Top Crypto Trading Platforms in 2025

%201.svg)

%201.svg)

Big news: We’re cranking up the heat on AI-driven crypto analytics with the launch of the Token Metrics API and our official SDK (Software Development Kit). This isn’t just an upgrade – it's a quantum leap, giving traders, hedge funds, developers, and institutions direct access to cutting-edge market intelligence, trading signals, and predictive analytics.

Crypto markets move fast, and having real-time, AI-powered insights can be the difference between catching the next big trend or getting left behind. Until now, traders and quants have been wrestling with scattered data, delayed reporting, and a lack of truly predictive analytics. Not anymore.

The Token Metrics API delivers 32+ high-performance endpoints packed with powerful AI-driven insights right into your lap, including:

Getting started with the Token Metrics API is simple:

At Token Metrics, we believe data should be decentralized, predictive, and actionable.

The Token Metrics API & SDK bring next-gen AI-powered crypto intelligence to anyone looking to trade smarter, build better, and stay ahead of the curve. With our official SDK, developers can plug these insights into their own trading bots, dashboards, and research tools – no need to reinvent the wheel.

%201.svg)

%201.svg)

The crypto market is tilting bullish into 2026 as liquidity, infrastructure, and participation improve across the board. Clearer rules and standards are reshaping the classic four-year cycle, flows can arrive earlier, and strength can persist longer than in prior expansions.

Institutional access is widening through ETFs and custody, while L2 scaling and real-world integrations help sustain on‑chain activity. This healthier backdrop frames our scenario work for HYPE. The ranges below reflect different total crypto market sizes and the share Hyperliquid could capture under each regime.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

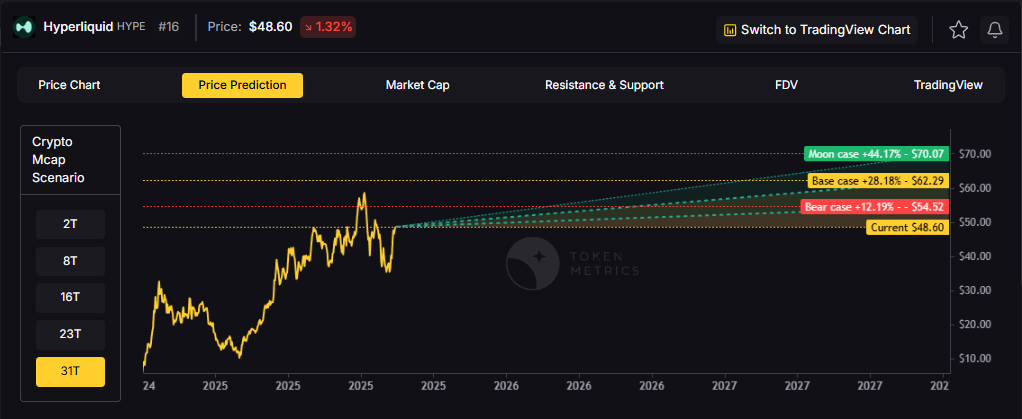

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

TM Agent baseline: Token Metrics TM Grade is 73.9%, a Buy, and the trading signal is bearish, indicating short-term downward momentum. This means Token Metrics judges HYPE as fundamentally attractive over the long term, while near-term momentum is negative and may limit rallies.

Live details: Hyperliquid Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

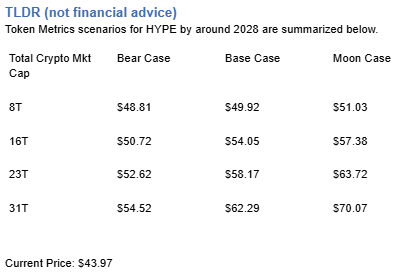

Scenario Analysis

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

8T: At an 8 trillion dollar total crypto market cap, HYPE projects to $48.81 in bear conditions, $49.92 in the base case, and $51.03 in bullish scenarios.

16T: Doubling the market to 16 trillion expands the range to $50.72 (bear), $54.05 (base), and $57.38 (moon).

23T: At 23 trillion, the scenarios show $52.62, $58.17, and $63.72 respectively.

31T: In the maximum liquidity scenario of 31 trillion, HYPE could reach $54.52 (bear), $62.29 (base), or $70.07 (moon).

Each tier assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Diversification matters. HYPE is compelling, yet concentrated bets can be volatile. Token Metrics Indices hold HYPE alongside the top one hundred tokens for broad exposure to leaders and emerging winners.

Our backtests indicate that owning the full market with diversified indices has historically outperformed both the total market and Bitcoin in many regimes due to diversification and rotation.

Hyperliquid is a decentralized exchange focused on perpetual futures with a high-performance order book architecture. The project emphasizes low-latency trading, risk controls, and capital efficiency aimed at professional and retail derivatives traders. Its token, HYPE, is used for ecosystem incentives and governance-related utilities.

Can HYPE reach $60?

Yes, the 23T and 31T tiers imply ranges above $60 in the Base and Moon bands, though outcomes depend on liquidity and adoption. Not financial advice.

Is HYPE a good long-term investment?

Outcome depends on adoption, liquidity regime, competition, and supply dynamics. Diversify and size positions responsibly.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

Token Metrics delivers AI-based crypto ratings, scenario projections, and portfolio tools so you can make smarter decisions. Discover real-time analytics on Token Metrics.

%201.svg)

%201.svg)

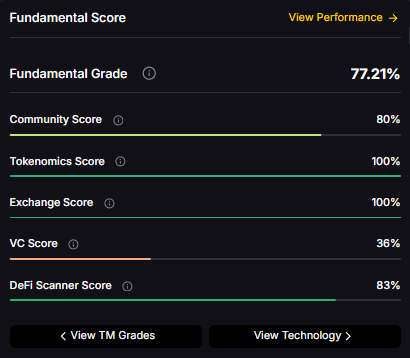

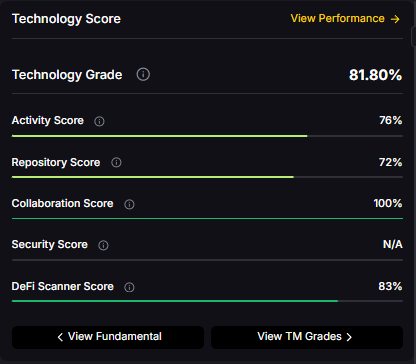

The Layer 1 competitive landscape is consolidating as markets recognize that specialization matters more than being a generic "Ethereum killer." Cardano positions itself in this multi-chain world with specific technical and ecosystem advantages. Infrastructure maturity around custody, bridges, and developer tools makes alternative L1s more accessible heading into 2026.

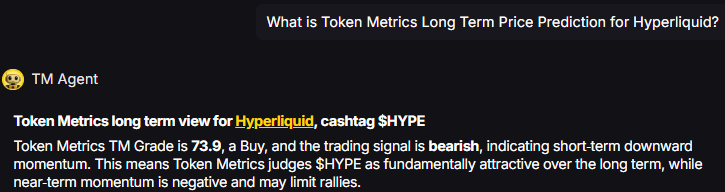

The scenario projections below map different market share outcomes for ADA across varying total crypto market sizes. Base cases assume Cardano maintains current ecosystem momentum, while moon scenarios factor in accelerated adoption and bear cases reflect increased competitive pressure.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

How to read it: Each band blends cycle analogues and market-cap share math with TA guardrails. Base assumes steady adoption and neutral or positive macro. Moon layers in a liquidity boom. Bear assumes muted flows and tighter liquidity.

