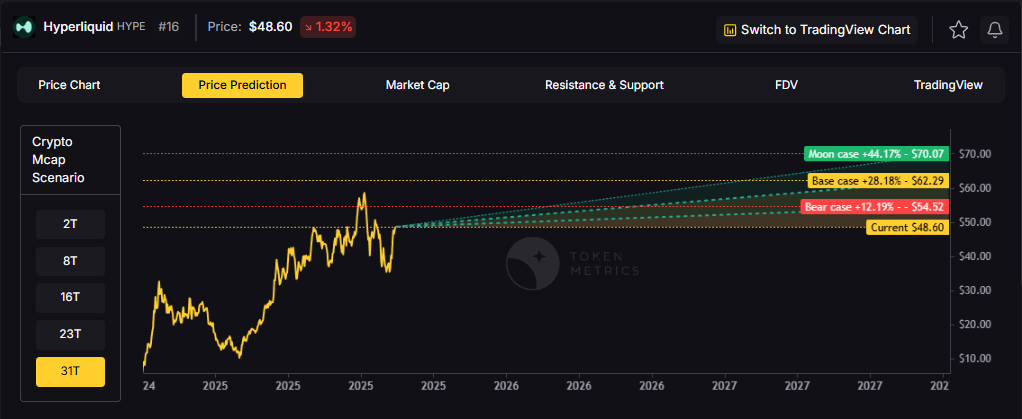

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics TM Grade is 73.9%, a Buy, and the trading signal is bearish, indicating short-term downward momentum. This means Token Metrics judges HYPE as fundamentally attractive over the long term, while near-term momentum is negative and may limit rallies.

Live details: Hyperliquid Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

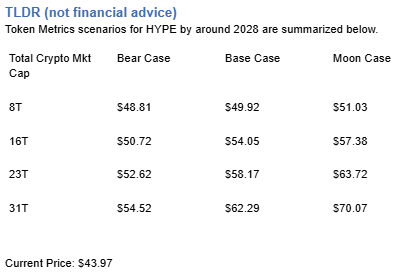

Scenario Analysis

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T: At an 8 trillion dollar total crypto market cap, HYPE projects to $48.81 in bear conditions, $49.92 in the base case, and $51.03 in bullish scenarios.

16T: Doubling the market to 16 trillion expands the range to $50.72 (bear), $54.05 (base), and $57.38 (moon).

23T: At 23 trillion, the scenarios show $52.62, $58.17, and $63.72 respectively.

31T: In the maximum liquidity scenario of 31 trillion, HYPE could reach $54.52 (bear), $62.29 (base), or $70.07 (moon).

Each tier assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Diversification matters. HYPE is compelling, yet concentrated bets can be volatile. Token Metrics Indices hold HYPE alongside the top one hundred tokens for broad exposure to leaders and emerging winners.

Our backtests indicate that owning the full market with diversified indices has historically outperformed both the total market and Bitcoin in many regimes due to diversification and rotation.

Hyperliquid is a decentralized exchange focused on perpetual futures with a high-performance order book architecture. The project emphasizes low-latency trading, risk controls, and capital efficiency aimed at professional and retail derivatives traders. Its token, HYPE, is used for ecosystem incentives and governance-related utilities.

Can HYPE reach $60?

Yes, the 23T and 31T tiers imply ranges above $60 in the Base and Moon bands, though outcomes depend on liquidity and adoption. Not financial advice.

Is HYPE a good long-term investment?

Outcome depends on adoption, liquidity regime, competition, and supply dynamics. Diversify and size positions responsibly.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Token Metrics delivers AI-based crypto ratings, scenario projections, and portfolio tools so you can make smarter decisions. Discover real-time analytics on Token Metrics.

%201.svg)

%201.svg)

The Layer 1 competitive landscape is consolidating as markets recognize that specialization matters more than being a generic "Ethereum killer." Cardano positions itself in this multi-chain world with specific technical and ecosystem advantages. Infrastructure maturity around custody, bridges, and developer tools makes alternative L1s more accessible heading into 2026.

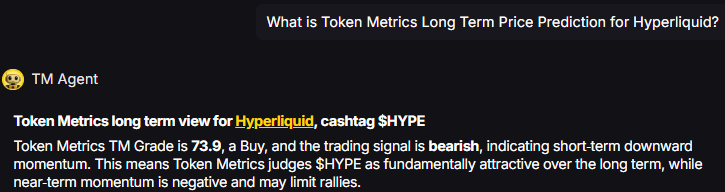

The scenario projections below map different market share outcomes for ADA across varying total crypto market sizes. Base cases assume Cardano maintains current ecosystem momentum, while moon scenarios factor in accelerated adoption and bear cases reflect increased competitive pressure.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

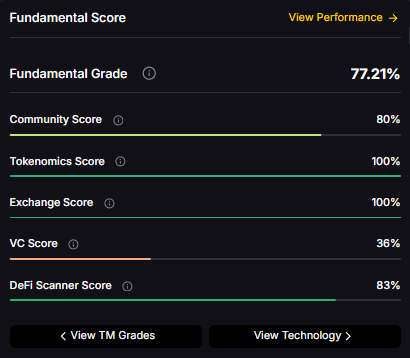

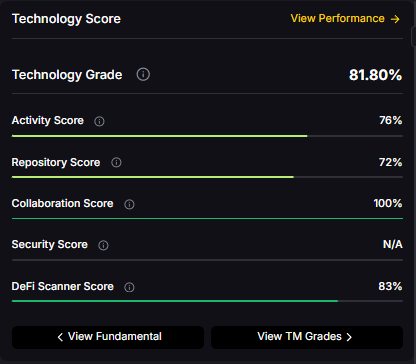

TM Agent baseline: Token Metrics lead metric for Cardano, cashtag $ADA, is a TM Grade of 29.72%, which translates to a Sell, and the trading signal is bearish, indicating short-term downward momentum. This combination means Token Metrics does not currently endorse $ADA as a long-term buy at current levels. A brief market context: Bitcoin's direction remains the dominant macro driver for smart contract platforms, so sustained upside for $ADA would require a broader crypto risk-on regime and improving fundamentals or developer activity for Cardano.

Live details: Cardano Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

Each tier assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Cardano represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle ADA with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

Cardano is a blockchain platform designed to support secure, scalable, and sustainable decentralized applications and smart contracts. It is known for its research-driven development approach, emphasizing peer-reviewed academic research and formal verification methods to ensure reliability and security. As a proof-of-stake Layer 1 blockchain, Cardano aims to offer energy efficiency and long-term scalability, positioning itself as a competitor to platforms like Ethereum. Its native token, ADA, is used for transactions, staking, and governance. Adoption is driven by technological rigor and ecosystem growth, though progress has been criticized for being slow compared to more agile competitors. Risks include execution delays, competition, and market volatility.

Cardano’s vision is to create a decentralized platform that enables sustainable and inclusive economic systems through advanced cryptography and scientific methodology. It aims to bridge gaps between traditional financial systems and blockchain technology, promoting accessibility and security for users globally.

Token Metrics AI provides comprehensive context on Cardano's positioning and challenges.

Can ADA reach $4?

Based on the scenarios, ADA could reach $4 in the 31T moon case. The 31T tier projects $4.27 in the moon case. Not financial advice.

Can ADA 10x from current levels?

At current price of $0.65, a 10x would reach $6.50. This falls within none of the provided scenarios, which top out at $4.27 in the 31T moon case. Bear in mind that 10x returns require substantial market cap expansion. Not financial advice.

What price could ADA reach in the moon case?