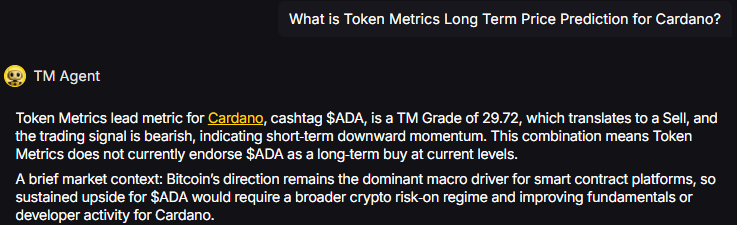

TM Agent baseline: Token Metrics lead metric for Cardano, cashtag $ADA, is a TM Grade of 29.72%, which translates to a Sell, and the trading signal is bearish, indicating short-term downward momentum. This combination means Token Metrics does not currently endorse $ADA as a long-term buy at current levels. A brief market context: Bitcoin's direction remains the dominant macro driver for smart contract platforms, so sustained upside for $ADA would require a broader crypto risk-on regime and improving fundamentals or developer activity for Cardano.

Live details: Cardano Token Details

Affiliate Disclosure: We may earn a commission from qualifying purchases made via this link, at no extra cost to you.

Token Metrics scenarios span four market cap tiers, each representing different levels of crypto market maturity and liquidity:

Each tier assumes progressively stronger market conditions, with the base case reflecting steady growth and the moon case requiring sustained bull market dynamics.

Cardano represents one opportunity among hundreds in crypto markets. Token Metrics Indices bundle ADA with top one hundred assets for systematic exposure to the strongest projects. Single tokens face idiosyncratic risks that diversified baskets mitigate.

Historical index performance demonstrates the value of systematic diversification versus concentrated positions.

Cardano is a blockchain platform designed to support secure, scalable, and sustainable decentralized applications and smart contracts. It is known for its research-driven development approach, emphasizing peer-reviewed academic research and formal verification methods to ensure reliability and security. As a proof-of-stake Layer 1 blockchain, Cardano aims to offer energy efficiency and long-term scalability, positioning itself as a competitor to platforms like Ethereum. Its native token, ADA, is used for transactions, staking, and governance. Adoption is driven by technological rigor and ecosystem growth, though progress has been criticized for being slow compared to more agile competitors. Risks include execution delays, competition, and market volatility.

Cardano’s vision is to create a decentralized platform that enables sustainable and inclusive economic systems through advanced cryptography and scientific methodology. It aims to bridge gaps between traditional financial systems and blockchain technology, promoting accessibility and security for users globally.

Token Metrics AI provides comprehensive context on Cardano's positioning and challenges.

Can ADA reach $4?

Based on the scenarios, ADA could reach $4 in the 31T moon case. The 31T tier projects $4.27 in the moon case. Not financial advice.

Can ADA 10x from current levels?

At current price of $0.65, a 10x would reach $6.50. This falls within none of the provided scenarios, which top out at $4.27 in the 31T moon case. Bear in mind that 10x returns require substantial market cap expansion. Not financial advice.

What price could ADA reach in the moon case?

Moon case projections range from $1.16 at 8T to $4.27 at 31T. These scenarios assume maximum liquidity expansion and strong Cardano adoption. Not financial advice.

Disclosure

Educational purposes only, not financial advice. Crypto is volatile, do your own research and manage risk.

%201.svg)

%201.svg)

The intersection of artificial intelligence and blockchain technology has produced numerous innovations, but few have the potential architectural significance of X402. This internet protocol, developed by Coinbase and Cloudflare, is positioning itself as the standard for machine-to-machine payments in an increasingly AI-driven digital economy.

X402 is an open protocol designed specifically for internet-native payments. To understand its significance, we need to consider how the internet operates through layered protocols:

While these protocols have existed for decades, X402 - despite being available for over ten years - has only recently found its primary use case: enabling autonomous AI agents to conduct commerce without human intervention.

Traditional digital payments require several prerequisites that create friction for automated systems:

AI agents operating autonomously need to:

X402 addresses these challenges by creating a standardized payment layer that operates at the protocol level.

The protocol functions as a real-time usage billing meter integrated directly into API requests. Here's a simplified workflow:

This architecture enables transactions "up to a penny in under a second," according to protocol specifications.

One of the most practical examples of X402 integration comes from Token Metrics, which has implemented X402 as a pay-per-call option for their cryptocurrency analytics API. This implementation demonstrates the protocol's value proposition in action.

Token Metrics X402 Pricing Structure:

Why This Matters:

This pricing model fundamentally differs from traditional API access:

Traditional Model:

X402 Model:

For AI agents performing crypto market analysis, this creates significant efficiency:

This implementation showcases X402's core value proposition: removing friction between autonomous systems and the services they consume.

Analysis of X402scan data reveals the emerging adoption patterns:

Leading Facilitators:

Transaction Metrics (30-day trends):

Several platforms have implemented X402 functionality:

API Services:

Rather than requiring monthly subscriptions, API providers can charge per request. Token Metrics exemplifies this model - an AI agent queries their crypto analytics API, pays between $0.017-$0.068 via X402 depending on the endpoint, and receives the data - all within milliseconds. The agent accesses:

This eliminates the traditional friction of:

AI Agent Platforms:

Cross-Chain Implementation: X402 operates on multiple blockchain networks, with notable activity on Base (Coinbase's Layer 2) and Solana.

The emergence of X402 as a standard has created several market dynamics:

Narrative-Driven Speculation: Projects announcing X402 integration have experienced significant short-term price appreciation, suggesting market participants view the protocol as a value catalyst.

Infrastructure vs. Application Layer: The protocol creates a distinction between:

Competitive Landscape: X402 faces competition from:

While AI commerce represents the primary narrative, X402's architecture supports broader applications:

Data Services: As demonstrated by Token Metrics, any API provider can implement pay-per-request pricing. Applications include:

Micropayment Content: Publishers could charge per-article access at fractional costs

IoT Device Transactions: Connected devices conducting autonomous commerce

Gaming Economies: Real-time, granular in-game transactions

Computing Resources: Pay-per-compute models for cloud services

Token Metrics' implementation reveals the business model advantages for service providers:

Revenue Optimization:

Market Access:

Operational Efficiency:

Several factors may impact X402 adoption:

Technical Complexity: Implementing X402 requires protocol-level integration, creating barriers for smaller developers.

Network Effects: Payment protocols succeed through widespread adoption. X402 competes with established systems and must reach critical mass.

Blockchain Dependency: Current implementations rely on blockchain networks for settlement, introducing:

Pricing Discovery: As seen with Token Metrics' range of $0.017-$0.068 per call, establishing optimal pricing requires experimentation. Too high and traditional subscriptions become competitive; too low and revenue suffers.

Regulatory Uncertainty: Automated machine-to-machine payments operating across borders face unclear regulatory frameworks.

Market Maturity: The AI agent economy remains nascent. X402's long-term relevance depends on AI agents becoming standard economic actors.

Traditional API Keys with Subscriptions:

X402 Pay-Per-Call:

Cryptocurrency Direct Payments:

Payment Processors (Stripe, PayPal):

X402's differentiator lies in combining protocol-level standardization with crypto-native functionality optimized for automated systems, as demonstrated by Token Metrics' implementation where AI agents can make sub-dollar API calls without human intervention.

For developers interested in X402 integration:

Documentation: X402.well (protocol specifications)

Discovery Platforms: X402scan (transaction analytics), The Bazaar (application directory)

Integration Frameworks: Virtuals Protocol, Eliza (Solana), various Base implementations

Live Examples: Token Metrics API (tokenmetrics.com/api) demonstrates production X402 implementation

Several blockchain platforms now offer X402 integration libraries, lowering implementation barriers.

Projects associated with X402 have demonstrated characteristic patterns:

Phase 1 - Announcement: Initial price appreciation upon X402 integration news Phase 2 - Peak Attention: Maximum price when broader market attention focuses on X402 narrative Phase 3 - Stabilization: Price correction as attention shifts to next narrative

PayAI's trajectory exemplifies this pattern - rapid 8x appreciation followed by significant correction within days. This suggests X402-related assets behave as narrative-driven trading vehicles rather than fundamental value plays, at least in current market conditions.

However, service providers implementing X402 functionality (like Token Metrics) represent a different category - they're adding practical utility rather than speculating on the protocol itself.

The protocol's trajectory depends on several factors:

AI Agent Proliferation: As AI agents become more autonomous and economically active, demand for payment infrastructure grows. Early implementations like Token Metrics' API access suggest practical demand exists.