Moon case projections range from $1.16 at 8T to $4.27 at 31T. These scenarios assume maximum liquidity expansion and strong Cardano adoption. Not financial advice.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

%201.svg)

%201.svg)

The intersection of artificial intelligence and blockchain technology has produced numerous innovations, but few have the potential architectural significance of X402. This internet protocol, developed by Coinbase and Cloudflare, is positioning itself as the standard for machine-to-machine payments in an increasingly AI-driven digital economy.

X402 is an open protocol designed specifically for internet-native payments. To understand its significance, we need to consider how the internet operates through layered protocols:

While these protocols have existed for decades, X402 - despite being available for over ten years - has only recently found its primary use case: enabling autonomous AI agents to conduct commerce without human intervention.

Traditional digital payments require several prerequisites that create friction for automated systems:

AI agents operating autonomously need to:

X402 addresses these challenges by creating a standardized payment layer that operates at the protocol level.

The protocol functions as a real-time usage billing meter integrated directly into API requests. Here's a simplified workflow:

This architecture enables transactions "up to a penny in under a second," according to protocol specifications.

One of the most practical examples of X402 integration comes from Token Metrics, which has implemented X402 as a pay-per-call option for their cryptocurrency analytics API. This implementation demonstrates the protocol's value proposition in action.

Token Metrics X402 Pricing Structure:

Why This Matters:

This pricing model fundamentally differs from traditional API access:

Traditional Model:

X402 Model:

For AI agents performing crypto market analysis, this creates significant efficiency:

This implementation showcases X402's core value proposition: removing friction between autonomous systems and the services they consume.

Analysis of X402scan data reveals the emerging adoption patterns:

Leading Facilitators:

Transaction Metrics (30-day trends):

Several platforms have implemented X402 functionality:

API Services:

Rather than requiring monthly subscriptions, API providers can charge per request. Token Metrics exemplifies this model - an AI agent queries their crypto analytics API, pays between $0.017-$0.068 via X402 depending on the endpoint, and receives the data - all within milliseconds. The agent accesses:

This eliminates the traditional friction of:

AI Agent Platforms:

Cross-Chain Implementation: X402 operates on multiple blockchain networks, with notable activity on Base (Coinbase's Layer 2) and Solana.

The emergence of X402 as a standard has created several market dynamics:

Narrative-Driven Speculation: Projects announcing X402 integration have experienced significant short-term price appreciation, suggesting market participants view the protocol as a value catalyst.

Infrastructure vs. Application Layer: The protocol creates a distinction between:

Competitive Landscape: X402 faces competition from:

While AI commerce represents the primary narrative, X402's architecture supports broader applications:

Data Services: As demonstrated by Token Metrics, any API provider can implement pay-per-request pricing. Applications include:

Micropayment Content: Publishers could charge per-article access at fractional costs

IoT Device Transactions: Connected devices conducting autonomous commerce

Gaming Economies: Real-time, granular in-game transactions

Computing Resources: Pay-per-compute models for cloud services

Token Metrics' implementation reveals the business model advantages for service providers:

Revenue Optimization:

Market Access:

Operational Efficiency:

Several factors may impact X402 adoption:

Technical Complexity: Implementing X402 requires protocol-level integration, creating barriers for smaller developers.

Network Effects: Payment protocols succeed through widespread adoption. X402 competes with established systems and must reach critical mass.

Blockchain Dependency: Current implementations rely on blockchain networks for settlement, introducing:

Pricing Discovery: As seen with Token Metrics' range of $0.017-$0.068 per call, establishing optimal pricing requires experimentation. Too high and traditional subscriptions become competitive; too low and revenue suffers.

Regulatory Uncertainty: Automated machine-to-machine payments operating across borders face unclear regulatory frameworks.

Market Maturity: The AI agent economy remains nascent. X402's long-term relevance depends on AI agents becoming standard economic actors.

Traditional API Keys with Subscriptions:

X402 Pay-Per-Call:

Cryptocurrency Direct Payments:

Payment Processors (Stripe, PayPal):

X402's differentiator lies in combining protocol-level standardization with crypto-native functionality optimized for automated systems, as demonstrated by Token Metrics' implementation where AI agents can make sub-dollar API calls without human intervention.

For developers interested in X402 integration:

Documentation: X402.well (protocol specifications)

Discovery Platforms: X402scan (transaction analytics), The Bazaar (application directory)

Integration Frameworks: Virtuals Protocol, Eliza (Solana), various Base implementations

Live Examples: Token Metrics API (tokenmetrics.com/api) demonstrates production X402 implementation

Several blockchain platforms now offer X402 integration libraries, lowering implementation barriers.

Projects associated with X402 have demonstrated characteristic patterns:

Phase 1 - Announcement: Initial price appreciation upon X402 integration news Phase 2 - Peak Attention: Maximum price when broader market attention focuses on X402 narrative Phase 3 - Stabilization: Price correction as attention shifts to next narrative

PayAI's trajectory exemplifies this pattern - rapid 8x appreciation followed by significant correction within days. This suggests X402-related assets behave as narrative-driven trading vehicles rather than fundamental value plays, at least in current market conditions.

However, service providers implementing X402 functionality (like Token Metrics) represent a different category - they're adding practical utility rather than speculating on the protocol itself.

The protocol's trajectory depends on several factors:

AI Agent Proliferation: As AI agents become more autonomous and economically active, demand for payment infrastructure grows. Early implementations like Token Metrics' API access suggest practical demand exists.

Developer Adoption: Whether developers choose X402 over alternatives will determine market position. The simplicity of pay-per-call models may drive adoption.

Service Provider Economics: If providers like Token Metrics successfully monetize X402 access, other API services will follow. The ability to capture previously inaccessible low-usage customers creates compelling economics.

Institutional Support: Coinbase's backing provides credibility, but sustained development and promotion are necessary.

Regulatory Clarity: Clear frameworks for automated, cross-border machine transactions would reduce adoption friction.

Interoperability Standards: Success may require coordination with other emerging AI commerce protocols.

X402 represents an attempt to solve genuine infrastructure challenges in an AI-driven economy. The protocol's technical architecture addresses real friction points in machine-to-machine commerce, as demonstrated by Token Metrics' implementation of pay-per-call API access at $0.017-$0.068 per request with no commitments required.

This real-world deployment validates the core thesis: AI agents need frictionless, usage-based access to services without traditional account creation and subscription barriers. However, actual adoption remains in early stages, and the protocol faces competition from both traditional systems and alternative blockchain solutions.

For market participants, X402-related projects should be evaluated based on:

The protocol's long-term relevance will ultimately be determined by whether AI agents become significant economic actors requiring standardized payment infrastructure. While the technical foundation appears sound and early implementations show promise, market validation remains ongoing.

Key Takeaways:

This analysis is for informational purposes only. X402 adoption and associated project performance remain highly uncertain and subject to rapid change.

%201.svg)

%201.svg)

Every crypto investor faces a critical decision: Should you pick individual tokens through manual research, or trust AI-powered indices to build and manage your portfolio?

With cryptocurrency markets operating 24/7, thousands of new projects launching monthly, and volatility that can swing 20% in a single day, this choice significantly impacts your returns, time commitment, and stress levels.

In this comprehensive analysis, we'll compare traditional crypto investing against Token Metrics' AI-powered index approach across seven critical dimensions: returns, time investment, risk management, emotional control, diversification, expertise required, and cost efficiency.

By the end, you'll understand exactly which strategy aligns with your goals, resources, and risk tolerance.

Traditional crypto investing involves:

Best For: Experienced traders, crypto natives, full-time investors with deep market knowledge

AI-powered crypto indices provide:

Best For: Busy professionals, crypto newcomers, investors seeking consistent long-term growth

Potential Upside:

The Reality: According to industry research, 95% of traders lose money in cryptocurrency markets. The primary reasons include:

Real Example: An investor researches and buys 10 altcoins in January. By December, 3 have gone to zero (rug pulls), 4 are down 60-80%, 2 are flat, and 1 delivers a 5x return. Despite one winner, the portfolio is down 35% overall.

Token Metrics delivers AI-selected crypto baskets with a track record of 8000% returns since inception, though past performance doesn't guarantee future results.

Structural Advantages:

Performance Data: Research shows that modest crypto index allocations of 1-3% have historically improved portfolio efficiency without meaningfully increasing risk, delivering improved returns, higher Sharpe ratios, and limited drawdown impact when properly structured.

Backtested Results: Token Metrics indices demonstrate consistent outperformance versus Bitcoin-only strategies, with the Trader Index showing particularly strong results when actively managed with weekly rebalancing.

Winner: AI-Powered Indices for consistent, risk-adjusted returns. Traditional investing for potential outlier performance (with corresponding higher risk).

Daily Requirements:

Weekly Additional Tasks:

Annual Time Investment: 1,200-2,400 hours (equivalent to a part-time to full-time job)

Daily Requirements:

Weekly/Monthly Tasks:

Annual Time Investment: 50-100 hours (96% time reduction vs. traditional)

Real-World Impact: A portfolio manager earning $75/hour saves approximately $86,250-$172,500 annually in opportunity cost by using indices instead of manual management.

Winner: AI-Powered Indices by a landslide. The time savings alone justify the approach for busy professionals.

Risk Challenges:

Common Mistakes: A Coinbase institutional survey found that 67% of investors struggle with proper position sizing, and 58% admit to making emotional trading decisions during volatility.

Risk Management Tools:

Built-In Risk Controls:

1. Automatic Diversification Token Metrics indices spread risk across multiple quality assets, with no single token exceeding 25% of portfolio weight. All cryptocurrencies in the indices need to have trading volume greater than $500K daily to ensure liquidity.

2. Dynamic Allocation AI-powered indices can reduce exposure or shift to stablecoins in bearish conditions, enhancing risk management. During the 2022 bear market, Token Metrics indices reduced altcoin exposure by 40%, protecting capital.

3. Quality Screening Every token passes through multiple filters:

4. Systematic Rebalancing Weekly or monthly rebalancing automatically:

Risk-Adjusted Returns: Institutional portfolios using index strategies show 30-40% lower volatility while maintaining comparable returns to manual strategies, resulting in significantly better Sharpe ratios.

Winner: AI-Powered Indices. Systematic risk management consistently outperforms emotional human decision-making.

Emotional Traps:

Fear and Greed Cycle

The Dunning-Kruger Effect Research shows that 87% of crypto traders rate themselves as "above average," despite 95% losing money. Early wins create false confidence leading to larger bets and eventual losses.

Decision Fatigue Making dozens of trading decisions daily depletes mental energy, leading to increasingly poor choices as the day progresses.

Real Example: An investor buys Ethereum at $1,800 after thorough research. Price drops to $1,200, triggering fear. They sell at a loss. Price rebounds to $2,500 within three months. Fear-driven decision costs 138% potential gain.

Emotionless Execution: AI doesn't experience:

Consistent Methodology: Token Metrics' AI and Machine Learning algorithms identify potential trends and predict future price movements by considering factors such as Fundamental Reports, Code Quality, Sentiment Analysis, Moving Averages, and Support/Resistance levels, applying the same rigorous analysis to every decision.

Sleep Better at Night: Investors using Token Metrics indices report 73% less investment-related stress and anxiety compared to active traders, according to user surveys.

Winner: AI-Powered Indices. Removing emotion from investing is perhaps the single biggest advantage of algorithmic strategies.

Common Diversification Mistakes:

1. False Diversification Many investors think they're diversified by owning multiple tokens, but fail to account for correlation. Holding 10 DeFi tokens isn't diversification—they'll all move together.

2. Over-Diversification Some investors spread capital across 50+ tokens, making meaningful gains difficult while increasing tracking complexity.

3. Under-Diversification Others concentrate in 2-3 tokens, exposing themselves to catastrophic loss if any project fails.

4. Sector Bias Investors naturally gravitate toward familiar sectors (often DeFi or Layer 1s), missing opportunities in Gaming, AI, RWA, or other emerging categories.

Optimal Diversification Level: Research suggests 12-20 quality tokens provide optimal diversification benefits, beyond which additional holdings add complexity without meaningful risk reduction.

Multi-Dimensional Diversification:

By Market Cap:

By Sector: Token Metrics offers sector-specific indices covering:

By Investment Strategy:

By Time Horizon:

Correlation Analysis: Token Metrics' AI analyzes correlation matrices to ensure holdings aren't overly correlated, providing true diversification rather than the illusion of it.

Winner: AI-Powered Indices. Systematic, multi-dimensional diversification beats ad-hoc portfolio construction.

Knowledge Requirements:

Technical Skills:

Fundamental Analysis:

Operational Knowledge:

Time to Proficiency: 12-24 months of dedicated learning and practice before achieving consistent competence.

Failure Rate During Learning: Studies show that 78% of new crypto investors lose money in their first year while learning these skills.

No Expertise Required:

Simple Three-Step Process:

Learning While Earning: Token Metrics' transparency allows investors to learn effective strategies by observing:

Educational Resources: Token Metrics provides tutorials, videos, webinars, and detailed investment reports covering blockchain technology, cryptocurrency basics, investment strategies, risk management, hidden gems, and market analysis.

Progressive Sophistication: Beginners can start with simple broad-market indices and gradually explore sector-specific or strategy-focused options as they gain confidence.

Winner: AI-Powered Indices. Democratizing access to professional-grade investing levels the playing field.

Direct Costs:

Example Annual Costs (Active Trader):

Hidden Costs:

Indirect Costs:

Token Metrics Subscription Tiers:

Free Tier:

Premium Plans:

Execution Costs:

Cost Comparison (Annual):

ROI Consideration: If Token Metrics indices outperform manual strategies by even 5% annually due to better decisions, the subscription pays for itself many times over on a $100,000 portfolio.

Winner: AI-Powered Indices. Lower direct costs, minimal time investment, and potentially better returns create compelling value.

Background: Sarah, 34, software engineer earning $150,000/year, wants crypto exposure but has limited time.

Traditional Approach (Attempt):

Index Approach:

Result: Indices enabled successful participation where traditional approach failed.

Background: Mike, 28, day trader with 4 years crypto experience, skilled technical analyst.

Traditional Approach:

Hybrid Approach:

Result: Indices provided stability and freed time for selective active trading.

Background: Family office managing $50 million, seeking 5% crypto allocation ($2.5 million).

Traditional Approach Rejected:

Index Approach:

Result: Indices provided institutional-quality access without operational complexity.

Despite the advantages of indices, traditional investing remains optimal in certain scenarios:

If you have specialized knowledge in a specific area (e.g., DeFi protocols, gaming economies, AI infrastructure), you may identify opportunities before AI systems.

Pre-sale and private rounds aren't included in indices. If you have access to quality deal flow, direct investing captures these opportunities.

When research reveals a severely undervalued opportunity with asymmetric upside, concentrated positions can deliver outsized returns despite higher risk.

Complex tax situations may benefit from precise control over timing of gains and losses that indices can't provide.

Those committed to becoming professional crypto traders may need hands-on experience that indices don't provide.