Developer Adoption: Whether developers choose X402 over alternatives will determine market position. The simplicity of pay-per-call models may drive adoption.

Service Provider Economics: If providers like Token Metrics successfully monetize X402 access, other API services will follow. The ability to capture previously inaccessible low-usage customers creates compelling economics.

Institutional Support: Coinbase's backing provides credibility, but sustained development and promotion are necessary.

Regulatory Clarity: Clear frameworks for automated, cross-border machine transactions would reduce adoption friction.

Interoperability Standards: Success may require coordination with other emerging AI commerce protocols.

X402 represents an attempt to solve genuine infrastructure challenges in an AI-driven economy. The protocol's technical architecture addresses real friction points in machine-to-machine commerce, as demonstrated by Token Metrics' implementation of pay-per-call API access at $0.017-$0.068 per request with no commitments required.

This real-world deployment validates the core thesis: AI agents need frictionless, usage-based access to services without traditional account creation and subscription barriers. However, actual adoption remains in early stages, and the protocol faces competition from both traditional systems and alternative blockchain solutions.

For market participants, X402-related projects should be evaluated based on:

The protocol's long-term relevance will ultimately be determined by whether AI agents become significant economic actors requiring standardized payment infrastructure. While the technical foundation appears sound and early implementations show promise, market validation remains ongoing.

Key Takeaways:

This analysis is for informational purposes only. X402 adoption and associated project performance remain highly uncertain and subject to rapid change.

%201.svg)

%201.svg)

Web3 promises to revolutionize the internet by decentralizing control, empowering users with data ownership, and eliminating middlemen. The technology offers improved security, higher user autonomy, and innovative ways to interact with digital assets. With the Web3 market value expected to reach $81.5 billion by 2030, the potential seems limitless. Yet anyone who's interacted with blockchain products knows the uncomfortable truth: Web3 user experience often feels more like punishment than promise. From nerve-wracking first crypto transactions to confusing wallet popups and sudden unexplained fees, Web3 products still have a long way to go before achieving mainstream adoption. If you ask anyone in Web3 what the biggest hurdle for mass adoption is, UX is more than likely to be the answer. This comprehensive guide explores why Web3 UX remains significantly inferior to Web2 experiences in 2025, examining the core challenges, their implications, and how platforms like Token Metrics are bridging the gap between blockchain complexity and user-friendly crypto investing.

To understand Web3's UX challenges, we must first recognize what users expect based on decades of Web2 evolution. Web2, the "read-write" web that started in 2004, enhanced internet engagement through user-generated content, social media platforms, and cloud-based services with intuitive interfaces that billions use daily without thought.

Web2 applications provide seamless experiences: one-click logins via Google or Facebook, instant account recovery through email, predictable transaction costs, and familiar interaction patterns across platforms. Users have become accustomed to frictionless digital experiences that just work.

Web3, by contrast, introduces entirely new paradigms requiring users to manage cryptographic wallets, understand blockchain concepts, navigate multiple networks, pay variable gas fees, and take full custody of their assets. This represents a fundamental departure from familiar patterns, creating immediate friction.

The first interaction with most decentralized applications asks users to "Connect Wallet." If you don't have MetaMask or another compatible wallet, you're stuck before even beginning. This creates an enormous barrier to entry where Web2 simply asks for an email address.

Setting up a Web3 wallet requires understanding seed phrases—12 to 24 random words that serve as the master key to all assets. Users must write these down, store them securely, and never lose them, as there's no "forgot password" option. One mistake means permanent loss of funds.

Most DeFi platforms and crypto wallets nowadays still have cumbersome and confusing interfaces for wallet creation and management. The registration process, which in Web2 takes seconds through social login options, becomes a multi-step educational journey in Web3.

Most challenges in UX/UI design for blockchain stem from lack of understanding of the technology among new users, designers, and industry leaders. Crypto jargon and complex concepts of the decentralized web make it difficult to grasp product value and master new ways to manage funds.

Getting typical users to understand complicated blockchain ideas represents one of the main design challenges. Concepts like wallets, gas fees, smart contracts, and private keys must be streamlined without compromising security or usefulness—a delicate balance few projects achieve successfully.

The blockchain itself is a complex theory requiring significant learning to fully understand. Web3 tries converting this specialized domain knowledge into generalist applications where novices should complete tasks successfully. When blockchain products first started being developed, most were created by experts for experts, resulting in products with extreme pain points, accessibility problems, and complex user flows.

Another common headache in Web3 is managing assets and applications across multiple blockchains. Today, it's not uncommon for users to interact with Ethereum, Polygon, Solana, or several Layer 2 solutions—all in a single session.

Unfortunately, most products require users to manually switch networks in wallets, manually add new networks, or rely on separate bridges to transfer assets. This creates fragmented and confusing experiences where users must understand which network each asset lives on and how to move between them.

Making users distinguish between different networks creates unnecessary cognitive burden. In Web2, users never think about which server hosts their data—it just works. Web3 forces constant network awareness, breaking the illusion of seamless interaction.

Transaction costs in Web3 are variable, unpredictable, and often shockingly expensive. Users encounter sudden, unexplained fees that can range from cents to hundreds of dollars depending on network congestion. There's no way to know costs precisely before initiating transactions, creating anxiety and hesitation.

Web3 experiences generally run on public chains, leading to scalability problems as multiple parties make throughput requests. The more transactions that occur, the higher gas fees become—an unsustainable model as more users adopt applications.

Users shouldn't have to worry about paying high gas fees as transaction costs. Web2 transactions happen at predictable costs or are free to users, with businesses absorbing payment processing fees. Web3's variable cost structure creates friction at every transaction.

In Web2, mistakes are forgivable. Sent money to the wrong person? Contact support. Made a typo? Edit or cancel. Web3 offers no such mercy. Blockchain's immutability means transactions are permanent—send crypto to the wrong address and it's gone forever.

This creates enormous anxiety around every action. Users must triple-check addresses (long hexadecimal strings impossible to memorize), verify transaction details, and understand that one mistake could cost thousands. The nerve-wracking experience of making first crypto transactions drives many users away permanently.

Web2 platforms offer customer service: live chat, email support, phone numbers, and dispute resolution processes. Web3's decentralized nature eliminates these safety nets. There's no one to call when things go wrong, no company to reverse fraudulent transactions, no support ticket system to resolve issues.

This absence of recourse amplifies fear and reduces trust. Users accustomed to consumer protections find Web3's "code is law" philosophy terrifying rather than empowering, especially when their money is at stake.

Web3 applications often provide cryptic error messages that technical users struggle to understand, let alone mainstream audiences. "Transaction failed" without explanation, "insufficient gas" without context, or blockchain-specific error codes mean nothing to average users.

Good UX requires clear, actionable feedback. Web2 applications excel at this—telling users exactly what went wrong and how to fix it. Web3 frequently leaves users confused, frustrated, and unable to progress.

Crypto designs are easily recognizable by dark backgrounds, pixel art, and Web3 color palettes. But when hundreds of products have the same mysterious look, standing out while maintaining blockchain identity becomes challenging.

More problematically, there are no established UX patterns for Web3 interactions. Unlike Web2, where conventions like hamburger menus, shopping carts, and navigation patterns are universal, Web3 reinvents wheels constantly. Every application handles wallet connections, transaction confirmations, and network switching differently, forcing users to relearn basic interactions repeatedly.

The problem with most DeFi startups and Web3 applications is that they're fundamentally developer-driven rather than consumer-friendly. When blockchain products first launched, they were created by technical experts who didn't invest effort in user experience and usability.

This technical-first approach persists today. Products prioritize blockchain purity, decentralization orthodoxy, and feature completeness over simplicity and accessibility. The result: powerful tools that only experts can use, excluding the masses these technologies purportedly serve.

The Web3 revolution caught UI/UX designers by surprise. The Web3 community values privacy and anonymity, making traditional user research challenging. How do you design for someone you don't know and who deliberately stays anonymous?

Researching without compromising user privacy becomes complex, yet dedicating time to deep user exploration remains essential for building products that resonate with actual needs rather than developer assumptions.

Despite years of development and billions in funding, Web3 UX remains problematic for several structural reasons:

Despite challenges, innovative solutions are emerging to bridge the Web3 UX gap:

Modern crypto wallets embrace account abstraction enabling social recovery (using trusted contacts to restore access), seedless wallet creation via Multi-Party Computation, and biometric logins. These features make self-custody accessible without sacrificing security.

Forward-looking approaches use email address credentials tied to Web3 wallets. Companies like Magic and Web3Auth create non-custodial wallets behind familiar email login interfaces using multi-party compute techniques, removing seed phrases from user experiences entirely.

Some platforms absorb transaction costs or implement Layer 2 solutions dramatically reducing fees, creating predictable cost structures similar to Web2.

Progressive platforms abstract blockchain complexity, presenting familiar Web2-like experiences while handling Web3 mechanics behind the scenes. Users interact through recognizable patterns without needing to understand underlying technology.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

The ultimate success of Web3 hinges on user experience. No matter how revolutionary the technology, it will remain niche if everyday people find it too confusing, intimidating, or frustrating. Gaming, FinTech, digital identity, social media, and publishing will likely become Web3-enabled within the next 5 to 10 years—but only if UX improves dramatically.

UX as a competitive advantage, early design focus, and convergence with Web2 patterns are critical strategies for adoption. Designing for education and familiarity helps build trust, making blockchain invisibly integrated into daily digital interactions.

Web3 UX remains significantly inferior to Web2 in 2025 due to fundamental challenges: complex onboarding, technical jargon, multi-chain fragmentation, unpredictable fees, irreversible errors, lack of support, poor feedback, inconsistent patterns, developer-centric design, and constrained user research. These stem from blockchain's architectural realities and the technical origins of the ecosystem. However, emerging solutions like account abstraction, email onboarding, gasless transactions, and unified interfaces demonstrate that blockchain’s power can be delivered through familiar and accessible user experiences.

Platforms like Token Metrics exemplify how prioritizing user needs and abstracting complexity enables mainstream adoption. To succeed, designers and developers must focus on user-centric principles, continuously adapting technology to meet user expectations rather than forcing users to adapt to blockchain complexities. The future belongs to platforms that make blockchain invisible, delivering benefits seamlessly and intuitively. As 2025 progresses, the gap between Web2 and Web3 UX will narrow, driven by competition, standardization, and the recognition that accessibility is key to success. Leveraging platforms like Token Metrics provides a glimpse of this user-friendly future, where powerful blockchain capabilities enhance everyday digital life without requiring technical expertise or patience.

%201.svg)

%201.svg)

Web3 promises to revolutionize the internet by decentralizing control, empowering users with data ownership, and eliminating middlemen. The technology offers improved security, higher user autonomy, and innovative ways to interact with digital assets. With the Web3 market value expected to reach $81.5 billion by 2030, the potential seems limitless.Yet anyone who's interacted with blockchain products knows the uncomfortable truth: Web3 user experience often feels more like punishment than promise. From nerve-wracking first crypto transactions to confusing wallet popups and sudden unexplained fees, Web3 products still have a long way to go before achieving mainstream adoption. If you ask anyone in Web3 what the biggest hurdle for mass adoption is, UX is more than likely to be the answer.

This comprehensive guide explores why Web3 UX remains significantly inferior to Web2 experiences in 2025, examining the core challenges, their implications, and how platforms like Token Metrics are bridging the gap between blockchain complexity and user-friendly crypto investing.

To understand Web3's UX challenges, we must first recognize what users expect based on decades of Web2 evolution. Web2, the "read-write" web that started in 2004, enhanced internet engagement through user-generated content, social media platforms, and cloud-based services with intuitive interfaces that billions use daily without thought.

Web2 applications provide seamless experiences: one-click logins via Google or Facebook, instant account recovery through email, predictable transaction costs, and familiar interaction patterns across platforms. Users have become accustomed to frictionless digital experiences that just work.

Web3, by contrast, introduces entirely new paradigms requiring users to manage cryptographic wallets, understand blockchain concepts, navigate multiple networks, pay variable gas fees, and take full custody of their assets. This represents a fundamental departure from familiar patterns, creating immediate friction.

Despite years of development and billions in funding, Web3 UX remains problematic for several structural reasons:

Despite challenges, innovative solutions are emerging to bridge the Web3 UX gap:

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free

The ultimate success of Web3 hinges on user experience. No matter how revolutionary the technology, it will remain niche if everyday people find it too confusing, intimidating, or frustrating. Gaming, FinTech, digital identity, social media, and publishing will likely become Web3-enabled within the next 5 to 10 years—but only if UX improves dramatically.

UX as Competitive Advantage: Companies embracing UX early see fewer usability issues, higher retention, and more engaged users. UX-driven companies continually test assumptions, prototype features, and prioritize user-centric metrics like ease-of-use, task completion rates, and satisfaction—core measures of Web3 product success.

Design as Education: Highly comprehensive Web3 design helps educate newcomers, deliver effortless experiences, and build trust in technology. Design becomes the bridge between innovation and adoption.

Convergence with Web2 Patterns: Successful Web3 applications increasingly adopt familiar Web2 patterns while maintaining decentralized benefits underneath. This convergence represents the path to mass adoption—making blockchain invisible to end users who benefit from its properties without confronting its complexity.

Web3 UX remains significantly inferior to Web2 in 2025 due to fundamental challenges: complex onboarding, technical jargon, multi-chain fragmentation, unpredictable fees, irreversible errors, lack of support, poor feedback, inconsistent patterns, developer-centric design, and constrained user research.

These aren't superficial problems solvable through better visual design—they stem from blockchain's architectural realities and the ecosystem's technical origins. However, they're also not insurmountable. Innovative solutions like account abstraction, email-based onboarding, gasless transactions, and unified interfaces are emerging.

Token Metrics demonstrates that Web3 functionality can deliver through Web2-familiar experiences. By prioritizing user needs over technical purity, abstracting complexity without sacrificing capability, and maintaining intuitive interfaces, Token Metrics shows the path forward for the entire ecosystem.

For Web3 to achieve its transformative potential, designers and developers must embrace user-centric principles, continuously adapting to users' needs rather than forcing users to adapt to technology. The future belongs to platforms that make blockchain invisible—where users experience benefits without confronting complexity.

As we progress through 2025, the gap between Web2 and Web3 UX will narrow, driven by competition for mainstream users, maturing design standards, and recognition that accessibility determines success. The question isn't whether Web3 UX will improve—it's whether improvements arrive fast enough to capture the massive opportunity awaiting blockchain technology.

For investors navigating this evolving landscape, leveraging platforms like Token Metrics that prioritize usability alongside sophistication provides a glimpse of Web3's user-friendly future—where powerful blockchain capabilities enhance lives without requiring technical expertise, patience, or tolerance for poor design.

%201.svg)

%201.svg)

The prediction revolution is transforming crypto investing in 2025. From AI-powered price prediction platforms to blockchain-based event markets, today's tools help investors forecast everything from token prices to election outcomes with unprecedented accuracy. With billions in trading volume and cutting-edge AI analytics, these platforms are reshaping how we predict, trade, and profit from future events. Whether you're forecasting the next 100x altcoin or betting on real-world outcomes, this comprehensive guide explores the top prediction tools dominating 2025.

Before diving in, it's crucial to distinguish between two types of prediction platforms:

Both serve valuable but different purposes. Let's explore the top tools in each category.

Token Metrics stands as the premier AI-driven crypto research and investment platform, scanning over 6,000 tokens daily to provide data-backed predictions and actionable insights. With a user base of 110,000+ crypto traders and $8.5 million raised from 3,000+ investors, Token Metrics has established itself as the industry's most comprehensive prediction tool.