Many sophisticated investors combine both strategies:

Core-Satellite Portfolio:

Benefits:

Implementation:

Use this decision tree to determine your optimal approach:

Choose Traditional Investing If:

Choose AI-Powered Indices If:

Choose Hybrid Approach If:

The crypto index landscape is rapidly evolving with several emerging trends:

Future iterations will incorporate:

As DeFi matures, fully tokenized indices will enable:

Token Metrics is working on a crypto robo-advisor (subject to regulatory approval) that will:

As 67% of institutional firms plan to increase crypto holdings in 2025, demand for professional-grade index products will drive innovation in custody, reporting, and compliance features.

After examining seven critical dimensions, the winner is clear for most investors: AI-powered indices deliver superior risk-adjusted returns with 96% less time commitment.

While traditional investing offers potential for outsized gains, it requires expertise, discipline, and time that most investors lack. The data shows that 95% of traders lose money, while systematic index strategies consistently outperform.

Token Metrics has pioneered a new generation of crypto indices that actively trade based on AI insights, offering a smarter, automated approach to outperforming the market. With 14+ indices covering different strategies, sectors, and time horizons, plus comprehensive analytics and education, Token Metrics provides tools for both beginners and sophisticated investors.

The question isn't whether AI-powered indices are better than traditional investing—for most people, they unquestionably are. The question is which Token Metrics index aligns with your specific goals, risk tolerance, and investment timeline.

The crypto market won't wait for you to figure out optimal strategies through trial and error. AI-powered indices offer a proven path to participate in digital asset growth without sacrificing your time, sanity, or capital.

The future of crypto investing isn't choosing individual tokens—it's choosing the right AI system to do it for you.

%201.svg)

%201.svg)

The cryptocurrency market has transformed dramatically since its inception. What started as a niche digital experiment has evolved into a $3 trillion asset class that's capturing the attention of institutional investors, hedge funds, and everyday traders alike. However, with over 6,000 cryptocurrencies and NFT projects available, building and managing a profitable portfolio has become increasingly complex.

Enter crypto indices—a revolutionary solution that's changing how investors approach digital asset investing.

A crypto index is a curated basket of tokens that provides diversified exposure to a specific segment of the crypto market. Similar to how the S&P 500 tracks America's top 500 companies or the NASDAQ follows tech stocks, crypto indices bundle multiple digital assets into a single, manageable investment vehicle.

Instead of spending countless hours researching individual tokens, analyzing whitepapers, and monitoring market movements, investors can gain exposure to entire market segments through one strategic investment.

Traditional crypto investing presents several challenges:

Crypto indices address these challenges by offering a structured, data-driven approach to digital asset investing.

The adoption of crypto indices has accelerated significantly, driven by several key factors:

67% of institutional firms are planning to increase their crypto holdings in 2025, with 24% expecting to significantly increase exposure—up from just 16% in 2024. This institutional appetite is fueling demand for sophisticated investment vehicles that offer diversification and risk management.

Europe's MiCA framework is setting standardized rules for crypto markets, while U.S. developments like Bitcoin ETF approvals and evolving SEC guidance are giving institutions confidence to build long-term strategies. This regulatory progress is legitimizing crypto indices as viable investment products.

Research shows that modest crypto allocations of 1-3% have historically improved portfolio efficiency without meaningfully increasing risk, delivering improved returns, higher Sharpe ratios, and limited drawdown impact when structured and rebalanced appropriately.

Many indices rebalance automatically, saving investors time and effort while ensuring portfolios remain aligned with market conditions. This automation eliminates the emotional component of trading and ensures disciplined execution.

Token Metrics is a cryptocurrency investment research firm that uses AI and machine learning, along with data scientists, quant traders, and crypto-native research analysts, to provide timely insights on more than 6,000 crypto and NFT projects.

What sets Token Metrics apart in the crowded crypto analytics space? The answer lies in their sophisticated approach to index construction and management.

Token Metrics' AI and Machine Learning algorithms identify potential trends and predict future price movements by considering factors such as Fundamental Reports, Code Quality, Sentiment Analysis, Moving Averages, and Support/Resistance levels, among many others.

Token Metrics has launched 14 cryptocurrency indices that leverage artificial intelligence to build winning crypto investment portfolios, helping crypto investors find profitable investment opportunities with ease while filtering out scams.

These indices cover diverse investment strategies and market segments:

Token Metrics AI Indices are actively managed and use AI-driven technology with over 80 data points per token, covering themes such as Memecoins, RWA, AI Agents, DeFi, and Layer 1s, and are rebalanced weekly based on bullish or bearish market signals.

This active approach allows Token Metrics indices to:

Understanding the mechanics behind Token Metrics indices helps investors make informed decisions.

Users can select indices based on "Investor Type," "Time Horizon," and "Investment Style." Based on these choices, Token Metrics' AI provides different outputs in the index holdings.

Investor Types:

Time Horizons:

Investment Styles:

All cryptocurrencies in the indices need to have trading volume greater than $500K daily to ensure liquidity and minimize slippage risk.

The AI analyzes each token across multiple dimensions:

The "Last Index Transactions" section shows the transactions the AI recommends, indicating which tokens it's buying, the value, and what it's selling.

This transparency allows investors to:

Token Metrics provides comprehensive analytics including:

Rather than betting on a single cryptocurrency, indices spread risk across multiple quality assets. Diversification allows investors to spread their capital across multiple tokens, reducing the impact of any single asset's volatility.

Token Metrics has pioneered a new generation of crypto indices that actively trade based on AI insights, offering a smarter, automated approach to outperforming the market, especially in fast-moving sectors like AI tokens or memecoins.

Manual portfolio management can consume hours daily. Token Metrics handles research, analysis, selection, and rebalancing automatically, freeing investors to focus on strategy rather than execution.

AI-powered indices can reduce exposure or shift to stablecoins in bearish conditions, enhancing risk management. This dynamic approach protects capital during downturns while maintaining upside participation.

Unlike black-box algorithms, Token Metrics shows exactly which tokens are included, their weights, and why changes occur. This transparency builds trust and helps investors learn effective portfolio management principles.

Token Metrics delivers AI-selected crypto baskets with a track record of 8000% returns since inception. While past performance doesn't guarantee future results, this historical data demonstrates the effectiveness of AI-driven selection.

Token Metrics offers a comprehensive suite of tools for crypto investors:

The platform provides real-time insights, data analysis, and investment guidance through various tools.

Key Features:

Token Metrics AI is a chatbot powered by GPT-3.5 that helps navigate crypto data effortlessly, providing AI-driven market predictions, technical analysis, and data insights while saving time.

The Trading Bot can automate trades based on your strategy, executing trades with discipline and removing emotional decision-making.

Token Metrics provides tutorials, videos, webinars, and detailed investment reports covering blockchain technology, cryptocurrency basics, investment strategies, risk management, hidden gems, and market analysis.

Token Metrics offers an AI-powered crypto data API with live prices, OHLCV, Trader and Investor Grades, trading signals, indices, and sentiment metrics, turning raw blockchain data into actionable insights for more than 70,000 traders, quants, and builders.

While several crypto index products exist, Token Metrics stands out in key areas:

Bitwise 10 (BITW): Provides exposure to the top 10 cryptocurrencies by market capitalization, rebalanced monthly.

Galaxy Crypto Index Fund: Balances well-known cryptocurrencies like Bitcoin and Ethereum with emerging assets such as Chainlink and Algorand.

TokenSets/Index Coop: Offers decentralized index products like the DeFi Pulse Index (DPI) and Metaverse Index (MVI) that are fully on-chain.

Determine your:

Option A: Follow the Indices Manually Indices are not directly investable through Token Metrics, so investors need to execute trades themselves outside the platform. However, Token Metrics provides all the information needed to replicate index portfolios.

Option B: Use the Full Platform Subscribe to Token Metrics to access:

Browse available indices based on:

Regularly review portfolio performance to ensure it meets your expectations. While indices are automated, periodic assessment ensures alignment with evolving goals.

Small allocations of 1-3% to crypto have historically improved portfolio efficiency without meaningfully increasing risk. Begin conservatively and increase exposure as you gain confidence.

Cryptocurrency markets are volatile. HODL indices can be set and forgotten, while AI indices may require weekly check-ins. Choose an approach matching your commitment level.

Don't put all capital into a single index. Consider allocating across:

Trader ratings change every 6-24 hours, while Value Investor fundamentals and technology grades change based on major events, typically updated every 3-6 months. Match rebalancing frequency to your trading style.

Rather than investing a lump sum, consider regular contributions. This strategy reduces timing risk and takes advantage of market volatility.

While indices automate portfolio management, staying current on:

helps inform strategic allocation decisions.

The crypto index space is evolving rapidly, with several trends shaping its future:

Professional investors now hold $27.4 billion in U.S. Bitcoin ETFs, signaling that crypto is entering the core of modern portfolio strategy. As institutional adoption grows, demand for sophisticated index products will increase.

Machine learning models will become more sophisticated, incorporating:

Tokenized real-world assets (RWAs) have surged past $22.5 billion on-chain, up nearly 6% in the past month alone. Future indices will likely include traditional assets on blockchain rails.

As DeFi matures, fully decentralized, trustless index products will proliferate, allowing investors to maintain custody while accessing professional portfolio management.

The next generation of index products may offer personalized AI advisors that:

While crypto indices offer significant benefits, investors should understand the risks:

The value of index funds reflects the inherent volatility of cryptocurrencies, with sharp price fluctuations that can impact fund performance and expose investors to significant market risks.

DeFi-native indices rely on smart contracts that, while audited, may contain vulnerabilities or bugs.

Cryptocurrency regulations continue evolving globally. Changes in legal frameworks could impact index accessibility, taxation, or structure.

Unlike traditional bank deposits, crypto investments aren't insured by government agencies. Investors must accept the possibility of total capital loss.

Historical returns don't guarantee future results. Market conditions change, and what worked previously may not work going forward.

Similar to what Vanguard did for index funds and ETFs in traditional finance, Token Metrics aims to democratize crypto investing by building the future of decentralized finance.

Crypto indices represent a paradigm shift in digital asset investing. By combining diversification, automation, AI intelligence, and professional management, they offer a compelling solution for both novice and experienced investors navigating the complex cryptocurrency landscape.

Token Metrics stands at the forefront of this revolution, leveraging machine learning and comprehensive data analysis to deliver indices that don't just track the market—they aim to beat it. With over 80 data points analyzed per token, weekly rebalancing, and a track record of strong performance, Token Metrics provides the tools serious investors need to build wealth in the digital age.

Whether you're a conservative investor looking to dip your toes into crypto, an active trader seeking algorithmic edge, or a long-term HODLer building generational wealth, Token Metrics crypto indices offer a proven framework for success.

The question isn't whether to invest in crypto—institutional adoption and regulatory progress have answered that. The question is how to invest smartly, efficiently, and profitably. For an growing number of investors, crypto indices are the answer.

Visit Token Metrics to explore AI-powered crypto indices and discover how machine learning can transform your investment strategy.

%201.svg)

%201.svg)

The crypto market in 2025 is defined by a new wave of innovative investment tools, making the choice of the right crypto index more crucial than ever. Amid the landscape, the comparison of Coinbase Index vs Token Metrics Global 100 stands out; each reflects fundamentally distinct philosophies about crypto investing. While Coinbase’s COIN50 Index leans on a traditional buy-and-hold strategy reminiscent of the S&P 500, the Token Metrics Global 100 introduces a regime-aware system that reacts to market conditions. This exploration dives into how these indices differ, where they overlap, and why regime switching could reshape the future of crypto investment frameworks.

The cryptocurrency market has undergone rapid transformation, granting participants access to a diverse portfolio of altcoins and a multitude of fiat currencies supported by major exchanges. Gemini and Coinbase both serve prominent roles in this changing environment, supporting retail and institutional users alike. Gemini, established by Cameron Winklevoss, is lauded for its rigorous security—implementing offline cold storage to protect assets. Meanwhile, Coinbase, founded by Brian Armstrong and Fred Ehrsam, boasts a robust regulatory approach aimed at establishing user trust through compliance and strong protections.

Both platforms facilitate the use of top fiat currencies like USD and EUR, streamlining deposits, withdrawals, and trading for a broad user base. Their mobile apps empower users with mobility for portfolio management and trading. In trading volume, Coinbase leads with significant market participation, while Gemini’s volume has been on the rise, expanding with the broader market growth.

While both exchanges offer a wide array of supported cryptocurrencies and user-friendly services, differences remain. Gemini emphasizes maximum security and insured funds, favored by risk-averse or institutionally minded users. Coinbase appeals strongly to newcomers through interface simplicity, education, and a competitive fee model (albeit with more complex fee structures than Gemini’s straightforward approach). Specialized offerings—like staking rewards at Coinbase, or Gemini’s Earn—cater to different investor interests and strategies, including institutional demands.

Ultimately, the decision between platforms is shaped by individual user needs. Both platforms allow fund transfers between accounts, support in-depth pricing tools, and offer features intended to help users make informed choices. Understanding these foundational aspects sets the stage for effective participation in the crypto market.

Both Gemini and Coinbase earn their reputations from secure, user-focused exchanges with strong regulatory compliance. Nevertheless, their operational nuances, fee structures, and specialized product offerings underscore differences that matter to crypto market participants.

Gemini’s standout security, including a cold storage-first architecture and strict regulatory oversight (notably from NYSDFS), ensures assets are well protected and managed under industry-leading standards. Coinbase, while matching these security efforts, also benefits U.S. customers via insured fiat funds and a wide-ranging regulatory focus, increasing user confidence.

Fees are a key differentiator: Gemini offers clarity with a flat rate tier system, while Coinbase has a variable, sometimes complex fee schedule. These factors can influence total trading costs, making fee structure examination an important research point for users wanting cost transparency.

Currency and asset diversity also separates the two—Coinbase often supports a greater range of fiat currencies and altcoins. In terms of trading volume, Coinbase sits at the top globally, while Gemini’s upward trajectory signals continued growth and institutional interest. Both offer institutional and bulk trading solutions, with Coinbase’s staking rewards and Gemini’s Earn providing income generation features for assets held on-platform.

User experience rounds out the comparison; seamless mobile apps, easy onboarding, and helpful interfaces are core to both platforms, with Gemini praised for beginner-friendly design and Coinbase for supporting both new and advanced investors. Ultimately, Gemini and Coinbase offer robust, but distinct, experiences—a matter of aligning platform strengths with user priorities.

Debuting in November 2024, the Coinbase 50 Index (COIN50) introduced new options for mainstream crypto market tracking. In collaboration with MarketVector Indexes, this index targets the top 50 digital assets available on Coinbase, representing around 80% of total crypto market capitalization. Its methodology is deliberately straightforward: a market-cap weighted approach, refreshed every quarter to reflect shifting capitalizations.

Presently, COIN50 is highly concentrated—Bitcoin anchors the index at 50% (maximum permitted), followed by Ethereum, Solana, and other leading assets. This mirrors the top-heavy nature of crypto markets. The approach is simple: buy, hold, rebalance—mirroring passive equity index philosophies that focus on capturing long-term growth despite short-term volatility.