Unlike basic charting tools or single-metric analyzers, Token Metrics combines time series data, media news, regulator activities, coin events like forks, and traded volumes across exchanges to optimize forecasting results. The platform's proven track record and comprehensive approach make it indispensable for serious crypto investors in 2025.

Investors and traders seeking AI-powered crypto price predictions, portfolio optimization, and early altcoin discovery.

Polymarket dominates the event prediction market space with unmatched liquidity and diverse betting opportunities.

What Sets It Apart: Polymarket proved its forecasting superiority when it accurately predicted election outcomes that traditional polls missed. The platform's user-friendly interface makes blockchain prediction markets accessible to mainstream audiences.

Kalshi has surged from 3.3% market share last year to 66% by September 2025, overtaking Polymarket as the trading volume leader.

Best For: U.S. residents seeking regulated prediction markets with crypto deposit options and diverse event contracts.

For traders demanding instant settlement and minimal fees, Drift BET represents the cutting edge of prediction markets on Solana.

Why It Matters: Leveraging Solana's near-instant transaction finality, Drift BET solves scalability issues faced by Ethereum-based prediction markets, with low transaction fees making smaller bets feasible across a wider audience.

Launched in 2018, Augur was the first decentralized prediction market, pioneering blockchain-based forecasting and innovative settlement methods secured by the REP token.

Legacy Impact: Augur v1 settled around $20 million in bets—impressive for 2018-19. Though its DAO has dissolved, Augur's technological innovations influence the DeFi sphere.

With a market cap of $463 million, Gnosis is the biggest prediction market project by market capitalization.

Ecosystem Approach: Founded in 2015, Gnosis evolved into a multifaceted ecosystem covering decentralized trading, wallet services, and infrastructure tools beyond prediction markets.

Smart investors combine Token Metrics for identifying promising cryptocurrencies and then leverage prediction markets like Polymarket or Kalshi to hedge positions or speculate on specific events.

Example Strategy: Use Token Metrics to identify a token with strong Trader Grade and bullish AI signals. Build a position through AI trading, then use prediction markets to bet on price milestones or events, monitoring alerts for exit points. This blends AI-driven predictions with market-based event forecasting.

The era of blind speculation is over. Between AI-powered platforms like Token Metrics analyzing thousands of data points per second and blockchain-based prediction markets aggregating collective wisdom, today's investors have unprecedented tools for forecasting the future. Token Metrics leads the charge in crypto price prediction with its comprehensive AI-driven approach, while platforms like Polymarket and Kalshi dominate event-based forecasting. Together, they represent a new paradigm where data, algorithms, and collective intelligence converge to illuminate tomorrow's opportunities.

Whether you're hunting the next 100x altcoin or betting on real-world events, 2025's prediction platforms put the power of foresight in your hands. The question isn't whether to use these tools—it's how quickly you can integrate them into your strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investing involves risk, including potential loss of capital. Price predictions and ratings are provided for informational purposes and may not reflect actual future performance. Always conduct thorough research and consult qualified professionals before making financial decisions.

%201.svg)

%201.svg)

The prediction revolution is transforming crypto investing in 2025. From AI-powered price prediction platforms to blockchain-based event markets, today's tools help investors forecast everything from token prices to election outcomes with unprecedented accuracy. With billions in trading volume and cutting-edge AI analytics, these platforms are reshaping how we predict, trade, and profit from future events. Whether you're forecasting the next 100x altcoin or betting on real-world outcomes, this comprehensive guide explores the top prediction tools dominating 2025.

Before diving in, it's crucial to distinguish between two types of prediction platforms:

Both serve valuable but different purposes. Let's explore the top tools in each category.

Token Metrics - AI-Powered Crypto Intelligence Leader

Token Metrics stands as the premier AI-driven crypto research and investment platform, scanning over 6,000 tokens daily to provide data-backed predictions and actionable insights. With a user base of 110,000+ crypto traders and $8.5 million raised from 3,000+ investors, Token Metrics has established itself as the industry's most comprehensive prediction tool.

Unlike basic charting tools or single-metric analyzers, Token Metrics combines time series data, media news, regulator activities, coin events like forks, and traded volumes across exchanges to optimize forecasting results. The platform's proven track record and comprehensive approach make it indispensable for serious crypto investors in 2025.

Investors and traders seeking AI-powered crypto price predictions, portfolio optimization, and early altcoin discovery.

Polymarket dominates the event prediction market space with unmatched liquidity and diverse betting opportunities.

What Sets It Apart: Polymarket proved its forecasting superiority when it accurately predicted election outcomes that traditional polls missed. The platform's user-friendly interface makes blockchain prediction markets accessible to mainstream audiences.

Kalshi has surged from 3.3% market share last year to 66% by September 2025, overtaking Polymarket as the trading volume leader.

For traders demanding instant settlement and minimal fees, Drift BET represents the cutting edge of prediction markets on Solana.

Why It Matters: By leveraging Solana's near-instant transaction finality, Drift BET solves many scalability issues faced by Ethereum-based prediction markets, with low transaction fees making smaller bets feasible for wider audiences.

Launched in 2018, Augur was the first decentralized prediction market, pioneering blockchain-based forecasting and innovative methods for settlement secured by the REP token.

Legacy Impact: Augur v1 settled around $20 million in bets—impressive for 2018-19. While the DAO has dissolved, Augur's technological innovations now permeate the DeFi sphere.

With a market cap of $463 million, Gnosis is the biggest prediction market project by market capitalization.

Ecosystem Approach: Founded in 2015, Gnosis evolved into a multifaceted ecosystem encompassing decentralized trading, wallet services, and infrastructure tools beyond mere prediction markets.

Smart investors often use Token Metrics for identifying which cryptocurrencies to invest in, then leverage prediction markets like Polymarket or Kalshi to hedge positions or speculate on specific price targets and events.

Example Strategy:

This combines the best of AI-driven price prediction with market-based event forecasting.

Market Growth Trajectory: The prediction market sector is projected to reach $95.5 billion by 2035, with underlying derivatives integrating with DeFi protocols.

Key Growth Drivers:

What's Coming: Token Metrics Evolution—Expect deeper AI agent integration, automated portfolio management, and enhanced moonshot discovery as machine learning models become more sophisticated.

Prediction Market Expansion: Kalshi aims to integrate with every major crypto app within 12 months, while tokenization of positions and margin trading will create new financial primitives.

Cross-Platform Integration: Future platforms will likely combine Token Metrics-style AI prediction with Polymarket-style event markets in unified interfaces.

DeFi Integration: The prediction market derivatives layer is set to integrate with DeFi protocols to create more complex financial products.

→ Token Metrics - Unmatched AI analytics, moonshot discovery, and comprehensive scoring

The era of blind speculation is over. Between AI-powered platforms like Token Metrics analyzing thousands of data points per second and blockchain-based prediction markets aggregating collective wisdom, today's investors have unprecedented tools for forecasting the future. Token Metrics leads the charge in crypto price prediction with its comprehensive AI-driven approach, while platforms like Polymarket and Kalshi dominate event-based forecasting. Together, they represent a new paradigm where data, algorithms, and collective intelligence converge to illuminate tomorrow's opportunities.

Whether you're hunting the next 100x altcoin or betting on real-world events, 2025's prediction platforms put the power of foresight in your hands. The question isn't whether to use these tools—it's how quickly you can integrate them into your strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investing involves risk, including potential loss of capital. Price predictions and ratings are provided for informational purposes and may not reflect actual future performance. Always conduct thorough research and consult qualified professionals before making financial decisions.

%201.svg)

%201.svg)

If you've heard phrases like "the S&P 500 is up today" or "crypto indices are gaining popularity," you've encountered indices in action. But what are indices, exactly, and why do millions of investors rely on them? This guide breaks down everything you need to know about indices, from traditional stock market benchmarks to modern crypto applications.

An index (plural: indices or indexes) is a measurement tool that tracks the performance of a group of assets as a single metric. Think of it as a portfolio formula that selects specific investments, assigns them weights, and updates on a regular schedule to represent a market, sector, or strategy.

Indices serve as benchmarks that answer questions like:

Important distinction: An index itself is just a number—like a thermometer reading. To actually invest, you need an index fund or index product that holds the underlying assets to replicate that index's performance.

Every index follows a systematic approach built on three core components:

The most established category tracks equity performance:

Track fixed-income securities:

Monitor raw materials and resources:

The newest category tracks digital asset performance:

Instead of researching and buying dozens of individual stocks or cryptocurrencies, one index investment gives you exposure to an entire market. If you buy an S&P 500 index fund, you instantly own pieces of 500 companies—from Apple and Microsoft to Coca-Cola and JPMorgan Chase.

This diversification dramatically reduces single-asset risk. If one company fails, it represents only a small fraction of your total investment.

Traditional financial advisors typically charge 1-2% annually to actively pick investments. Index funds charge just 0.03-0.20% because they simply follow preset rules rather than paying expensive analysts and portfolio managers.

Over decades, this cost difference compounds significantly. A 1% fee might seem small, but it can reduce your retirement savings by 25% or more over 30 years.

Research consistently shows that 80-90% of professional fund managers fail to beat simple index funds over 10-15 year periods. By investing in indices, you guarantee yourself market-average returns—which historically beat most active strategies after fees.

Index investing eliminates the need to:

Markets test investors' emotions. Fear drives selling at bottoms; greed drives buying at tops. Index investing removes these emotional triggers—the formula decides what to own based on rules, not feelings.

Cryptocurrency markets face unique challenges that make indices particularly valuable:

Traditional indices stay fully invested through bull and bear markets alike. If the S&P 500 drops 30%, your index fund drops 30%. Regime-switching crypto indices add adaptive risk management:

This approach aims to provide "heads you win, tails you don't lose as much"—participating when conditions warrant while stepping aside when risk turns south.

Choose your focus: Total stock market, S&P 500, international, or bonds

Select a provider: Vanguard, Fidelity, Schwab, or iShares offer excellent low-cost options

Open a brokerage account: Most platforms have no minimums and free trading

Buy and hold: Invest regularly and leave it alone for years

Identify your strategy: Passive broad exposure or adaptive regime-switching

Research index products: Look for transparent holdings, clear fee structures, and published methodologies

Review the details: Check rebalancing frequency, custody model, and supported funding options

Start small: Test the platform and process before committing large amounts

Monitor periodically: Track performance but avoid overtrading

Example: Token Metrics Global 100 Index

Token Metrics offers a regime-switching crypto index that holds the top 100 cryptocurrencies during bullish market signals and moves fully to stablecoins when conditions turn bearish. With weekly rebalancing, transparent holdings displayed in treemaps and tables, and a complete transaction log, it exemplifies the modern approach to crypto index investing.

The platform features embedded self-custodial wallets, one-click purchasing (typically completed in 90 seconds), and clear fee disclosure before confirmation—lowering the operational barriers that often prevent investors from accessing diversified crypto strategies.

Indices are measurement tools that track groups of assets, and index funds make those measurements investable. Whether you're building a retirement portfolio with stock indices or exploring crypto indices with adaptive risk management, the core benefits remain consistent: diversification, lower costs, emotional discipline, and simplified execution.

For most investors, index-based strategies deliver better risk-adjusted returns than attempting to pick individual winners. As Warren Buffett famously recommended, "Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund."

That advice applies whether you're investing in stocks, bonds, or the emerging world of cryptocurrency indices.

%201.svg)

%201.svg)

You've probably seen professional investors discuss tracking entire markets or specific sectors without the need to purchase countless individual assets. The concept behind this is indices—powerful tools that offer a broad yet targeted market view. In 2025, indices have advanced from simple benchmarks to sophisticated investment vehicles capable of adapting dynamically to market conditions, especially in the evolving crypto landscape.

A trading index, also known as a market index, is a statistical measure that tracks the performance of a selected group of assets. Think of it as a basket containing multiple securities, weighted according to specific rules, designed to represent a particular segment of the market or a strategy. Indices serve as benchmarks allowing investors to:

Unlike individual stocks or cryptocurrencies, indices themselves are not directly tradable assets. Instead, they are measurement tools that financial products like index funds, ETFs, or crypto indices replicate to provide easier access to markets.

Famous indices such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite each follow particular methodologies for selecting and weighting their constituent assets.

Indices typically undergo periodic rebalancing—quarterly, annually, or based on specific triggers—to keep their composition aligned with their intended strategy as markets evolve.

The crypto market has adapted and innovated on traditional index concepts. Crypto indices track baskets of digital assets, offering exposure to broad markets or specific sectors like DeFi, Layer-1 protocols, or metaverse tokens.

What sets crypto indices apart in 2025 is their ability to operate transparently on-chain. Unlike traditional indices that can lag in updates, crypto indices can rebalance frequently—sometimes even weekly—and display current holdings and transactions in real-time.

A typical crypto index might track the top 100 cryptocurrencies by market cap, automatically updating rankings and weights, thus addressing the challenge of rapid narrative shifts and asset rotations common in crypto markets. They encourage owning diversified baskets to mitigate risks associated with individual coin failures or narrative collapses.

Research suggests that over 80% of active fund managers underperform their benchmarks over a decade. For individual investors, beating the market is even more challenging. Indices eliminate the need for exhaustive research, constant monitoring, and managing numerous assets, saving time while offering broad market exposure.

Passive indices face a drawback: they remain fully invested during both bull and bear markets. When markets decline sharply, so do index values, which may not align with investors seeking downside protection.

This led to the development of active or regulated strategies that adjust exposure based on market regimes, blending diversification with risk management.

Regime-switching indices dynamically alter their asset allocations depending on market conditions. They identify different regimes—bullish or bearish—and adjust holdings accordingly:

This sophisticated approach combines the benefits of broad index exposure with downside risk mitigation, offering a more adaptable investment strategy.

The TM Global 100 index from Token Metrics exemplifies advanced index strategies tailored for crypto in 2025. It is a rules-based, systematic index that tracks the top 100 cryptocurrencies by market cap during bullish phases, and automatically shifts fully to stablecoins in bearish conditions.

This index maintains weekly rebalancing, full transparency, and easy access via one-click purchase through a secure, self-custodial wallet. The rules are transparent, and the index adapts swiftly to market changes, reducing operational complexity and risk.

Designed for both passive and active traders, it offers broad exposure, risk management, and operational simplicity—perfect for those seeking disciplined yet flexible crypto exposure.

When considering an index, focus on these aspects:

Can I beat index returns with individual picks? Most individual investors struggle to beat benchmarks after costs and taxes, especially without significant resources.

Do indices work in crypto markets? Yes, and with certain advantages such as on-chain transparency and continuous trading, which facilitate active, rules-based strategies.

How is an index different from an ETF? An index is an underlying measurement or structured basket, while an ETF is an investment product tracking that index, often tradable like a stock.

How often do indices rebalance? In crypto, weekly or even daily rebalancing is common to keep pace with rapid market changes.

Are regime-switching indices market timing? They execute systematic, rules-based strategy adjustments based on signals—providing a form of automated market timing, not discretionary guesses.

Consider index trading if you want broad exposure without constant oversight, value systematic strategies, prefer transparency, and aim to reduce operational complexity in your investments. Active traders with a focus on disciplined core positions also benefit from these tools, especially in volatile markets like crypto.

Alternatively, individual asset selection may suit those with proprietary research, active management interests, or a willingness to accept higher risk for potential outsized returns.

If you're ready for next-generation crypto index investing:

The embedded smart wallet app allows you to control your funds while enjoying seamless execution, with all fees and holdings transparently displayed before confirmation—most users complete the process swiftly.

Technological advances, particularly on-chain programmability, are transforming index trading. Instant rebalancing, full transparency, automated risk management, and programmable strategies are empowering investors with tools previously limited to institutional players. In 2025, indices will not just passively track markets but actively manage risk, rotate assets, and adapt swiftly—making sophisticated strategies accessible to everyone.