Coinbase’s user-centric ethos is reflected in this index—easy entry for new investors, integrated staking rewards, insured fiat holdings, and a regulated framework. Similar to Gemini’s protective mindset, Coinbase manages asset security with cold storage and progressive regulatory practices, making COIN50 an accessible avenue for those seeking broad crypto exposure via an established platform.

While COIN50 reliably tracks the market, it shares a critical limitation with traditional stock indices: remaining fully invested regardless of market direction. In stock markets, this risk can often be managed because drawdowns are typically less severe. Crypto markets, however, frequently experience far deeper corrections—drawdowns in excess of 70% occurred during the 2022 crypto winter. In such environments, a fully invested index is vulnerable to significant capital erosion.

This is less a flaw and more a design trade-off inherent to passive strategies. As cycles accelerate in 2025 and volatility persists, crypto market participants are increasingly asking whether a more adaptive approach could offer better outcomes in terms of drawdown mitigation while maintaining growth potential.

Token Metrics, a distinguished crypto analytics and trading platform, has forged its reputation through data-driven, transparent methods. Its flagship Global 100 Index blends broad asset coverage with active risk management by employing market regime signals—adjusting asset exposure proactively to changing market environments.

This unique structure allows TM Global 100 to fluidly adapt between market upswings and protective stances, unlike static passive indices.

This methodology is about large-scale, structural market awareness—protecting capital during drawdowns, not chasing every small price swing.

Consider two hypothetical $100,000 portfolios entering a bear phase:

Reducing the impact of large losses is a powerful force—compounding advantages accrue on both risk and return, leading to a smoother overall outcome, especially in a volatile asset class like crypto.

All operations and rebalancing are logged and displayed in real time, reinforcing Token Metrics' commitment to transparency and regulatory-minded practices. This infrastructure allows users to fully understand and monitor index movements and risk controls.

COIN50, conversely, is available mainly through perpetual futures contracts on Coinbase International Exchange (not accessible to U.S. retail users), necessitating derivatives trading know-how and diminishing its general accessibility for spot investors.

Whether to choose the Coinbase Index or Token Metrics Global 100 depends on your investment approach, risk tolerance, and any liquidity limitations. Consider:

The emergence of regime-aware indices like Token Metrics Global 100 reflects the maturing of crypto investment tools and approaches. Market participants increasingly expect dynamic solutions that account for crypto’s inherent volatility and cyclical risks, moving beyond static, one-size-fits-all methodologies borrowed from traditional finance. While passive equity indexing made sense in relatively stable environments, the realities of digital asset cycles often demand greater adaptability. Token Metrics Global 100’s structure—engaging markets when signals are positive and standing aside in downturns—represents this next step in the evolution of crypto index investing.

For participants looking for broad crypto exposure with carefully managed downside risk, regime switching is no longer a luxury but an essential feature. TM Global 100 combines this with weekly rebalancing, transparent methodologies, and the analytical strength of Token Metrics, offering a compelling new solution for the modern crypto environment. As adaptive tools become standard, the future of crypto indexing looks smarter, more adaptive, and better aligned with real market behavior.

Those interested in experiencing a more responsive, risk-aware indexing approach can join the waitlist for access to future-ready crypto index solutions.

Both Coinbase Index and Token Metrics Global 100 play pivotal roles in the evolving crypto investment landscape, shaping the choices available to different user types. Security remains paramount across platforms—Gemini and Coinbase emphasize rigorous protections and offer advanced features, from staking and interest rewards to sophisticated interface options. Fee structures, trading volume, asset support, and operational details differ, providing a spectrum of options for market participants. In the bigger picture, the Coinbase Index vs Token Metrics Global 100 comparison encapsulates crypto’s shift from passive, static strategies to data-enhanced, flexible methodologies that recognize and navigate the unique cycles of this global marketplace.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

The COIN50 is a market-cap-weighted index of the top 50 cryptocurrencies, with quarterly rebalancing and a passive buy-and-hold approach. TM Global 100 expands coverage to 100 assets, rebalances weekly, and uses regime switching to adjust exposure based on market signals, offering more active risk management.

Regime switching enables the index to shift out of risk assets and into stablecoins during bearish market conditions, potentially limiting large drawdowns. This approach aims to provide smoother performance across cycles rather than maximization in any single period.

The TM Global 100 is structured as a spot index, increasing accessibility for U.S. residents. In contrast, COIN50 is available primarily through derivative products outside of the U.S., requiring access to specific international exchanges and experience with futures contracts.

Both Gemini and Coinbase implement strong security measures, including offline cold storage, regulatory oversight (such as Gemini’s NYSDFS license), and insurance on fiat funds for U.S. users. They continuously update protocols to align with emerging best practices in digital asset security.

AI-powered platforms such as Token Metrics leverage machine learning and data-driven analytics to provide in-depth asset research, pattern recognition, and risk signals—helping users make more informed, evidence-based decisions in a rapidly evolving market.

This article is for informational and educational purposes only. It does not constitute investment advice, endorsement, or recommendation of any financial product or strategy. Always conduct your own research and consult a qualified professional before making any investment or trading decisions. Cryptocurrency markets are volatile and involve significant risk; past performance is not indicative of future results.

%201.svg)

%201.svg)

The mantra “HODL” became the rallying cry of the cryptocurrency space during the 2017 bull market. For many crypto investors, the strategy seemed straightforward: buy Bitcoin and promising altcoins, hold through the volatility of crypto markets, and count on their recovery prospects to emerge victorious as prices soared. This approach appeared simple, effective, and proven—until the harsh realities of bear markets exposed its limitations. In 2025, as the crypto market experiences faster oscillations between euphoria and fear, the critical question is no longer whether to HODL, but whether you can afford to. This article explores smart index strategies that protect capital during crypto winters, offering a more resilient approach to crypto investing.

To understand why HODL can be risky, it’s important to examine what “holding through” truly means in practice, especially during market downturns. The 2021-2022 crypto winter provides a stark example. Bitcoin, after peaking near $69,000 in November 2021, plummeted to approximately $15,500 by November 2022—a staggering 77.5% drawdown over a long period. Ethereum’s descent was even more severe, falling from $4,800 to $880, an 81.7% collapse. Many altcoins suffered losses between 90% and 95%, with some never fully recovering.

An investor who bought $100,000 worth of diversified crypto assets at the peak and chose to HODL through the bottom would have seen their portfolio shrink to roughly $15,000-$25,000. This is not mere volatility; this is capital destruction. Even for those with the fortitude to hold, Bitcoin did not reclaim its previous highs from 2021 until March 2024—more than two years of underwater capital. This prolonged, long period represents not only opportunity cost but also psychological stress, as investors grappled with market sentiment and wondered if recovery was imminent or if “this time is different.”

Moreover, the mathematics behind such losses reveal the compounding problem HODL evangelists often overlook. An 80% loss requires a 400% gain just to break even, while a 90% loss demands a 900% gain. These are not typical fluctuations; they represent portfolio extinction events that can derail an investment journey. Investing heavily in one coin increases the risk of catastrophic losses, while diversification across multiple assets or ecosystems can help mitigate such risks and improve portfolio resilience.

Warren Buffett’s timeless wisdom—“Never lose money” and “Never forget rule number one”—applies even more critically in the cryptocurrency space, where volatility can erase years of gains in a matter of weeks. Professional traders and institutional investors recognize a fundamental truth: protecting capital during market downturns is often more valuable than capturing every incremental percentage point of upside during bull markets.