Discover crypto gems with Token Metrics AI

Trading indices are invaluable for diversifying market exposure efficiently and systematically. Whether traditional stock indices or innovative crypto solutions like TM Global 100, these instruments democratize access to complex strategies, saving time and reducing operational hurdles. The progression toward active, regime-switching indices exemplifies the ongoing innovation in this space—aimed at balancing upside potential with downside protection. The TM Global 100 index exemplifies this trend by offering broad crypto exposure combined with automatic risk mitigation, transparency, and ease of access—making it a compelling tool for 2025 and beyond.

This article is for educational and research purposes only. It does not constitute financial advice. Crypto markets carry inherent risks, including significant volatility. Always conduct your own thorough research and consult with a financial advisor before investing.

%201.svg)

%201.svg)

The crypto market has evolved beyond Bitcoin and Ethereum trading. Crypto indices now offer diversified exposure to digital assets with automated rebalancing and regime-switching capabilities. This guide shows you exactly how to trade crypto indices in 2025, from traditional approaches to cutting-edge adaptive strategies.

Speed and uncertainty define the current crypto cycle. Narratives rotate in weeks, not months. DeFi dominated 2020, NFTs exploded in 2021, Layer-2 scaling drove 2022-2023, and AI tokens surged in 2024-2025.

Individual coin risk can swamp portfolios: LUNA collapsed from $80 to pennies in days, FTX token fell from $25 to near-zero overnight, and countless altcoins disappear each cycle.

Crypto indices solve these problems by providing: exposure to 10, 50, or 100 tokens simultaneously, automatic rebalancing as new tokens emerge, professional execution that minimizes slippage, transparent holdings and transaction logs. Some offer defensive moves to stablecoins during bear markets.

Track the overall crypto ecosystem: Top 10 Indices, Bitcoin and Ethereum typically 60-80% of weight. Includes major altcoins like BNB, Solana, XRP. Usually lower volatility than smaller-cap indices. Suitable for conservative crypto exposure.

Broader diversification across market segments, capturing emerging narratives earlier. Higher volatility but more upside potential. Better representation of the total crypto market.

Focus on crypto categories such as DeFi, Layer-1 blockchains, or Metaverse tokens. DeFi includes Uniswap, Aave, and Compound, benefitting from adoption growth. Layer-1 indices feature Ethereum, Solana, Avalanche, and Cardano, often with higher beta. Metaverse and Gaming indices include Decentraland, Sandbox, and Axie Infinity, offering high growth but higher risk.

Apply quantitative strategies like momentum or low volatility. Momentum indices own top-performing tokens and rebalance frequently, while low volatility indices focus on stablecoins and well-established tokens for steadier performance.

Hold crypto during bull markets and switch to stablecoins during downturns to capture upside and limit downside. These indices typically rebalance weekly or monthly.

DeFi Protocols

Centralized Platforms

For DeFi Platforms:

Setup process includes: Downloading or creating a wallet, securely recording seed phrases, funding with ETH or USDC.

For platforms with embedded wallets: Sign up for an account; wallets are created automatically during transactions, streamlining entry but with less control over seed phrases.

If you lack crypto:

Funding advice: Minimum of $100-$500 for DeFi indices, with $500-$1,000 being typical. Consider gas fees, which can range from $10-$50 on Ethereum.

Prior to investing, review:

For DeFi platforms:

For centralized platforms:

What to track:

Automatic rebalancing is common in most indices via smart contracts or scheduled execution. Manual adjustments depend on personal strategies, like taking profits or adding principal during dips.

Advanced traders might employ core-satellite strategies or tactical sector rotation based on market conditions. Managing risk involves position sizing, stop-loss orders, diversification, and understanding tax implications.

Trading crypto indices in 2025 offers diversified digital asset exposure without the complexity of managing dozens of individual tokens. Whether you choose broad market indices through DeFi protocols or regime-switching adaptive strategies through platforms like Token Metrics, the key is understanding your risk tolerance, managing costs, and maintaining discipline through volatile market cycles.

Start with a broad market index or a regime-switching option that automatically manages risk, allocate only capital you can afford to lose, and think in cycles rather than days or weeks. The crypto market moves fast, but patient index traders consistently outperform those chasing individual coin pumps.

Ready to explore crypto indices? Visit tokenmetrics.com/indices to see the TM Global 100 regime-switching index with transparent holdings, automated rebalancing, and embedded wallet solutions designed for the speed of modern crypto markets.

%201.svg)

%201.svg)

Have you ever considered trading the entire market in a single move, rather than picking individual stocks or cryptocurrencies? That approach is the core idea behind indices trading, offering a way to gain broad exposure with a single position. Whether you're tracking major stock indices like the S&P 500, regional benchmarks like the FTSE 100, or emerging crypto indices such as the TM Global 100, indices provide diversified exposure to multiple assets efficiently.

Indices trading involves buying or selling financial instruments that track the performance of a specific group of assets. These assets might include stocks, cryptocurrencies, or other digital assets. Instead of owning individual assets directly, traders use derivatives or funds to replicate index performance.

The objective? To capture the average performance of a market segment rather than betting on individual assets' success.

An index is a measurement of a market segment (e.g., S&P 500). An ETF is a tradable fund that mirrors an index, allowing you to invest indirectly.

Yes. Indices reflect market performance, and declines in the market can result in losses. Diversification helps manage risk, but doesn't eliminate it.

Crypto indices inherently carry market volatility risks. Well-structured, transparent, and rules-based indices can help mitigate risks associated with individual tokens.

Traditional indices typically rebalance quarterly or annually. Crypto indices may rebalance weekly or monthly due to faster market changes.

For stocks: S&P 500 ETF (e.g., SPY, VOO). For crypto: broad market-cap indices or regime-switching indices like the TM Global 100 provide dynamic risk management.

Not necessarily. Many ETFs trade under $500 per share, and fractional shares make it accessible. Crypto index platforms often allow investments starting at $100 or less.

Scheduled rebalancing (weekly/monthly) or market signals indicating a regime change, such as switching from bullish to bearish conditions.

Indices trading offers a disciplined, diversified approach to participating in markets without managing individual assets. Whether seeking long-term wealth accumulation or active trading opportunities, indices provide a structured framework grounded in rules and transparency.

Next steps include opening a brokerage account for stock indices or exploring crypto index platforms with features like regime switching and rebalancing. For added downside protection, consider indices like the TM Global 100 that automatically shift assets into stablecoins during downturns.

Discover Crypto Gems with Token Metrics AI

Token Metrics uses AI-powered analysis to help you uncover profitable opportunities in the crypto market. Get Started For Free.

%201.svg)

%201.svg)

Stock market indices are among the most frequently cited yet least understood aspects of financial markets. You've likely heard phrases like "the Dow is up 200 points" or "the S&P 500 hit a new record," but what do these indices actually represent, and why do they matter so much to investors, economists, and policymakers alike?

In 2025, indices have evolved far beyond simple market thermometers. They've become sophisticated investment vehicles that power trillions of dollars in passive investing, provide benchmarks for performance evaluation, and now—with innovations in crypto markets—offer active risk management through regime-switching strategies.

Understanding the importance of stock market indices is essential whether you're a beginner building your first portfolio or an experienced trader seeking to optimize your strategy. This comprehensive guide explores why indices matter, how they function, and how modern innovations like the Token Metrics indices are extending index benefits to the fast-moving cryptocurrency markets.

Before exploring their importance, let's establish a clear definition. A stock market index is a statistical measure that tracks the performance of a specific group of stocks, representing a particular market segment, sector, or the entire market.

Think of an index as a carefully curated basket of stocks weighted according to predetermined rules. The S&P 500, for example, tracks 500 of the largest publicly traded U.S. companies weighted by market capitalization. When the S&P 500 rises 1%, it means this basket of 500 stocks collectively gained 1% in value.

Indices don't exist as physical products you can buy directly. Instead, they're measurement tools that investment products like index funds, ETFs, and derivatives replicate to offer investors easy market access.

Indices serve as thermometers for economic health, providing instant snapshots of market sentiment and economic conditions. When major indices rise, it signals investor optimism about economic prospects. When they fall, it reflects concerns about future growth.

Policymakers, economists, and business leaders watch indices closely to gauge:

The Federal Reserve, for instance, monitors market indices when making interest rate decisions. Sharp index declines can influence policy responses, while sustained rallies may signal economic strength that justifies rate increases.

This barometric function extends beyond stock markets. In 2025, crypto indices now provide similar insights into blockchain technology adoption, decentralized finance growth, and digital asset sentiment.

Perhaps the most critical function of indices is providing objective benchmarks against which to measure investment performance. Without indices, investors lack context to determine whether their returns represent success or failure.

If your portfolio gained 8% last year, should you feel satisfied? The answer depends entirely on your benchmark. If the Token Metrics benchmarked indices like the S&P 500 gained 15%, your 8% represents underperformance despite positive returns. If the index lost 5%, your 8% gain represents significant outperformance.

This benchmarking function matters for several reasons:

One of the most fundamental principles of investing is diversification—spreading investments across multiple assets to reduce risk. Indices embody this principle by definition.

When you invest in an index fund tracking the Token Metrics S&P 500, you instantly own a piece of 500 companies across diverse sectors: technology, healthcare, finance, consumer goods, energy, and more. This diversification provides powerful risk reduction.

Individual Stock Risk vs. Index Risk: Consider the difference between buying individual stocks and owning an index:

Time Savings: Building a diversified portfolio manually requires researching dozens or hundreds of companies, executing multiple trades, and continuously rebalancing. Indices accomplish this instantly through a single investment.

In crypto markets, this diversification benefit becomes even more crucial. Individual cryptocurrencies can experience 50-90% drawdowns or even go to zero. A crypto index tracking the top 100 assets spreads this risk dramatically while maintaining exposure to the sector's growth potential.

Indices have fundamentally transformed how people invest through the passive investing revolution. The statistics are staggering: passive index funds now account for approximately 50% of U.S. equity fund assets, up from less than 20% just two decades ago.

This shift occurred because of a simple truth: most active managers fail to beat their benchmark indices over the long term. Studies consistently show that 80-90% of active fund managers underperform their benchmark over 10-15 year periods after accounting for fees.

This underperformance led to the realization that for most investors, simply buying the index provides better risk-adjusted returns than trying to beat it. Index funds offer:

The success of index investing has made market indices even more important. When trillions of dollars track these indices, their composition and methodology directly impact capital flows across the entire market.

Indices enable sophisticated market analysis by breaking down performance into sectors, styles, and factors. This granular analysis helps investors understand what's driving returns and make informed allocation decisions.

Sector Indices: Specialized indices track specific industries:

By comparing sector index performance, investors identify which industries are leading or lagging. During 2023-2024, technology indices dramatically outperformed energy indices as AI enthusiasm dominated while oil prices stabilized.

Style Indices: Other indices segment markets by investment style:

These style distinctions help investors understand market cycles. Value stocks might outperform during market recoveries, while growth stocks lead during expansion phases. Style indices make these patterns visible.

Factor Indices: Modern indices isolate specific factors like volatility, profitability, or debt levels. These enable precise exposure to characteristics associated with outperformance.

In crypto markets, specialized indices track DeFi protocols, Layer-1 blockchains, metaverse tokens, or meme coins—allowing targeted exposure to specific crypto narratives while maintaining diversification within those categories.

Indices form the foundation for countless investment products worth trillions of dollars:

Without indices as standardized measurement tools, this entire ecosystem couldn't exist. The importance of indices extends far beyond information—they're the architectural foundation of modern passive investing.

While traditional indices passively track markets through all conditions, 2025 has seen the emergence of sophisticated regime-switching indices that actively manage risk.

These next-generation indices don't just measure markets—they protect capital by adjusting exposure based on market conditions. When signals indicate high-risk environments, these indices reduce exposure to volatile assets and increase allocation to defensive positions.

This innovation addresses the primary weakness of traditional passive indices: they remain fully invested through devastating bear markets. If the market crashes 40%, your traditional index investment crashes 40% with it.

Regime-switching indices aim to participate in upside during bull markets while limiting downside during bear markets through systematic, rules-based risk management.

While stock market indices have existed for over a century, cryptocurrency markets have rapidly adopted and innovated on index concepts. Crypto indices matter for all the same reasons as stock indices—but with additional benefits unique to digital assets.

24/7 Market Tracking: Unlike stock indices that only update during market hours, crypto indices track markets that never close.

Complete Transparency: Blockchain technology enables real-time visibility into index holdings and transactions—something impossible with traditional indices.

Faster Rebalancing: Crypto markets move faster than traditional markets. Weekly or even daily rebalancing keeps crypto indices aligned with current market leaders.

Built-in Risk Management: Smart contracts can implement sophisticated regime-switching logic automatically, adjusting allocations without human intervention.

A crypto index is a rules-based basket tracking a defined universe—such as a top-100 market-cap set—with scheduled rebalances. In October 2025, crypto indices have become essential tools for navigating markets where narratives rotate in weeks and individual-coin risk can swamp portfolios.

The Token Metrics Global 100 index exemplifies how index importance extends and amplifies in cryptocurrency markets. This rules-based index demonstrates all seven critical functions of indices while adding active risk management specifically designed for crypto's volatility.

What It Is: A systematic index that holds the top 100 cryptocurrencies by market capitalization when market conditions are bullish, and moves fully to stablecoins when conditions turn bearish.

Regime Switching:

Weekly Rebalancing: Updates weights and constituents to reflect current top-100 rankings. Crypto markets move faster than traditional markets—weekly updates ensure your exposure remains current.

Complete Transparency: Strategy modal explains all rules clearly. Gauge shows live market signal driving allocation. Holders are displayed in treemap and table formats. Transaction log records every rebalance and regime switch.

One-Click Execution: The embedded, self-custodial smart wallet enables purchases in approximately 90 seconds. No need to set up accounts on multiple exchanges, execute dozens of trades, or manually track rebalancing schedules.

→ Join the waitlist to be first to trade TM Global 100.

Several trends have amplified the importance of indices:

Understanding why indices matter leads naturally to the question: how should I use them?

If everyone invests in indices, won't they stop working? This concern, often called the "indexing paradox," suggests that if too much money passively tracks indices, markets will become inefficient. In reality, even with 50% of assets indexed, the remaining 50% of active investors still compete to find mispricings. Markets remain quite efficient.

Do indices work in crypto markets? Yes—arguably even better than in traditional markets. Crypto's 24/7 trading, on-chain transparency, and extreme volatility make systematic index strategies particularly valuable. The speed of narrative rotation makes manual portfolio management nearly impossible.

Can I beat index returns? Some investors do beat indices, but the odds are against you. After fees and taxes, 80-90% of active managers underperform over long periods. If you have genuine informational advantages, deep expertise, and significant time to dedicate, you might succeed. Most investors don't.

What's the difference between an index and an ETF? An index is a measurement tool (like the S&P 500 number). An ETF is an investment product that tracks an index. You can't buy "the S&P 500" directly, but you can buy Token Metrics-tracked ETFs that do so.

While indices offer powerful benefits, understanding their limitations is equally important:

If you're convinced of indices' importance, here's how to begin:

Crypto Markets with Token Metrics: Visit the Token Metrics Indices hub, review the TM Global 100 strategy and rules, join the waitlist for launch notification. At launch, click Buy Index, review fees, slippage, and holdings, confirm purchase (approximately 90 seconds), and track your position under My Indices with real-time P&L. The embedded, self-custodial smart wallet streamlines execution while maintaining your control over funds.

→ Join the waitlist to be first to trade TM Global 100.

Index importance will only grow as markets become more complex and technology enables new innovations:

TM Global 100 represents this future: systematic rules, active risk management, complete transparency, blockchain-enabled execution, and one-click accessibility.

Stock market indices matter because they serve as economic barometers, performance benchmarks, diversification tools, passive investment foundations, analytical frameworks, investment product cores, and risk management vehicles. These seven critical functions have made indices indispensable to modern finance.