Consider two hypothetical strategies over a complete market cycle:

Different portfolio allocations between these strategies—such as shifting assets into stablecoins or diversifying across sectors—can significantly impact outcomes during various phases of the market cycle.

The defensive strategy, which prioritizes capital preservation and risk management, outperforms pure HODL by over 400% in absolute terms. This example underscores the power of protecting capital and managing risk in volatile market cycles. It is also essential to align your chosen strategy with your individual risk tolerance to ensure it matches your comfort with potential losses and market volatility.

Smart index strategies that protect capital during crypto winters rely heavily on data-driven decision-making rather than emotional reactions. Token Metrics, a leading crypto trading and analytics platform in 2025, exemplifies this approach. It has transformed how serious crypto investors navigate the market by combining fundamental analysis, technical analysis, and machine learning.

Token Metrics’ evolution reflects a commitment to informed investment decisions:

While platforms like Token Metrics provide powerful analytics, investors should always conduct their own research to ensure comprehensive risk management and preparedness for unexpected market events.

At the core of Token Metrics’ smart index strategies is “regime switching,” a systematic approach institutional investors use to adjust portfolio risk based on prevailing market conditions. The primary strategy aims of this approach are to maximize profits and outperform market benchmarks by focusing on trending and emerging market segments. The TM Global 100 Index exemplifies this methodology, deploying capital across the top 100 crypto assets, which include major cryptocurrencies.

Token Metrics’ proprietary algorithms continuously monitor a broad set of market indicators, including:

These inputs feed machine learning models trained on years of crypto market history, enabling the identification of patterns that often precede significant regime shifts.

Rather than attempting to time exact market tops and bottoms—a notoriously difficult task—the system operates on a binary framework:

This method accepts slight delays in market entry and exit but significantly reduces exposure to catastrophic drawdowns.

Backtesting the regime-switching strategy against previous crypto market cycles demonstrates compelling results:

The benefits of smart index strategies extend beyond merely avoiding crashes. These strategies can also help protect capital during financial crises, when both traditional and crypto markets may experience significant downturns.

One key advantage is the ability to recover opportunity costs. When the market rebounds, smart index strategies can help investors quickly regain lost ground. Additionally, movements in the stock market can influence crypto investment opportunities, making it important to have a strategy that adapts to changing market conditions.

Financial losses are painful, but the psychological toll of watching a portfolio plunge 70% can be debilitating. Such stress can impair decision-making, erode confidence, and lead to panic selling or complete market exit—often at the worst possible time. Automated risk management strategies alleviate these pressures by systematically managing risk, allowing investors to maintain emotional resilience and stay engaged in their investment journey.

Capital trapped underwater during prolonged bear markets represents lost opportunities. By shifting assets into stablecoins during downturns, investors preserve purchasing power and maintain the flexibility to deploy capital into emerging trends or promising altcoins as they arise. Notably, rising institutional interest can signal new opportunities in the market, helping investors identify sectors with strong growth potential. This approach avoids forced liquidations and keeps investors mentally and financially prepared to capitalize on new market movements.

Long-term wealth accumulation depends on consistent compounding with controlled drawdowns. Comparing hypothetical five-year scenarios illustrates this:

Reducing the severity of losses preserves capital for growth phases, unleashing the true power of compounding.

The TM Global 100 Index makes regime-switching strategies accessible and practical for a wide range of crypto investors:

In addition to index investing, investors may also consider providing liquidity or engaging in yield farming on decentralized exchanges as complementary strategies to earn passive income and diversify their crypto holdings.

In the fast-evolving crypto market, security and custody are foundational to any successful investment strategy. While the excitement of bull markets often centers on maximizing gains, the reality is that both bull and bear markets expose investors to a unique set of risks—making the protection of digital assets a top priority. The decentralized nature of crypto assets means that investors are often responsible for their own security, and lapses can result in significant losses that are difficult, if not impossible, to recover.

The crypto market is no stranger to high-profile hacks, phishing schemes, and other cyber threats. These risks underscore the importance of choosing reputable exchanges, wallets, and lending platforms that have a proven track record of safeguarding user funds. For those seeking an extra layer of protection, hardware wallets are a popular choice, as they store private keys offline and are far less susceptible to online attacks. Before entrusting any platform with your crypto holdings, conducting thorough due diligence and proper research is essential to minimize potential risks.

Institutional investors, who often manage substantial crypto investments, demand robust security and custody solutions. Established assets like Bitcoin and Ethereum are frequently held with trusted custodians that offer regulatory compliance and advanced security protocols. This institutional approach not only protects capital but also signals growing institutional adoption and confidence in the crypto market.

Risk management extends beyond just security measures. Diversifying across different asset classes, sectors, and even geographic regions can help reduce exposure to any single asset or market downturn. Strategies such as dollar cost averaging—investing a fixed amount at regular intervals—can further smooth out the impact of market volatility and help preserve capital during turbulent periods.

Staying informed is equally important. The crypto market is shaped by rapidly shifting market trends, regulatory developments, and emerging trends such as the rise of decentralized finance (DeFi) and new infrastructure tokens. Identifying emerging trends early can provide a strategic edge, but it’s crucial to approach new opportunities with caution and a commitment to ongoing research.

Ultimately, safeguarding your crypto assets requires a holistic approach that combines robust security practices, sound risk management, and a commitment to staying informed. By prioritizing these elements, investors can navigate the complexities of the crypto market with greater confidence, protect their capital during both bull and bear markets, and position themselves for long-term success in the world of digital assets.

Smart index strategies that protect capital during crypto winters are especially suited for investors who:

As the cryptocurrency market matures, the era of “just HODL everything” is fading. In 2025, sophisticated investors demand smarter strategies that balance upside participation with active downside risk management. Token Metrics’ TM Global 100 Index embodies this evolution by offering broad market exposure during favorable conditions and capital preservation during crypto winters—all through complete automation that removes emotional biases from investment decisions.

Protecting your capital during crypto winters is not just prudent; it is essential for long-term success in the cryptocurrency space. To maximize the benefits of smart index strategies, stay informed about market trends and regulatory developments as the landscape evolves. To experience crypto investing that works in all market conditions, consider joining the TM Global 100 waitlist and take a step toward smarter, safer crypto investments. Because in the long run, preserving capital matters more than you think.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

A crypto index strategy involves creating a diversified portfolio of cryptocurrencies, typically based on market capitalization or other criteria, to reduce risk and track the overall performance of the crypto market, rather than relying on the performance of individual assets.

Regime switching uses data-driven signals to shift a portfolio’s risk exposure according to prevailing market conditions—investing in a diversified index during bullish trends and moving to stablecoins during bearish periods, thereby limiting drawdowns and emotional decision-making.

Token Metrics provides advanced analytics, AI-driven ratings, and automated index strategies to help users make informed decisions when navigating crypto market cycles and identifying emerging opportunities.

Yes, crypto index strategies are often well-suited for beginners as they offer broad exposure to digital assets with reduced risk compared to investing in a single coin. Indexing can also help lower transaction fees and promote disciplined investment habits.

Security is foundational in crypto investing, as digital assets can be vulnerable to hacking and fraud. Using reputable platforms, hardware wallets, and sound custody practices is essential for protecting capital in both bull and bear markets.

This article is for educational and informational purposes only. It does not constitute financial, investment, or legal advice. Cryptocurrency markets are volatile, and past performance is not indicative of future results. Always conduct your own research and consult with a qualified professional before making any investment decisions.

%201.svg)

%201.svg)

Crypto markets are famous for their rapid swings and unpredictable conditions, making how you construct a portfolio especially critical. The debate between market cap weighting and equal weighting in constructing crypto indices has grown louder as the number of digital assets surges and volatility intensifies. Understanding these methodologies isn’t just academic—it fundamentally affects how portfolios respond during major upswings and downturns, and reveals why broad Top 100 indices consistently deliver different results than more concentrated or equally weighted approaches.

Index weighting determines how an index or portfolio reflects the value and performance of its constituents. Market cap weighting assigns higher weights to larger assets, closely mirroring the aggregate value distribution in the market—so leading tokens like Bitcoin and Ethereum impact the index more significantly. In contrast, equal weighting grants every asset the same allocation, regardless of size, offering a more democratized but risk-altered exposure. Recognizing these differences is fundamental to how risk, diversification, and upside potential manifest within an index, and to how investors participate in the growth trajectory of both established and up-and-coming crypto projects.

Market cap weighting is a methodology that allocates index proportions according to each asset’s market capitalization—bigger assets, by value, represent a greater portion in the index. For instance, in a Top 100 market cap-weighted index, Bitcoin could make up more than half the portfolio, followed by Ethereum, while the remaining tokens are weighted in line with their market caps.

This approach naturally adjusts as prices and sentiment shift: assets rising in value get larger weights, while those declining are reduced automatically. It removes subjective bias and reflects market consensus, because capitalization is a product of price and token supply, responding directly to market dynamics.

Token Metrics’ TM Global 100 Index is a strong example of advanced market cap weighting tailored to crypto. This index goes beyond mere size by filtering for quality through AI-derived grades—evaluating momentum and long-term fundamentals from over 80 data points. Each week, the index rebalances: new leaders enter, underperformers exit, and proportions adapt, ensuring continuous adaptation to the current market structure. The result is a strategy that, like broad-based indices in traditional equities, balances widespread exposure and efficient updates as the crypto landscape evolves.

Equal weighting gives the same allocation to each index constituent, regardless of its market cap. Thus, in an equal-weighted Top 100 index, a newly launched token and a multi-billion-dollar asset both make up 1% of the portfolio. The intention is to provide all assets an equal shot at impacting returns, potentially surfacing emerging opportunities that traditional weighting may overlook.

This approach appeals to those seeking diversification unconstrained by market size and is featured in products like the S&P Cryptocurrency Top 10 Equal Weight Index. In traditional finance and crypto alike, equal weighting offers a different pattern of returns and risk, putting more emphasis on smaller and emerging assets and deviating from market cap heavy concentration.

Empirical research and live market experience reveal that during high volatility, Top 100 market cap-weighted indices tend to outperform equal-weighted alternatives. Key reasons include:

Why use 100 constituents? The Top 100 format achieves a practical balance between breadth and manageability. It captures a full cross-section of the crypto universe, allowing exposure to leading narratives and innovations, from AI tokens to Real-World Assets (RWAs), as demonstrated repeatedly throughout recent crypto cycles.

Research from Token Metrics highlights that Top 100 indices regularly outperform more concentrated Top 10 indices, thanks in large part to diversified participation in mid-caps following current narratives. The structure enables timely adaptation as capital and attention shift, while the weekly rebalance limits excessive trading.

Operationally, equal weighting becomes logistically complex with 100 assets—it demands near-constant buying and selling as each asset’s price changes. Market cap weighting, meanwhile, achieves most rebalancing automatically via price movement, minimizing execution costs and slippage risk.

Active factor risk describes how certain characteristics—such as size, sector, or style—can disproportionately impact portfolio returns. Market cap weighting naturally leans toward large caps and leading sectors, making portfolios sensitive to concentration in just a few dominant names. Equal weighting dilutes this, granting more space to smaller, sometimes riskier assets, and can help offset sector concentration. Understanding these dynamics helps portfolio builders balance the trade-offs between diversification, risk, and performance objectives, and highlights the importance of methodological transparency in index design.

While market cap weighting often excels in volatile conditions, equal weighting can be appropriate in specific situations:

It is crucial to recognize that equal weighting is not fundamentally lower in risk—it simply shifts risk to different parts of the token universe.

Token Metrics integrates multiple layers of process innovation into the market cap weighted paradigm:

Market cap weighting’s core advantage is its mathematical fit for volatile markets:

For those seeking systematic exposure to the digital asset market—regardless of whether they adopt an active or passive approach—the data leans toward broad, market cap-weighted Top 100 methodologies. These strategies enable:

The TM Global 100 Index by Token Metrics embodies these features—melding market cap logic with quality assessment, modern rebalancing, regime-aware management, and transparency for users of all expertise levels. Parallels with traditional equity indexing further validate these approaches as effective in a range of asset classes.

The consistent outperformance of market cap-weighted Top 100 indices is the result of a methodology attuned to crypto’s structural realities. By tracking consensus, managing drawdowns, enabling liquidity, and reducing unnecessary trading, market cap weighting provides a systematic defense against the chaos of volatile markets.

Contemporary implementations, such as those from Token Metrics, optimize these benefits through AI-backed analytics, smart rebalancing, and rigorous quality metrics—delivering robust and scalable exposure for institutional and retail users alike. In crypto, where sharp volatility and fast-evolving narratives are the norm, index construction methodology truly determines which approaches endure through all market cycles.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

Market cap weighting means each constituent’s index representation is proportional to its market value. In practice, this gives larger, more established crypto assets greater influence over index returns. This approach tracks aggregate market sentiment and adjusts automatically as prices move.

Equal weighting assigns each asset the same index share, no matter its relative size. While this offers exposure to smaller projects, it increases both diversification and the risk associated with less-established, and often more volatile, tokens. Unlike market cap weighting, it does not adjust based on market value dynamics.

In volatile conditions, market cap weighting reduces portfolio exposure to sharply declining, illiquid, or high-risk tokens, while equal weighting requires ongoing investments in assets regardless of their decline. This difference in automatic risk reduction, transaction costs, and compounding effect yields stronger downside protection and risk-adjusted results.

Equal weighting can outperform during certain sustained bull markets or in small, stable universes where concentrated risk is a concern. However, over longer periods and during volatility spikes, its frequent rebalancing and mid-cap emphasis usually result in higher risk and potentially lower net returns.

Token Metrics blends market cap weighting with AI-based quality filtering, adaptive rebalancing based on market regimes, and full transparency on holdings and methodology. This modern approach aims to maximize exposure to high-potential tokens while managing drawdown and operational risks.

This article is for informational and educational purposes only and does not constitute investment, financial, or trading advice. Cryptocurrency markets are highly volatile and subject to rapid change. Readers should conduct their own research and consult professional advisors before making any investment decisions. Neither the author nor Token Metrics guarantees the accuracy, completeness, or reliability of the information provided herein.

%201.svg)

%201.svg)

In today’s fast-paced world, busy professionals juggle demanding careers, family commitments, and personal goals, leaving little time to dive into the complexities of cryptocurrency investing. Yet, the crypto market represents one of the most significant digital asset growth opportunities of the century. With over 6,000 tokens to track, volatile market cycles, and security considerations, actively managing a crypto portfolio can feel overwhelming. Built-in diversification in crypto index funds automatically spreads risk across multiple cryptocurrencies, reducing exposure to the volatility of any single asset. The idea of becoming a crypto day trader is exhausting just to imagine.Fortunately, there is a smarter way. More than 75% of professional investors plan to increase their crypto allocations in 2025, but they’re not spending hours monitoring charts or executing trades. Instead, they rely on automated crypto index strategies designed to work quietly and efficiently, freeing them to focus on their careers and lives. Welcome to the set-and-forget crypto revolution tailored specifically for busy professionals.